Deagreez

This article was published on Dividend Kings on Monday, December 19th.

—————————————————————————————

For most people, the best gifts they can receive this Christmas center around family, friends, and the ability to spend more time with loved ones.

In this article, I also showed why, for those who don’t like picking individual stocks, three of the world’s best dividend growth exchange-traded funds (“ETFs”) are a great gift that will keep giving for decades to come.

- delivering 35% superior yield today and 20% better annual returns long-term

- 66% higher long-term inflation-adjusted wealth over 30 years.

But if you’re comfortable buying individual blue-chips, then the world is a far more wonderful place.

That’s because Santa is bringing three incredible dividend aristocrat bargains for Christmas this year: Altria Group, Inc. (MO), V.F. Corporation (VFC), and Lowe’s Companies, Inc. (LOW).

Why are these such incredible aristocratic bargains? Why might you want to buy some of them today?

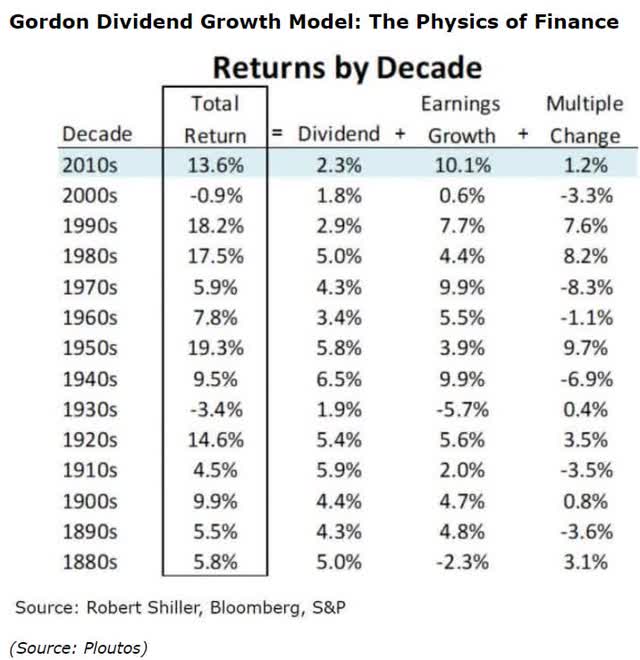

Because yield, growth, and valuation are the only three factors that directly drive all long-term stock returns.

And guess what these aristocrat bargains offer? The best yield, growth, and valuation among the aristocrats. What does that potentially mean for long-term investors?

- 6.0% very safe yield

- 9.9% long-term growth potential

- 15.9% long-term return potential

- a 40% discount to fair value

- 26.7% annual return potential for the next five years = 3.3X (almost 7X more than the S&P 500).

16% return potential and 6% very safe yield from dividend aristocrats!? And the potential to more than triple in the next five years?

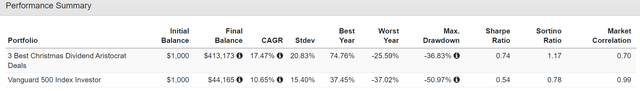

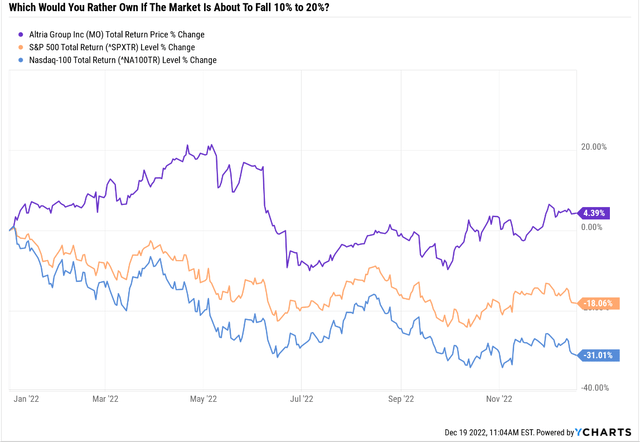

Historical Returns Since 1985

Indeed, that’s something these dividend aristocrats have been doing for the last 37 years. In fact, from bear market lows, as we have now, they have been capable of delivering Buffett-like returns that have changed millions of investors’ lives.

