SolStock/E+ via Getty Images

A Quick Take On Oatly

Oatly Group AB (NASDAQ:OTLY) went public in May 2021, raising approximately $1.4 billion for the company and selling stockholders in an IPO that was priced at $17.00 per share.

The firm sells a variety of oat-based products as an alternative to traditional dairy items worldwide.

Until the firm can make meaningful headway on increasing its revenue base to cover its high global cost structure, I don’t see significant upside to the stock.

I’m on Hold for OTLY in the near term.

Oatly Overview

Malmo, Sweden-based Oatly was founded to develop cow’s milk dairy product alternatives using oat-based products.

Management is headed by Chief Executive Officer, Toni Petersson, who has been with the firm since 2012 and was previously founder of several businesses in the hospitality and real estate industries.

The company’s primary offerings include:

-

Oat milk

-

Ice cream

-

Yogurt

-

Cooking creams

-

Spreads

-

On-the-go drinks.

The firm sells its products through retail and online channels.

Market & Competition

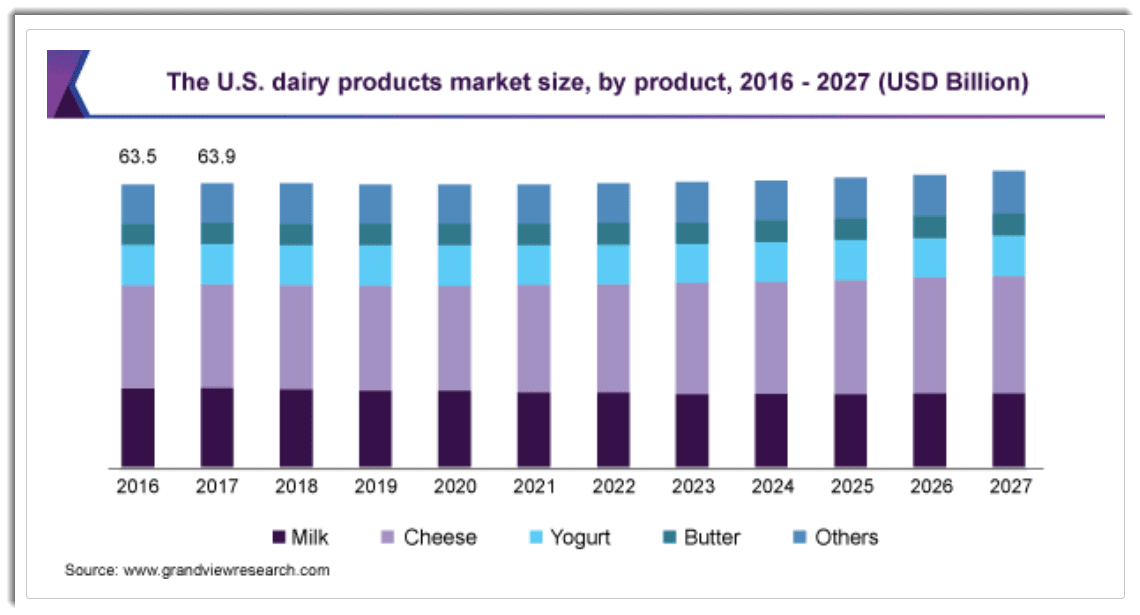

According to a 2020 market research report by Grand View Research, the global dairy product market size was an estimated $481 billion in 2019 and is forecast to reach $586 million by 2027.

This represents a forecast CAGR of 2.5% from 2020 to 2027.

The main drivers for this expected growth are shifting consumer demand preference for protein derived from dairy products or alternatives as opposed to from animal meat sources.

Also, improved cold supply chains and modern facilities have made storage and transport of dairy/alternative dairy products more available for consumers.

