Tashka/iStock via Getty Images

The Gold Miners Index (GDX) has struggled to gain any traction in a 27-month cyclical bear market, and while many of the majors have continued to perform well, the wheat has quickly been separated from the chaff among the junior and mid-tier producers. In Victoria Gold’s (OTCPK:VITFF) case, the company is on track for another extremely disappointing year following a massive miss in FY2021 on its annual guidance. The result is that Victoria’s production could fall 10% year-over-year while margins see severe compression due to higher capital spending and inflationary pressures. Let’s take a closer look at the most recent quarter below.

Eagle Mine Operations (Company Presentation)

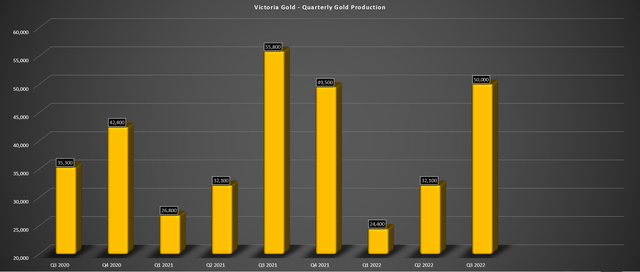

Q3 Production

Victoria Gold released its preliminary Q3 results last month, reporting quarterly production of just ~50,000 ounces, a 10% decline from the year-ago period. The lower production was attributed to fewer tonnes stacked on the pad (2.1 million tonnes vs. 3.3 million tonnes), with Victoria choosing not to haul run of mine tonnes directly from the pit to the heap leach facility due to the higher unit costs and lower recoveries from this strategy. Unfortunately, this lower production was exacerbated by a temporary suspension of crushing, conveying, and stacking operations for roughly three weeks due to a splice failure of the main belt on the company’s 1.5-kilometer overland conveyor.

Victoria Gold – Quarterly Gold Production (Company Filings, Author’s Chart)

While Victoria was able to replace the belting in the guided timeline of three weeks (September 29th to October 16th), and mining, leaching, and ADR plant activities continued during the temporary suspension, this will hurt Victoria’s Q4 and FY2022 performance. The reason is that the company was already set up to deliver below its guidance based on my previous estimates (163,500 ounces). Still, with just ~106,400 ounces produced year-to-date and lower stacking rates in Q4 with the downtime, it’s no surprise that the company has retracted its guidance. This will lead to lower gold production year-over-year and much higher costs than expected, with a lower denominator and slightly higher capital spending to replace the belting.

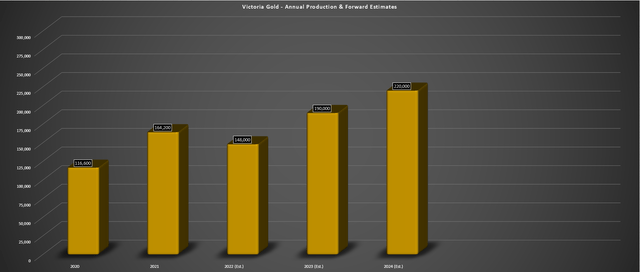

Victoria Gold – Annual Production & Forward Estimates (Company Filings, Author’s Chart & Estimates)

While a single hiccup in a mine start-up is entirely excusable, this is the second year Victoria Gold failed to deliver into its guidance, and these haven’t been near-misses. Last year, the company guided for 180,000 to 200,000 ounces and finished 2021 9% below the low end of its guidance range, with costs above the top end at $1,193/oz. This year, the company set the bar relatively low with a weaker outlook vs. that which it couldn’t achieve in FY2021 (177,500 mid-point vs. 190,000 ounce FY2021 guidance), guiding for 165,000 to 190,000 ounces at higher costs ($1,225/oz – $1,425/oz). However, it’s looking like the company will be lucky to produce 148,000 ounces, and once again, it’s delivering the bad news about guidance in the eleventh hour.

Finally, the company noted in Q1 2022 that it expected it could increase production to 250,000 ounces in 2023, another hail Mary by the company that is going to miss the mark by a wide margin. While this was partially related to higher costs than anticipated for a second screening plant between the secondary and tertiary crusher, it’s another example of the company over-promising and under-delivering. Based on the current outlook, Victoria is set to see a 10% decline in production to 148,000 ounces or less in FY2022 vs. the ~164,200 ounces produced in FY2021.

Costs & Margins

Previously, Victoria had guided for all-in-sustaining costs of $1,225/oz to $1,425/oz in FY2022, and it looked like costs would trend to the upper portion of this range with a tight labor market, plus rising fuel, cyanide, and other consumables prices. However, with Victoria now expected to see annual production that’s more than 15% below its guidance mid-point, we could see costs rise above $1,500/oz in FY2022, translating to a 26% increase on a year-over-year basis. Unfortunately, the gold price has been falling at the same time, putting pressure on margins on the sales side.

Some investors might note that these issues are temporary and don’t affect the long-term future of the mine, and this is a valid point. Besides, although costs will be elevated this year, sustaining capital is expected to decline to much lower levels in FY2023 and FY2024, with 2022 being a higher-spend year due to the construction of the water treatment plant and mobile equipment rebuilds. Hence, we should see all-in-sustaining costs dip below $1,400/oz in FY2023. Still, these continued hiccups are impacting cash flow generation with the lower production in the first three quarters meaning that Victoria is now selling its ounces at a weaker gold price and will generate minimal free cash flow this year. If the company had a better Q2/Q3, it might have been able to take advantage of $1,750/oz plus gold prices for most of its sales.

So, what’s the good news?

