Eoneren

I have covered Viatris (NASDAQ:VTRS) several times in the past. In November 2021, I concluded that Viatris was a compelling deep value pick – shares have declined significantly since my initial bullish note, largely due to the unexpected divestment of the biosimilars segment. Unlike the broader market, I welcomed the asset sale, as outlined in my follow-up analyses in February 2022 and shortly after the release of first-quarter 2022 results.

Of course, investing in Viatris remains relatively speculative, as the company’s leverage is significant and ongoing portfolio modifications make it difficult to assess actual earnings power. I am therefore keeping a close eye on Viatris and will share my opinion on the company’s Q2 results released on August 8, 2022 in this article.

Viatris’ Performance In The Second Quarter Was Significantly Impacted By The Strong U.S. Dollar

Viatris is a globally diversified manufacturer of generic drugs and is therefore exposed to significant foreign exchange risk.

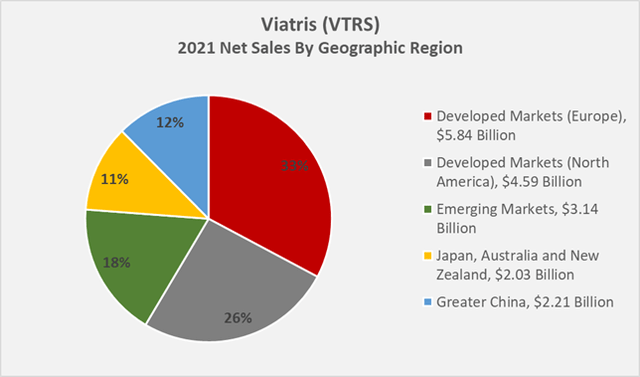

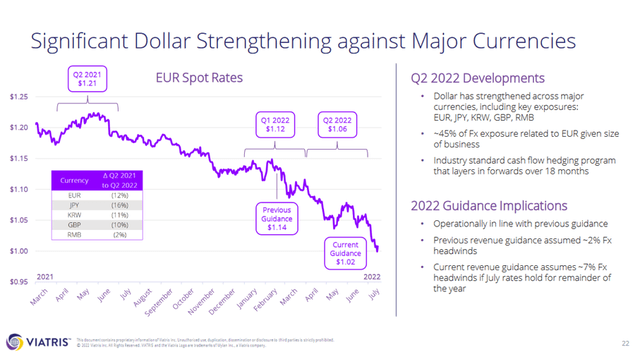

Figure 1 shows Viatris’ 2021 net sales by region. It should be noted that the company reports its North American and European businesses in the Developed Markets segment, but also reports region-specific revenue figures. According to management, approximately 70% of the business is not denominated in U.S. dollars. 45% of Viatris’ foreign exchange exposure relates to EUR (Slide 22, Q2 2022 earnings presentation, Figure 2). The Emerging Markets segment also includes a contribution from Eastern European countries. As the company does not provide more granular revenue figures, the impact of the war in Ukraine cannot be estimated. However, as the segment encompasses revenues generated in 125 countries, it is reasonable to assume that the contribution from Russia and Ukraine is not material.

Figure 1: Viatris’ 2021 net sales by geographic region (own work, based on the company’s 2021 10-K) Figure 2: Slide 22 of Viatris’ Q2 2022 earnings presentation, detailing the impact of foreign exchange rates

26% of Viatris’ 2021 net sales were generated in North America, although the company does not detail the share attributable to Canada. However, considering that CAD and USD largely move in lockstep, Viatris’ currency exposure in this segment can be considered insignificant. Accordingly, 74% of the company’s revenue is generated overseas, and to a large extent not in U.S. Dollars, as noted above. Viatris’ currency risk is therefore much greater than that of Amgen (AMGN) or Gilead Sciences (GILD), for example.

In Q2 2022, Viatris’ net sales declined 10% year-over-year, or 3% in constant currency (slide 29, Q2 2022 earnings presentation). Given Viatris’ global footprint, this fairly steep decline is not surprising. To reflect management’s expectations of the negative impact of foreign exchange, the company has revised its full-year revenue guidance and now expects a related impact of approximately $800 million, compared to $350 million previously. Accordingly, the company now expects full-year revenues of around $16.45 billion.

