hadynyah/E+ via Getty Images

I last discussed VinaCapital Vietnam Opportunity Fund (OTCPK:VCVOF) back in 2019. In my previous article, I focused more on the longer-term history of the fund and macro drivers in Vietnam. At the time, Vietnam stocks had corrected some 25%, so investors buying the dip back then would have achieved quite good returns by now.

Now, a similarly attractive entry point into the stock is opening up thanks to large declines in Vietnam stocks in 2022. I shall now focus on some of the key events that have unfolded over the last three years that still favor exposure to Vietnam stocks via this fund.

Why are Vietnam stocks falling in 2022?

In the first six months of 2022, the VN-Index fell circa 20%. While Vietnam stocks have largely mirrored the falls seen on Wall Street this year, there are also local factors at play. I shall now list such factors that have contributed to the falls.

Vietnam retail investors panic

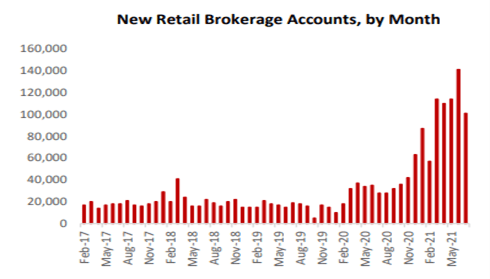

First, the Vietnam retail investor boom has finally led to some panic. In the last couple of years there has been a massive surge in new retail account openings. In rough numbers, there were about 2.5 million individual investor stockbroking accounts prior to the pandemic. In the following 12 months, that grew to about 3 million. It is still quite a small number of the total population, but the growth rate was large.

VinaCapital Insights The Evolution of Vietnams Stock Market

Anecdotally, there are many stories of inexperienced speculators that could easily succumb to panic selling at the wrong times. They account for far more of the daily volume traded compared with the pre-pandemic time period, and this panic selling is contributing to the declines in the Vietnam stock market.

Such anecdotal stories can be read here. Note how in December 2020 the surge in retail trading caused the Ho Chi Minh stock exchange to halt trading. I view this to be of little concern longer term, though. There is huge potential for further growth in new retail accounts given that Vietnam’s population is around 100 million.

Corruption crackdown

Second, there has been a corruption crackdown that resulted in a series of high-profile corporate arrests earlier in the year. This article offers an example of some of the flow on effects to the stock market.

This understandably has made the market nervous regarding what further market manipulation or fraud may be uncovered. Having said that, it is a sign that Vietnam is taking such matters seriously. This is what the indices providers want to see as they ponder whether to upgrade Vietnam from frontier to emerging stock market status.

Strangely enough, the corruption crackdown could even be a blessing in disguise for the Vietnam stock market. As a result, we could see it prompt further progress with matters such as corporate governance, securities laws, enhanced stock exchange systems, market regulations, and foreign investment rights. These factors were highlighted in many articles speculating when Vietnam might be upgraded to emerging market status.

I therefore again am not overly concerned from a longer-term standpoint regarding this reason used for Vietnam stocks falling in 2022.

Geopolitical developments

Another thing I have heard is that the geopolitical developments in 2022 have made global investors nervous about touching emerging/frontier markets. Some were certainly burnt by searching for value in Russian stocks. Those highlighting Chinese stocks as a place to look for value have generally had a terrible time in the last decade. It’s possible that those who aren’t too familiar with the Vietnam stock market simply see the political system and place it in the “too hard” basket, given all the developments in 2022.

I think this attitude can be costly in bypassing a good opportunity here. In fact, from a geopolitical point of view, Vietnam refreshingly seems to be playing things low key and neutral. From a local point of view the country’s people seem to have a relatively high degree of faith in the political leadership. This was illustrated when complying with directions made during the pandemic. According to studies completed in February this year, Vietnam ranks high in terms of trust in the government.