For starters, Victoria has hired Timothy Fisch as Vice President and General Manager for the Eagle Gold Mine. He has over 40 years of experience and began his career with Bethlehem Copper in 1978. Most recently, he was a member of the design team for Coeur’s (CDE) Silvertip Expansion Project, and before this, he worked at Red Chris and Mount Polley as General Manager. Hopefully, this new appointment can lead to more consistent operations in the future. With luck, the mine might finally be able to deliver 190,000+ ounces in 2023 and come in near the elusive 200,000-ounce mark.

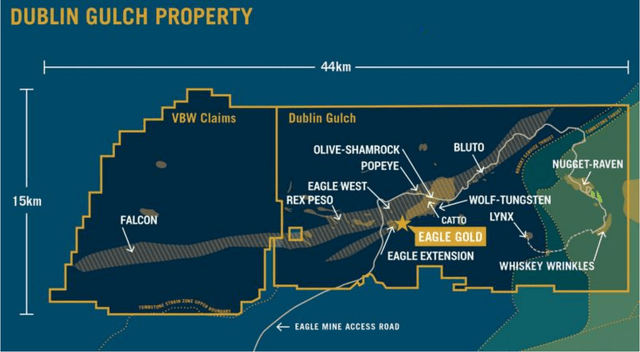

The other positive news that was unfortunately overshadowed by the weak performance was that Victoria declared an initial inferred resource estimate of 1.07 million ounces at 1.67 grams per tonne of gold at Eagle. These grades are well above average reserve grades, and the resource is based on a 0.50 gram per tonne cut-off grade and a $1,700/oz gold price. This points to mine life extension potential with another satellite deposit at the Dublin Gulch Property. Besides, the main Eagle Mine already has reserve upside along strike and at depth, suggesting this asset could produce well into the 2040s.

Dublin Gulch Property (Company Presentation)

Finally, it is essential to note that Victoria has seen solid grade reconciliation and recoveries align with expectations. Hence, this is not an issue with the ore body, and it’s not an issue with mining the deposit; the issue is primarily unexpected hiccups and the inability to manage investors’ expectations correctly. So, while there is no sugar-coating this disappointing performance, and it’s become difficult to trust future guidance, this is an asset with a bright future; it’s just a matter of getting past the 225,000-ounce production mark to pull costs below the industry average and start generating significant free cash flow.

A Better Way To Gain Exposure To Eagle

Based on ~68 million fully diluted shares and a share price of US$5.10, Victoria Gold trades at a market cap of ~$350 million and an enterprise value of ~$500 million. This is a dirt-cheap valuation for a company with an estimated net asset value of ~$1.02 billion, with Victoria now trading at just ~0.35x P/NAV. In fact, if Victoria continues to trade at these levels, I would see it as a likely takeover target. However, due to the company’s continued sub-par performance since reaching commercial production, combined with a weaker gold price and a lack of diversification (single-asset producer), it’s hard to invest in Victoria with much confidence.

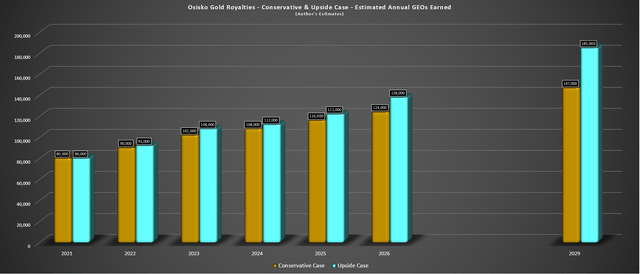

Fortunately, there’s a way to get exposure to this asset with minimal inflation risk (operating costs, capital costs) and still enjoy a similar or better growth trajectory to Victoria’s Project 250 goals. This can be accomplished by owning Osisko Gold Royalties (OR), which has a massive 5.0% NSR royalty on the Eagle Gold Mine until at least 2029 (drops to 3.0% thereafter). The benefit to owning Osisko Gold Royalties (“Osisko GR”) is that its business model as a royalty/streaming company protects it from inflationary pressures that are leading to higher operating costs and higher sustaining capital expenditures over mine lives.

Osisko GR – Annual GEOs Earned & Forward Estimates (Company Filings, Author’s Chart)

Notably, Osisko GR also protects investors if the snafus continue at Eagle, given that it has a portfolio of 20+ producing assets, meaning that any one asset does not make or break the stock. Most importantly, Osisko GR trades at its most attractive valuation in years, sitting at just ~0.85x P/NAV vs. P/NAV multiples of 1.40 – 1.80x for its larger peers like Franco-Nevada (FNV), and it has exposure to assets with world-class operators that do know how to meet guidance and manage expectations. So, with Osisko GR set to grow attributable production by over 60% from FY2021 levels looking out to FY2026 (~130,000 GEOs vs. ~80,000 GEOs) and it’s paying investors a ~1.70% dividend yield with consistent buybacks, I see it as a far more attractive way to get exposure to this asset.

Summary

Victoria Gold has had another rough year in 2022, and while 2023 should be better, it’s becoming increasingly difficult to trust this team to deliver on its promises. The good news is that Eagle should have a much better year in 2023 and could finally get above the 220,000-ounce mark in 2024, and it’s also possible that the stock is taken over with it trading at a deep discount to its estimated net asset value. That said, I prefer investing in consistent companies that I can rely on at attractive valuations. While Victoria might be attractively valued, Osisko GR is also trading at a deep discount to fair value but with a lower-risk business model. Hence, I continue to favor owning OR for exposure to the gold price without the headaches.

Be the first to comment