Sundry Photography/iStock Editorial via Getty Images

Despite going through a major re-valuation over the last year, shares of Beyond Meat (BYND) are still overvalued. The alternative meat business is growing its top line and has great distribution deals with international retailers in place, but Beyond Meat’s sales growth trades at a massive premium to what I think would be fair!

Beyond Meat: A new kind of meat business

Beyond Meat produces meat-free burgers and sausages that are marketed as high-protein alternatives to traditional meat. The company made a splash with its plant-based meat alternatives and Beyond Meat burger patties quickly sold in many locations.

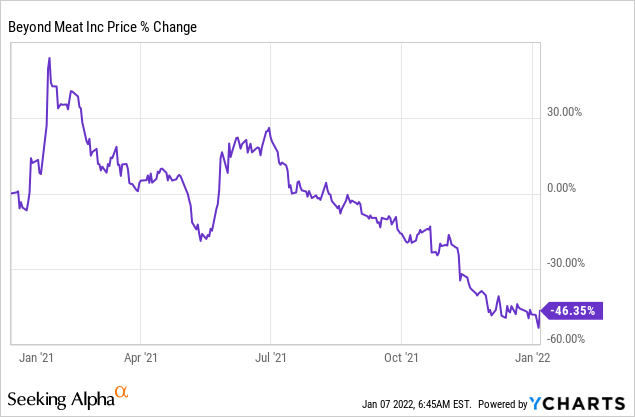

The IPO was also hot. Shares of Beyond Meat were sold at $25 in the IPO in May of 2019 and the first trade occurred at $46. Since then Beyond Meat has been on a wild ride, seeing its share price swing as high as $221. Since reaching this high, however, excitement about the company’s products has faded. While enjoying high-flyer status for quite some time, Beyond Meat’s stock is now trading materially below its last highs and BYND even dropped into a long term downtrend.

Why the re-valuation?

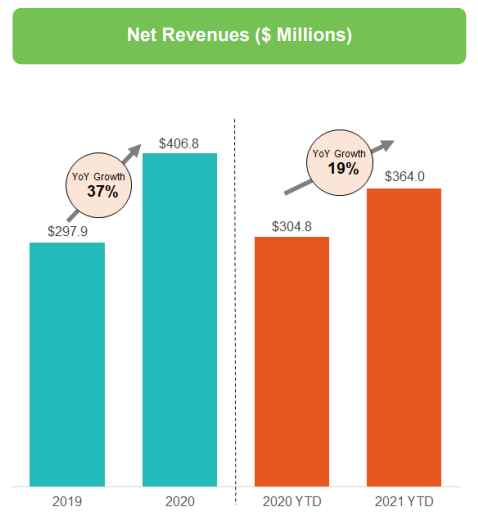

Beyond Meat entered the market with a killer product that is appealing to a growing market of vegetarians and health-conscious consumers. The brand has seen a massive upswing in its revenue base due to growing meat substitute retail sales, an appealing novelty factor and growing brand awareness. Beyond Meat’s revenues soared in 2019 and 2020 when the product first hit the market and new distribution deals fueled the firm’s commercial growth inside and outside the United States. But this growth has started to slow lately which adds to concerns that the brand may be losing some of its momentum in the marketplace for plant-based meat substitute products.

In the third-quarter, Beyond Meat generated just 12.7% year over year growth in its revenue line. Net revenues for the quarter were $106.4M, showing an increase of $12.0M year over year, but sales in the important U.S. market have been coming under pressure lately. Beyond Meat’s Q3’21 net revenues in the U.S. market skidded 13.9% year over year to $67.5M, with sales dropping in both the retail and the food service segments. The U.S. market still represents a revenue share of approximately 63%. Beyond Meat had more success in international markets in 2021 which are less penetrated by plant-based meat alternatives. The firm’s international net revenues increased 142.5% year over year to 38.9M with international retail sales surging 168.2% to $21.4M.

For the first nine months of FY 2021, however, Beyond Meat’s revenues increased only 19% year over year to $364.0M. In the same period a year earlier, Beyond Meat generated 52.9% revenue growth so the slowdown in total company sales growth is quite significant.

(Source: Beyond Meat)

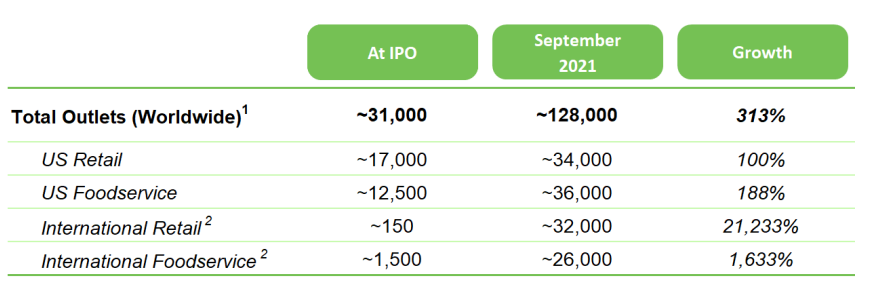

Opportunity for international expansion

Beyond Meat, despite the slowdown in domestic sales growth, has been excellent in growing its international retail network and the firm’s products can be seen on retail shelves all around the world. Growth in international retail has been nothing but spectacular for the company with the number of outlets carrying Beyond Meat products surging to 32 thousand in September. Growth in the U.S. retail market, which topped out at 100%, is almost a disappointment relative to the growth achieved in Beyond Meat’s international markets.