However, while the exchange rate impact is significant and likely to irritate some investors, I would not overstate this temporary headwind, partly because the U.S. has a vested interest in keeping the strength of the U.S. dollar at bay, including from the perspective of countries with other currencies but significant U.S. dollar-denominated debt. Of course, Viatris also hedges its foreign exchange rate risk appropriately. Viatris has maintained its free cash flow guidance and continues to expect around $2.7 billion for the full year. However, according to slide 26 of the earnings presentation, this will be achieved by reducing capital expenditures by $100 million. Considering the significant foreign exchange impact, I still think this is a strong performance and an indication that Viatris’ hedging programs are effective and that the company is successfully streamlining operations (see following section).

In general, and apart from the pronounced but expected currency-related headwind, the company’s segments performed very well. Viatris’ Developed Markets segment benefited from stronger than expected sales of EpiPen, Dymista and Brufen while the generics portfolio performed in line with expectations. Performance in emerging markets was broadly in line with expectations as well, driven by higher volumes in South Korea, Brazil and Malaysia. However, the segment’s quarterly operating sales decline of 19% year-over-year was significant – even after accounting for a currency effect of 600 basis points. Viatris’ operations in Japan, Australia and New Zealand experienced a sales-related 1300 basis point currency headwind, resulting in a 15% year-over-year decline in quarterly revenue. The Greater China segment performed slightly better than expected (sales growth of 1% in Q2 in constant currency, taking a 1% exchange rate impact into account).

New product launches are expected to contribute $600 million to Viatris top-line in 2022. This is significantly better than the previously announced $500 million in new product launches after 2023. Of course, this is partly due to faster-than-expected drug development and approval. For example, Viatris’ levothyroxine preparation was recently approved and, more importantly, the company expects to launch its Revlimid generic (lenalidomide) in the second half of 2022. The drug, which is used to treat multiple myeloma, smoldering myeloma and myelodysplastic syndromes, was originally developed by Celgene, which was acquired by Bristol-Myers Squibb (BMY) in 2019. Viatris lenalidomide sales are likely to ramp up relatively slowly as BMY still benefits from volume-limiting licenses granted to generic manufacturers and expects full-year sales of about $9.25 billion, as described in my recent article.

Debt Paydown And Operational Streamlining

At the end of 2021, Viatris’ net debt stood at $22.4 billion, or 3.5 times 2021 adjusted EBITDA. At the end of Q2 2022, net debt was down by $2.1 billion, but as measured by EBITDA, Viatris’ leverage declined only marginally due to lower 2022 adjusted EBITDA expectations ($6.0 billion in mid-2022 vs. $6.4 billion in 2021). Nevertheless, the company is using a significant portion of its free cash flow to pay down debt ($840 million in Q2), as evidenced, for example, by the decline in receivables ($530 million in H1 2022), inventories ($365 million in H1 2022), and other current assets ($260 million in H1 2022). It is worth noting that Viatris did not just “juggle” liabilities, as shown by the almost unchanged non-interest-bearing liabilities – the company actually repaid $808 million in other current liabilities and $111 million in tax liabilities. In total, the company has already achieved its goal of paying off $2 billion in debt in 2022 in the first half of the year. Considering that at least part of the cash flow used for debt repayment is attributable to a decrease in working capital, it can be expected that the company will not exceed its target in the second half of the year from this perspective.

Depending on the timing of the closing of the transaction with Biocon, the related proceeds may of course be used for further debt reduction. Viatris remains committed to maintaining its investment grade rating of BBB- (Standard & Poor’s). The transaction and the anticipated sale of other non-core assets will allow the Company to redeem notes currently trading at or below par, such as the 4.2% senior unsecured notes due November 2023 (current price $101) or the 5.2% notes due 2048 (current price $81). The transaction with Biocon has received key antitrust approvals in the U.S. and India but is subject to final approval by the Reserve Bank of India. Nevertheless, management expects the transaction to close in the second half of the year. Management did not elaborate on the sale of other non-core assets during the earnings call, but net assets held for sale increased by $121 million in the second quarter of 2022.

