DKosig/E+ via Getty Images

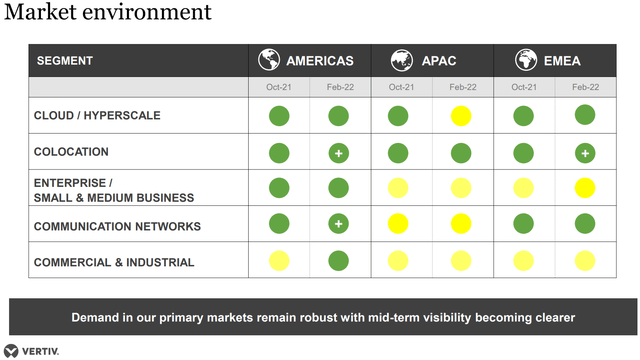

Vertiv (NYSE:VRT) continues to ride the tailwinds of a digitizing global economy. Networks are becoming more distributed and complex as data usage accelerates, and the result is secular growth for leading solutions providers like Vertiv. A quick peak at their 50%+ order growth in the fourth quarter of 2021 and apparent strength across all their segments from Cloud and Hyperscale to Colocation should grab the attention of digitally aware investors. It would seem that all is well at Vertiv considering the strong demand, but year-end 2021 results painted a different picture. In the back half of 2021, management lost control of the balance between rising input costs and price increases, and margins got crushed. The result was rather shocking earnings guidance for 2022 that sent the share price tumbling. Management rolled out a litany of explanations for the weak guidance from supply chain bottlenecks to faltering ERP systems, but importantly, also listed several actions taken to right the ship. Chief among them – pricing. In this article, we discuss why the company’s pricing efforts, combined with a variety of operational initiatives, should result in attractive profitability levels by the end of 2022, making the current depressed share price a rare deal for opportunistic investors.

Vertiv’s end markets. (Vertiv Holdings Co 2021 Q4 – Results – Earnings Call Presentation)

Vertiv’s crushing 2022 guidance and profitability setback

There is little doubt that Vertiv disappointed investors with its 2021 year-end reporting. The results themselves were not particularly bad, but guidance for the first quarter of 2022 clearly displayed management’s failure to adjust pricing effectively for orders booked in the second half of 2021 as cost inflation and supply chain bottlenecks began to bite. Adjusted diluted earnings per share guidance of ($0.20) – ($0.15) versus a consensus estimate of $0.23 sent investor jaws dropping along with the company’s share price.

Vertiv was on a path of margin expansion since going public in 2020 through a SPAC deal. As late as October of 2021, the company was still guiding for fourth quarter adjusted operating margins of 12% or higher and touting progress toward their mid-term goal of 16% and longer-term ambitions to reach 20%. How quickly things changed. Just a few months later, a clearly riled up Executive Chairman David Cote expressed his disappointment and embarrassment regarding Vertiv’s second half 2021 and projected first half 2022 financial performance following the company’s guidance for a negative adjusted operating margin to start the year. Clearly, times have been tough with a pandemic, supply chain bottlenecks and key costs such as shipping rates driving higher inflation than most have seen since the 1980s. But how could it go so wrong for a company with such a strong product portfolio?

Vertiv’s operational issues and pricing failures

Vertiv performed well in times of silky supply chains and anemic cost inflation, but management weaknesses were exposed by the supply chain crunch and spiking inflation in 2021, especially in the company’s Americas region. The basic explanation is that the company was ineffective at implementing price increases to cover the escalating costs from areas such as shipping and expensive spot buys of electro-mechanical parts and sophisticated fans that were nearly impossible to get at any price. The more complicated explanation is that Vertiv’s operating structure contained a number of key weaknesses that ripped through financial results before the executive team was able to contain the damage. Management describes the deterioration from 2020 to 2021 as largely a price versus cost problem, but several failings contributed to the pricing stumble, including the list below.

- The company’s ERP system was in the final stages of implementation in the third and fourth quarter of 2021 in the Americans region (it had been implemented earlier in other regions). Poor management of the implementation meant a lack of timely data regarding costs and order pricing which left executives in the dark about the impending profitability crunch.

- Only about one third of Vertiv’s sales force had metrics related to margin or pricing in their compensation or incentive plans, leading to a lack of focus on profitability.

