jimfeng/E+ via Getty Images

Zillow (NASDAQ:Z) stock has been through quite the ride. First, its stock crashed after exiting the iBuying business. Then, it crashed again alongside the broader tech crash. Amidst falling stock prices it is important to remind ourselves of the long term investment thesis – Z remains positioned as a dominant online real estate platform, albeit one that will no longer be directly involved in real estate transactions. The stock trades with considerable upside even if management disappoints on its 2025 targets, making this one worth buying for the long term.

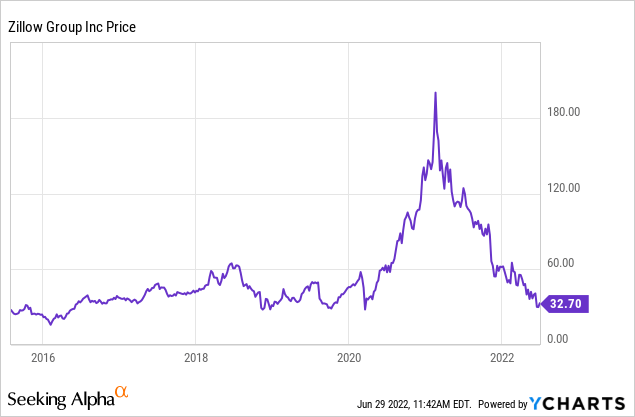

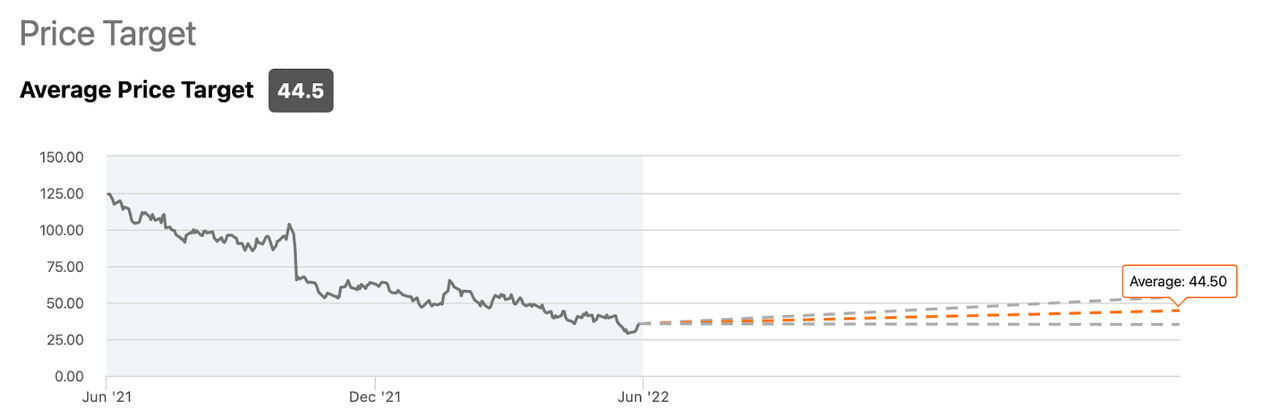

Zillow Stock Price

Z peaked above $200 per share in early 2021. The stock has since crashed down to around $33 per share. The stock is now at the same place it traded nine years ago.

I last covered the stock in February when I rated it a buy on account of the attractive upside. The stock has since fallen 49% since then, and it is now time to upgrade my rating to strong buy.

Zillow Stock Basics

The latest quarter saw revenues grow 250% to $4.3 billion. Investors should not extrapolate this growth further because the big boost was due to Z aggressively exiting the iBuying business. Z was able to sell $3.7 billion worth of houses at a slight gain – both being welcome surprises.

Z ended the quarter with $3.6 billion in cash versus $2.5 billion in debt, for a net cash position of $1.1 billion. Cash increased $500 million from the previous quarter in spite of $348 million of share repurchases.

The rapid exit from iBuying has helped Z almost fully repay its borrowings under real estate credit facilities. The company entered the third quarter with just under $500 million of inventory – a staggering reduction from the $3.9 billion of inventory as of the end of the 2021 year.

Is Zillow Profitable?

