Cindy Ord/Getty Images Entertainment

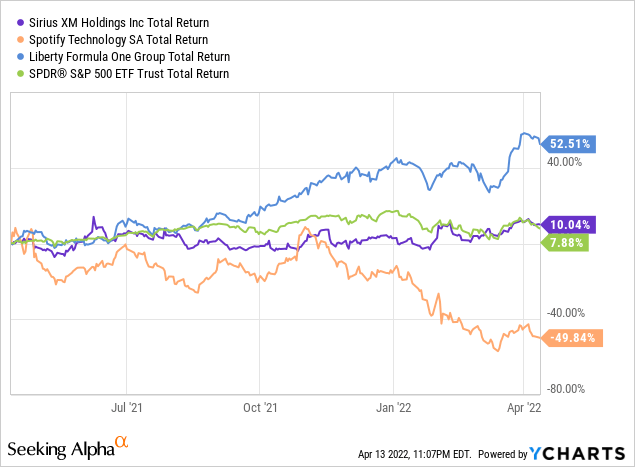

Over the last twelve months, radio+Pandora giant Sirius XM (NASDAQ:SIRI) has generated a total return of ~10%, roughly in-line with the S&P 500, and avoiding the extremes of Liberty’s (FWONK) ~50% return and Spotify’s (SPOT) 50% loss in value. At 18.3x forward earnings and a reasonable enough dividend yield of 1.4%, at first blush, the stock appears reasonably well-priced. However, with the auto industry suffering from a parts crisis, Sirius XM faces some near-term headwinds to growth, or right now, Pandora looks like it will continue to struggle to achieve profitability. It represents only a quarter of the company’s gross profit, but, as it extends its reach into podcasting, I believe the upside story in a higher returning sector will start playing out, proving the bears wrong.

According to Seeking Alpha data, the Street is currently mixed on the stock. 8 analysts rate the stock a “buy” or “strong buy”, but 4 rate it just a “hold”, and 3 a “sell”. In general, the sentiment has become slightly more bearish since October 2020 when just ~75% of analysts had the stock in “buy” territory. Part of the pessimism stems from immediate headwinds in the auto industry. However, when you consider that the stock now trades at 18.3x forward earnings with operating margins of 22.2%, the potential market rotation away from unprofitable Spotify may become a theme. In general, as the market starts to normalize valuations, I believe there will be a shift from growth to value stocks, and Sirius XM is one of the likelier parties to benefit from this given that it offers that “growth” feel while being a relatively mature, undervalued price.

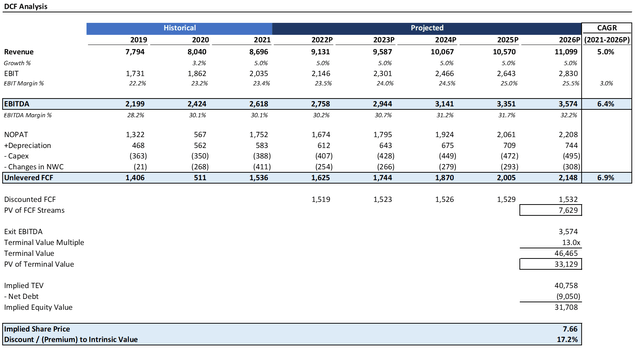

DCF Analysis Indicates Material Upside

To get a sense of the company’s intrinsic value, I ran a DCF analysis. No DCF analysis can provide a perfect picture of future returns for shareholders; however, they can provide an illustrative “story” of the likelihood of different scenarios. I forecast revenue growing at a slow 5% rate into 2026. I assumed margins expanding by 200 bps into 2026 to 25.5%. Capex, increase in net working capital, depreciation, and taxes were flat-lined for simplicity. By 2026, I have EBITDA at $3.5 billion.

Source: Created by author using data from Yahoo! Finance

Assuming a terminal EBITDA multiple of 13x and a discount rate of 7%, the stock is ~17% below intrinsic value. And here’s the thing: 13x is actually relatively conservative. Sirius XM has generally traded in the 14-19x range over the last decade and a half. Accordingly, there’s materially more upside here, especially when you consider that I’m anticipating very modest growth of 5% annually.

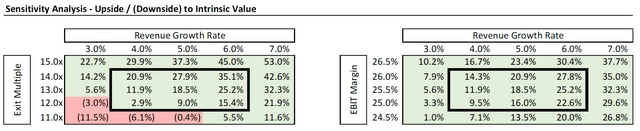

Source: Created by author using data from Yahoo! Finance

Looking at the sensitivity analysis, things become even more appealing. Should growth tick up to 7%, there’s 32% upside here. Currently, the market is treating the stock as if it’s destined for a sub-GDP growth rate. Importantly, returns are not too sensitive to margins; a change of 1% margins yields only a change of returns of 5%. This is the area where I would expect the company to be under pressure from Spotify pricing competition.

Upside Catalysts

With Pandora factored into the equation, I believe there is considerably more upside than my model anticipates. Right now, Pandora is bleeding money, so it is hard for investors to focus on the longer-term. Nevertheless, podcasting is a disruptive media opportunity that is inherently open to new growth. Podcasting is still a relatively new medium, so Pandora certainly has room to acquire attractive names in the space and build a presence. Sirius XM benefits from having a resilient business model that affords it the ability to take risks and not worry about losing the existing legacy business. The churn rate has been historically very low, with an implied average life for new car purchases of around five years. If Sirius XM can take some of the advertising reach it can get through radio to push Pandora into podcasting or expand cross-selling opportunities, I think the 5% growth rate assumed in my model looks quite low. The Audio Up service has kickstarted the podcasting space. Agreements with top-ranked podcasts, like Crooked Media, reflect management’s focus on this growth area.

I am also optimistic about the company’s 360L service that combines the best of both worlds in satellite and streaming. Around 4 million cars have the 360L-enabled technology, but 25% of new cars are getting the modules enabled, reflecting a massive runway for future growth. 360L provides a very feature-rich, personalized media experience that is ready-made for the next generation of electric, Tesla-esque cars. The plan going forward is to make 360L the plan of record for OEM partners for an anticipated 80% penetration. As 360L is rolled out, the opportunity to push podcasting and generate a new revenue stream becomes actionable. Along the same lines, the recent acquisition of Cloud Cover Music demonstrates that the company is willing to take risks on broadening the scope of Sirius XM’s media platform.

Risks

In the near-term, Sirius XM is a bit of a difficult one to swallow. Stabilizing MAU and total listening hours continues to be a challenge on Pandora. Further, debt continues to mount and stands at $9.2 billion, or 3.5x EBITDA / nearly 50% of the market cap. With anemic revenue growth and a current ratio of 0.4, the leverage is particularly concerning. The evolution of the online streaming industry will also add downside pressure to the margins. Decelerating auto sales have compounded problems with Connected Vehicle Service at a time when the auto industry is in a parts crisis.

Conclusion

While Sirius XM certainly isn’t a risk-free investment, it is in a strong position to leverage its radio leadership position into market adjacencies. I am very bullish on the company’s potential in podcasting. Spotify’s deal with Joe Rogan may have attracted a lot of controversy, but it nevertheless demonstrates how powerful of a medium podcasting has become. As 360L’s penetration rate in new cars continues to grow, Sirius XM is in a privileged position to take on leadership status here. Yes, growth has been disappointing of late, but this really just sets expectations low for strong performance. An increase in Liberty ownership could force out higher dividends as well and, at a beta of ~1.0, the stock is not volatile, which reflects a resilient business model with loyal customers. Accordingly, I strongly recommend investing in Sirius XM.

Be the first to comment