(Source: Beyond Meat)

Beyond Meat’s stronger sales growth in international markets creates an opportunity for the company to grow its top line outside the United States. New distribution deals with international retailers could be catalysts for additional sales growth moving forward.

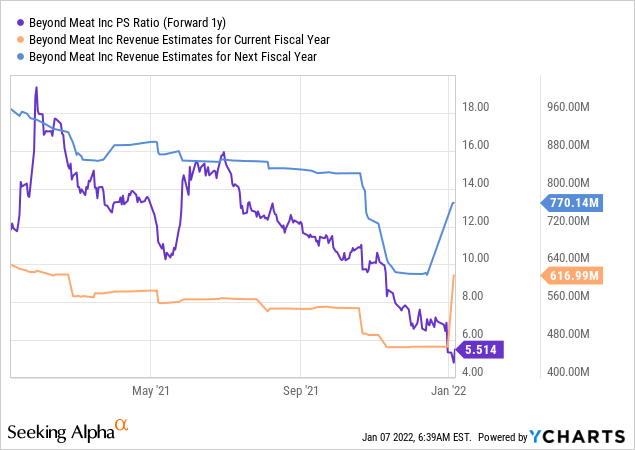

Beyond Meat’s growth is overvalued

The market seems to agree that Beyond Meat today is worth less than a year ago, in part due to saturation and revenue challenges that the U.S. market poses. Beyond Meat may kick-start its growth in the U.S. again through the roll-out of the Beyond Fried Chicken which will go on nationwide sale in KFC restaurants, starting on January 10. The Beyond Fried Chicken is a plant-based chicken and has been developed by Beyond Meat for two years exclusively for KFC. The product launch could give Beyond Meat’s U.S. sales a much needed boost while introducing a new ‘chicken’ sales category.

The decline in sales in Beyond Meat’s domestic market poses a long term challenge and I estimate that the majority of sales will come from outside of the U.S. by 2024.

However, slowing sales growth in the domestic market is a problem for Beyond Meat and it has been driving a significant re-valuation of the firm’s stock prospects. Although revenue growth has slowed markedly from the same period last year, Beyond Meat’s sales prospects are still implying a significant premium that may not be justified. Given the moderating prospects for growth, Beyond Meat’s P-S ratio of 5.5 X overvalues the firm.

Risks with Beyond Meat

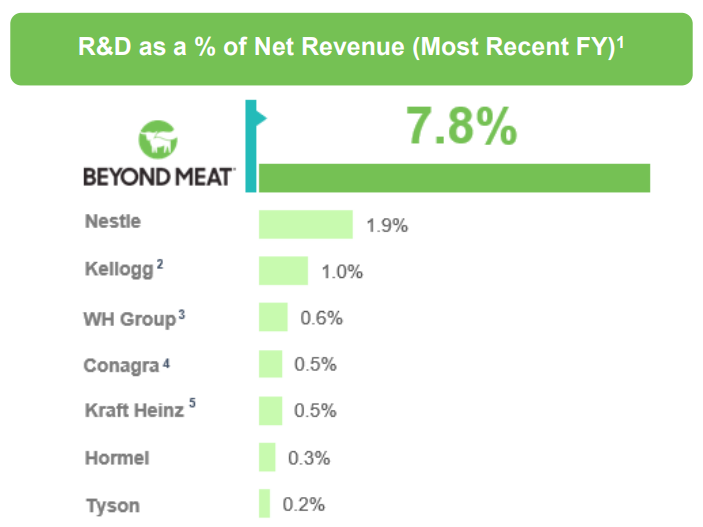

Beyond Meat is spending a lot of money to stay on top of the plant-based meat substitute world. The firm is spending significantly more funds on research and development than other major consumer goods companies. In the most recent fiscal year, Beyond Meat spent 7.8% of its net revenues on product innovation, taking the lead in an industry that spends less than 1% on R&D.

(Source: Beyond Meat)

Besides risking to lose its competitive edge, Beyond Meat must present a solution to the sales drop. The launch of the Beyond Fried Chicken could change the sales path for the firm, but the risk profile remains skewed to the downside, due to Beyond Meat’s very high valuation based on expected sales.

Final thoughts

Beyond Meat benefited from novelty factors when the first meat-free products were introduced to the market. However, the U.S. market is now showing signs of saturation and negative sales growth for Beyond Meat in the third-quarter is an unmistakable warning shot that things could get worse in FY 2022. The company may still grow its top line in the future, but likely at a much lower rate than in the past. For that reason, shares of Beyond Meat may have further to fall!

Be the first to comment