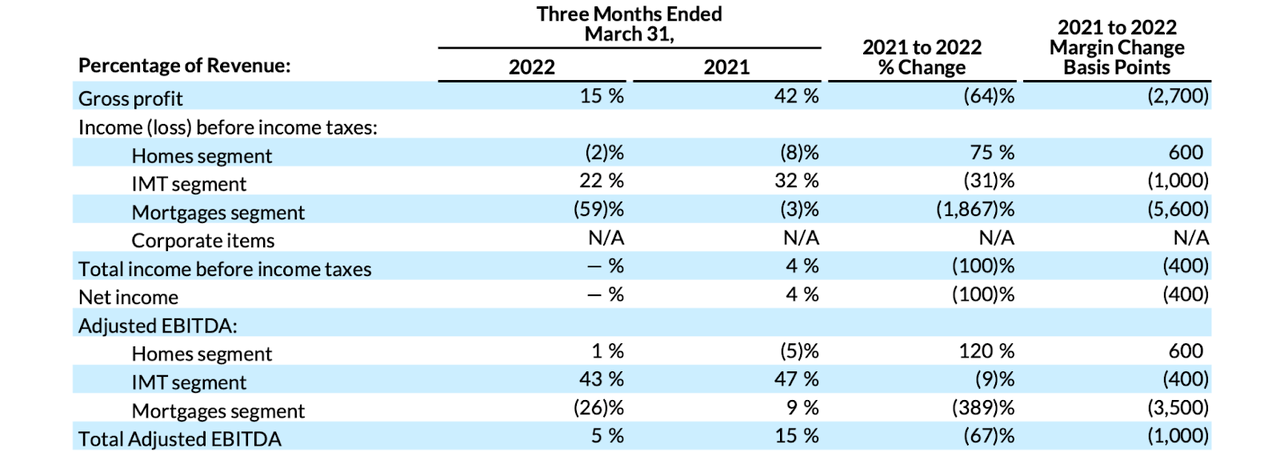

While exiting the iBuying business removed its fast growing segment, I expect it to boost its profit margins. As we can see below, whereas Z generates minimal margins on home sales, its core IMT segment is still generating a 43% adjusted EBITDA margin.

2022 Q1 Shareholder Letter

The company’s debt is made up primarily of convertible notes with interest rates ranging from 0.75% to 2.75% which in conjunction with the net cash position makes interest a negligible component of net income. Share-based compensation made up only 19% of IMT gross profits, suggesting that Z should be generating GAAP profits over the next several quarters as it fully exits the iBuying business.

Will Zillow Stock Ever Recover?

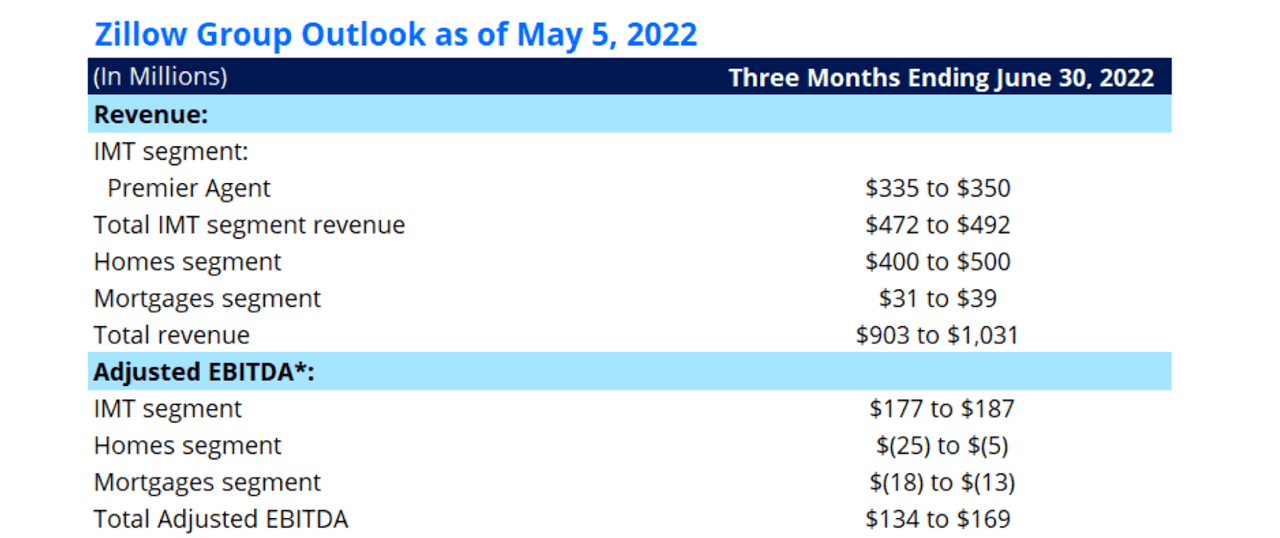

It is interesting how just several months can change the outlook. Whereas Z was crashing just seven months ago when it announced that it was exiting the iBuying business, that move may ironically help the stock recover. Rising interest rates have led to a rise in mortgage rates and a decline in home demand – raising the potential for a crash in the real estate market. Z has guided for the coming quarter to see as much as $500 million in home sales.

