brytta

It was a mixed Q2 Earnings Season for the Gold Miners Index (GDX), with most producers maintaining annual production guidance but having to revise cost guidance higher. Although Victoria Gold (OTCPK:VITFF) didn’t have to adjust its outlook, it noted that it’s tracking toward the low end of production guidance, which should push costs above $1,400/oz. This is not ideal and will be the second consecutive year where it’s guided too aggressively. That said, with Victoria trading at ~4.2x FY2022 cash flow estimates, I see this weaker outlook short-term being mostly priced into the stock.

Eagle Mine Operations (Company Presentation)

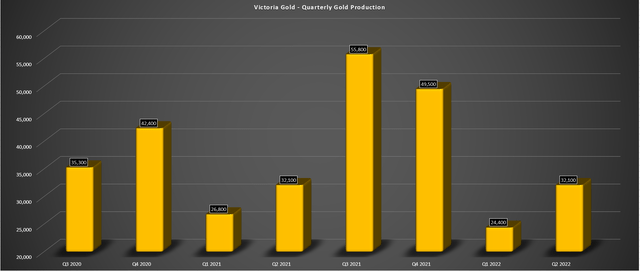

Q2 Production

Victoria Gold released its Q2 results earlier this month, reporting quarterly production of ~32,100 ounces, translating to flat production vs. the year-ago period. The softer start has left H1 2022 production 4% behind last year’s levels (~56,400 vs. ~58,900) and is not the start the company wanted if it had any hopes of meeting its FY2022 guidance mid-point (~177,500 ounces). This resulted from harsher weather in Q1, and wildfires southwest of its Eagle Mine disrupted the Yukon Power Grid, impacting crushing and stacking operations in July.

Victoria Gold – Quarterly Production (Company Filings, Author’s Chart)

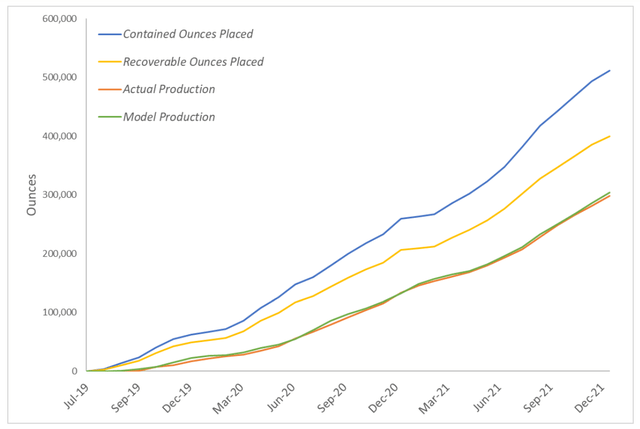

Given the sub-par start to the year, Victoria has noted that it expects production to come in at the lower end of its FY2022 guided range (165,000 to 190,000 ounces), potentially leading to a year-over-year decline in production if production misses the range. Given that FY2021 was already a much softer year than expected (~164,200 ounces vs. 190,000-ounce mid-point), the miss vs. easy comps is less forgivable. That said, this has been a difficult year (wildfires, extreme temperatures), but to regain investors’ trust, the company will need to start guiding more accurately. The silver lining is the ore is where it should be, and operations are tracking well against estimates, with higher ounces recovered than estimated in the recovery model to date.

Victoria Gold – Actual Production vs. Modeled Production (Company Presentation)

This is important because it means that this is not an asset with issues and may not ever produce according to plan like the Pure Gold Mine in Red Lake. Instead, Eagle is an exceptional asset with some temporary growing pains from external factors. In fact, if Project 250 is achievable, this asset is operating at nowhere near its true potential, which is 250,000+ ounces per annum after implementing initiatives like year-round stacking and installing an intermediate scalping screen. From a mine life standpoint, the current Technical Report also understates Eagle’s potential. I would expect the mine life to increase considerably by 2025, given that the current pit only includes mineralization within 400 meters of the surface, but mineralization extends to ~800 meters.

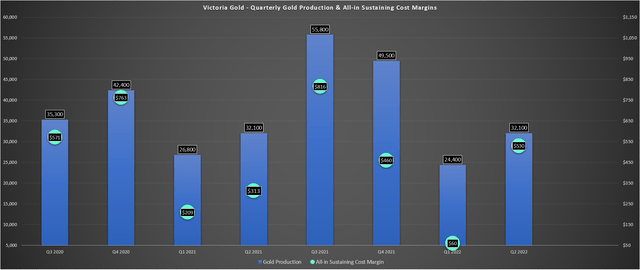

Costs & Margins

While the lower production already would have provided an impact on FY2022 costs, higher diesel prices, a tight labor market, and the impact of higher fuel costs on several other cost inputs. On a quarterly basis, inflationary pressures and a weaker denominator (~28,600 ounces sold vs. ~32,100 ounces produced) led to higher than expected operating cash costs and all-in sustaining costs [AISC] of $1,057 and $1,371/oz, respectively. Fortunately, Victoria saw a slight tailwind from the higher gold price vs. Q2 2021 levels ($1,901/oz vs. $1,872/oz), which was one of the highest realized gold prices in the sector.

