photobyphm

Verizon Communications Inc.’s (NYSE:VZ) shares are down nearly 25% in the last 6 months, and investors are wondering if it’s a good time for bottom fishing. The bullish narrative, in general, is that Verizon Communications stock yields a lucrative 7% and it’s undervalued at current levels. But while that may seem like a compelling bullish argument, it doesn’t factor in the uncertainty surrounding the company. In this article, I’ll attempt to break down the issues miring Verizon and explain why its shares will languish for the time being at least. Let’s take a closer look at it all.

User Traction Uncertainty

Let me start by saying that the telecom industry has become cutthroat over the past decade or so. Companies are finding it difficult to pass on price hikes and have had to maintain elevated levels of capital expenditures to retain market shares. While some companies such as AT&T (T) are doing a terrific job, Verizon has started to show signs of business deterioration. It seems to be succumbing to macroeconomic pressures, which should be a cause of concern for investors.

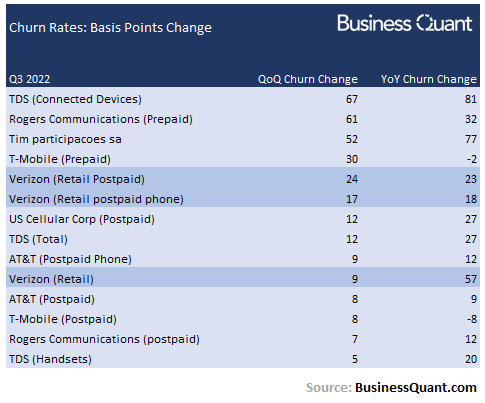

For starters, note in the chart below that churn rate for most telecom companies rose in Q3. This is a clear indication that customers increasingly disconnected redundant connections and/or switched their network providers to get better deals, as inflationary pressures weighed down on their disposable incomes. Verizon also suffered due to the economic downturn, and its churn rate spiked across different connection types during the quarter.

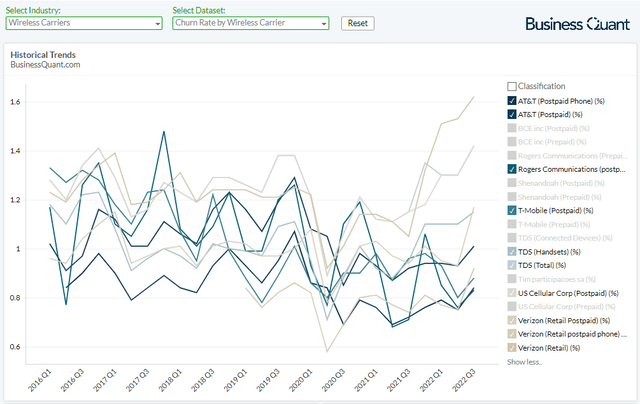

While this may seem like an acceptable increase, considering that this is an industry-wide phenomenon, it should actually be worrisome for Verizon’s investors. Its churn rates, be it for retail, retail postpaid or retail postpaid phone categories, have breached their 4-year highs and are now hovering above the industry median. This is a clear indication that Verizon’s customer base isn’t as sticky and is prone to erosion.

BusinessQuant.com

Note in the table above how Verizon was amongst the industry laggards when it comes to churn rate increases during Q3 2022, be it on a sequential or on a year over year basis.

In Verizon’s defense, the company hiked prices across the board a few months ago and its management warned investors beforehand about rising churn. But the problem now is that we just don’t know when will the churn rate peak and how many subscribers will move away from Verizon as a result of these price hikes. It’s anyone’s best guess as to whether Verizon’s churn rates will peak at 2%, or at 5%, and if the metric will even return to its usual levels anytime in the next year.

This heightened level of uncertainty makes it difficult for anyone trying to project Verizon’s financials and reliably value the stock. It also encourages investors to reconsider their thesis for the name and nudges them to buy into other telecom companies such as AT&T and T-Mobile that are posting much lower levels of churn rate.