2022 Q1 Shareholder Letter

That would be enough to almost fully exit the iBuying business. In its shareholder letter, Z noted that it ended the quarter with approximately 1,300 homes and had already sold or entered into agreements to sell most of those homes, with only 100 homes not yet under contract to be sold. In other words, investors can have a high degree of certainty that Z will be almost completely rid of its iBuying operations when it reports earnings over the coming months.

Is Zillow Fairly Valued?

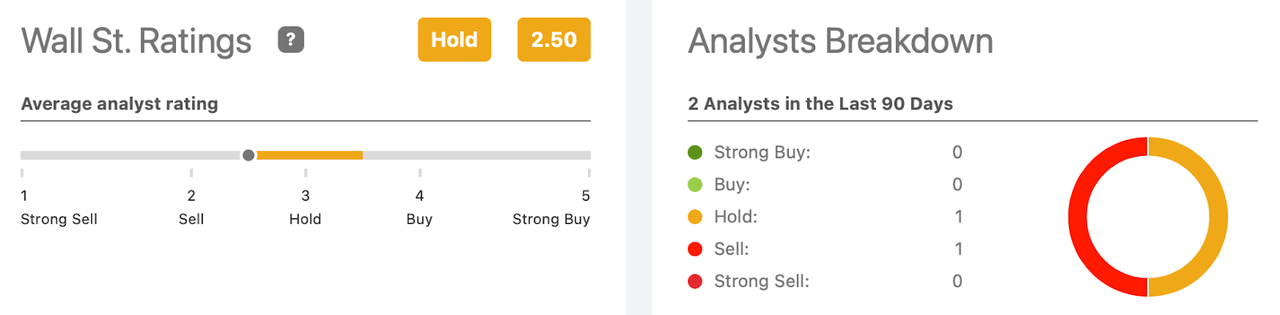

Wall Street analysts appear to have lost faith in Z stock. The average rating is 2.5 out of 5.

Seeking Alpha

The average price target is $44.50 per share, representing only 35% potential upside.

Seeking Alpha

That is surprising considering that Z is down nearly 90% from all time highs.

What Is The Future Of Zillow Stock?