In fact, from such incredible discounts, as they offer today, investors have enjoyed as much as 25% annual returns for 15 years.

- a 30X return in 15 years.

And over five years? They’re capable of annual returns of 36% or 4.7X returns.

And let’s not forget about the big draw of aristocrats.

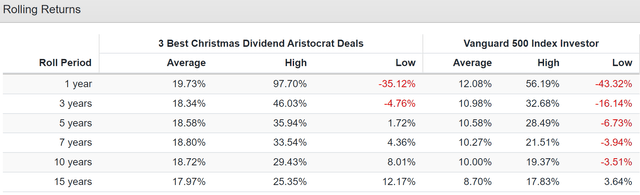

Life-Changing Income You Can Count On In Any Economy

These aristocrats have been growing their income by 19% annually for 36 years.

- 4.3% yield in 1986

- 24,492% yield on cost in 2022.

How fast do analysts think they can grow your income in the future? About 16% per year.

- doubling every five years for the foreseeable future.

So, that’s a 6% very safe yield today, and potentially a 12% yield in 2027 and 24% in 2032. And all this with the potential to more than triple your money in the next five years, almost 7X more than the S&P 500 is capable of?

How on earth can these aristocrat bargains do this? Let’s find out.

Altria: The Highest Yielding Dividend Aristocrat (And King) On Wall Street

Further Reading

This article highlights Altria’s exact investment thesis, growth outlook, and risk profile, but here is the summary.

Reasons To Potentially Buy Altria Today

| Metric | Altria |

| Quality | 99% 13/13 Ultra SWAN (Sleep Well At Night) Quality Dividend King |

| Risk Rating | Medium Risk |

| DK Master List Quality Ranking (Out Of 500 Companies) | 19 |

| DK Master List Quality Percentile | 96% |

| Dividend Growth Streak (Years) | 53 |

| Dividend Yield | 8.00% |

| Dividend Safety Score | 100% |

| Average Recession Dividend Cut Risk | 0.5% |

| Severe Recession Dividend Cut Risk | 1.00% |

| S&P Credit Rating |

BBB Stable Outlook |

| 30-Year Bankruptcy Risk | 7.50% |

| LT S&P Risk-Management Global Percentile |

45% Average, Medium Risk |

| Fair Value | $69.94 |

| Current Price | $46.89 |

| Discount To Fair Value | 33% |

| DK Rating |

Potential Very Strong Buy |

| P/E | 9.3 |

| Cash-Adjusted P/E | 8.6 |

| Growth Priced In | 0.2% |

| Historical P/E | 14 to 16 |

| LT Growth Consensus/Management Guidance | 5.0% |

| 5-year consensus total return potential |

15% to 19% CAGR |

| Base Case 5-year consensus return potential |

16% CAGR (3X S&P 500) |

| Consensus 12-month total return forecast | 12.0% |

| Fundamentally Justified 12-Month Return Potential | 57% |

| LT Consensus Total Return Potential | 13.0% |

| Inflation-Adjusted Consensus LT Return Potential | 10.7% |

| Consensus 10-Year Inflation-Adjusted Total Return Potential (Ignoring Valuation) | 2.76 |

| LT Risk-Adjusted Expected Return | 8.42% |

| LT Risk-And Inflation-Adjusted Return Potential | 6.09% |

| Conservative Years To Double | 11.83 |

(Source: Dividend Kings Zen Research Terminal)

Let me be very clear that MO’s investment thesis in no way relies on the price/earnings ratio ever returning to its historical 14 to 16X. The long-term returns are purely driven by yield and growth.

- 8% yield + 5% growth = 13% returns.

That’s not speculative; it’s not guesswork; it’s the physics of finance. Any company that yields 8% and grows at 5% will eventually return 13% long-term returns, which is far above the S&P, dividend aristocrats, and even the Nasdaq.