Capital Expenditure at Risk

Secondly, Verizon had $174 billion in debt at the end of Q3, which is roughly 12.1-times its free cash flow. The interest expense on this pile of debt amounted to $3.2 billion over the last 4 quarters. Although the company generates sufficient EBITDA to cover its interest expenses 14-times over, the concern is that rising interest rates will increase its debt servicing costs, weigh down on margin profile and restrict growth-related capital expenditures in the quarters ahead. Due to this, there’s the risk that Verizon would either lose more market share to peers that have higher levels of capex, or it may have to slash dividends and boost capex to preserve its already-eroding subscriber base.

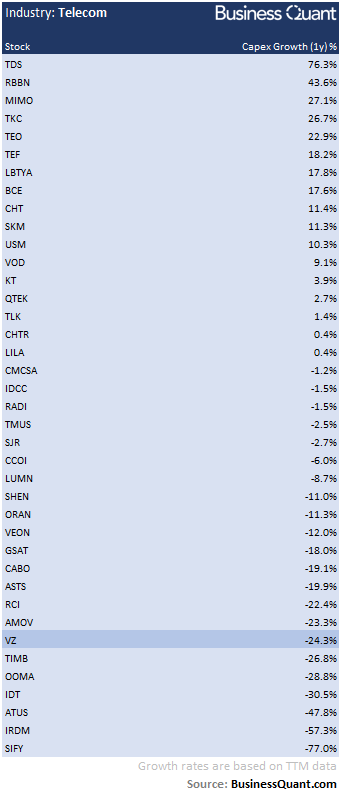

I believe the latter scenario would result in a shock for the market and it might even result in a sharp selloff in Verizon’s shares. I say this because Verizon is one of the few major telecom companies that hiked its dividends recently. Its other sizable peers (like AT&T) have slashed dividends or have suspended them altogether to fund their growth-related capital investments. This is particularly evident in the table below – note how Verizon’s twelve-month capital expenditure dropped by 24.3% of late which is quite poor by industry standards.

BusinessQuant.com

In contrast, US Cellular (USM) ramped up its capital expenditure by over 10% in the said period. Although T-Mobile’s (TMUS) capex dropped by 2.5%, it’s still vastly better than Verizon.

The point that I’m trying to make here is that with this shift in capital allocation strategy, other telecom companies will have an upper hand over Verizon in terms of capital investments and they might actually become more attractive to end users in terms of pricing, coverage, speed and other differentiating parameters. So, in case Verizon’s subscriber base erosion becomes a runaway problem, its management will have to either slash dividends and risk a stock selloff, or they’ll be relegated to cutting back on capital investments to fund dividend payouts.

Final Thoughts

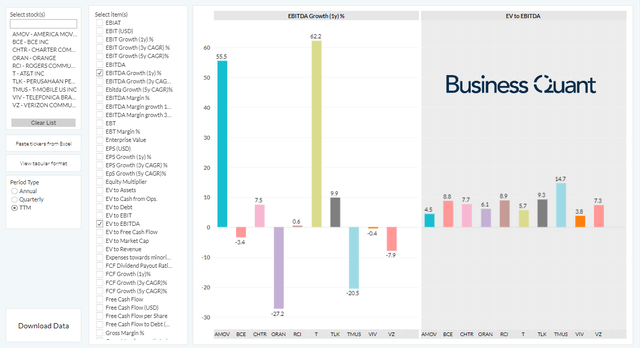

Lastly, many investors get tempted by Verizon’s low stock price and mistake it for an undervalued company. The stock is trading at an EV-to-EBITDA multiple of 7.3x at the time of this writing which may seem attractive on a standalone basis. But that doesn’t depict the entire picture. Once we factor in EBITDA growth rates for Verizon and its peers, an entirely different picture emerges. There are many other telecom stocks that are trading at comparable EV-to-EBITDA multiples but are growing their EBITDA at vastly higher rates. This suggests that Verizon isn’t all that undervalued as many bulls believe it to be.

This valuation myth, coupled with declining user traction and the capital expenditure conundrum, leads me to believe that Verizon stock is unlikely to rally anytime soon. This, however, should not be construed as a call to short the stock. At best, I rate Verizon Communications stock as “Hold” for now due to its consistent dividend payouts and will consider switching to a bullish stance once the company shows meaningful improvement in its operating performance. Good Luck!

Be the first to comment