Petmal/iStock via Getty Images

Stock down 27% in March, attractive buying opportunity

Via Renewables (NASDAQ:VIA) stock price has fallen 27% in March and we think this more than factors in the muted 4Q results. There has been no company news flow other than the earnings that has further contributed to the decline in the stock price. Therefore, we believe this is a good buying opportunity for investors given that the stock is trading at very cheap valuations and gives investors an attractive dividend yield of 9.0%. In 2021, Via Renewables’ financials have been affected by margin pressure and the winter storm in February 2021. We think there is limited downside for the stock price from here. At current levels, Via Renewables gives investors a good entry point. While the total return for the stock has been flat since our initial recommendation, we still see 86% upside to our $15 price target.

4Q21 results

Via Renewables 4Q21 results were weak, impacted by higher record commodity prices. For the quarter, the company reported a loss of $35.8mn as compared to a profit of $8.8mn in 4Q20. Adjusted EBITDA too was down 53.0% YoY because of lower gross margin. Gross margin fell by 48.5% YoY because of higher commodity prices and lower customers in the company’s portfolio. For 2022, management aims to grow organically by increasing its marketing efforts, expanding its product range and customer book acquisitions.

Attractive dividend yield

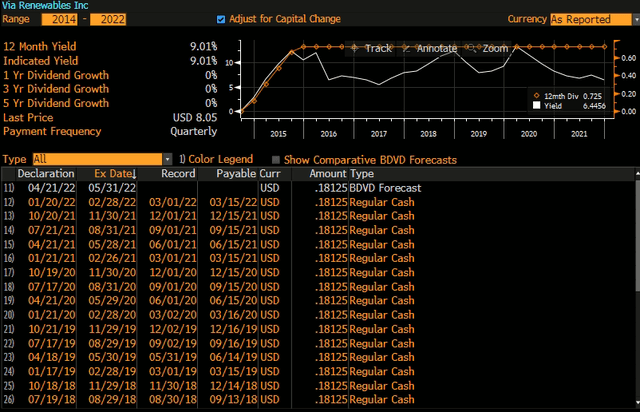

Via Renewables offers Class A stockholders a dividend of $0.725 per share which translates to a very attractive yield of 9.0%. The dividend per share has been constant since 2015. With a low net debt to equity ratio and strong generation of free cash flow, we expect the company to maintain current dividend levels in the medium term. Since 2018, the company has averaged an FCF yield of 49%, which goes to demonstrate the amount of cash the company is able to generate. Even in 2021, when the company reported a net loss, free cash flow remained positive and demonstrated a FCF yield of 5.8%.

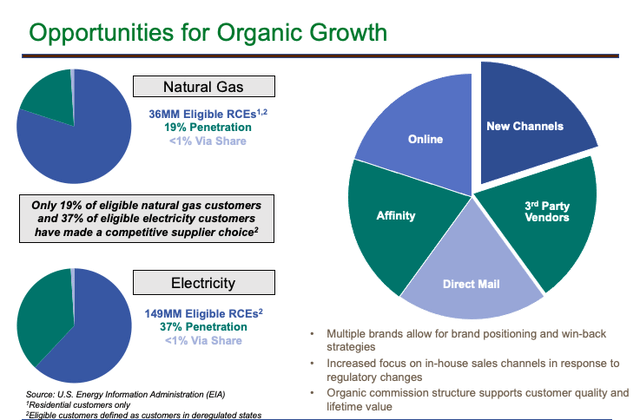

Growth opportunities

Via Renewables’ management has highlighted that significant room for organic growth exists in both natural gas and electricity. In natural gas, there are 36mm RCE’s [residential customer equivalents] within which only 19% of eligible customers have made a competitive supplier choice and Spark Energy’s share is less than 1%. In electricity too, a similar situation holds. Of the 149mm RCE’s, 37% have made a competitive supplier choice and Spark Energy’s share is again less than a percent. This indicates enough potential room for Spark Energy to grow its customer base.

