hapabapa

Written by Nick Ackerman. This article was originally published to members of Cash Builder Opportunities on October 26th, 2022.

Paychex, Inc. (NASDAQ:PAYX) continues to deliver results to shareholders. With their last earnings announcement at the end of September, they beat both EPS and revenue expectations. They also raised their fiscal year guidance, which is important to consider for an HR and payroll company.

At the same time, shares have come down since our previous update earlier this year. This has potentially created an opportunity where one could consider starting an initial position. However, I’ll admit that shares remain rather elevated based on their historical valuation. Yet, at the same time, companies that can continue to deliver have the chance to remain elevated for extended periods of time.

For those unfamiliar with PAYX, they are a payroll, HR, and benefits company. They work with more than 730,000 businesses. These are small or mid-sized companies that don’t or can’t really afford in-house HR and payroll solutions. The growth has been quite tremendous. They’ve been able to run double-digit revenue growth since COVID, and during COVID only saw relatively shallow hits to revenue.

Fiscal Year EPS Guidance Boost

In the latest quarter, they reported a 14% increase in diluted EPS, coming in at $1.05 per share. Revenue grew 11% for the quarter, rising to $1.188 billion.

Despite the weaker economy, they were even confident enough to raise their earnings guidance for the full year. This is important, because they announced their Q1 results, meaning they are looking at the fiscal year 2023 already. This is when everyone else is generally announcing their Q3 results. Their fiscal year end is May 31st. So the forecast is for a reduced portion of the next calendar year, but it is still quite impressive nonetheless.

Revenue guidance remained the same. It still suggests a rather optimistic outcome in operations through the next year. Here’s from their earnings call:

The majority of our guidance remains unchanged from that provided in June, with the exception of an increase in our expected growth for adjusted earnings per share. Let me provide some color in certain areas as follows…

…Total revenue is expected to grow in the range of 7% to 8% but, again based on what I just said, is anticipated to be towards the upper end of that range, and adjusted diluted earnings per share is now expected to grow in the range of 11% to 12%, an increase from the previous guidance of 9% to 10%. Just want everyone to remember, I’m talking about adjusted diluted earnings per share.

Since they rely on strong labor to generate results, this shows some confidence they can deliver in the coming year. This is notable as most expect the Fed to push us into a recession by overdoing interest rates. As a quick reminder, the Fed does have a dual mandate of attempting to provide stable processes and maximum employment.

In another way, with the Fed’s dual mandate, it could be a bit of a “Fed put” for PAYX. If unemployment starts to rise too rapidly, they essentially need to somehow correct that – which would eventually support PAYX. At that point, it would come down to how much damage could be done before such a recovery.

One of the reasons for their confidence seems clear; they continue to see a tight labor market with no signs of slowing. Here’s another remark when pressed on the call to add a bit more color to the macro assumptions for the fiscal year guide:

I would say I don’t think there is anything we’re seeing at this point that we’d see as a sign of a recession. As Marty pointed out, there was moderation that we expected going into this year on retention because of the business charge, but when I look at it, employment levels continue to increase, we see that in our checks, we see that in worksite employees per customer. The labor market continues to be tight. Our business watch certainly showed that information.

I would also point to our revenue retention is remaining at the record levels we’ve seen before, so again we continue to see the fact that retention and the use of our products, when I look at the underlying pieces, clients are taking high value services from us, those things are creating more stickiness for those customers. Our price value losses continue to remain significantly below even the pre-pandemic levels, so again any moderation that we’re seeing, I view as more of a normalization of what we saw anomaly going on during the pandemic.

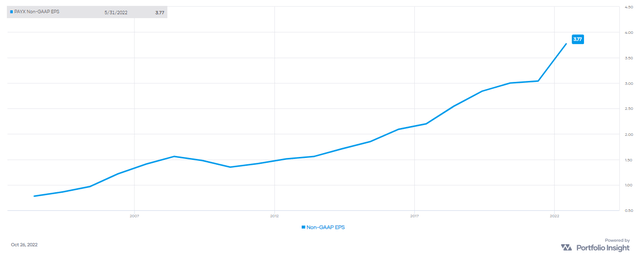

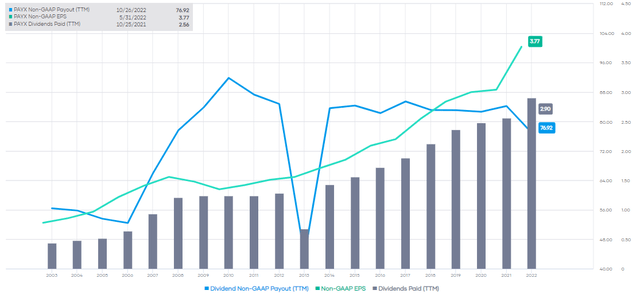

For PAYX, it is yet to be seen if they can achieve this despite the outlook on the broader economy, but this management team isn’t generally one to over-promise and under-deliver. This has clearly been shown with their ability to drive earnings growth over the years. Even in 2008/09, they only saw a shallow dip in their profitability. 2020 essentially flatlined with earnings, still a remarkable result.