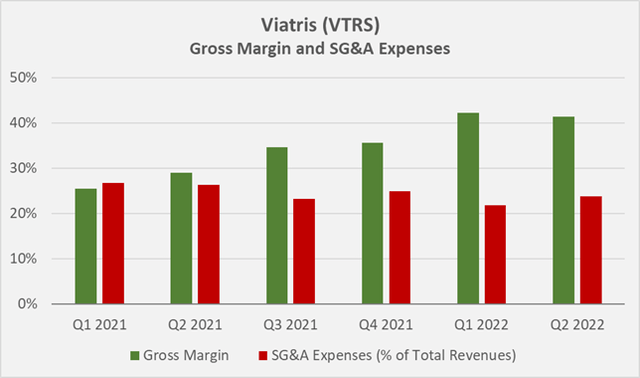

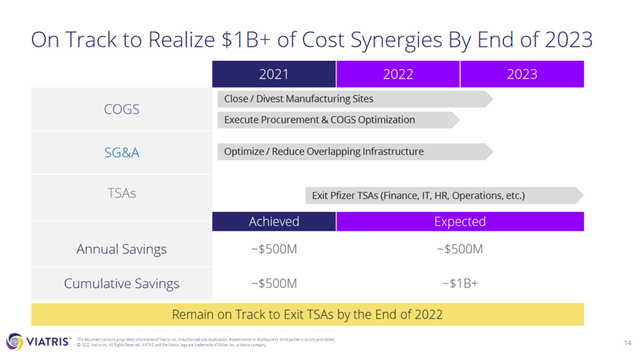

Viatris continues to realize operational synergies. The company continues to close or divest manufacturing sites, reduce overlapping infrastructure and optimize existing structures. The Upjohn-related assets were heavily dependent on Pfizer’s (PFE) systems and infrastructure. However, Viatris expects to have exited most, if not all, of the transition services agreements by the end of 2022 (slide 14, Q2 2022 earnings presentation). Selling, general and administrative (SG&A) expenses as a percentage of total revenue decreased 500 basis points in Q1 2022 and 200 basis points in Q2 2022 (Figure 3).

Figure 3: Viatris’ quarterly gross margin and relative SG&A expenses (own work, based on the company’s Q1 2021 to Q2 2022 10-Qs and the Q4 2021 earnings 8-K)

The company achieved $500 million in savings in 2021 and expects to save another $500 million by the end of 2023. Slide 14 of the earnings presentation (Figure 4) indicates that the cumulative savings by the end of 2023 will be approximately $1 billion, so only $500 million in annual savings should be carried forward into the future. In the Q&A session of the conference call, Viatris’ CFO confirmed that the cost savings are permanent in nature:

But all the items that we are seeing, in terms of our SG&A line, are sticky and sustainable over a period of time.

With regard to, again, on the free cash flow, the improvement that we’re doing are of permanent nature.

– Sanjeev Narula, Viatris’ CFO

Figure 4: Slide 14 of Viatris’ Q2 2022 earnings presentation, detailing cost synergies expected to be realized by the end of 2023

As a long-term investor, I am very pleased with the developments at Viatris in terms of debt reduction, operational rationalization and profitability, which is also underlined by the company’s stable gross margin in the low 40% range – at a time when many companies are reporting declining gross margins due to inflationary pressures. On an adjusted basis, Viatris’ gross margin remained very stable as well, declining only 10 basis points during the quarter to 58.5% (slide 16, Q2 2022 earnings presentation).

Concluding Remarks – A Small Caveat

Viatris reported another strong performance in the second quarter. Fears that free cash flow guidance would be lowered, which likely brought the share price down intermittently, have proven to be unfounded. Although the company is facing significant exchange rate headwinds, it will still be able to generate full-year free cash flow of between $2.5 billion and $2.9 billion, in part due to a $100 million reduction in capital expenditures. Accordingly, Viatris remains highly undervalued, with a forward free cash flow yield of 21%, or 8% when debt and cash (enterprise value) are included. The stock is not for the faint of heart, but as the company continues to reduce debt, the investment is de-risked.

I stand by my earlier conclusion that I believe Viatris is a compelling but speculative choice. I remain positive on the divestment of the Biosimilars segment and welcome the further streamlining of the portfolio. Early signs such as a much-improved gross margin, leaner working capital and lower SG&A costs are definitely visible. However, given the restructuring Viatris is undergoing, it is important to keep an eye on management’s strategy regarding business development initiatives. The CEO and CFO of Viatris have stated that they are looking at “bolt-on and tuck-in opportunities”. I would hate to see management squander cash on apparent growth opportunities while still in the process of downsizing and realigning the portfolio. Of course, I remain optimistic as long as such acquisitions are of a smaller scale, fit the therapeutic areas Viatris has focused on, and the company remains focused on reducing debt and increasing the dividend.

Thank you very much for taking the time to read my article. In case of any questions or comments, I’m very happy to read from you in the comments section below.

Be the first to comment