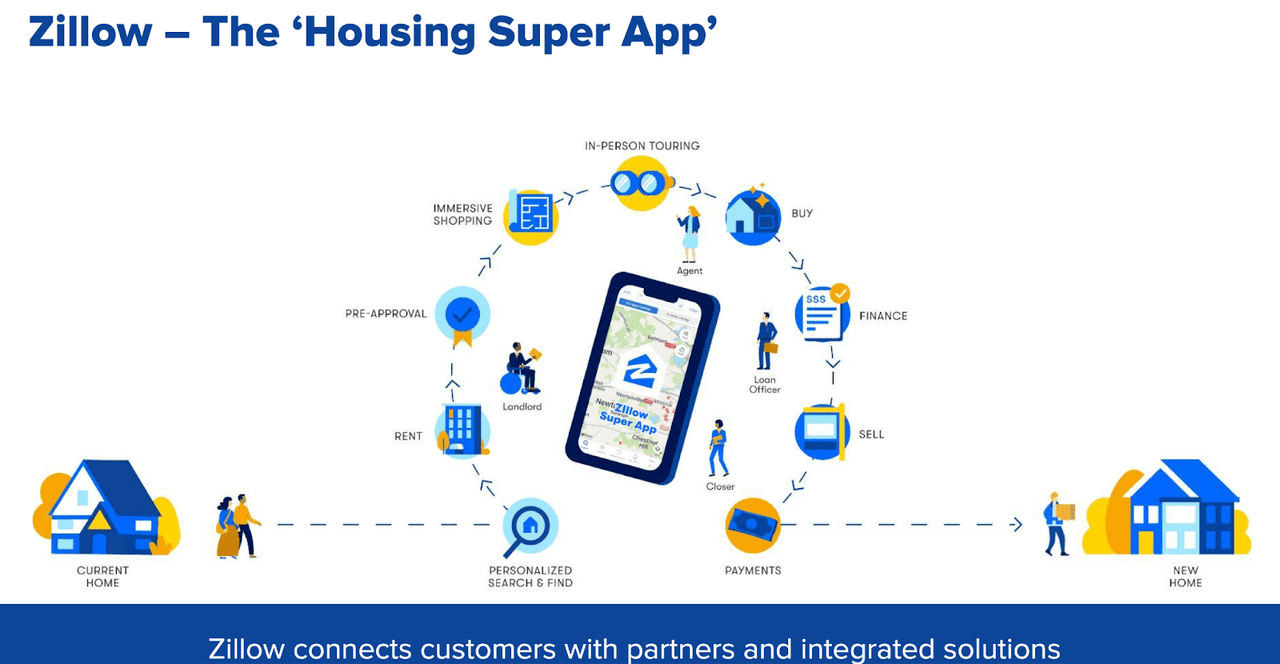

Looking forward, Z has signaled its intentions to build a “Housing Super App.” Z wants to play a role in every part of the real estate transaction (except perhaps the transaction itself).

2022 Investor Presentation

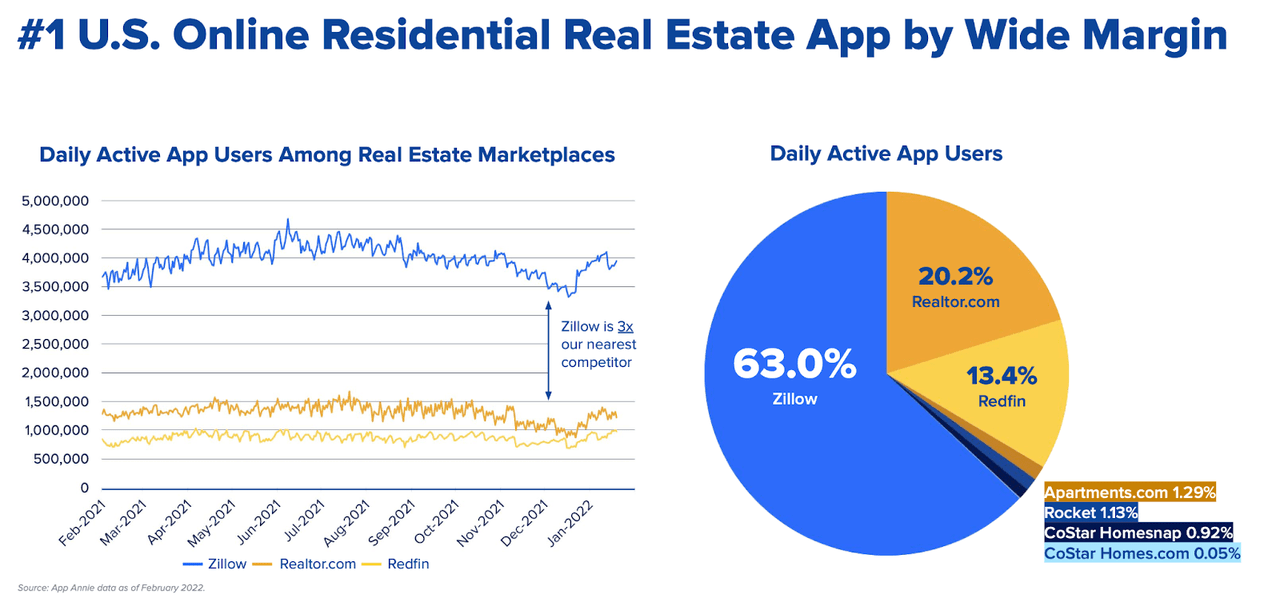

With the stock price falling, it is easy to forget that Z is the number one online residential real estate app with 63% market share (as measured by daily users).

