martin-dm/E+ via Getty Images

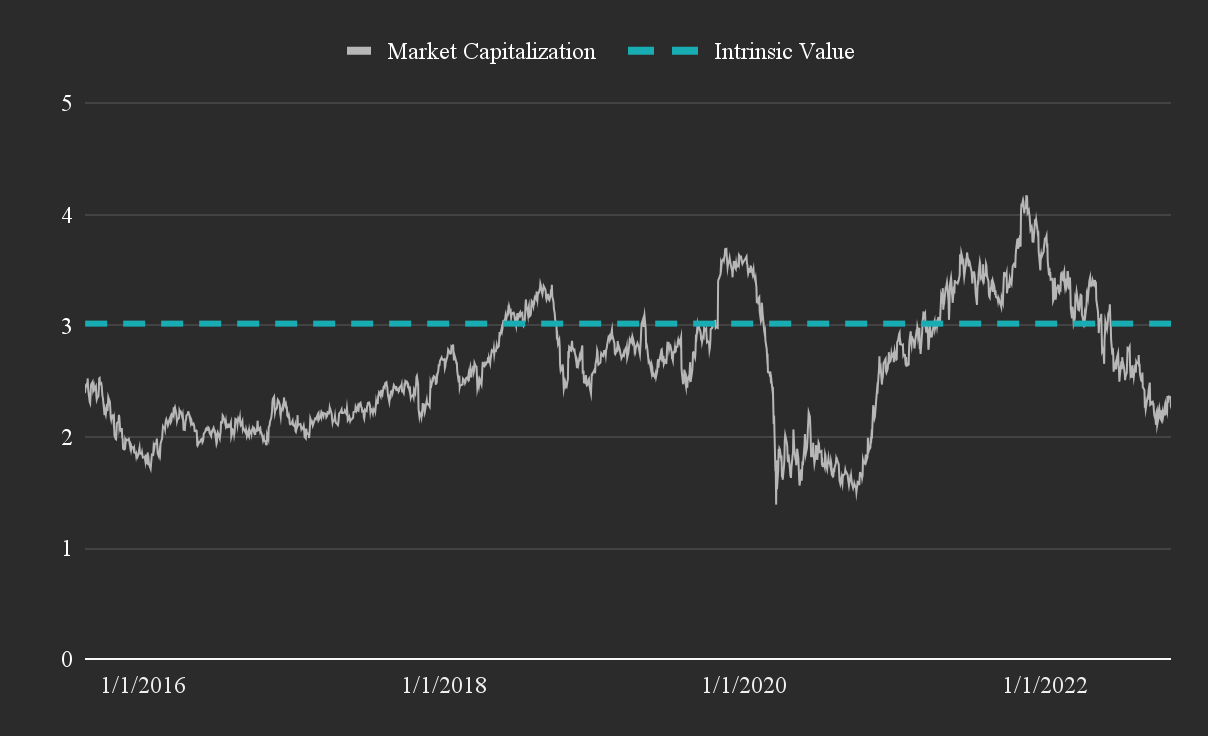

Steven Madden (NASDAQ:SHOO) primarily sells standard-tier women’s shoes that offer customers similar designs to premium brands such as Versace. Madden caters to a specific demographic that wants to look expensive without paying a brand premium. As such, the company has fairly successfully positioned itself primarily in the U.S. market, and with a market cap of $2.3 b, seems to be significantly undervalued for investors.

