VioletaStoimenova

Thesis highlights

I believe TELUS International (NYSE:TIXT) is undervalued as of today. Customers quantify brands based on the quality of experience they are offered. TELUS has superior, cutting-edge technology based on a sustainable model for building and preserving customer relationships.

Company overview

TIXT is an innovative digital experience company that designs, builds, and delivers futuristic solutions for global brands. It helps clients support and make the best use of their customers’ lifecycles using digital technology, as they move towards better business outcomes.

The TIAI solutions TELUS offers can be seen in the annotation of data on text, images, videos, and audio in more than 500 languages and dialects, making it easier and more effective in social media, retail, and mobile. It helps improve the way data works and gives clients solutions that are secure, compliant, scalable, and of high quality.

Investment merits

Technology is eating the world

Technology is transforming the way businesses interact with their customers at an unprecedented pace and scale. More than ever, companies have more information on their customers’ choices than ever. Mobile devices, social media platforms, and other methods of digital interaction mean unlimited access to information for customers, a development set in motion by the COVID pandemic. Customers are known to value personalized experiences when interacting with companies that serve them. Businesses are finding ways to feel, act, and be more human when interacting with their customers.

Across industries, businesses of various scales are measured by the quality of their customer interactions. Using next-generation technology like advanced analytics, AI, robotic process automation, and augmented and virtual reality, digitally focused companies can streamline customer interaction without seeming too mechanical. Thus, they can carry the customer along from product awareness, product research, purchase, fulfillment, and customer retention at the highest level. Adopting newer technology like AI requires access to the high-quality data required to power products and analytics platforms, making them personalized and consistent for consumers around the world.

In addition, customer interaction has evolved from a one-way channel to omnichannel points of engagement based on increasing knowledge of customer behavior. These points of engagement serve as opportunities to build customer loyalty and maximize profits. Recognizing that people are the primary point of contact between their company and its customers, businesses of all stripes are shifting their attention to the customer experience. Agent-driven interactions have given way to a more holistic approach to managing the customer experience across digital and human channels, with the latter reserved for more complex interactions and exception handling. Because humans are still relied upon for the majority of interactions and exception handling, the importance of having employees who are invested in their work and have experience representing their brands in interactions with customers has never been higher.

However, a customer-centric mindset is not enough. Companies need to redesign their customer engagement platforms to help them gather all available customer information and integrate with middle- and back-office systems to use the data to provide a personal experience. This highlights the importance of advanced analytics experts who can deploy collected data using AI and machine learning.

Getting such experts poses a major challenge to the companies already in existence. They are equipped with sophisticated technology but lack skilled hands to deploy it. There is a severe lack of operations talent to develop strategies, engineer processes, and provide profitable customer experiences that are integrated across digital and human channels.

Current solutions do not fit the bill

One needs highly trained professionals working alongside leading digital technology to deliver the best omnichannel customer experience. There are few organizations like TELUS that have a good quantity and quality of both. This is because experts are not built by solutions. Experts build solutions. Most times, the solutions provided lack talented fingers to reliably deliver them.

TIXT has deep domain expertise

TELUS has proactively built an integrated system to deliver customer experience solutions for its clients. Services range from designing to building to delivery, offering clients a complete, transformative, digitally enabled solution. Moreover, TIXT is able to design, construct, and provide integrated solutions that combine both process and technology, making it better able to meet the varied and complex requirements of its customers.

Its end-to-end solutions address client needs at all stages and position TELUS to appropriately confront clients’ evolving priorities over time while growing the company. As the scope of work expands and TELUS gains more footing in the business, it becomes better positioned to identify new opportunities for continued improvement. This forms a virtuous cycle as TELUS has been able to leverage its expertise in its industries to grow its capabilities and attract new clients as its client base has grown.

Global GTM model

TIXT has spent years perfecting a global delivery model that is uniquely its own, made possible by cutting-edge technology and featuring the scope and nimbleness necessary to provide excellent service to clients. It employs over 50,000 people in over 50 different delivery hubs, and almost all of them are linked together by a highly reliable and secure carrier-grade network.

In addition, the company’s ability to collaborate and pivot client solutions across geographies, time zones, and communication channels is enhanced by its fully virtualized, cloud-based infrastructure. Because of the sophistication, agility, and scale of its delivery capabilities, TIXT can rapidly adjust its delivery strategy in response to fluctuating client demand and unique circumstances. In addition to enhancing business availability and resilience, TIXT’s global AI community of over a million crowdsourced data annotation professionals makes this possible.

Diversified base of customers

For me, TIXT’s success has come in large part because of the variety of people it serves. Within its core industry verticals, TIXT works with a wide range of clients, from startups to large corporations, and within some of these verticals, TIXT serves clients in multiple sub-sectors. When it comes to delivering our TIAI solutions, TIXT also works with industry-leading digital assistant, search engine, and ad network providers.

It is crucial to keep in mind that TIXT’s customers put their trust in TIXT to safeguard their names and images. TIXT’s high ability to provide client references boosts its credibility with clients in both existing verticals and new ones. This, in turn, helps the company grow.

Valuation

Price target

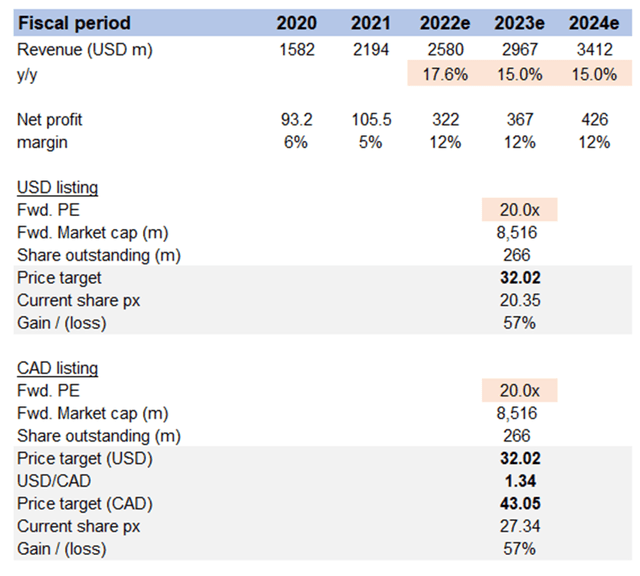

My model suggests a price target of USD32 in FY23. This assumes that revenue will continue to grow in the mid-teens range, and that the forward P/E multiple will be 20x in FY23e.

For FY22e, I used FY22 guidance and for FY23e and beyond, I believe TIXT can continue to grow at mid-teens rates by capturing more market share and advance its leadership.

As for how much TIXT is worth, it trades at 15x forward P/E right now, but I believe it should revert to at least 20x (assuming it trades at 4x below its average since inception due to interest rate difference).

Risks

Intense competition

TELUS fishes in a large, competitive market. As it continues to expand its digital capabilities, new and different competitors are doing the same. The one who can be most innovative gets the lion’s share of the market, hence, there is always the possibility that TIXT falls behind the race.

Recession

Economic changes that affect clients’ businesses in adverse ways could also impact TELUS, as they will lead to a decreased demand for services. This could deal a deadly blow to revenue because, in times of economic and political upheaval, clients might choose to reduce or defer spending. The existence of these possibilities makes clients wary.

Conclusion

TIXT is undervalued. Few companies can combine technology power and human resources as efficiently and on such a scale as TELUS has been able to do. This means that while the market is competitive, there are fewer still that could threaten TELUS’ advantages. This is evidence of TELUS’ enormous value in the industry.

Be the first to comment