Santiaga

I am a REIT analyst, so I tend to stick to the realm of REITs, but occasionally something offers such an extreme value proposition that I am compelled to exit the comfort of my wheelhouse. I am not going to pretend that I can value a company like Adobe with any degree of accuracy, but I do have a fair amount of experience evaluating M&A and the market’s reaction to the Figma deal borders on absurdity and has me salivating at the value it has created.

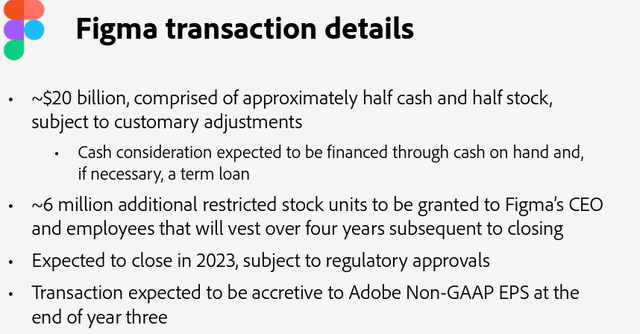

If you owned Adobe (NASDAQ:ADBE) at the time of announcement, you paid your proportional share of $20B for the fast-growing add-on. Consensus seems to be that this is too high of a purchase price, and I tend to agree, given the often referenced 50X multiple of sales.

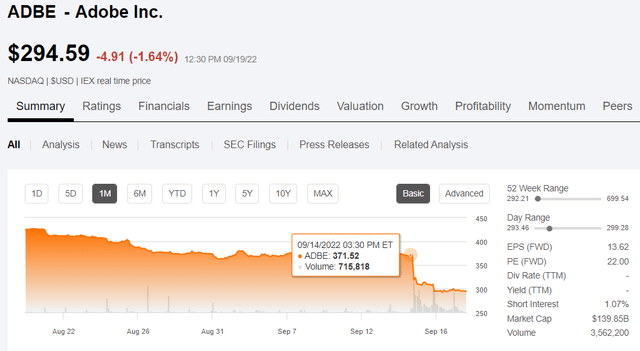

In its disgust at the valuation Adobe paid for Figma, the market sold Adobe off… hard.

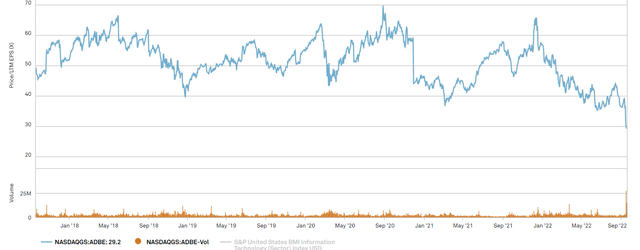

ADBE was trading at $371 and some change prior to the announcement and now trades at $294.59.

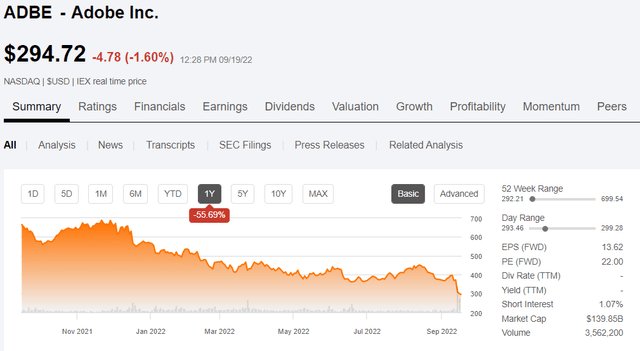

This was after Adobe had already sold off from nearly $700 per share in the broader tech market downdraft.

If we isolate just the declines after the announcement of the Figma purchase, Adobe’s market cap declined $36.52B.

How does a $20B (plus 6 million RSUs) purchase, even if Adobe overpaid, cause its market cap to drop by $36.5B?

Even if Adobe lit $20B on fire, that seems like an overreaction. The market is functionally valuing Figma at negative $16.5B. So, while I do think Adobe overpaid and that the deal is probably a net negative for those who already owned Adobe, it strikes me as a great deal for those who buy Adobe today.

Given the magnitude of reaction, it behooves us to look into if that transaction was really that bad. Here are the main details:

The bear take on the buyout is that Adobe was afraid of Figma taking market share from them. Thus, Adobe could have been willing to pay the $20B just to avoid Figma hurting its core business, even if they recognize it is not worth that much in terms of extra earnings power to Adobe.

I think there is some truth in that, but a defensive buyout doesn’t mean that there aren’t also revenue synergies here. I see 2 main ways for Adobe to rapidly increase Figma’s revenues:

- It can increase prices on Figma’s product

- It can introduce Figma to the entire Adobe userbase, rapidly growing its customer base

Figma is already expected to double revenues in 2022 and with Adobe’s shelf space there should be a significant runway after that. The acquisition adds what is widely regarded as a great cloud-based design product to Adobe’s pre-existing suite of indispensable products.

Adobe Valuation

At $294.72, Adobe is trading at 18.76X 2023 estimated normalized EPS of $15.71. The Nasdaq is trading at about 23X forward earnings.

