Leestat

Vanguard FTSE Europe ETF (NYSEARCA:VGK) gives investors a broad exposure to Europe, but there’s not a whole load of reasons to want that. While some of the exposures are resilient, all have a fair bit of wallet share in Europe. For US investors there’s the FX concern, but even for European investors, there are plenty of reasons to worry about the economic state of Europe as the war in Ukraine continues to broil. The recession is already evident, and the financial exposures don’t capitalise on more aggressive rate hiking going on in other regions. European rate hikes will never compare to what the US just did, and their economy will still languish as they pick up the bill for what is effectively a proxy war in Ukraine. Europe is losing influence over the next decade and doesn’t deserve your investment.

VGK Breakdown

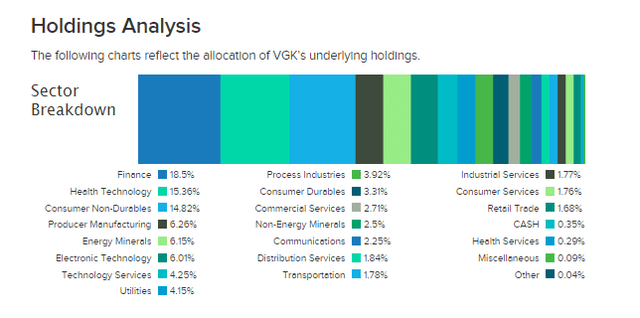

Let’s have a quick look at the sectoral exposures to start.

Sectoral Exposures (etfdb.com)

In a global economic regime of rate hiking, financial exposures, whether insurance or banking, would be favourable as lending rates rise ahead of deposit rates. The problem is that European inflation is more cost-push than elsewhere due to their previous reliance on Russian gas which is no longer flowing, and their pretty rapid phase out of coal in all countries but Germany over the last 5 years, as well as ignoring nuclear with the exception of France and to a lesser extent Spain. Outside of Norway, there isn’t all that much oil either. Britain never did any fracking, and oil has been far from front of center with lots of European refineries transforming into renewable diesel operations. Rate hiking will not help the inflation and the ECB knows it. Rates in Europe are barely above 2% today, and that’s the reason for it. There isn’t a big tailwind to European banks and insurance companies.

Healthcare can’t be faulted here. Exposures like Novartis (NVS), AstraZeneca (AZN) and others may have some slight idiosyncratic issues going on, Roche (OTCQX:RHHBY) as well with its COVID diagnostics business, but ultimately whether European wallet share or not, the recession resistance is there. US investors might still be concerned with the overall EUR risk, but the fundamentals will be pretty strong for the most part.

For the rest of the portfolio, while non-durables might be more or less alright, the recession in Europe will still affect them, and for manufacturing, industry and cyclicals it’ll be getting worse and worse. Automotive is not insignificant in the European basked, and they are still coasting off pent-up demand which could suddenly evaporate into much lower demand in a high rate environment.

Bottom Line

The war in Ukraine has upended the European energy supply and forced them into expensive alternative arrangements. Beneficiaries from that dislocation are in east and southeast Asia. The US gets to export gas at high prices, and the strength in the dollar due to less cost-push pressures and scope for larger rate hikes put their country finances and current account in a good situation. The war in Ukraine reparations have already been committed to by Europe so they’re picking up the bill there. Europe is rolling over, and their economic strength, even Germany’s which was a beacon in the region, will see permanent relative decline over the next couple of years. The VGK stocks have a lot of European wallet share, and many industries, especially manufacturing, are beginning to see pressure in European markets and are in decline. The recession has started and will go on for a while. Loss of influence will go on more secularly as others benefit and consolidate newfound advantages. Geopolitics has really gone against them, and for a 17.5x PE, the VGK implies a decent earnings situation despite recessionary pressures and a relatively worse EU situation. The multiple is not far off from the SPY PE of 20x. No reason to take that bet.

Thanks to our global coverage we’ve ramped up our global macro commentary on our marketplace service here on Seeking Alpha, The Value Lab. We focus on long-only value ideas, where we try to find international mispriced equities and target a portfolio yield of about 4%. We’ve done really well for ourselves over the last 5 years, but it took getting our hands dirty in international markets. If you are a value-investor, serious about protecting your wealth, us at the Value Lab might be of inspiration. Give our no-strings-attached free trial a try to see if it’s for you.

Be the first to comment