Below is a chart showing the historical and projected future growth trajectory of the U.S. dairy products market:

U.S. Dairy Products Market Size (Grand View Research)

Major competitive or other industry participants include:

-

PepsiCo

-

Coca-Cola

-

Chobani

-

Nestle

-

Danone

-

Lactalis

-

Fonterra HP Hood

-

Arla Foods

-

Valio

-

Blue Diamond Growers

-

Califia Farms

-

Ripple Foods

-

Ecotone

Oatly’s Recent Financial Performance

-

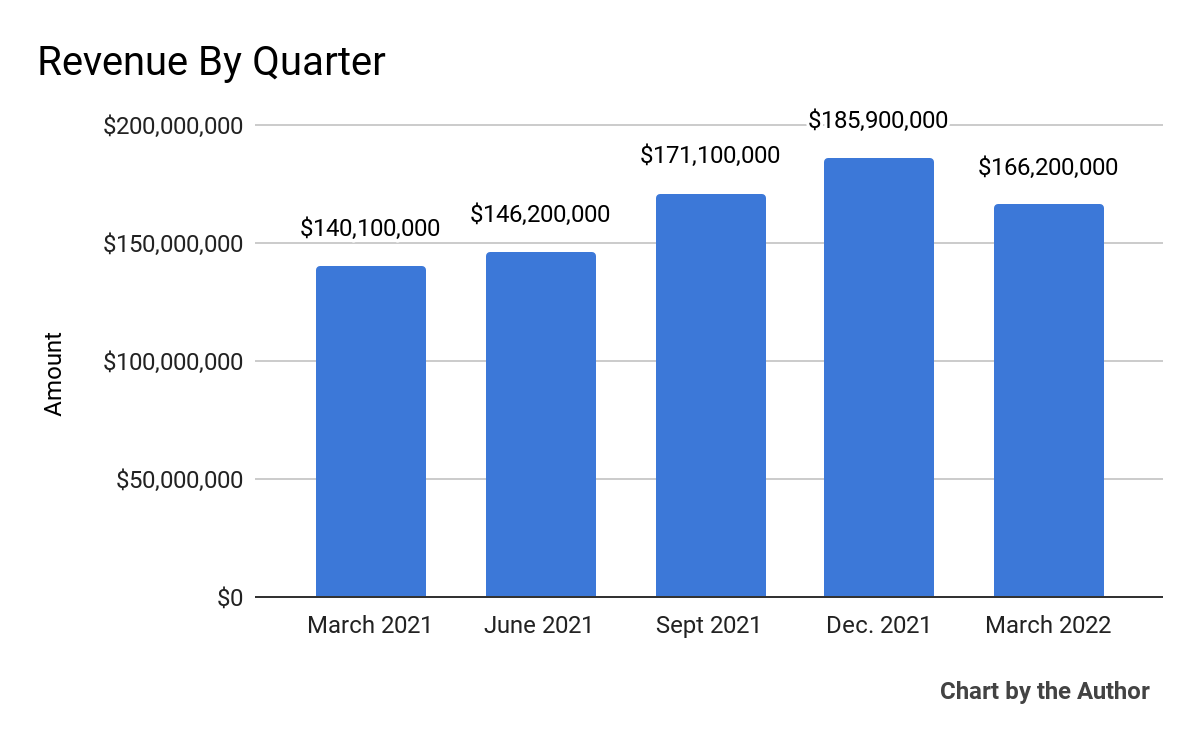

Total revenue rose in recent quarters, until the most recent quarter:

5 Qtr Total Revenue (Seeking Alpha)

-

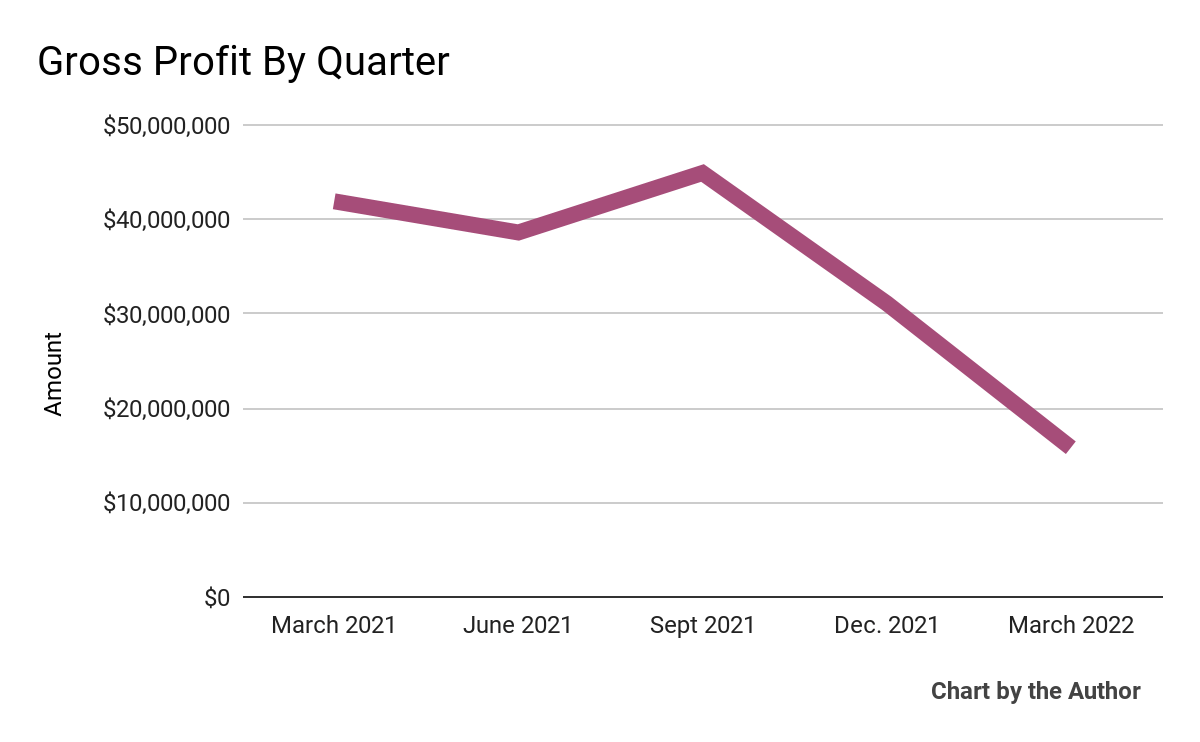

Gross profit by quarter has worsened markedly over the past 2 quarters:

5 Qtr Gross Profit (Seeking Alpha)

-

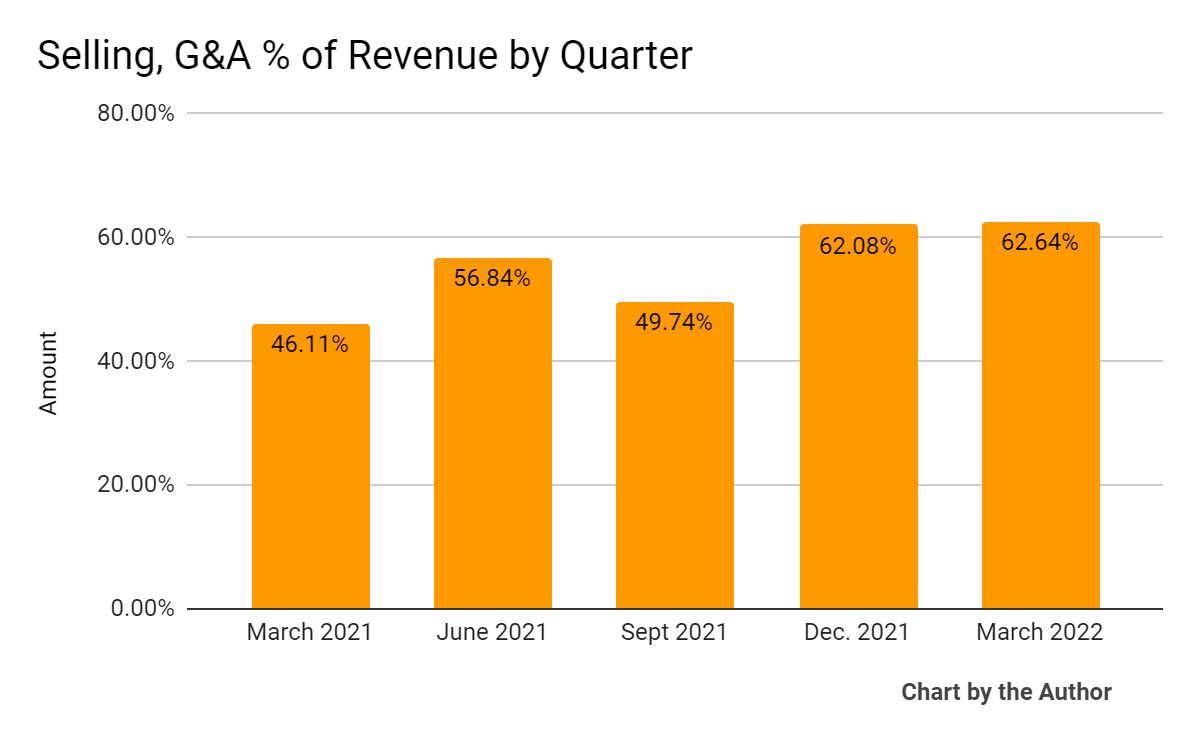

Selling, G&A expenses as a percentage of total revenue by quarter have trended higher in recent quarters:

5 Quarter Selling, G&A % Of Revenue (Seeking Alpha)

-

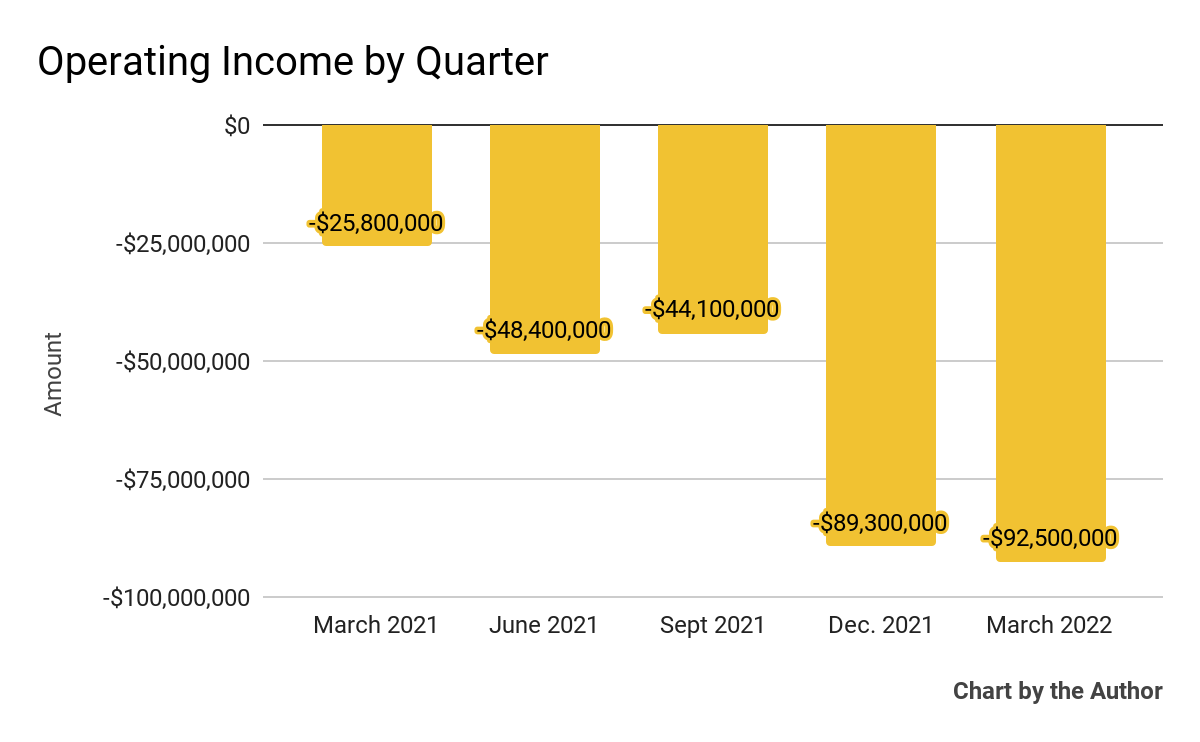

Operating losses by quarter have worsened dramatically:

5 Quarter Operating Income (Seeking Alpha)

-

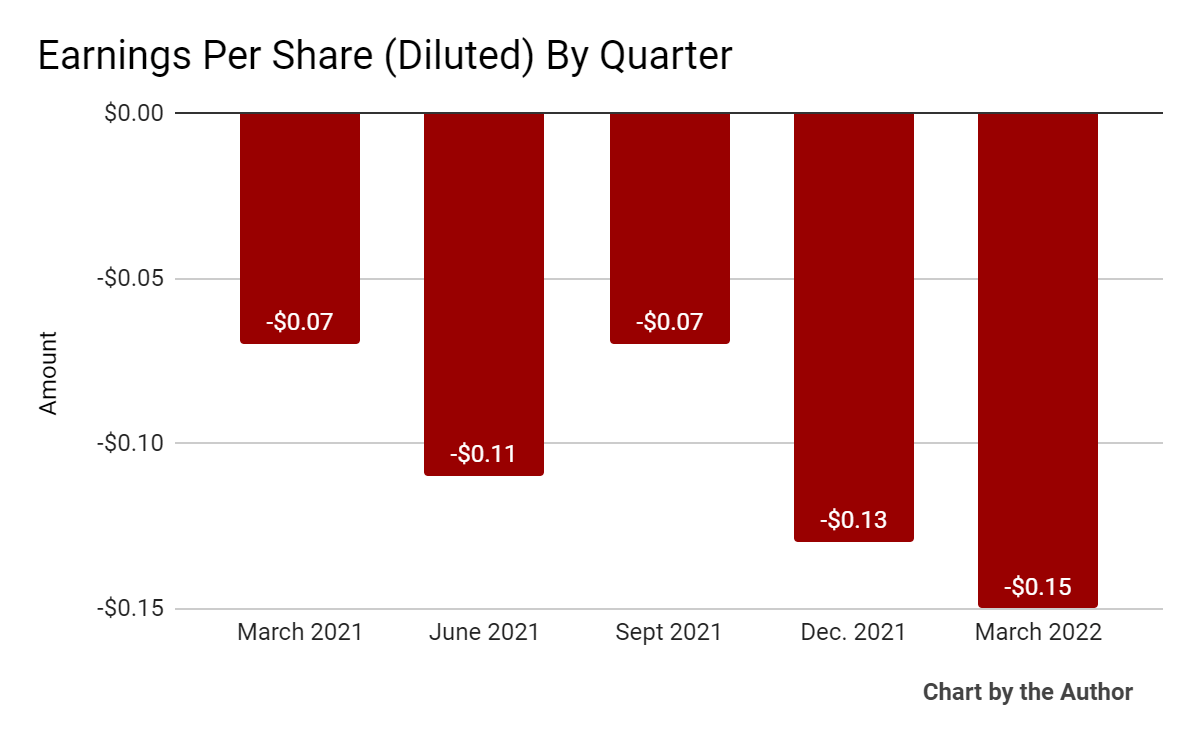

Earnings per share (Diluted) have also worsened in a similar trajectory to that of operating income:

5 Quarter Earnings Per Share (Seeking Alpha)

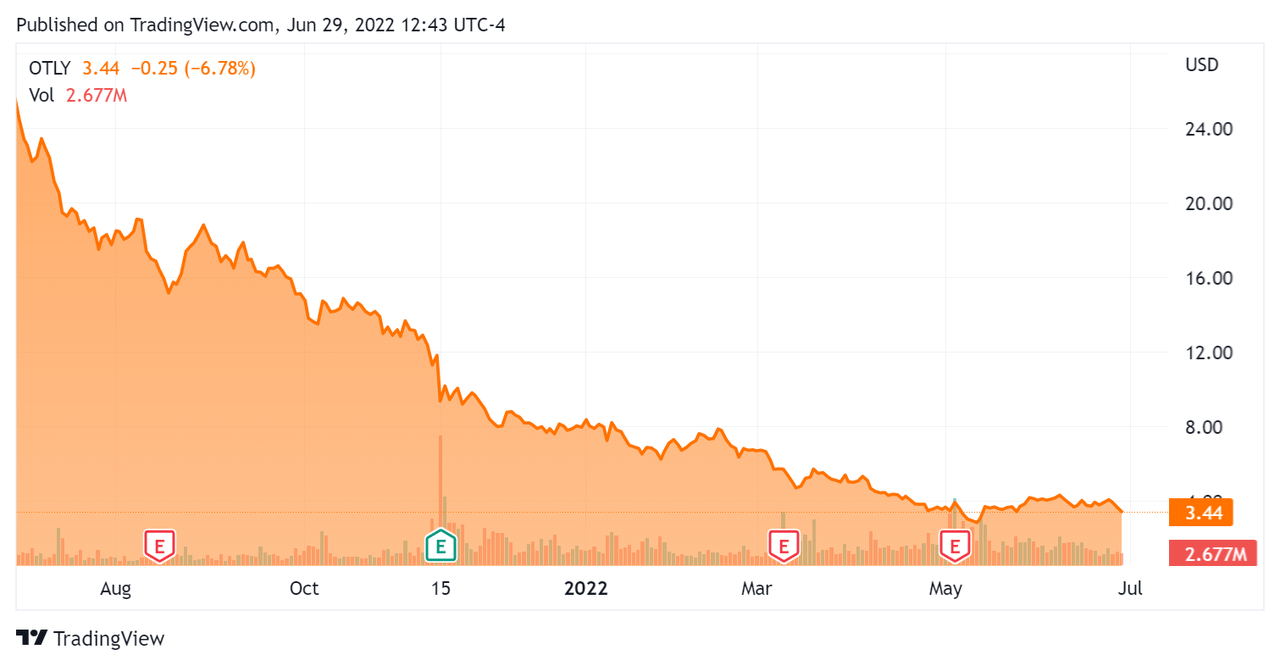

In the past 12 months, OTLY’s stock price has fallen 86.6 percent vs. the U.S. S&P 500 Index’s drop of around 11.2 percent, as the chart below indicates:

52 Week Stock Price (Seeking Alpha)

Valuation Metrics For Oatly

Below is a table of relevant capitalization and valuation figures for the company:

|

Measure |

Amount |

|

Market Capitalization |

$2,340,000,000 |

|

Enterprise Value |

$1,930,000,000 |

|

Price/Sales (TTM) |

3.18 |

|

Enterprise Value/Sales (TTM) |

2.88 |

|

Operating Cash Flow (TTM) |

-$253,570,000 |

|

Revenue Growth Rate (TTM) |

40.27% |

|

Earnings Per Share |

-$0.46 |

(Source – Seeking Alpha)

Commentary On Oatly

In its last earnings call (Source – Seeking Alpha), covering Q1 2022’s results, management highlighted improved results in the regions of EMEA and the Americas, while China was negatively affected by pandemic lockdowns in a number of regions.

The company also hired Jean-Christophe Flatin as Global President in a move that is being seen as readying him to take over as CEO while current CEO Petersson may move to a business development role.

Flatin has extensive operating experience for major consumer food brands.

The firm reported production challenges in the Americas as well as in Asia due to weather conditions, logistical constraints and COVID-19 lockdowns.

Notably, management intends to increase the company’s self and hybrid manufacturing focus, lowering its reliance on co-packers and localizing its production footprint.

By doing so, the company believes it can ‘improve our production and supply chain economics, economies of scale and our service levels.’

As to its financial results, revenue dropped 18.6% as production output decreased.

Operating income continued to produce highly negative results as the company carries a significant cost structure that the revenue ramp needs to grow substantially in order to fully utilize.

Looking ahead, management reiterated its revenue guidance for 2022 as it seeks to reorient its production to 50% – 60% volume coming from self-manufacturing.

Regarding valuation, the market has punished OTLY to an EV/Revenue multiple of around 2.9x.

The primary risks to the company’s outlook are the amount of time it will take to become more self-sufficient in production as well as the continued inflationary environment on its costs of production and transportation.

While a lower inflation read later in 2022 may present an upside catalyst, the firm is generating high and worsening operating losses and tremendous use of cash at a time of rising cost of capital.

Until the firm can make meaningful headway on increasing its revenue base to cover its high global cost structure, I don’t see significant upside to the stock.

I’m on Hold for OTLY in the near term.

Be the first to comment