JHVEPhoto

An Open Letter to Sundar

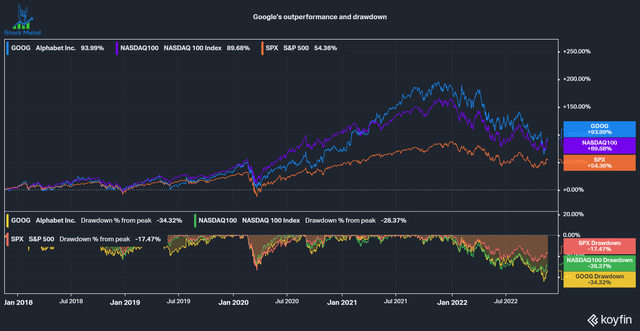

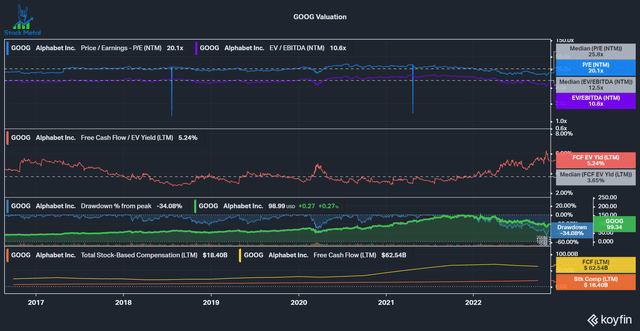

Alphabet Inc. (GOOG, GOOGL) (“Google”) has outperformed the S&P 500 (SP500) and Nasdaq 100 (QQQM) over the last five years, but has recently lost over 34% of its value since the tides turned. This can be attributed to many things: elevated multiples during the bull market, over-earning during 2020/2021, and/ or lack of cost discipline.

This week, TCI Fund Management Limited released a public activist letter directed at Sundar Pichai addressing their concerns as shareholders. Let’s dive into it.

Google’s outperformance and drawdown (Koyfin)

Who is TCI Fund Management?

TCI Fund Management is a value-oriented global fund looking to invest with a long-term investment horizon. To quote Christopher Hohn, TCI founder and portfolio manager:

“We invest in high quality companies with predictable free cash flow.”

The fund has a concentrated portfolio on high conviction bets with currently ten stocks (9 companies because they own both Alphabet Share classes). With $28 billion under management and 23% allocated to Alphabet, the company shows a high conviction of the company. The fund first invested in Alphabet in 2017, and since Q2 2019, Alphabet has accounted for more than 20% of the portfolio. We have to remember that most of the position is in GOOG (class C shares, no vote, 17.64% in Q3 22) and not GOOGL (class A shares, one vote, 5.34% in Q3 22). I’ll get to why this matters in the Will Google Listen? section of this article.

What does the letter demand?

The letter addresses three main points, which I’ll talk about now:

Cost cutting

The letter says that Google’s headcount is too high. Since 2017 the headcount has grown by a 20% CAGR, accelerating after a 14% CAGR from 2013 to 2017. This is especially troubling if we consider that the median compensation for an employee at Alphabet is $295,884. This is significantly above the median for the Top 20 technology companies at $117,055 (150% higher) and even 67% above Microsoft’s (MSFT) median compensation. Alphabet does employ some of the brightest minds on the planet, but it is the only big tech company that keeps hiring while most tech companies are cutting their headcount. Last month, Brad Gerstner of Altimeter Capital wrote a letter to Meta Platforms (META) with a similar message, saying the following about big tech’s hiring discipline:

It is a poorly kept secret in Silicon Valley that companies ranging from Google to Meta to Twitter to Uber could achieve similar levels of revenue with far fewer people. I would take it a step further and argue that these incredible companies would run even better and more efficiently without the layers and lethargy that comes with this extreme rate of employee expansion.

The last point regarding costs TCI brings up is Alphabet’s cash burn with its “Other Bets” segment, which has incinerated $20 billion to generate $3 billion in revenue in the last five years. Especially Waymo should be cut, with competitors like Ford Motor Company (F) and Volkswagen (OTCPK:VWAGY) withdrawing their initiatives because they don’t see a way to profitability.

I agree with everything TCI says here. Alphabet has been a remarkable growth story over the last decade, and nobody really bothered with their cost discipline while they grew at 25%. As growth stalls in this environment, it’s time to cut the fat and drive profitability.

EBIT target and management compensation

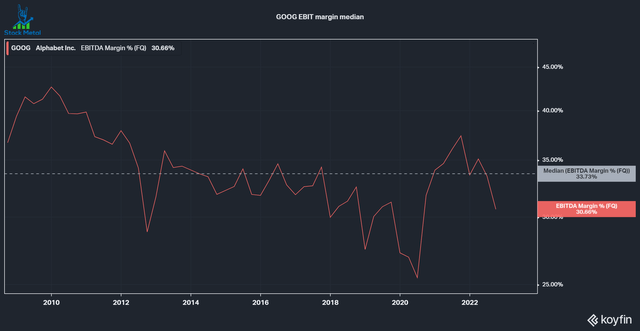

As a result of these proposed cost-cutting measures, TCI suggests Alphabet should establish an EBIT margin target of 40%+. Over the last 15 years, the median EBIT margin has been 33%, with 40%+ already achieved around 2010. I believe that this would be a significant step toward having a goal for profitability.