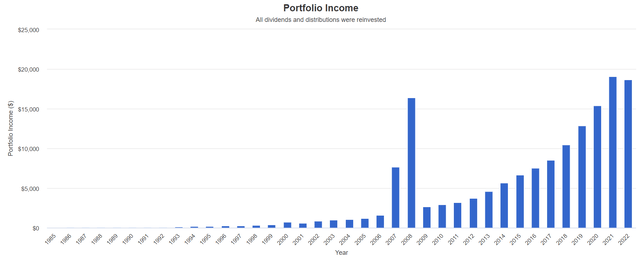

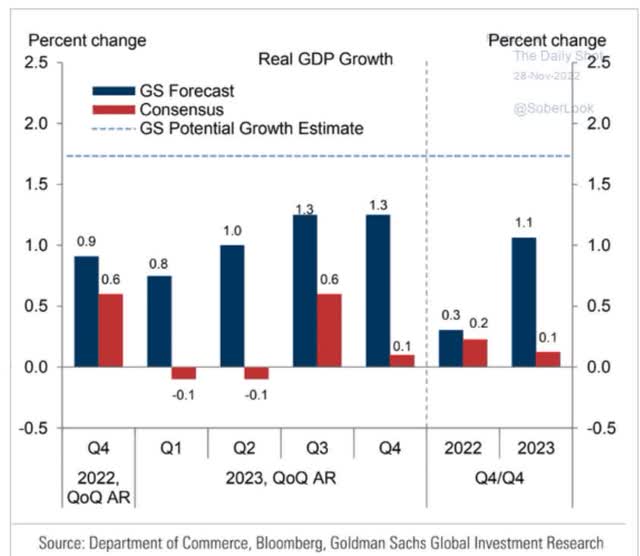

And let’s not forget that the market is likely to face a rather grim start to 2023.

S&P Potential Bear Market Bottom

| Earnings Decline In 2023 | 2023 S&P Earnings | X 25-Year Average PE Of 16.7 | Decline From Current Level |

| 0% | $218.45 | $3,648.12 | 5.3% |

| 5% | $207.53 | $3,465.71 | 10.0% |

| 10% | $196.61 | $3,283.30 | 14.8% |

| 13% | $190.05 | $3,173.86 | 17.6% |

| 15% | $185.68 | $3,100.90 | 19.5% |

| 20% | $174.76 | $2,918.49 | 24.2% |

(Source: DK S&P Valuation Tool, FactSet, Bloomberg)

If the market is likely to fall 10% to 20%, which the fundamentals say it will, then wouldn’t you rather own a 33% undervalued defensive dividend king that’s beating the market by 22% and actually up in 2022?

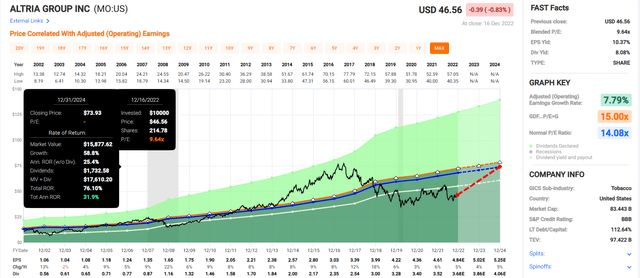

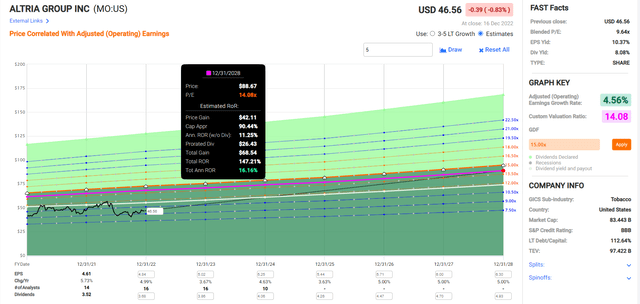

Altria 2024 Consensus Return Potential

(Source: FAST Graphs, FactSet)

Altria almost always grows as expected, and if it returns to historical market-determined fair value, it could deliver 76% returns over the next two years. How good is that?