A time to look offshore to buy the 2022 stock market dip

We have seen substantial declines in U.S. stocks in 2022, and that particular complacent long trade is failing. I believe this will result in more investors searching offshore. Vietnam has many attractive fundamentals to be considered. Investors should not be overly concerned with the above-mentioned Vietnam-specific factors for stocks falling. Rather, they should welcome them as having provided a healthy correction in the market to now add exposure.

What about inflation and interest rates in Vietnam?

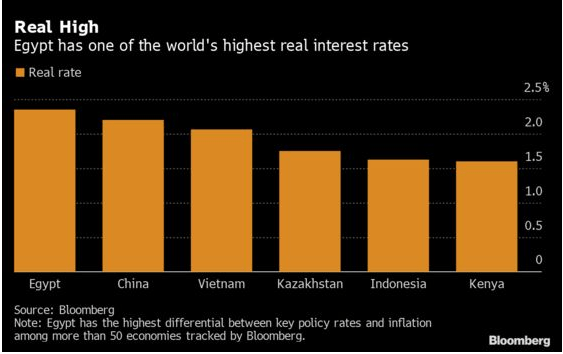

Rising inflation is a theme affecting the globe, and Vietnam has not escaped this threat. This is linked to some of the geopolitical issues in 2022, not to mention pandemic-related supply disruptions. U.S. stocks have felt the pain from the Fed needing to raise rates quickly, and the negative sentiment has spread to Vietnam stocks.

I would point out though that the U.S. might envy Vietnam in that the latter at least started the year with clearly positive real interest rates. Below is a snapshot of a Bloomberg report from February this year, comparing real interest rates of more than 50 economies. Vietnam featured as the third highest.

Bloomberg

Vietnam stocks are cheap

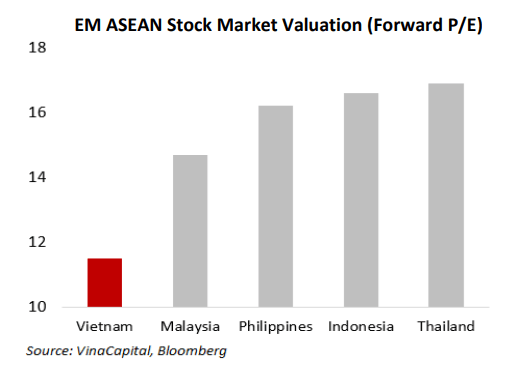

Based on forward estimates, the below table (created on June 9th), shows that Vietnam stocks trade on a forward P/E of circa 11.5x. Note in the month since the market fell another 10%, so the multiple now has likely gotten cheaper.

VinaCapital Insights Vietnams Stock Market Bounced Back And More Gains Ahead

Most investors would consider such a P/E ratio on its own as cheap. The above chart also shows that, when compared with other markets in the Southeast Asia region, Vietnam stands out.

It also appears cheap when one considers Vietnam has been one of the globe’s top-performing economies in terms of GDP over the last couple of decades. I would conservatively expect Vietnam’s GDP over the next couple of years to be in the 6%-7% range, which is what we have become used to over the last decade (pandemic years excluded). Brokers’ EPS growth over 2022 and 2023 is also very strong. Vietnam fund manager Dragon Capital recently highlighted the strong GDP and EPS forecasts.

Vietnam to benefit longer term from recent global events

Since my previous article, written back in 2019, it is worth pondering how global events since then might impact Vietnam going forward.

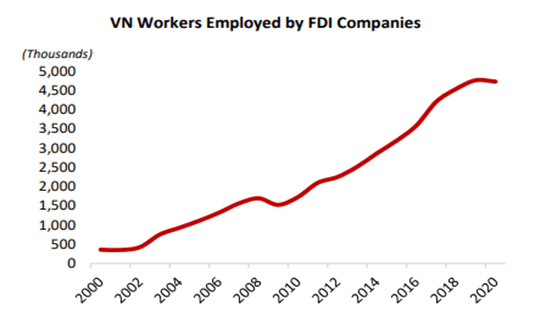

Despite the pandemic, Vietnam’s FDI flows are only going through more of a pause rather than any slump over the last couple of years. That would be an impressive achievement, in light of the strong growth seen leading up to 2020. The chart below shows how steadily increasing FDI flows into Vietnam can have a powerful effect on their economy.