GOOG median EBIT margin (Koyfin)

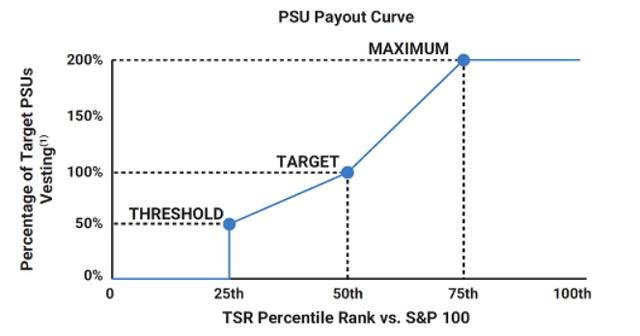

TCI suggests putting the EBIT target as a criterion for executive compensation. I am delighted to hear that because the current executive compensation policy is terrible. The only criterion currently is total shareholder return compared to the S&P 100 index. This does not offer any long-term alignment with shareholders and caters to short-term thinking. My preferred compensation policies are long-term incentives linked to free cash flow (“FCF”) growth, EBIT growth and ROIC/ROCE. This would align management a lot better with long-term shareholders.

Alphabet exec compensation (Alphabet Proxy Statement)

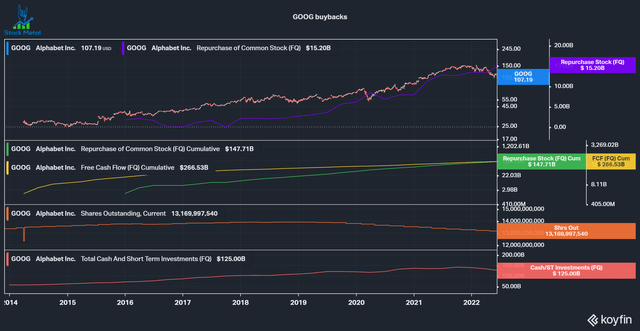

Increased buybacks

The last point TCI addresses is that Google should increase buybacks. Right now, Google has a $60 billion buyback run rate. That’s a lot of buybacks, but Alphabet also has $125 billion in cash and equivalents, only down $15 billion from the $142 billion seen in September 2021. The company should do something with this money. I personally would prefer if Alphabet started to pay a dividend instead of increasing buybacks. I don’t understand why tech companies seem allergic to paying out dividends. Buybacks are great to offset dilution, but they can also destroy a lot of value. I’d love management to pay out a growing dividend and repurchase shares opportunistically when it makes sense, like right now.

Continuing to grow the buybacks will not be advantageous to shareholders once we’re back into a better environment with rising valuations. Regardless of what they do, there is no need for $125 billion in cash sitting around, but at least they are making some money on it now with interest rates rising. At a 3.6% yield (10-year treasury rate), Alphabet would earn $4.5 billion a year this way.

TCI’s history as an activist investor

TCI had done successful activism in the past, for example, in 2021 when the fund called on Canadian National (CNI) to “stop acting in a manner that ignores the interest of shareholders.” One and a half months later, the CEO stepped down as TCI requested. TCI has held TCI since 2018 and is a long-term shareholder. I much prefer TCI’s long-term approach as an activist investor, compared to, for example, Dan Loeb’s Third Point hedge fund. Third Point took a significant stake in Disney in 2020, drove changes and then quickly exited his position. In August 2022, he once again took a position at Disney to try and push changes, this time with less success. To be a credible activist, you need to have a long-term shareholding in mind, in my opinion.

Will Google listen?

In reality, the Founders Larry Page (26.2%) and Sergey Brin (24.9%) control a collective 51.1% of Alphabet’s voting rights. This is the case because of Alphabet’s corporate structure. Alphabet has three different shares classes:

- Class A shares (NASDAQ:GOOGL) are publicly traded and represent one vote per share.

- Class B shares are not publicly traded and are for the founders and insiders. Each share represents ten votes. Besides the founders, Director L. John Doerr also owns over 1 million B shares, representing 1.5% of total Alphabet voting power.

- Class C shares (NASDAQ:GOOG) are publicly traded and do not have any voting rights.

This means that the founders do not have to listen and that activist investors can’t put real pressure on them. As a shareholder myself, I hope that they’ll listen, though!

Valuation

Google has come down a lot, down 34% from ATH. The company currently trades much cheaper than its five-year median valuation:

- Forward P/E of 20.1x versus 25.8x median

- Forward EV/EBITDA of 10.6x versus 12.5x median

- EV/FCF yield of 5.24% versus 3.65% median.

Especially for the FCF yield, we have to take Stock-based compensation (SBC) into account, though, as this is excluded in FCF. Over the last year, SBC accounted for 29% of Free Cash Flows. So the FCF yield, excluding SBC, would be 29% lower, around 3.72%. Still, I believe that Google is at an attractive valuation, considering the high quality of the business and the possibilities of trimming the fat and increasing margins over time. Even though the founders do not have to do these things, I hope they listen to what TCI outlined in their letter. I currently have a 6% position in Alphabet and rate the stock as a buy.

Be the first to comment