- 3X more than the S&P 500

- 32% annual return potential.

Altria 2028 Consensus Return Potential

(Source: FAST Graphs, FactSet)

MO offers 150% total return potential over the next five years, about 3X more than the S&P 500. That’s a 16% annual return potential, on par with the greatest investors in history.

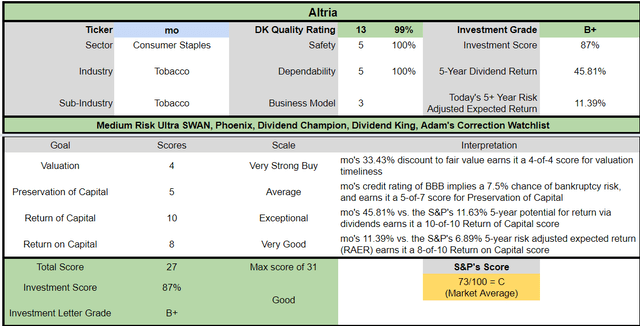

Altria Investment Decision Score

Dividend Kings Automated Investment Decision Tool

MO is a potentially very good ultra-yield deep value dividend king opportunity for anyone comfortable with its risk profile. Look at how it compares to the S&P 500.

- 33% discount to fair value vs. 1% discount S&P = 32% better valuation

- 8.0% safe yield vs. 1.7% (5X higher and much safer)

- approximately 13.0% long-term annual return potential vs. 10.2% CAGR S&P

- about 2X higher risk-adjusted expected returns

- 4X higher income potential over five years.

If you believe MO can make the transition to its smoke-free future, which management, analysts, rating agencies, and the bond market think it can, this is the best ultra-yield aristocrat bargain you can buy this Christmas.

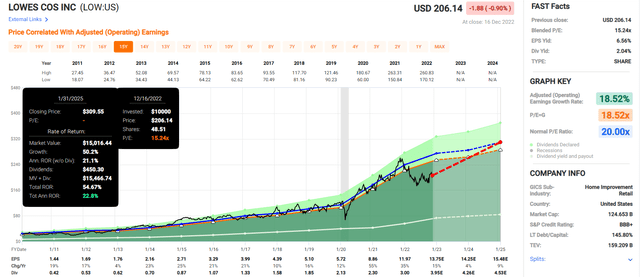

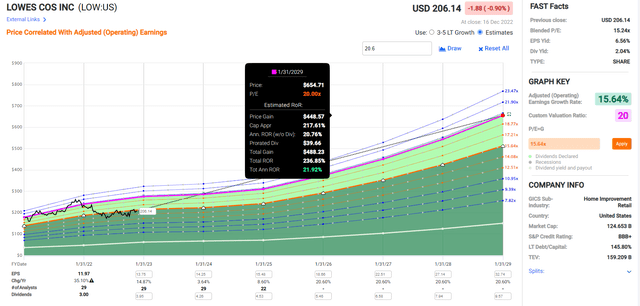

Lowe’s: The Fastest Growing Dividend Aristocrat (And King) On Wall Street

Further Reading

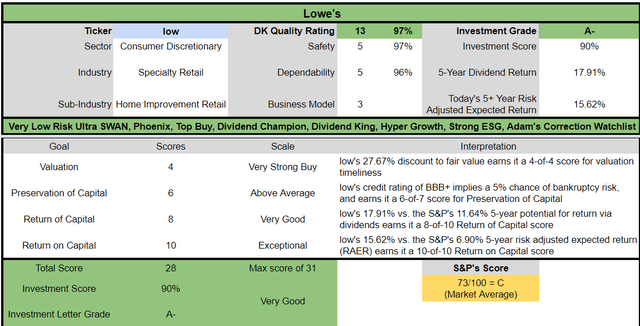

This article highlights Lowe’s exact investment thesis, growth outlook, and growth plans, but here is the summary.