2022 Investor Presentation

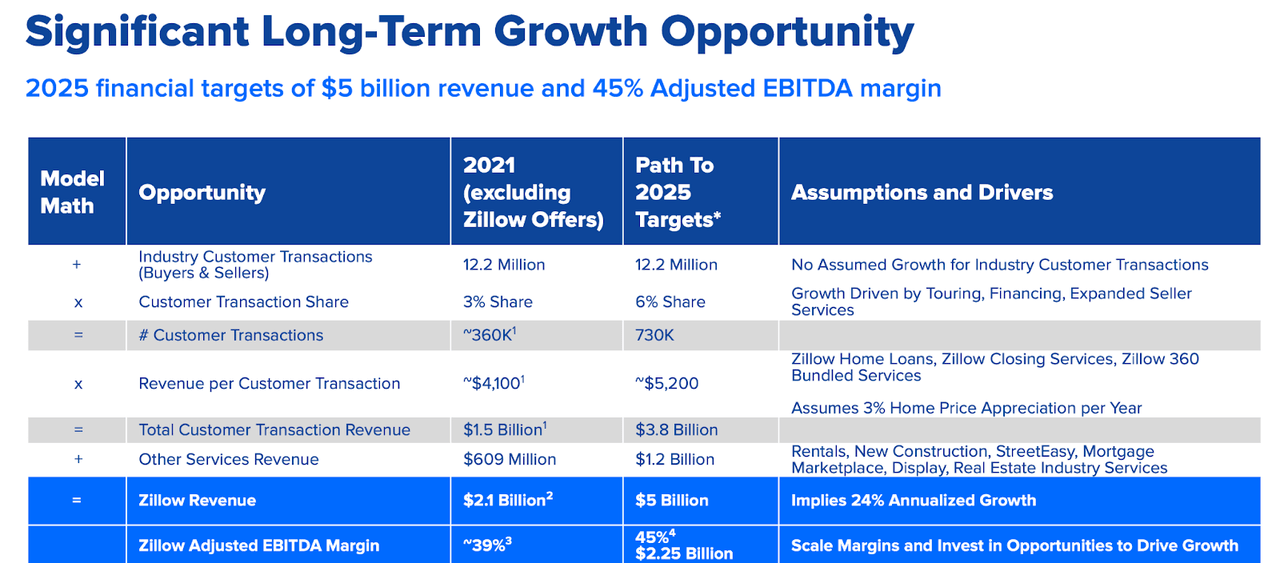

Z believes that it will be able to play a role in 6% of real estate transactions (up from 3% in 2021) and generate $5,200 per customer (up from $4,100 in 2021). These may allow the company to generate as much as $2.25 billion of adjusted EBITDA by 2025.

2022 Investor Presentation

Is Zillow Stock A Buy, Sell, or Hold?

At recent prices, Z is trading at a $8.8 billion market cap. There is $1.1 billion of net cash, yielding an enterprise value of $7.7 billion. I ignore the net cash in the following analysis for conservatism. If Z can achieve $2.25 billion of adjusted EBITDA in 2025, then the stock is currently trading at just 3.4x that number. The company is already profitable and actively repurchasing shares, suggesting that its enterprise value may be even lower in 2025. I can see Z growing at a double-digit clip for many years as it continues to take market share in real estate. I view Z as being very similar to what Amazon (AMZN) and e-commerce are for retail transactions. I can see Z trading at 20x to 25x adjusted EBITDA by 2025, representing a stock price of $169 per share at the low end. That suggests around 90% annual upside over the next 2.5 years.

Wall Street consensus estimates are less optimistic. Wall Street expects Z to earn only $3 billion of revenues by 2025 – far short of management’s $5 billion target.

Seeking Alpha

Under that assumption, Z might generate $1.35 billion of adjusted EBITDA based on a 45% margin assumption. If we then assume that Z trades at only 15x that number, then the stock might trade at $76 per share, representing around 38% annual upside over the next 2.5 years. Even using the more conservative assumptions, the stock is still priced for strong upside over the near term. What are key risks to the stock? If the housing market suffers a downturn, then Z will likely see its near term growth rates stall as it may not be able to offset overall demand with increased market share. I am less concerned with inventory risk as I expect the company to be almost out of iBuying by next quarter. On a side note, I must state that I am not necessarily bearish on the iBuying market, as I am long the stock of iBuying leader Opendoor (OPEN). I am merely stating that Z for its part should not have the same direct exposure to underlying housing prices. The biggest long term risk is if the company does not meet its long term guidance for revenues or margins. That said, I showed above that even assuming only 43% revenue growth from 2021 through 2025, Z can still generate 38% annual upside. I rate the stock a strong buy as the valuation has steered too far to the negative – this stock should explode higher once investors return to focusing on the fundamentals.

Be the first to comment