- The company had few pricing escalation clauses built into order agreements or contracts with customers, making it difficult to re-coup margin following cost increases.

- Vertiv’s pricing culture lacked belief that strong price increases could be implemented, which may have been a relic of its past, but certainly didn’t reflect the strength of its product offering.

Vertiv suffered from its shortcomings and will continue to do so as orders booked with weak profitability levels will take several quarters to work through financial results. Company guidance for the first half of 2022 makes the ongoing pain apparent. But a positive take on the situation is that Vertiv’s issues have already been addressed and that the solutions will be apparent before the end of this year. For long-term investors that draw confidence from the company’s solid industry positioning, a rapid recovery to attractive profitability levels would mean today’s share price likely offers an attractive bargain. There’s reason to hope for a swift satisfactory outcome with price increases implemented at the end of 2021 and additional increases in 2022 set to boost profitability. Management boasts of “super robust demand” despite passing more of the cost burden onto customers and promises ERP kinks and operational wrinkles have been ironed out. It’s helpful to review the detailed company response to its pricing challenges to get comfort regarding the company’s long-term future.

Vertiv’s profitability pain should be temporary

Vertiv used to be part of Emerson Electric (EMR) and was eventually divested by the company partially due to its low growth and history of a negative pricing trajectory, especially in China. The company’s portfolio was shuffled and improved over time, but the culture of weak pricing power seemed to remain. Pricing improvements were still rather muted in 2019 and 2020 before the debacle in 2021. So why should Vertiv be able to achieve strong price increases now and avoid similar profitability stumbles in the future?

The most important and fundamental driver of Vertiv’s pricing power in our opinion is its leading product offering in a structurally growing industry, which forms the base of our investment case. Vertiv has come a long way since its time at Emerson Electric and so has data usage and the digitization of the global economy. Partially through acquisitions such as the recent purchase of E&I Engineering, Vertiv has rounded out its global offering in key area such as Cloud/Hyperscale and Colocation. The company describes itself as the world’s leading critical digital infrastructure provider, and it’s hard to argue with them considering few can match Vertiv’s global reach and service offering across data centers, communication networks and commercial and industrial end markets. More importantly perhaps, Vertiv has increased its focus on research and development in recent years with new products and services only strengthening its competitive position and ability to price appropriately. Even in a troubled 2021, Vertiv increased its research and development spending by 17%.

It’s unfortunate that Vertiv didn’t manage to convert its new product offering and strong positioning into effective pricing in 2021 as costs escalated, but the positive outcome of current earnings pain is that recent price increases are sticking and hardly denting demand, convincing Vertiv’s sales force that they can indeed shoot for higher prices going forward. Management speaks as if the company’s eyes have been opened to the power of their product offering and site recent price increases as evidence that the old culture of pricing weakness has been relegated to the dust bin for good. Time will tell, but it’s reasonable to believe that premium industry positioning should lead to at least average industry profitability, which is all that management is working toward in the mid-term.

In addition to the underlying strength of Vertiv’s offering, management has made several improvements to operations which should support profitability going forward. The company’s ERP system is now largely implemented in the Americas, and management is receiving daily updates on costs as well as order pricing, which should help prevent unwelcome margin surprises from the geography. Going forward, 100% of the sales force will have metrics related to margins and pricing in their incentive programs. Pricing escalation clauses are also being incorporated into the terms and conditions of deals and contracts to increase flexibility when costs move swiftly higher. These changes combined with a refreshed and confident pricing culture should result in better profitability outcomes.

Critically, Vertiv also made a significant management change in the Americas region where most of their troubles stemmed from at the end of 2021. Vertiv named Giordano Albertazzi President of the Americas region, replacing John Hewitt. Albertazzi has been with the company for 24 years, most recently leading the company’s EMEA region. Albertazzi aided in the ERP implementation in EMEA and should be able to work out any remaining issues with the Americas integration. His performance in the EMEA region has been admirable, which will now hopefully translate into similar performance in the company’s troubled Americas region. According to the company’s press release, in 2021 EMEA delivered organic sales growth over 18%, and improved adjusted operating profit margin by over 700 basis points.