Reasons To Potentially Buy Lowe’s Today

| Metric | Lowe’s |

| Quality | 97% 13/13 Ultra SWAN (Sleep Well At Night) Quality Dividend King |

| Risk Rating | Very Low Risk |

| DK Master List Quality Ranking (Out Of 500 Companies) | 37 |

| DK Master List Quality Percentile | 93% |

| Dividend Growth Streak (Years) | 61 |

| Dividend Yield | 2.1% |

| Dividend Safety Score | 97% |

| Average Recession Dividend Cut Risk | 0.5% |

| Severe Recession Dividend Cut Risk | 1.15% |

| S&P Credit Rating |

BBB+ Stable Outlook |

| 30-Year Bankruptcy Risk | 5.0% |

| LT S&P Risk-Management Global Percentile |

86% Very Good, Very Low Risk |

| Fair Value | $280.80 |

| Current Price | $203.41 |

| Discount To Fair Value | 28% |

| DK Rating |

Potential Very Strong Buy |

| P/E | 15.0 |

| Cash-Adjusted P/E | 11.7 |

| Growth Priced In | 6.4% |

| Historical P/E | 19 to 21 |

| LT Growth Consensus/Management Guidance | 20.6% |

| PEG Ratio | 0.57 = hyper-growth at a wonderful price |

| 5-year consensus total return potential |

18% to 24% CAGR |

| Base Case 5-year consensus return potential |

22% CAGR (5X S&P 500) |

| Consensus 12-month total return forecast | 37.0% |

| Fundamentally Justified 12-Month Return Potential | 40% |

| LT Consensus Total Return Potential | 22.7% |

| Inflation-Adjusted Consensus LT Return Potential | 20.4% |

| Consensus 10-Year Inflation-Adjusted Total Return Potential (Ignoring Valuation) | 6.39 |

| LT Risk-Adjusted Expected Return | 15.10% |

| LT Risk-And Inflation-Adjusted Return Potential | 12.77% |

| Conservative Years To Double | 5.64 |

(Source: Dividend Kings Zen Research Terminal)

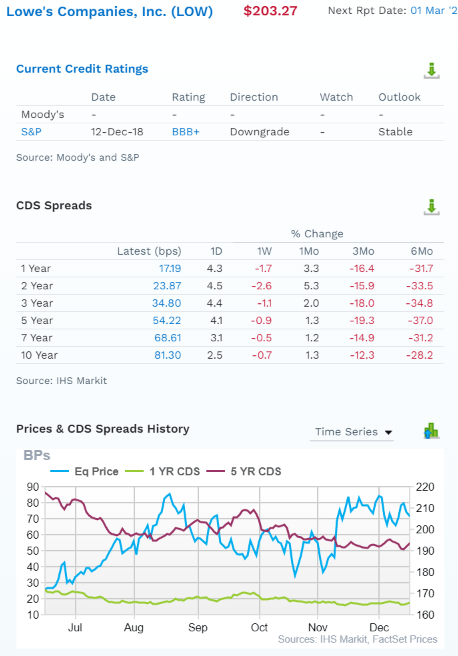

Analysts expect LOW’s to deliver 37% returns within 12-months and that’s 100% justified by its fundamentals. What about the 2023 recession? Won’t that ensure that LOW is going to crash in the next few months?

How much do you think LOW, trading at 11X cash-adjusted earnings and a PEG of 0.6 is going to fall if we experience the mildest recession in U.S. history?

Do you think the dividend is going to get cut? There is approximately a 1 in 200 chance of that.

Do you think Lowe’s balance sheet is going to collapse? The BBB+ stable credit rating and steadily falling fundamental risk according to the bond market say otherwise.

FactSet Research Terminal

Analysts are worried about LOW, rating agencies aren’t, and neither is the bond market. And guess what? Management just reiterated this year’s guidance.

Does this sound like a company whose stock is about to go over a cliff? Does that mean LOW’s can’t fall hard and fast? Of course not. But it does mean that its bottom is likely closer than you think.