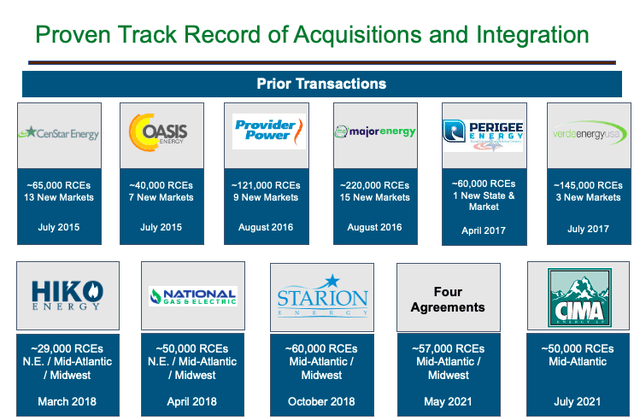

In addition to organic growth initiatives, Via Renewables has also relied on customer portfolio acquisitions to grow. Via Renewables has concluded a number of acquisitions in the last five years across the electricity and natural gas segments. The company actively evaluates M&A opportunities and seeks to acquire both customer portfolios as well as retail energy companies. COVID-19 had impacted a number of organic sales channels over the last few months, especially door to door marketing. As the situation improves, we expect marketing activity to pick up, which can help the company boost customer numbers.

Company Presentation Company Presentation Company Presentation Company Presentation

Conclusion

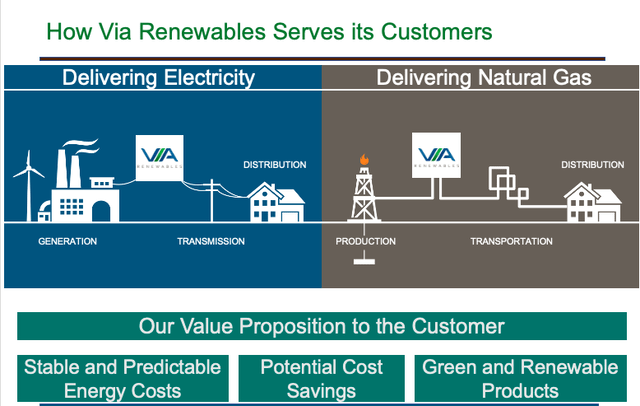

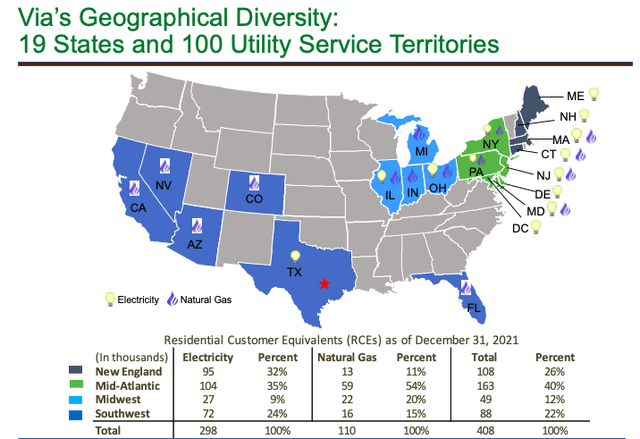

Via Renewables delivers electricity and natural gas to its customer base which includes residential and commercial customers across 19 different states in the US. With the company’s strategy of acquisitions over the last few years, we believe Via Renewables should continue growing well in the medium term. The company’s management has highlighted that significant room for organic growth exists in both their natural gas and electricity segments. A return to growth in financials, and any future acquisitions are catalysts for the stock. This, coupled with a compelling dividend yield of 9.0% and 2022 FCF yield of 32.6%, we believe, offers investors with an attractive dividend play and reflects our optimism in upside for the stock.

We estimate the company returning to revenue growth in 2022 once marketing activities that were affected by COVID-19 resume, and impact from the Texas winter storm settles. Our EV numbers take in to account the Class B shares outstanding. Risks to our thesis include high attrition in customers, lower margins, a cut in the dividend and financials stagnating where they are.

We have a target price of $15.00, which represents an 86% upside from current levels.

Be the first to comment