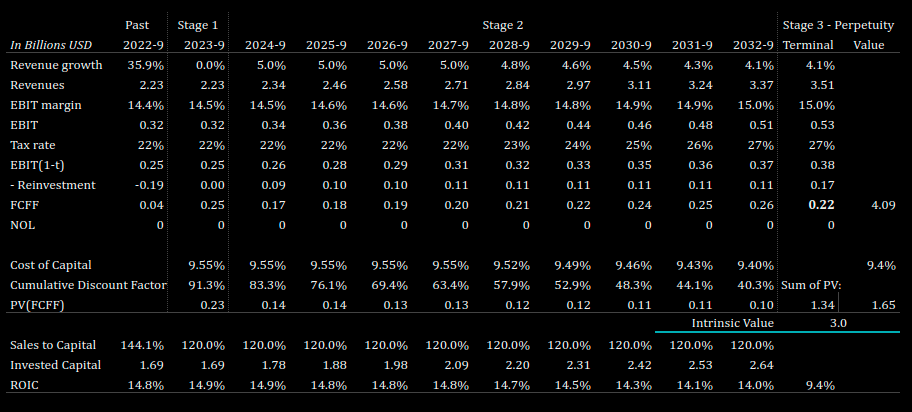

In my view, the company will recover and keep growing revenue around 5%, as well as elevate operating margins to 15% from future online distribution. This indicates that investors may be overlooking the fair value of Madden, which by my calculation comes up at $3 b or $38.2 per share, roughly where it was trading in April 2021. Here is my intrinsic value estimate for the company:

My intrinsic value estimate for Steven Madden (Author image with data from FMP)

I set the 1-year price target for the stock at $41, implying a 40% upside from today. Given the volatility of the stock, investors need to have an investment horizon of between 11 and 22 months for the stock to have a reasonable chance to converge to value.

The valuation and all calculations for the analysis can be viewed and freely tweaked from the spreadsheet model. We will evaluate the fundamentals and present the case for this valuation. We start with the latest earnings release.

Q3 Earnings Analysis

On a quarterly basis, the key earnings highlights are:

-

Revenue up 5.3% to $556.6 m, vs the $528.7 m from a year ago.

-

Gross profit as a percentage of revenue was 41.2% compared to 41.6% in the same period of 2021.

-

Income from operations totaled $78.8 m, or 14.1% of revenue, compared to $88.4 m, or 16.7% of revenue, from a year ago.

-

Net income $61.3 m, or $0.79 EPS, vs the $66.6 m, or $0.82 EPS, from a year ago.

Profitability seems to be taking a hit from inflation. The company has historically attempted to pass on rising inflation costs to the consumer, which may also be possible in the current setting.

I also translated the quarterly into trailing twelve-month earnings and here are the highlights:

-

Revenue of $2.23 b, up 36% YoY.

-

Gross profit of $913.5 m, with a margin of 41%, up 0.5% from 40.5% YoY.

-

Operating income of $321.3 m, with a margin of 14.4%, up 3.1% from 11.3% YoY.

-

Net income of $250.26 m, an 11.2% margin, up 2.2% from 9% YoY.

-

Calculated free cash flows to the firm of $38.9 m, down 46% vs $72.3 m a year ago.

The decline in earnings and free cash flows may be part of the reason why the value of the company has declined to $29.2 per share. Madden is not a widely followed stock, so investors may simply be using automated EPS % change investment strategies, which may fail to estimate the future potential of the company, leaving investors with more room to act.

Guidance

For fiscal 2022, Madden now expects revenue will increase around 13% over fiscal 2021, implying $2.1 b in FY 2022. This would mean a reduction of 5.4% over the current 12-month revenues.

Madden expects diluted EPS will be in the range of $2.77 to $2.79, and adjusted diluted EPS will be in the range of $2.77 to $2.82.

Fundamentals

Next, we will go into the key value drivers for our valuation. While growth may turn out to be flat or negative next year, it is profitability that is a more important driver for the valuation.

