Eoneren/E+ via Getty Images

Verve Therapeutics (NASDAQ:VERV) is a biotechnology company with a vision to provide cutting-edge solutions to cardiovascular heart diseases. Founded in 2018 with its headquarters in Cambridge, Massachusetts, the company’s reputable team of world-leading experts in human genetics aims to pioneer a new approach to treating cardiovascular disease with single-course gene-editing medicine. The company’s transformative new therapeutic approach is powerful enough to disrupt the current care model for cardiovascular disease treatment. Cardiovascular disease is often cited to be the disease of the heart and blood vessels. Cardiovascular disease is a significant contributor to the reduction in life expectancy and a leading cause of death. Because of the medical demands for Cardiovascular disease, Verve Therapeutics is developing some pipeline products, including the company’s lead candidate, VERVE-101.

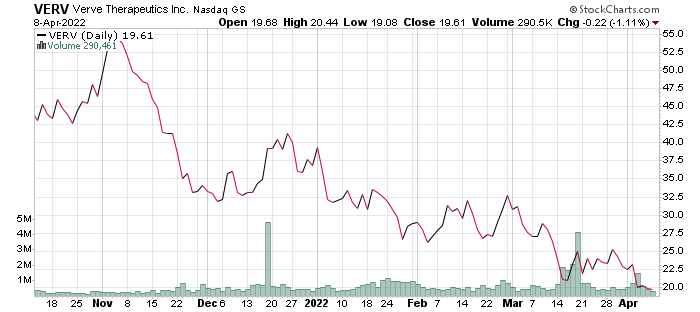

stockcharts.com

With cash and cash equivalents plus marketable securities of $360 million, which can sustain the company’s operations till 2024, Verve Therapeutics has a robust financial footing to continue its products research and development, particularly for its lead candidate, VERVE-101. The anticipated clinical trial of Verve-101 could be a major breakthrough for the company. Verve Therapeutics is trading at a discount price with a market capitalization of just under $1 billion. This, therefore, create an investment opportunity for long-term investors before the impending bullish momentum of the company.

Cardiovascular Disease

Cardiovascular disease (CVD), also known as heart disease, is a general term for conditions affecting the heart or blood vessels. A few causes of CVD include diabetes, high cholesterol, smoking, high blood pressure, overweight, and inactivity. The World Health Organization (WHO) estimated that 17.9 million people died of Cardiovascular Diseases in 2019 alone, representing 32% of the global death. Prominent among the death caused by CVDs are heart attack and stroke, which account for 85% of the deaths. Some of the common symptoms of Cardiovascular Disease include chest pain, cold sweat, fatigue, discomfort in the arm, and shortness of breath. Cardiovascular Disease could however be treated through multiple means which include medication, surgery, or cardiac rehabilitation.

Pipeline

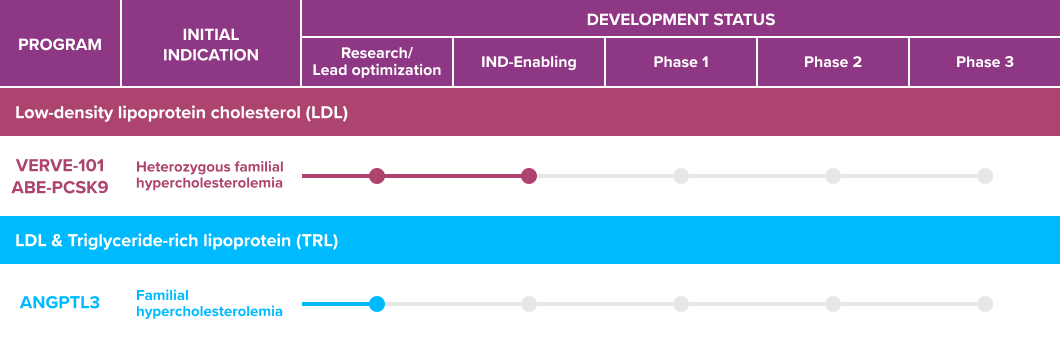

vervetx.com

Verve-101

Verve Therapeutics’ lead product candidate is VERVE-101, which is for patients with Heterozygous Familial Hypercholesterolemia (HeFH) and is a “single-course in vivo liver gene-editing treatment.” VERVE-101 has so far performed well in preclinical studies. It has proven to be “generally well-tolerated following a single administration in preclinical studies,” with only mild elevations in liver function tests that resolved within two weeks. The preclinical study projected that, while a build-up of low-density lipoprotein (LDL-C) levels results in reduced blood flow or blockage, which ultimately causes a heart attack or stroke, VERVE-101 is delivered via intravenous infusion into the blood, which permanently turns off a target gene in the liver using base editing to make a single change in the DNA sequence. Verve Therapeutics intends to file for Clinical trial application (CTA) and investigational new drug (IND) submissions for VERVE-101 in the second half of 2022, while the first patient will be treated with the drug in Phase 1 clinical trial in the same period. Verve Therapeutics’ second gene-editing program, ANGPTL3 gene, is a regulator of cholesterol and triglyceride metabolism but is still in the research and development phase.

