Marko Geber

Cardlytics, Inc. (NASDAQ:CDLX) is facing some challenges in the current macro environment, like all other advertising companies. The stock price is not immune to the overall market and has dropped significantly. Following up with my previous coverage of CDLX, I think it is worth discussing the updated fear factors associated with CDLX after Q2 2022 while I am still long the stock.

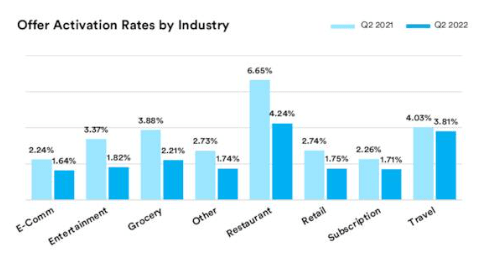

The activation rate went down

Last quarter, the billings growth is 26% (lower than long term target of 30%). Given the challenging macro environment, I think it is not bad. But the chart below shows that CDLX’s activation rate went down during Q2 2022. This is a concern because some advertisers might question CDLX’s conversion capabilities. If nobody activates those ads, it means: 1. nobody knows about CDLX’s ads; 2. CDLX’s ads are not interesting; and 3. nobody cares.

A counterargument is that CDLX offers much more choices than before. And there are more subscription-based ones that have naturally low activation rates. The activation rates and redemption rates for Starbucks’ (SBUX) offer could be as much as 15 to 30x more than an offer for AT&T (T).

CDLX activation rates (CDLX presentation)

The self-service platform is not showing huge momentum

The majority of bank people are still not on the server. The process is so slow that people worry that CDLX will delay their target of reaching 50% of MAUs to the ad server by the end of 2022. This ad server idea has gotten people excited for a while because of the possibility of truly scaling and elevating consumer experiences. However, it has been several quarters, and CDLX hasn’t shown the exponential growth that was expected. I started to question if there are any engineering issues and how automatic that platform truly is.

Not a mainstream platform

Multi-touch attribution (MTA) can attribute credit for a conversion to one or more touchpoints from the perspective of the customer’s journey. It is the practice that is widely used in the industry. There are lots of tools available and lots of experiences around them. MTA can also be programmed so advertisers can quickly understand ROIs. This is what CDLX lacks, which makes it difficult to be mainstream in terms of advertising. During tough macro times like we are having right now, CDLX may be the first to be dumped instead of Google (GOOG) (GOOGL) and Meta (META) because in my view CDLX is not a platform businesses really rely on.

Mediocre product

CDLX’s product offerings don’t reflect its potential and value for customers. CDLX is doing a well enough job to keep them on those banking apps but I don’t think the banks are super excited. After all, those tiles are static and not user-friendly. It is boring. This explains why only 20-30% of MAUs actually look at them.

There are no graphics, videos, or pop-up pages to show ads. CDLX could not make it more lively and engaging. Of course, CDLX could blame banks to be slow on adaption. But that sounds like an excuse to me. Why CDLX don’t help and facilitate changes in bank UI?

Banks may drop CDLX

This is always a concern. Banks have lots of initiatives going on which may involve investing in in-house ad tools or consumer analytical capabilities. News about these can always be interpreted as one step closer to dropping CDLX. The recent Figg acquisition can be a big issue for CDLX given the similarities between the two businesses. But I think the Figg acquisition should not be a move to replace CDLX. Chase’s (JPM) intention is to focus on SMB offers and analytics, as Figg has a stronger focus on SMB and local deals.

Will there be another similar acquisition or partnership by Chase and other banks? I am pretty sure there will be. The fact that CDLX has very little leverage and pricing power over those big banks is a concern. Banks don’t rely on CDLX, but CDLX does rely on banks. For now, it is a good thing to have CDLX in those banking apps. But there is no guarantee this will be the case 3-5 years from now.

The pace of tech innovation in CDLX is not impressive

CDLX just needs to do a better job on its platform. I don’t think they have done much in personalization and targeting. Those deals have been there for years, why I don’t see significant technological improvements other than more icons? CDLX’s main focus is customer onboarding and business expansion in the last several years. And I agree they did a good job on marketing and getting huge MAUs. The Bridg and Dosh acquisitions are also exciting. But what about its own tech stack? Why they cannot launch the ad server and self-service much earlier? Compared to other tech companies such as Shopify (SHOP), Block (SQ), and Asana (ASAN), CDLX’s pace of tech development is just not impressive.

Bottom line

Although these concerns will keep haunting CDLX in the near future, I don’t think they undermine the opportunities and growth potentials that it offers (I covered in my previous article). Companies are facing challenges here and there all the time. No moat is guaranteed. The good news is that some of these issues can be solved by simply improving its product offerings. The new CEO, Karim Temsamani, has experience working with media and publishing businesses like Time Inc, advertising tech like Google, and banking/financial products like Stripe. He definitely understands data science, software engineering, banking, advertising, and media. I think he is a perfect fit and will bring lots of unique perspectives to CDLX.

Be the first to comment