PAYX Non-GAAP EPS (Portfolio Insight)

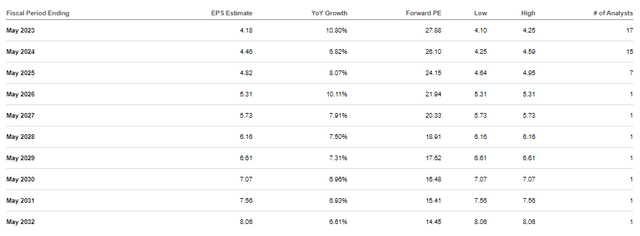

When looking at the outlook for earnings from analysts, they are seeing continued growth ahead for the company too.

PAYX Estimates (Seeking Alpha)

In fact, this has improved from our previous update quite considerably. Fiscal 2023 was expected to be $3.88, and fiscal 2024 was expected to be $4.23. These revisions higher are encouraging to see from analysts at a time when others are cutting expectations. For some color on fiscal 2022, the original estimate was $3.63, and they delivered $3.76.

Valuation

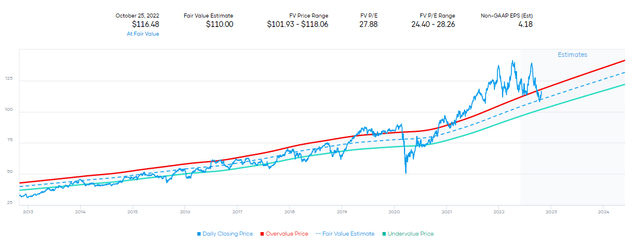

Looking at the valuation based on the historical P/E, we can see that shares of PAYX have now fallen back into their fair value range. This was when previously they had been trading above this level.

PAYX Fair Value Estimate (Portfolio Insight)

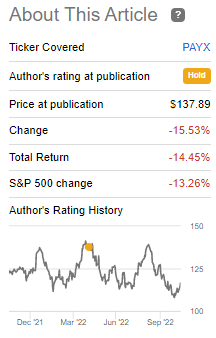

Still, this is on the upper end of the range for the stock. Overall, the whole market declined further since our April update, too. It was almost the same amount as PAYX.

PAYX Performance Since Previous Update (Seeking Alpha)

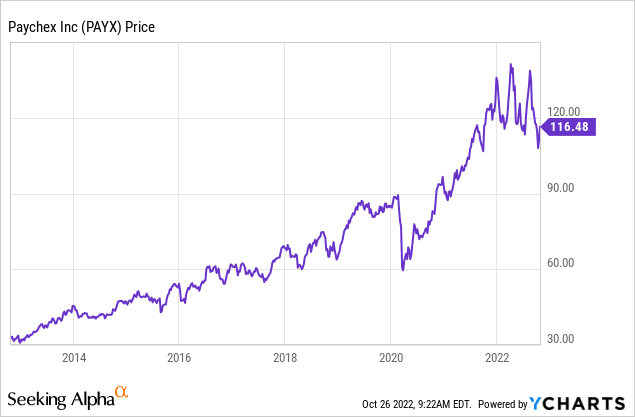

Overall, PAYX has been on quite the wild ride of hitting near all-time highs and then coming off of those levels. That isn’t all that unusual for a company that is producing all-time high earnings and revenue, either.

Ycharts

Dividend

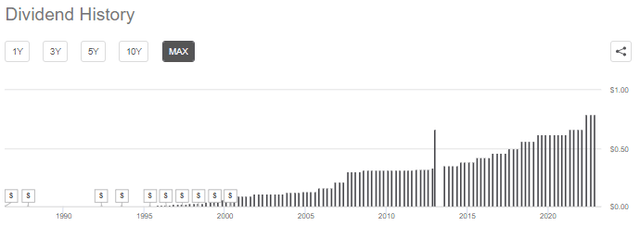

With earnings growing, the dividend has also continued to grow. The latest dividend boost was quite a significant amount too. However, through COVID, they remained conservative and didn’t raise. Thus, the last increase earlier this year could be seen as making up for some of that. They also held the dividend steady through the GFC, which makes sense to me.

PAYX Dividend History (Seeking Alpha)

Given the $3.16 in annualized dividends they are paying now, that works out to a forward payout ratio of nearly 75%. That is quite high but isn’t overly high for PAYX in the last decade. In fact, the payout ratio currently comes near the lower end as EPS growth outpaces the dividend growth.

PAYX Payout Ratio (Portfolio Insight)

Conclusion

PAYX has dipped, and I believe that could create an opportunity for an initial position. That being said, we are still looking at a stock price that is quite elevated – trading on the higher end of its fair value estimate range. On the other hand, Paychex is a company still boosting earnings guidance for their fiscal year 2023, which incorporates a period where many expect at least a mild recession. Maintaining growth in the environment we might be entering is quite a feat. The question will now become whether Paychex, Inc. can continue to deliver as they have been doing thus far.

Be the first to comment