Rodrigo/iStock via Getty Images

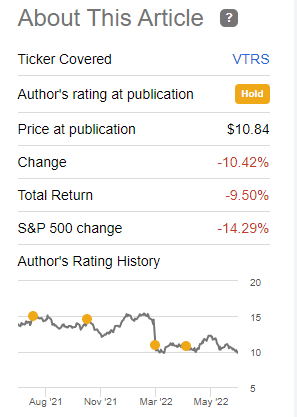

Look, no one is arguing that Viatris Inc. (NASDAQ:VTRS) looks cheap on many metrics. At the same time, there is a daunting mountain of hurdles to overcome to actually produce returns for investors. That is something we have been acutely aware of and have refused to budge off the “hold” rating ever since we started covering this. More importantly, over medium-term timeframes, a key driver is the change in earnings and our last coverage saw some rather significant headwinds for 2022 earnings. When we last covered VTRS, we told the bulls what were the key risks that could make the value into the value trap.

The three headwinds are material in our opinion and likely break the adjusted EBITDA well below the $6.0 billion mark. Based on VTRS’s walk-through, we see free cash flow coming in under $2.3 billion when we add our estimates in.

Source: 3 Things That Can Break The Bull Thesis In 2022

With 3 months more of data and Q2-2022 results on tap, we look at where our thesis stands.

Headwind 1

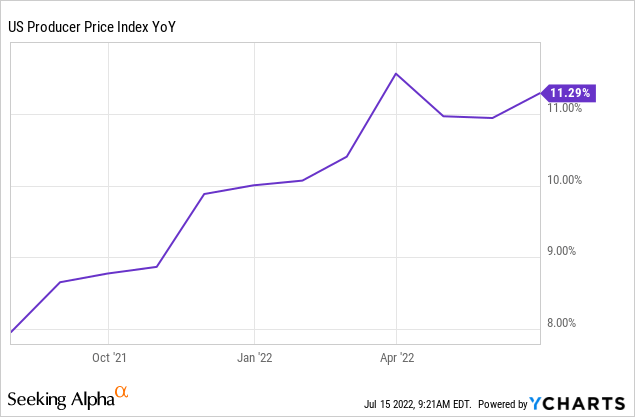

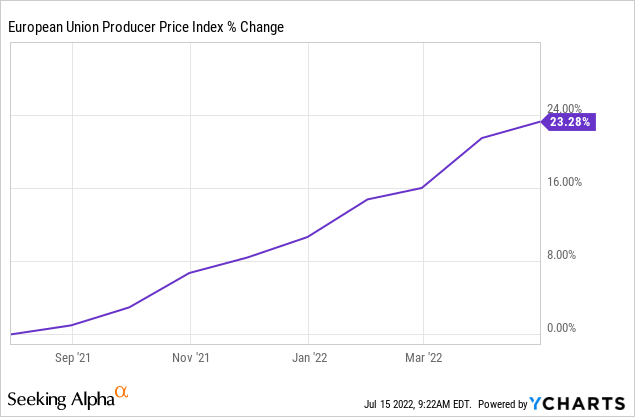

Inflation was on our minds, first and foremost and we have to say that the impact will likely be worse than expected. Producer price index has remained at a daunting 11% plus range in the US.

European changes have actually accelerated upwards.

The good news is that commodities appeared to have put in a top in the last two months and producer price indices will likely follow in 1-3 months. We will nonetheless see some damage to earnings potential as we don’t think VTRS can pass on these expenses. We see this headwind peaking in Q3-2022 and the moderating rapidly as we move on to 2023.

Headwind 2

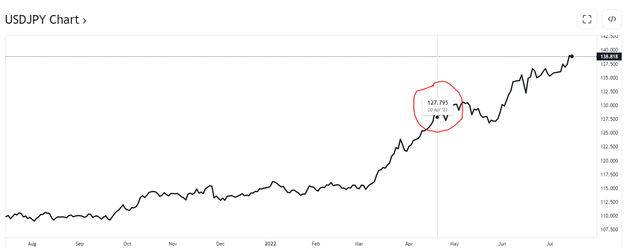

Forex was the second problem we identified and that too has extended the impact since we last covered VTRS. USD-JPY is perhaps the best example of that. On April 20 (date of the last article), it was at 127.80.

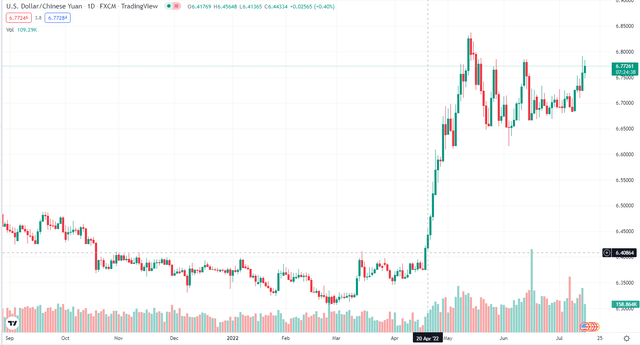

Today we are approaching the 140 zone. The USD has also started flexing its muscle against the Chinese Yuan, something that had not happened during the earlier part of the year.