VinaCapital Insights Vietnam Continues To Attract High Quality FDI

Diversifying one’s options for global manufacturing bases is seen as even more attractive now since the pandemic and what we have witnessed with China. Vietnam’s relatively young and cheap labor force in this area is a competitive advantage that it still boasts today. I was positive on this in my article three years ago; this remains the case, and FDI trends further back this up.

Another major global event has been the impact of inflation in 2022. Vietnam will not escape the pressure of rising inflation itself. However, from a relative standpoint it is in a better position than many in part due to a couple of factors. Unlike many developed countries, Vietnam had more of a normal positive interest rate curve leading up to 2022, with less intervention from central banks.

In terms of food price inflation, the fact that Vietnam is a significant food net exporter holds it in good stead. Food represents a relatively high component of their CPI basked compared to developed countries.

Lastly, post-pandemic the government is making infrastructure spend more of a priority. As someone who spends half the year living near Ho Chi Minh City, I can see the attempts to boost this area of the economy.

How to get your Vietnam exposure – active still preferable vs. passive ETFs

My preference to seek Vietnam stock exposure via this active fund rather than passive ETF options has not changed since my last article in 2019. In fact, the data since then suggests this is even more compelling.

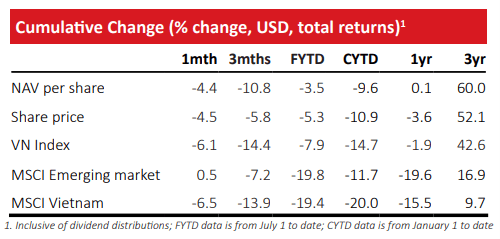

Below is the recent performance data from VCVOF’s monthly reports, as of May 31st this year:

VOF Monthly Factsheet May 2022

Note this May 31st date is flattering to them from a nominal performance perspective, because the VN-Index slumped 7.4% in June. According to filings with the London Stock Exchange, VCVOF’s performance relative to the index improved as their NAV only fell 5.1% for June.

I would point out that even if we take into account that Vietnam stocks slumped badly in June, their performance over the last three years is still quite positive. They achieved easily double-digit annualized returns and continue to comfortably outperform the VN-Index.

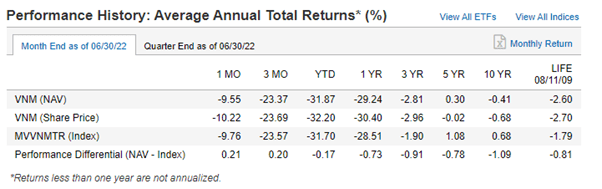

Let’s keep that in mind when taking a look at a very popular Vietnam ETF, such as the VanEck Vietnam ETF (VNM). Below is the performance table from their recent June 30th factsheet:

VNM VanEck Vietnam ETF factsheet June 30 2022

Over the last three years it shows clearly negative returns. In fact, over nearly all time periods returns are in the red, even over as long as 10 years plus.

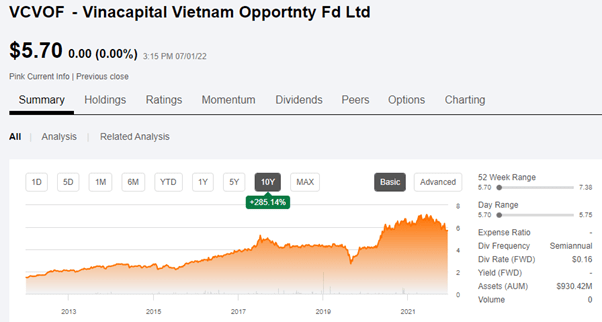

Now let’s turn back to VCVOF’s history over the last decade. Just from the share price trend we can see a major positive difference.

VinaCapital Vietnam Opportunity Fund Ltd [VCVOF] Stock Price Today Quote & News Seeking Alpha

Some readers might point out that there are even better active manager alternatives to VCVOF. I do have some sympathy for that view. While exploring those in detail would be an article in itself, a few funds do come to mind, which I shall mention.