And what if LOW does fall 10% or 20% more? Then just buy more. I can say with 80% statistical certainty that there is no fundamental reason not to buy LOW today and potentially experience returns like these.

Lowe’s 2024 Consensus Return Potential

LOW’s might have already bottomed, especially given how mild the recession is expected to be. If you don’t buy some today, you’re potentially giving up 23% return potential for the next two years, about 2X more than the S&P 500.

Lowe’s 2029 Consensus Return Potential

What do you get with a 28% undervalued dividend king growing at 16% per year? The potential for 22% annual returns, or a 3.4X return in the next five years.

That’s 5X the return potential of the S&P 500. From one of the most dependable hyper-dividend growth blue-chips on earth.

Lowe’s Automated Investment Decision Score

Dividend Kings Automated Investment Decision Tool

LOW is a potentially very good hyper-growth dividend king opportunity for anyone comfortable with its risk profile. Look at how it compares to the S&P 500.

- 28% discount to fair value vs. 1% discount S&P = 27% better valuation

- 2.1% safe yield vs. 1.7% (much safer and growing 2.5X faster)

- approximately 22.7% long-term annual return potential vs. 10.2% CAGR S&P

- about 2.5X higher risk-adjusted expected returns

- 60% higher income potential over five years

Unless you think 150 million Millennials and Gen Zers will permanently give up buying homes, this is the best hyper-growth aristocrat bargain you can buy this Christmas.

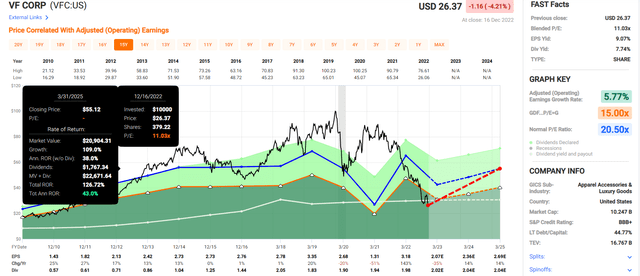

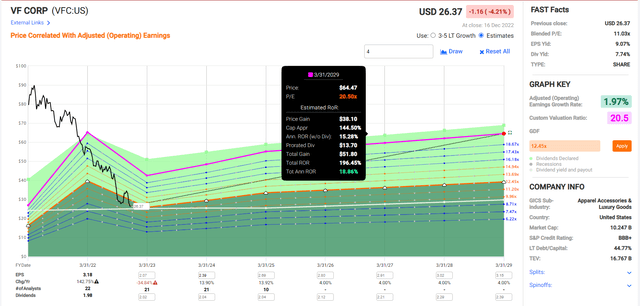

V.F. Corp: The Most Undervalued Dividend Aristocrat (And King) On Wall Street

Further Reading

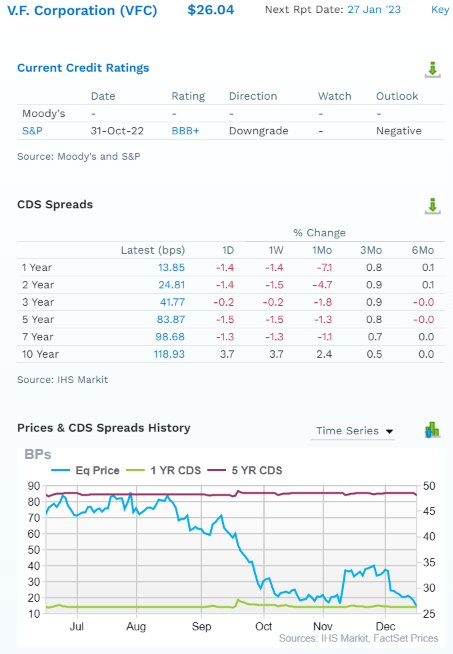

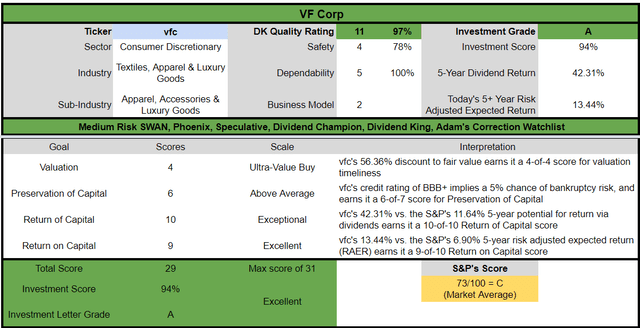

This article highlights VFC’s exact investment thesis, growth outlook, and risk profile, but here is the summary.