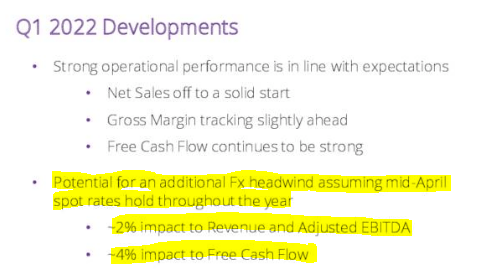

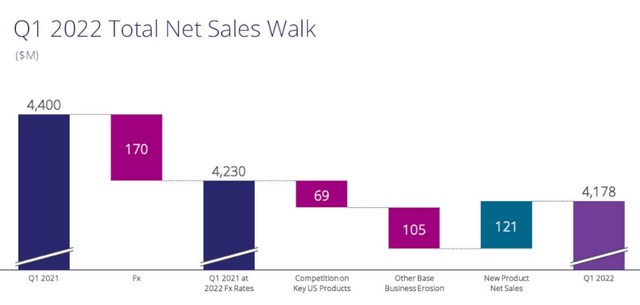

You already saw that Forex was hurting Q1-2022 results.

VTRS touched on this in the presentation.

VTRS Q1-2022 Presentation

Analysts were trying to get a further gauge in the VTRS presentation in June as well.

Nathan Rich

Okay, great. I have one more, then maybe I’ll pause and just see if there are any questions from the audience. Bill, I know that you mentioned that there’s not going to be a discussion around guidance. But if I could ask a clarification just on the guidance update that you gave with 1Q, you didn’t update for FX headwinds. I think you called them out as a 2% headwind as of April. I guess, are you planning to update the annual guidance for FX with the 2Q update? And I guess, all else equal, simplistically, would that mean the guidance comes down by 2%? I obviously understand things have changed since then. And I don’t know if you can kind of comment on FX moves in the interim and maybe what that would mean. But I just wanted to ask a clarification just in terms of what investors can expect the update to be with 2Q?

A – Sanjeev Narula

So, Nate, first, I think it’s very important to kind of mention, as we said on the first quarter call. Operationally, FX aside, we are performing in line with our expectation, in line with our guidance. So, I think that’s the first point of note. Clearly, as we pointed out, FX is a headwind and we mentioned that if the April spot rates were to hold for rest of the year, there is going to be a 2% impact on the top line and EBITDA. You also know, with everything that is going on in the world, dollar has further strengthened in the last two months against all the major currencies, like euro and Chinese RMB. 70% of our business is international business. So, we look at all of that, and then we will look at second quarter call and keep provide you an update. Clearly FX is the headwind, but I think an important note, we’ve been very transparent and we will continue to be transparent. But there’s so much moving going on right now, I think you will hear more from us at the second quarter call.

Source: Seeking Alpha VTRS Transcript

Our overall gauge here is that this has turned out even worse than our expectations, and unless the USD reverses abruptly, we think this will hurt VTRS the most.

Headwind 3

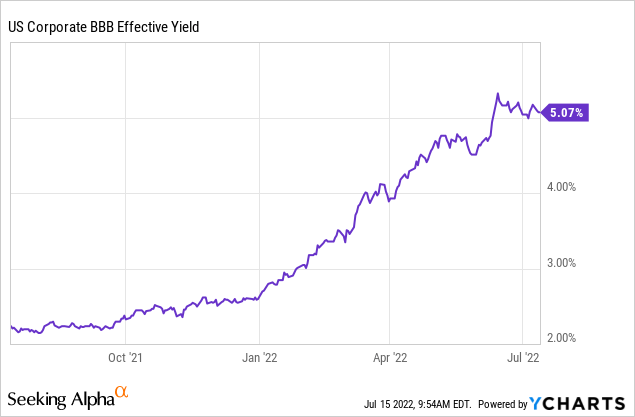

VTRS also faces a hurdle from rising rates. This comes as refinancings become more expensive over time. There is also the secondary impact to the stock price as investors get attractive yields on investment grade bonds. The required rate inputted into excel sheets moves up as the BBB yields rise.

We are most optimistic on this front as we see longer-term investment grade yields as close to peaking right away.

Verdict

In general, the problems we identified have increased over the last 3 months. Does the stock reflect this? Perhaps, but it has outperformed the S&P 500 since then, so we would not say that investors are exactly puking at this point.

Returns Since Last Article

Q2-2022 results and subsequent guidance will be critical to determine the direction. If we are correct, there should be a good drop across the board for revenues, margins and EBITDA. Remember, that our free cash flow estimate ($2.3 billion) is way below the company’s $2.7 billion midpoint. The good news for bulls here is that the company actually addressed the biggest issue we have with them. The reoccurring “one-time” costs.

What you should also see at the end of the day, the remainco will continue to drive significant cash flow as the one-time cash costs keep coming down. We’re expecting beyond 2023, the one-time cash cost to be in the range of 500 to $700 million. And remember this year as per our guidance, that cost is about $1.3 billion. So, you would see remaining company will have significant cash flow, improvement in cash flow conversion, lower one-time cash cost, and then you have the investible proceeds from all the reshipping initiative.

Source: Seeking Alpha VTRS Transcript

Yeah, the “one-time” costs don’t end, but at least that drop from $1.3 billion to $600 million should help fire up the debt paydown. We think investors should prepare for a bad quarter and be prepared to buy weakness following that. We maintain our stoic “hold”.

Please note that this is not financial advice. It may seem like it, sound like it, but surprisingly, it is not. Investors are expected to do their own due diligence and consult with a professional who knows their objectives and constraints.

Be the first to comment