Khosrork

Over the past year or two, America, along with other countries around the world, has been devastated by incredibly high inflation problems. This has resulted in rapidly-rising prices of things such as energy and food, which are necessities for daily life. As a result, people have been desperately seeking ways to increase their incomes in order to be able to afford to support themselves. We have already begun to see people taking on second jobs or performing odd tasks in order to obtain this extra money. However, as investors, we have alternative methods available to use that can be utilized in order to boost our incomes. One of the best of these is to purchase shares of a closed-end fund that specializes in the generation of income. These funds are sometimes overlooked in the market but they are something that any investor should be aware of since they provide an easy way to obtain a diversified portfolio of assets that can in many cases deliver a higher yield than just about anything else that trades publicly. In this article, we will look at one of these funds, the PIMCO Corporate & Income Strategy Fund (NYSE:PCN). This fund boasts a very appetizing 10.57% yield at the current price so it definitely will deliver more income than just about anything else that is available in the market. As this yield appears too good to be true, let us investigate and see if this fund could prove to be a good addition to your portfolio today.

About The Fund

According to the fund’s webpage, the PIMCO Corporate & Income Strategy Fund has the primary objective of providing its investors with a high level of current income. The fund also has a secondary objective of capital appreciation and preservation. This is hardly surprising for a PIMCO fund. PIMCO is fairly well-known for being a fixed-income fund house and this particular fund is certainly no exception to that general rule. The fund invests primarily in corporate debt, although it will invest in other fixed-income securities such as government bonds. A fixed-income security typically delivers nearly all of its investment return in the form of direct payments to investors. These securities tend to have minimal potential for capital gains since they do not benefit from any growth and prosperity of the issuing company. After all, we do not see companies increase their payments on their bonds just because profits increase. As such, the price performance of these securities typically correlates with interest rates. This is an inverse correlation as rising interest rates cause bond prices to decline and falling interest rates cause bond prices to rise. As a result, there is a limit to the capital gains that can be earned because nobody will lend money at an interest rate below 0% without being coerced by some external authority. Thus, the majority of the fund’s returns will be interest payments that it receives from the bonds in the portfolio, which is exactly what its objective states.

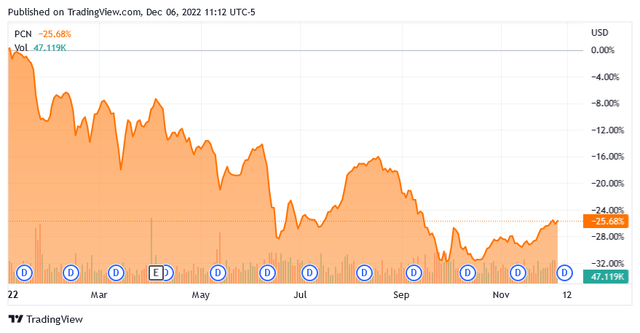

As everyone reading this is certainly aware, we saw an end to the easy money regime that was dominating the developed world earlier this year. In March, the Federal Reserve began to raise interest rates in an attempt to reduce the high levels of inflation that are plaguing the American economy. We have since seen other central banks around the world begin their own rate-hiking policy for the same reason and as of now, Japan is the only developed country whose central bank is not raising rates. This has naturally caused bond prices to decline, which shows up in the year-to-date performance of this fund. As of today, the fund’s shares are down 25.68% since the start of the year:

This is a bit worse than the corporate market has delivered over the period. As of the time of writing, the iShares iBoxx $ Investment Grade Corporate Bond ETF (LQD) is down 17.27% since the start of the year. However, the PIMCO fund does have a substantially higher yield that does close the performance gap somewhat. It seems likely that both funds will continue to suffer declines, at least over the near term. This is because the Federal Reserve has committed to maintaining its monetary tightening policies until the inflationary problem is conquered. The most recent CPI report shows a 0.4% month-over-month increase, which corresponds to a 5% annual rate. That is substantially above the Federal Reserve’s 2% annual inflation target so it seems likely that the central bank will continue to raise rates. Chairman Jerome Powell hinted as such during his presentation at the Brookings Institution last week. As bond prices correlate inversely with interest rates, we can therefore expect that shares of the fund will likely decline further before they rebound in any significant way.