Victoria Gold – Production & Costs (Company Filings, Author’s Chart)

From a margin standpoint, we did see a considerable improvement in AISC margins, with margins coming in at $530/oz vs. $313/oz (Q2 2021). This was despite sustaining capital being quite heavy in Q2 2022 (~$14 million) relative to where it will be in future years (sub $20 million per year), a drag on the company’s cost profile. The higher spending was related to scheduled rebuilds of the mining fleet, an expansion of the heap leach pad, and the construction of a water treatment facility.

Based on the continued impact of inflationary pressures combined with what’s likely to be a much weaker gold price in H2, I wouldn’t be surprised to see AISC come in above $1,400/oz this year, well above the FY2022 guidance mid-point ($1,325/oz). This would translate to a sharp decline in AISC margins year-over-year, with Victoria Gold likely to report sub $450/oz AISC margins vs. $597/oz last year. These AISC margins would be below the industry average, which I have estimated at $525/oz. Plus, it’s important to note that this is a much higher cost year for Victoria from a sustaining capital standpoint, depressing its margins vs. peers temporarily.

Valuation & Medium-Term Outlook

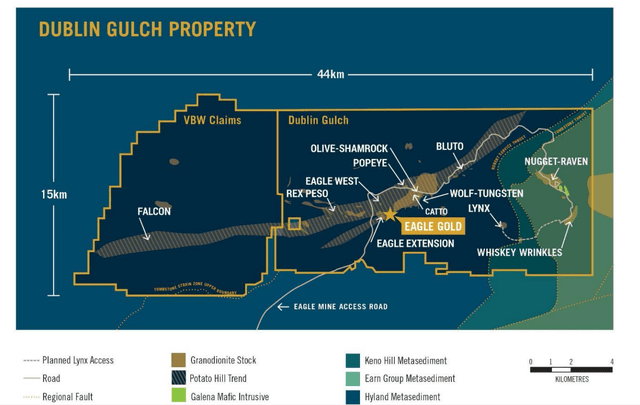

Based on an estimated ~68 million fully diluted shares and a share price of US$7.40, Victoria Gold trades at a market cap of ~$503 million and an enterprise value of ~$650 million. If we compare this to Victoria’s estimated net asset value of ~$1.04 billion, the stock is very attractively valued, trading at roughly 0.50x P/NAV. Notably, this NPV (5%) figure places minimal value on the project’s regional upside (~35,000 hectares) for the Dublin Gulch Property.

This is one reason why I see Victoria as a likely takeover target if it heads below US$7.00. The reason being Eagle could ultimately be a 275,000-ounce plus per year operation over a 25+ year mine life with year-round stacking, a slight increase in scale, and continued resource growth (below and west of current pit & regionally).

Victoria Gold Land Package (Company Presentation)

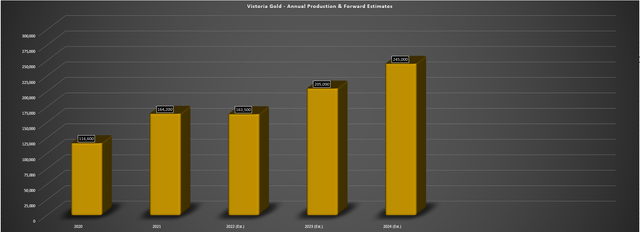

From a cash flow standpoint, Victoria is also very attractively valued, trading at less than 4.2x FY2022 cash flow per share estimates ($1.70). This is even though FY2022 will be a much softer year for the company due to elevated costs, with all-in sustaining costs likely to come in above $1,320/oz, with annual gold unlikely to surpass 170,000 ounces per annum. However, looking ahead to FY2023 and FY2024, I expect annual gold production to increase to 205,000 ounces and 245,000 ounces, respectively.

Victoria Gold – Annual Production & Forward Estimates (Company Filings, Author’s Chart & Estimates)

Under these assumptions and with a much more attractive cost profile in FY2024 (lower sustaining capital and higher production), all-in sustaining costs should retreat to below $950/oz. This would make Victoria one of the lowest-cost producers sector-wide, and it would set the company up to generate annual cash flow per share of $2.75, which assumes a sub $1,800/oz gold price. So, while Victoria already looks cheap based on FY2022 metrics (4.2x operating cash flow), it boasts a ~30% free cash flow yield if it can execute successfully on Project 250 by 2024, even if the gold price treads water ($1,780/oz – $1,820/oz).

Eagle Mine Operations (Company Presentation)

Summary

Victoria Gold had a disappointing start to FY2022 and while it’s had its challenges, this is the second year where production guidance will miss the mark. This is understandably quite disappointing for investors. That said, 2022 looks like it will mark the peak from a cost standpoint for Eagle and a trough for annual production. So, if one is willing to be patient, I see considerable upside over the next 18 months. That said, my preferred way to get exposure to this Tier-1 asset is through Osisko Gold Royalties (OR) which has a 5% net smelter return royalty, and trades at its most attractive valuation since March 2020.

Be the first to comment