It might be worth checking out another closed end fund in Vietnam Enterprise Investments Ltd. (OTC:VTMEF). In terms of open-end managed funds, I have a high regard for the Pyn Elite Fund and the AFC Vietnam Fund.

I am still personally largely sticking with VCVOF as it is a bit nimbler in terms of size vs. VTMEF. I also like the expertise VCVOF has in identifying investments at private equity stage.

So, why are such funds outperforming the VN-Index and VNM? It’s a combination of a variety of factors. Compared to the U.S., the Vietnam stock market is less efficient and there is less competition with active fund managers setting up shop to beat the market.

There are also notable structural differences with an ETF like VNM. It’s not set up locally in Vietnam, so it can run into foreign ownership limits in terms of being able to invest in Vietnam stocks. That might explain why this ETF allows itself to hold companies that trade on stock exchanges like Japan, South Korea, and Taiwan. They allow this if the stocks held have significant business exposures to Vietnam.

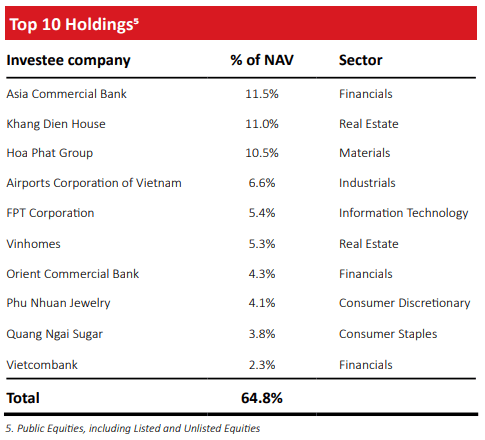

VCVOF Fund top holdings

Prospective investors in this fund should be mindful they are not frightened to take rather concentrated positions in their portfolio. Below is the holdings snapshot as of May 31st this year. I do consider it well diversified from a sector point of view.

VOF Monthly Factsheet May 2022

VCVOF expense ratio and corporate governance

I won’t repeat all the background here from my 2019 article, but note that the ongoing fees are expected to be 1.6% a year. This is before what I consider to be a relatively reasonable performance fee structure, and overall the fees have come down a little over the last decade. The performance fee has now come down from originally 20% to 12.5% of outperformance, based off a hurdle rate of a nominal 8% per annum return.

There was some pressure a decade ago from activists, and there is a continuation vote mechanism in place. The fund has also demonstrated it is willing to buy back a lot of shares when the discount is closer to its wides. There is a good chance one can still buy this at a 20%-plus discount. I believe such a discount is excessive, and the points I made about its performance against the VN-Index and other ETFs back this up.

Risks

Key risks include further scandals being uncovered by the crackdown on corruption. The most obvious risk relates to a global economic slowdown, where the outlook is becoming increasingly uncertain. Vietnam has been benefiting from a strong export sector to many more developed nations. They also benefit, as I discussed earlier, from major global companies’ FDI flows into Vietnam. These two trends weakening could drag down Vietnam economic growth more than expected.

Conclusion

Despite the above-mentioned key risks, a good buying opportunity has likely presented itself for Vietnam stocks at the halfway mark of 2022. Valuations appear to be very cheap, which should provide some downside protection to these risks, as well as if the environment of weakness in U.S. stocks continues.

A 20% discount to NAV makes VCVOF (note that I own this via its London listing, as the U.S. listing is less liquid) a logical way for investors to buy the Vietnam stock market dip in 2022. This becomes clearer when one examines active management in Vietnam vs. the performance of various Vietnam ETFs. This is a dynamic that differs from many large global developed stock markets, and one that prospective Vietnam stock market investors need to be well aware of.

A future positive catalyst might also be global indices providers deciding to upgrade Vietnam from frontier to emerging market status. While this might not occur for another couple of years, stocks could soon start to head into an uptrend again as investors position earlier for this.

Be the first to comment