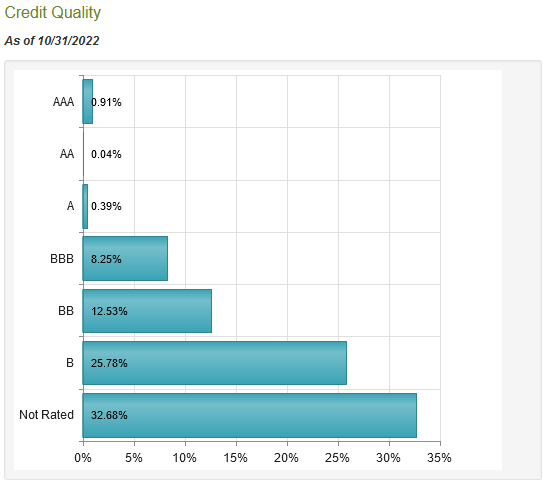

One way in which the PIMCO Corporate & Income Strategy Fund boosts its yield compared to the corporate bond index is by investing in high-yield bonds. These are what are colloquially known as “junk bonds” and their presence in the fund’s portfolio may account for some of the performance differences that we see between it and the index. We can see the presence of these bonds by looking at the credit ratings assigned to the assets in the portfolio. Here is a high-level summary:

CEF Connect

An investment-grade bond is anything with a rating of BBB and above so we can see that these bonds only account for 9.59% of the portfolio. It is unfortunately difficult to determine exactly what percentage of the fund is invested in junk bonds. This is because 32.68% of the portfolio is invested in unrated bonds. These might be issued by entities that would otherwise have a below-investment-grade rating but they also might not. However, it seems likely that most companies with very strong balance sheets would opt to spend the money to have their bonds rated as this can be a selling point to those investors and funds that will not buy anything other than investment-grade securities. A high rating also reduces the interest rate that the company has to offer to sell the bonds. As such, most of those unrated bonds are probably issued by companies that would otherwise not qualify for an investment-grade rating. If we assume that this is the case, fully 70.99% of the portfolio is invested in junk bonds. This is something that may concern more risk-averse investors.

With that said though, we can see that 38.31% of the bonds in the portfolio have either a BB or a B rating, which are the two highest ratings of junk bonds. According to the official bond rating scale, companies with these ratings do have sufficient financial strength to cover their debt obligations and should be fine through any mild or short-term economic shock. They might be vulnerable to long-term prolonged periods of economic weakness, but we have not really had one of those in the United States since the Great Depression. As such, the risk here is probably not as great as might otherwise be assumed.

One method that the fund can use to minimize its risk of losses due to default is having a large number of holdings in the fund. This ensures that a default or similar event will only affect a very small proportion of the fund’s portfolio. The PIMCO Corporate & Income Strategy Fund has 459 holdings at the current time, which should be sufficient to prevent it from losing very much if any single company goes bankrupt. Admittedly, the fund would still be vulnerable to a situation in which numerous companies across the economy all default at once, but such a situation would almost certainly be a sign that the economy has bigger problems than a few investors losing money. It is also highly unlikely so we can conclude that the fund’s default risk here is probably pretty low.

Leverage

As mentioned in the introduction, closed-end funds like the PIMCO Corporate & Income Strategy Fund have the ability to use certain strategies that allow them to boost their yields above that of their underlying assets. One of these strategies is the use of leverage. Basically, the fund borrows money and then uses those borrowed funds to purchase bonds and other income-producing assets. As long as those assets have a higher yield than the interest rate on the borrowed funds, this works pretty well to boost the yield of the overall portfolio. As the fund can borrow at institutional rates, which are significantly higher than retail rates, this will usually be the case.

However, the use of leverage is a double-edged sword. This is because debt boosts both gains and losses. This could be one reason why the closed-end fund has underperformed corresponding indices. As such then, we want to ensure that the fund is not employing too much leverage since that will expose us to too much risk. I do not generally like to see a fund’s leverage above a third as a percentage of assets for this reason. The PIMCO Corporate & Income Strategy Fund currently has a leverage ratio of 36.30% of its assets so it is above that threshold, but admittedly not substantially above it. When we consider that the fund is mostly invested in safe assets like bonds, its leverage is probably reasonable.