Let me be clear that while MO and LOW are not speculative investments, VFC is, and thus has a 2.5% or less max risk cap recommendation.

VFC is facing a perfect storm of negative factors right now. From supply chain disruption from China to a 2023 recession, management has slashed its long-term growth guidance from 4% to 9%, from 13% to 16%.

VF announced the unexpected and immediate retirement of long-time executive and CEO of the last five years, Steve Rendle. VF has launched a search for his successor, with Benno Dorer, a board member and former CEO of wide-moat Clorox, serving as interim CEO. Rendle, who has been instrumental in VF’s success, oversaw an upbeat analyst event just two months ago. However, the firm has repeatedly lowered guidance this year, and did so again in conjunction with the CEO announcement due, primarily to a heavily promotional environment and canceled wholesale orders in the U.S.” – Morningstar.

The CEO has resigned without warning, and that’s never a promising sign.

The company’s $500 million potential sale of its backpack business would normally not be a big deal, except that in today’s market environment, it’s likely to be selling at a depressed price.

VF’s CEO Resigns as Results Deteriorate; Shares Very Undervalued” – Morningstar.

But guess what? All of this and then some is baked into the price. Morningstar estimates VFC is 57% undervalued, and so does Dividend Kings.

What does a 57% discount look like? A 7.8% safe yield that’s the highest it’s been in 31 years.

And though the growth outlook has fallen to 4%, the low end of management’s new guidance, that still means almost 12% long-term return potential from a 51-year growth streak dividend king.

This is a screaming bargain unless you think that VFC’s popular brands will be forever abandoned by its loyal customers. In fact, it’s the single most undervalued dividend aristocrat and king on Wall Street.

FactSet Research Terminal

The bond market has been estimating a 0.84% five-year default risk pretty much all year. When the stock price crashes, but the bond market isn’t concerned? The chances of the thesis being broken are significantly reduced.

Reasons To Potentially Buy V.F. Corp Today

| Metric | V.F. Corp |

| Quality | 97% 11/13 Speculative Blue-Chip Quality Dividend King |

| Risk Rating | Medium Risk |

| DK Master List Quality Ranking (Out Of 500 Companies) | 36 |

| DK Master List Quality Percentile | 93% |

| Dividend Growth Streak (Years) | 51 |

| Dividend Yield | 7.8% |

| Dividend Safety Score | 97% |

| Average Recession Dividend Cut Risk | 0.5% |

| Severe Recession Dividend Cut Risk | 1.15% |

| S&P Credit Rating |

BBB+ Negative Outlook |

| 30-Year Bankruptcy Risk | 5.00% |

| LT S&P Risk-Management Global Percentile |

66% Good, Medium Risk |

| Fair Value | $59.75 |

| Current Price | $26.02 |

| Discount To Fair Value | 56% |

| DK Rating |

Potential Ultra Value Speculative Buy |

| P/E | 11.3 |

| Cash-Adjusted P/E | 11.0 |

| Historical P/E | 18 to 22.5 |

| LT Growth Consensus/Management Guidance | 4.0% |

| 5-year consensus total return potential |

19% to 28% CAGR |

| Base Case 5-year consensus return potential |

22% CAGR (5X S&P 500) |

| Consensus 12-month total return forecast | 25.0% |

| Fundamentally Justified 12-Month Return Potential | 137% |

| LT Consensus Total Return Potential | 11.8% |

| Inflation-Adjusted Consensus LT Return Potential | 9.5% |

| Consensus 10-Year Inflation-Adjusted Total Return Potential (Ignoring Valuation) | 2.47 |

| LT Risk-Adjusted Expected Return | 7.85% |

| LT Risk-And Inflation-Adjusted Return Potential | 5.52% |

| Conservative Years To Double | 13.05 |

(Source: Dividend Kings Zen Research Terminal)

VFC is so undervalued that within 12 months, it could soar 137% and merely return to fair value. Even with a 4% growth outlook, it offers slightly higher long-term return potential than the Nasdaq.