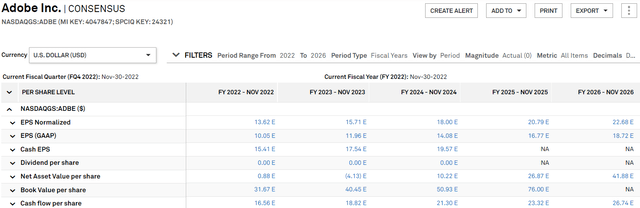

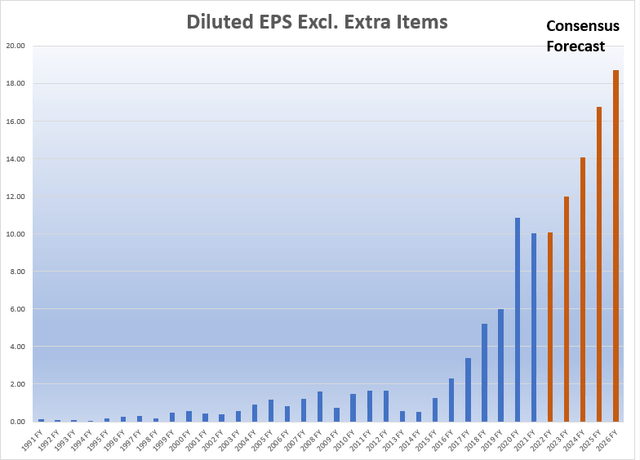

As I said at the outset, I am not a tech analyst, so I don’t think I can forecast earnings for Adobe with any real accuracy. As such, my valuation will not rely on my forecasts but rather on those of the Wall Street analysts that follow Adobe, which is shown below.

S&P Global Market Intelligence

The forward estimates look quite good.

- GAAP EPS and normalized EPS are rising significantly from $10.05 and $13.62 in 2022 to $18.72 and $22.68 in 2026, respectively.

- Cash flow per share is expected to rise from $16.56 in 2022 to $26.74 in 2026.

- Book value and NAV per share are expected to rise.

Such growth is significantly greater than that of the Nasdaq, much of which is struggling in this environment. As such, the discount at which ADBE now trades looks attractive to me.

ADBE is also cheap relative to itself. The stock has long traded at around 40X-60X trailing EPS.

S&P Global Market Intelligence

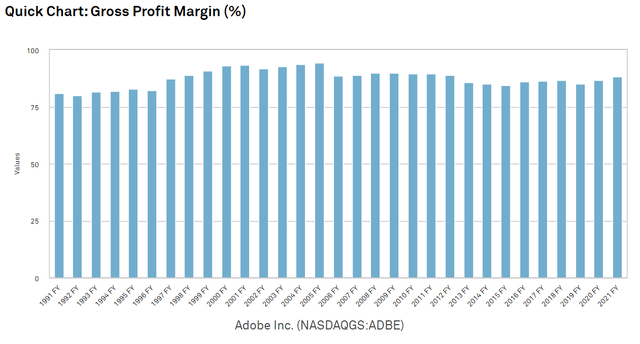

This valuation has been justified by the quality and growth. Gross profit margin has consistently been in the 80s.

S&P Global Market Intelligence

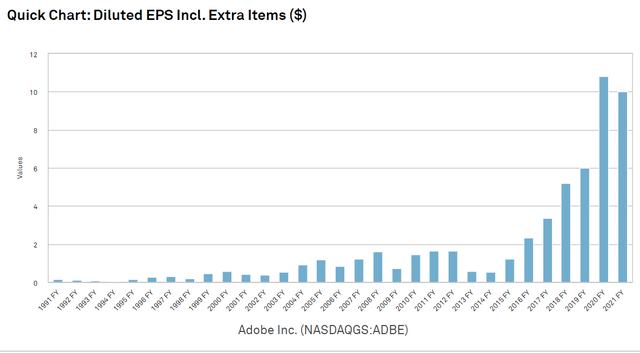

These high margins caused the revenue growth to flow nicely through to earnings growth.

S&P Global Market Intelligence

If we layer the consensus forward estimates into the historical data, it would appear as though the rapid growth trajectory remains intact.

Author generated using S&P Global Market Intelligence data

Today’s valuation implies that this growth will slow substantially. The analysts following Adobe do not see such a slowdown. I also don’t see a slowdown. There were a few percentage points of dilution as a result of the M&A, but that isn’t anywhere near enough to justify the value multiple at which ADBE now trades.

I have recently been quite critical of the Nasdaq. My bearishness on the index is based on 2 things:

- Extreme valuation of some constituents

- Weakness with regard to rising rates

There is nothing inherently wrong with tech. The problem is the extreme amount the market is paying for it and the fact that IRRs generally don’t rise as interest rates rise. With functionally zero debt, Adobe is largely immune to the cost side of rising rates.

Adobe used to have a bloated valuation. At close to $700 the market was pricing in a long and rapid growth runway, but at $294, the market is only pricing in the current level of cashflows. Any growth is gravy.

Be the first to comment