Distribution Analysis

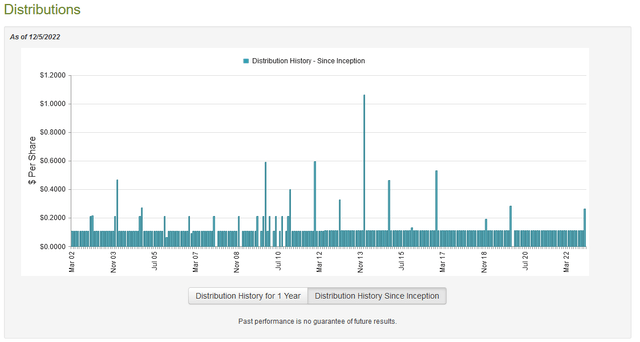

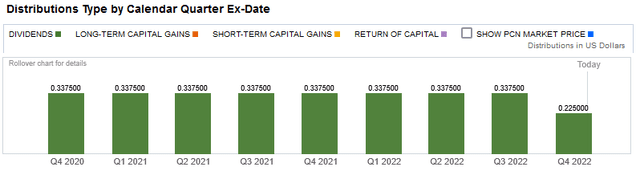

As stated earlier in the article, the PIMCO Corporate & Income Strategy Fund has the stated objective of providing its investors with a high level of current income. The fund accomplishes this by investing in a portfolio that primarily consists of high-yield bonds, which it then leverages up in order to increase the effective yield. As such, we may assume that the fund boasts a very high yield. This is certainly the case as the fund pays out a monthly distribution of $0.1125 per share ($1.35 per share annually), which gives it a 10.57% yield at the current price. The fund has been remarkably consistent about this payout over the years:

This sort of consistency is almost unheard of among bond funds, whose payouts usually vary with interest rates. However, it is not a bad thing if the fund can actually maintain this distribution. The fact that its distributions are entirely composed of dividend income gives some confidence that this is indeed the case:

The reason that dividend income is generally the most sustainable is its nature. A return of capital distribution can be a sign that the fund is returning the investors’ own money back to them. A capital gains distribution is dependent on the fund being able to produce capital gains, which is not always possible. Thus, neither one of these is guaranteed to be long-term sustainable. A dividend distribution generally is because bond payments do not vary over the lifetime of the bond. However, it is possible for these distributions to be misclassified, as I have pointed out before. Thus, we do still want to investigate in order to determine how exactly the fund is financing these distributions so that we can figure out how sustainable they are likely to be.

Fortunately, we do have a relatively recent document that we can consult for this purpose. The fund’s most recent financial report corresponds to the eleven-month period ending June 30, 2022. As such, it will give us a pretty good idea of how well the fund handed the switch from an easy money to a tight money central banking policy as well as the resultant rise in interest rates. During the eleven-month period, the fund received a total of $53.285 million in interest and another $827,000 in dividends from the investments in its portfolio. This gives the fund a total income of $54.112 million during the period. It paid its expenses out of this amount, leaving it with $47.576 million available for investors. This was not enough to cover the $52.821 million that the fund actually paid out in distributions over the period, but it did get pretty close.

There are other ways that a fund can generate the money that it needs to cover its distributions, however. The most common of these is capital gains. As might be expected, the fund was not particularly successful at this during the period in question though. During the eleven-month period, the fund did realize net gains of $55.173 million but it also had $183.070 million net unrealized losses. The fund’s assets declined by $96.288 million after accounting for all inflows and outflows during the period, which is admittedly not very encouraging. However, the fund did have sufficient realized capital gains to cover its distributions and when this is combined with net investment income, the fund had a lot of money left over. As the net investment income alone is almost sufficient to cover the distributions, it can use this surplus to maintain the payout for quite a while. This distribution is probably reasonably secure.

Valuation

It is always critical that we do not overpay for any asset in our portfolios. This is because overpaying for any asset is a surefire way to generate a suboptimal return on that asset. In the case of a closed-end fund like the PIMCO Corporate & Income Strategy Fund, the usual way to value it is by looking at the fund’s net asset value. The net asset value is the total current market value of all of the fund’s assets minus any outstanding debt. It is therefore the amount that the investors would receive if the fund were immediately shut down and liquidated.

Ideally, we want to purchase shares of a fund when we can buy them at a price that is less than the fund’s net asset value. This is because such a scenario implies that we are acquiring the fund’s assets for less than they are actually worth. That is unfortunately not the case with this fund right now. As of December 5, 2022 (the most current date for which data is available as of the time of writing), the fund had a net asset value of $11.53 per share but the shares actually trade for $12.84 per share. Thus, the shares are currently trading for an 11.36% premium to the net asset value. This is a very large premium to pay for any closed-end fund and it is also well above the 10.61% premium that the shares have averaged over the past month. While this does certainly appear to be a good bond fund, it may be a good idea to wait for the shares to trade for a more reasonable price before buying in.

Conclusion

In conclusion, the PIMCO Corporate & Income Strategy Fund appears to be a very good bond fund that could be a way for any investor to boost their income. The fund has one of the most consistent distribution histories among all fixed-income funds, a well-diversified portfolio, and a very high yield. There is still a great deal of interest-rate risk here though and the fund will likely continue to slide as the Federal Reserve raises interest rates further. In addition, the price is very high here so the fund is not offering a great proposition for value investors.

Be the first to comment