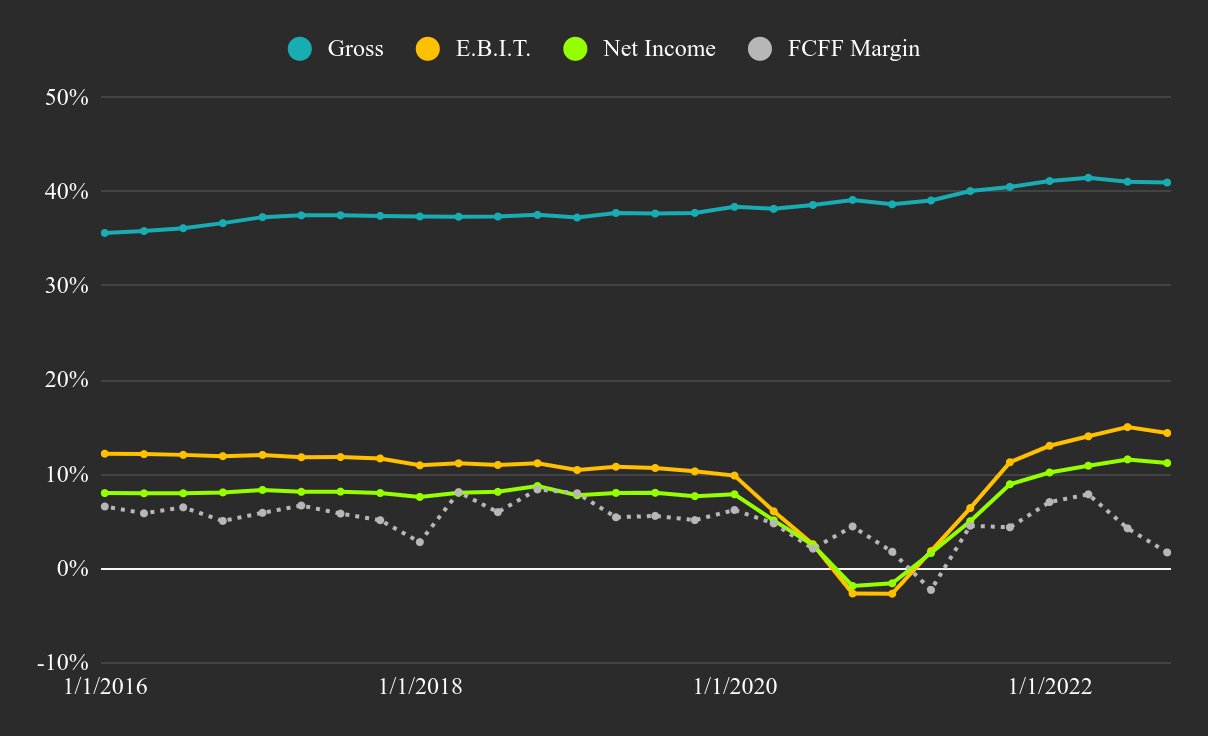

If we take a closer look at profitability, we can see that the company managed to recover from 2021 and kept margins stable:

Steven Madden’s trailing twelve month profit margins (Author image with data from FMP)

This helps us understand the company’s position, as it seems that in late 2021 and early 2022, SHOO enjoyed a recovery bump which can stabilize in the long term.

The Importance of Online Direct to Consumer

A look at the key segments reveals that (DTC) plays an important role in the business. As of the first six months of 2022, Madden sells in:

-

Wholesale footwear, accounting for some 58% of revenue.

-

Wholesale accessories/apparel, driving 19% of revenue.

-

Direct to consumer, constituting a blend of online and brick and mortar stores, accounting for 22.3% of revenues.

While inflation can impact profitability next year, we expect direct-to-consumer sales to improve and represent a bump to profitability in the future. For Madden, (DTC) comprises 216 stores and an online presence in 6 e-commerce websites. The (DTC) vertical that has potential to increase in profitability is specifically the online presence. The company seems to be behind this vertical, which they are now streamlining and will largely realize in the next few years.

My assumption is that future profitability is tied to the success of the online (DTC) vertical, and is the key difference between the market price and my valuation. If investors see the company reverting to historical EBIT margins between 10% to 12%, then the stock is likely trading at fair value. However, if you believe that Madden can drive profitability from their (DTC) segment, then you are looking at an undervalued stock.

For this reason, I expect that Madden reaches EBIT margins at 15% over the next decade.