Financials

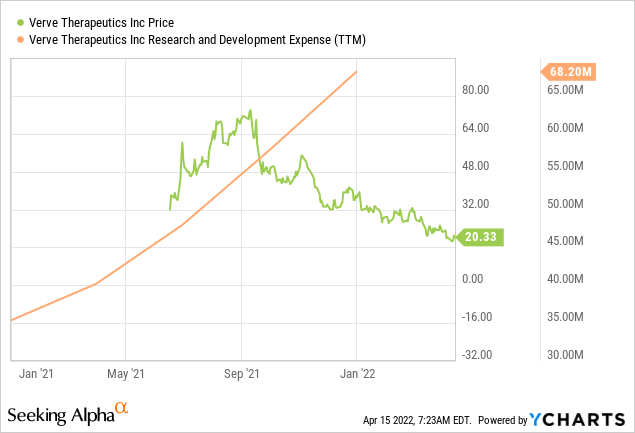

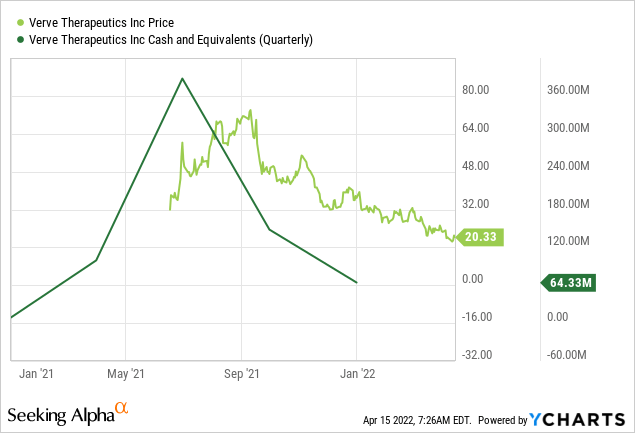

ycharts.com

Verve Therapeutics, as a development-stage therapeutical company with less than five years of existence, has no reported revenue at the moment. The new company has no marketable drug or clinical product. However, there is a massive prospect for the company’s lead candidate, VERVE-101, which aims to be an innovative treatment for cardiovascular disease. Although still at the preclinical stage, VERVE-101, if successfully approved by FDA, has the potential to create a record revenue channel for Verve Therapeutics. The company expended $68.2 million as research and development expenses on its entire pipeline products in FY 2021, with VERVE-101 taking a significant portion of the fund.

ycharts.com

Furthermore, a cash and cash equivalents of $64.33 million is a moderate sum that the company intends to use to fund its products candidates, particularly VERVE-101, which has shown tremendous progress. It is also important to note that Verve Therapeutics went public at the end of Q2 2021. The Massachusetts-based company raised $266 million during its initial public offering. Before its IPO, Verve Therapeutics raised $215 million in three funding rounds.

Risk and Competitors

Verve Therapeutics faces a number of risks. Significant among the risk is the unproven efficacy of any product candidates. The company has not initiated clinical trials of any product candidate. Thus it will take years before the company has a product candidate ready for commercialization. Before Verve Therapeutics becomes profitable, the company must have succeeded in commercializing a product or products that generate significant revenue. Meanwhile, amidst the non-availability of a marketable product, Verve Therapeutics yet requires a substantial amount of capital to fund its preclinical research. Thereby a delay or inability to secure capital when required can significantly delay research and reduce development programs. Furthermore, Verve Therapeutics’ clinical experience is low because the company commenced operations in 2018. As an early-stage company with no clinical experience yet, the risk of clinical failure is high.

Moreover, the manufacturing of genetic medicines is characterized by a sophisticated process. Usually, it requires an extensive period of testing to meet regulations. It is even possible to encounter production problems from the company or third parties that Verve Therapeutics relies on at certain stages in development. Verve Therapeutics will therefore have to battle with timely and successful completion of the preclinical stage and other stages of development to navigate the company to profitability within a considerable time. Additionally, Verve is faced with the novelty of gene editing. Gene editing, the company’s core product development model, is a novel technology that is not yet extensively clinically validated for human therapeutic use.

With the fast-paced evolution of technologies, the biotech industry faces intense competition and a strong defense of intellectual property. There is stiff competition between existing therapies and therapies that may become available in the future. Although Verve is a leader in gene editing and prides itself in its technology development and scientific knowledge, there may be others that can achieve similar or better results. Some of Verve’s viable competitors include Spark Therapeutics, OmniSeq, and Oxford BioTherapeutics. Meanwhile, some big companies, including Amgen Inc (AMGN), Novartis (NVS), Sanofi (SNY), and Regeneron Pharmaceuticals (REGN), already have approved cardiovascular risk reduction drugs in the market, which can provide some kind of threats to Verve’s products if eventually successful. These generic products or substitutes can pose a threat as they are usually much cheaper, and Verve does intend to give its products significant premium pricing.

Future outlook

Verve Therapeutics is a newly formed company with a clear growth path. The market potential of the company’s lead product candidate, VERVE-101, is the biggest driver for the company’s future growth. Moreover, the strong confidence that big investors such as Wellington Management, Janus Henderson Investor (JHG), Logos Capital, and a host of others have in the company’s long-term profitability is reflected in the $215 million raised in three rounds of funding. While posing significant risks, Verve Therapeutics also presents an opportunity for significant rewards for long-term investors who buy in at such an early stage.

Be the first to comment