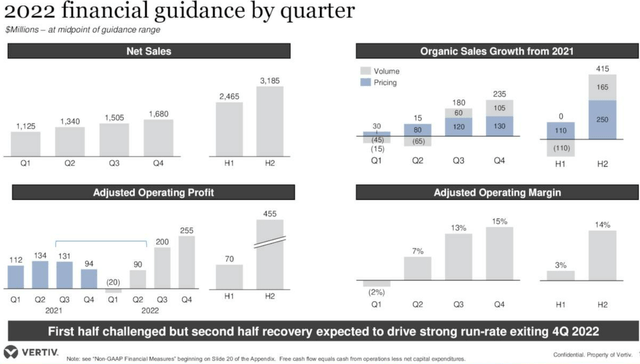

The first indication of improved outcomes comes from the company’s 2022 guidance. The guidance by quarter seen below shows the expected improvement in profitability through the year as the company works through less attractive orders booked before the substantial price increases and into newer orders which should yield attractive results. It’s critical to note the speed of the recovery from the company’s current malaise. By the fourth quarter of 2022, the company expects to reach a 15% operating margin, well on its way to the mid-term goal of 16%. For long-long term investors that can wait through a few patchy quarters, that level of profitability will likely result in a fair value for the company well above current share price levels.

Vertiv’s 2022 financial guidance. (Vertiv Holdings Co 2021 Q4 – Results – Earnings Call Presentation)

It’s encouraging to note that much of Vertiv’s guidance and optimism surrounding a return to attractive profitability were reconfirmed as recently as March 16th at J.P. Morgan’s 2022 Industrial Conference, when nearly all of the first quarter and additional price increases were already complete.

Attractive valuation and investment opportunity

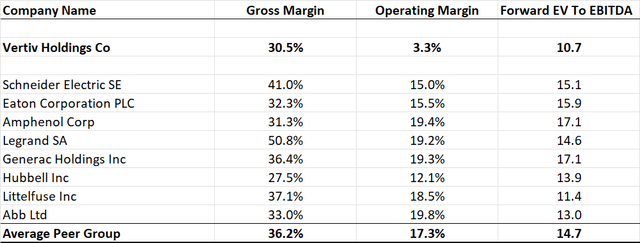

With demand strong and growth expectations intact, estimates of fair value hinge largely on profitability expectations. Vertiv’s guidance to achieve an adjusted operating margin of 15% (and eventually 16% or higher longer-term) seems reasonable considering its strong industry positioning and a peer group average operating margin near 17%.

Vertiv peer group. (Refinitiv Eikon)

One way we value Vertiv is using a discounted cash flow model which helps us see through the short-term challenges by estimating the cash flows of the company over many years. We use a growth rate over the coming decade near 5%, perhaps conservative for a structurally growing industry, and discount cash flows at a rate of 8% to arrive at a current fair value for the company. If we assume operating margins reach just 12% over the coming decade, the cash flows in our model already support a fair value above $20 per share. With the share price around $14, upside is substantial even if management doesn’t meet its targets. If operating margins reach 15%, the fair value is likely in the upper $20s per share. Using earnings based multiples to check relative valuation is currently tricky with the depressed profitability levels predicted for Vertiv, but we have used Enterprise Value (EV) to EBITDA multiples in previous articles, and the chart above shows that the company’s valuation relative to its peer group remains undemanding. There are certainly risks to management’s profitability ambitions including continued cost inflation beyond expectations, the company’s mediocre balance sheet or even complications from war in Europe, but the risk/reward balance currently looks compelling. As a side note, Vertiv has less than 1% exposure to Russia and the Ukraine on a revenue basis and essentially no direct supply chain exposure, but no company is immune to potential second degree affects.

Conclusion: Vertiv’s industry strength outweighs temporary pricing weakness

Vertiv and its share price are under pressure, but we believe the situation is temporary. The value of a company is dependent on the cash flow and returns it can produce over the long-term rather than a few quarters of weak profitability, even if self-inflicted. Vertiv’s strength and that of its long-term investment case are firmly supported by the company’s clear standing as a leading critical digital infrastructure provider with complete solutions and technologies few competitors can match. Vertiv failed to price effectively in a challenging inflationary environment in 2021, but the company has already taken corrective actions and a return to attractive profitability is likely already baked into the order book. Ultimately, Vertiv’s strong industry positioning make its stock a buy after a precipitous drop due largely to temporary pricing issues in 2021. We increased our holdings in the company at approximately $12 per share.

Be the first to comment