Valuation Model

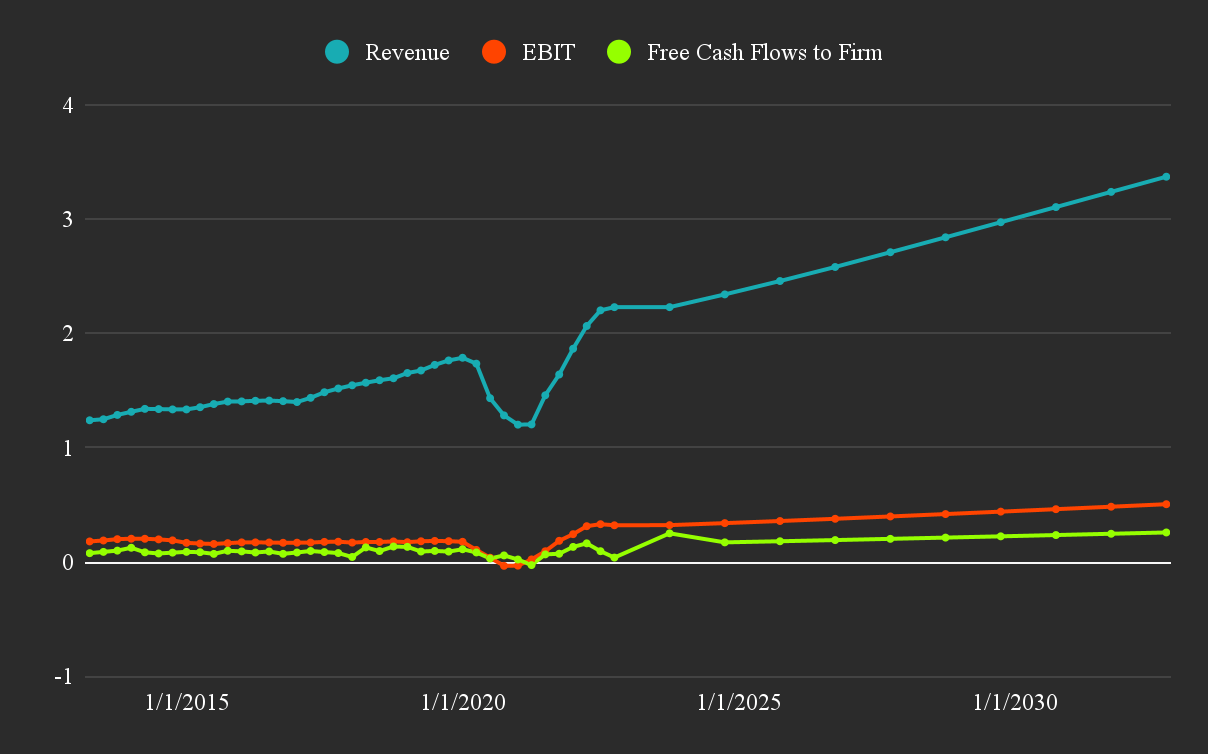

Using the mentioned assumptions, we can construct the following model for Madden: Estimated flat revenue growth next year and 5% growth in the 4 years after that. Future EBIT margin of 15%, implying unlevered free cash flows between $170 m and $250 m in the next 10 years. For a discount rate I use the cost of capital of 9.6% reflecting the current risk appetite of marginal investors and the risk of the business that cannot be diversified away in a portfolio.

Finally, we get our expectation of Madden’s future performance in the chart below:

Future performance model for Steven Madden (Author image with data from FMP)

You can also view the details for each year in the forecast period from the chart below:

Valuation table for Steven Madden (Author image with data from FMP)

Risks and Returns

As with any company, Madden has some risks that we should take into consideration. The first is the impact of inflation, which can make it difficult for the company to sell excess inventory if consumers can’t afford the new product pricing. Currently, inventory levels seem to be at $244.3 m, which is a manageable level, not too far off from past values. Another risk factor is the possible horizontal product-line expansion by competitors. Madden’s offered product line can be easily obtained by white label manufacturers from China, and premium brands such as Capri Holdings (CPRI), Ralph Lauren (RL) and others, may choose to take minority interests in manufacturers down the pricing chain in order to undercut Madden’s market share. Finally, we need to note the company’s reliance on foreign manufacturers, which can destabilize as U.S.-China relations escalate.

On the other hand, in the last 12-months, Madden had an adjusted payout ratio (including dividends and buybacks) of 10.67%. Which is great and means that the company is returning capital to investors above the cost of capital of 9.6%. Additionally, the company has a return on invested capital of around 15%, some 5% in excess of its cost of capital. This means that for every $1 of revenue growth, Madden is increasing the capital value by $0.05 cents – in other words, it is a value creating company.

Possible Investment Approach

Given that the company’s price reacts to its historical performance, I expect some downside risk as inflation unfolds. This should allow investors to either find a good entry or to accumulate a position over time. I estimate that the stock is a buy, but may not be appropriate for the “buy and hold” approach because of expected near-term market volatility.

This analysis assumes that investors hold a diversified portfolio and have an investment horizon of at least 11 months. This stock may not be appropriate for investors that are already holding footwear competitors or have a portfolio with 10%+ exposure to consumer staples.

Be the first to comment