But with dividend king status and 10X higher safe yield.

V.F. Corp 2025 Consensus Total Return Potential

VFC can often swing wildly around historical fair value. But if it returns to historical fair value by March 2025, that’s a potential 127% return or 43% annually.

- 6X the S&P 500 consensus.

V.F. Corp 2029 Consensus Total Return Potential

VFC has the potential to triple in the next five years, even with very modest growth.

That’s about 5X the S&P consensus, and by 2029, analysts expect the yield on today’s cost could be 9.2%.

V.F. Corp Investment Decision Score

Dividend Kings Automated Investment Decision Tool

VFC is a potentially excellent ultra-yield speculative dividend king opportunity for anyone comfortable with its risk profile. Look at how it compares to the S&P 500.

- 56% discount to fair value vs. 1% discount S&P = 55% better valuation

- 7.8% safe yield vs. 1.7% (4.5X higher)

- approximately 11.8% long-term annual return potential vs. 10.2% CAGR S&P

- about 2X higher risk-adjusted expected returns

- 4X higher income potential over five years.

VFC has been buying and selling brands for over a century, and this is unlikely to be it’s “GE moment.” That’s what makes this the best deep value aristocrat bargain you can buy this Christmas.

Bottom Line: Santa Is Bringing 3 Incredible Dividend Aristocrat Deals You Don’t Want To Miss

Most people think of Thanksgiving as the time for bargains, but this Christmas Santa is delivering mouth-watering bargains for patient long-term investors.

Whether your goal is maximum safe income today, hyper-dividend growth for years to come, or the deepest discount, MO, LOW, and VF are the best aristocrat bargains on Wall Street.

Let me be clear. I am NOT calling a bottom in MO, LOW, or VFC. I’m not a market timer.

Ultra SWAN quality and dividend aristocrat status does NOT mean “can’t fall hard and fast in a bear market.”

Fundamentals are all that determine safety and quality, and my recommendations.

- over 30+ years, 97% of stock returns are a function of pure fundamentals, not luck

- in the short term; luck is 25X as powerful as fundamentals

- in the long term, fundamentals are 33X as powerful as luck.

While I can’t predict the market in the short term, here’s what I can tell you about these dividend aristocrat deals.

All of these companies have been around for well over 50 years. They’ve dealt with more extreme conditions than we’re facing in 2023. Their balance sheets are sound, and expected to stay that way.

Their dividends are safe and expected to keep growing even through the 2023 recession.

And while they might not go up in a falling market (MO has the best chance of that), their bargain-basement prices mean they are a lot closer to bottom than you probably think.

Why recommend any stock when the market is likely to fall 10% to 20% in the coming months? Because it might not, and let’s not forget it’s always and forever a market of stocks, not a stock market.

When did MO bottom in the Great Recession? At a 15% very safe yield in December of 2008, and it was up 7% by the time stocks stopped dropping three months later.

When did Amazon bottom in 2002? In January, and it was up 70% by the time the S&P bottomed in October.

When you have the opportunity to earn Buffett-like returns from the best dividend king bargains on Wall Street, the risk is not that they keep falling more. The risk is that you wait too long and get too greedy, seeking valuations even more absurdly attractive than they are today.

Buy MO, LOW, and VFC today, and I’m confident that you’ll feel like a stock market genius in 5+ years.

From everyone at Dividend Kings and iREIT, I want to wish you and yours a safe, healthy, and joyous holiday season:)

Be the first to comment