Scott Olson/Getty Images News

Opening thoughts

DraftKings Inc. (NASDAQ:DKNG) has been a polarizing stock in recent years. The company’s stock climbed above $70/share in early 2021 as demand soared and sentiment surrounding the industry was extremely positive. Since then, shares of the online gambling company have plummeted, and virtually all gains made since the start of the pandemic have been erased. The pullback has stemmed from a variety of factors, both company-driven and macroeconomic-related. As headwinds like interest rate hikes and the Russia-Ukraine crisis continue to rattle the economy, investors are becoming increasingly risk-averse. And given that DraftKings is still years away from reaching profitability, the company remains a dicey long-term play.

DraftKings shares are down 66% this past year, and many investors are now showing interest in the stock. While the company’s valuation has grown more attractive, there are better opportunities available for investors who want to exploit the market’s madness today. I think DraftKings’s risk-to-reward ratio is unfavorable, and I don’t recommend buying the stock at this time.

Strong revenue growth and market potential

We’re witnessing a paradigm shift in the gambling industry towards online betting. Currently, 18 states allow mobile sports betting, and only six authorize online casinos. As mainstream adoption expedites and more states continue to approve legislation, the market potential for companies like DraftKings should grow exponentially. The global online gambling market is projected to grow at a compound annual growth rate (CAGR) of 12% through 2027, up to $127.3 billion. Since DraftKings has captured nearly 30% of the online sports betting market in the U.S., the company is in a firm position to enjoy robust growth moving forward.

Up to this point, DraftKings has experienced impressive top-line expansion. In 2021, the company generated $1.3 billion in sales, translating to 111% growth year over year. Forward projections look promising as well – analysts are modeling $2 billion in sales for 2022, representing 54% growth from a year ago. By 2025, DraftKings revenue is forecasted to climb to $3.9 billion, implying an average annualized growth of 25% from 2021 revenue.

The company’s sales growth has been outstanding, but it comes at a price for investors. DraftKings continues to spend aggressively in order to expand its operations, which in turn has led to monstrous losses. Growth is important, but profitability is too. DraftKings is far away from reaching that milestone.

Profitability is out of sight

DraftKings’ current business model relies intensely on substantial spending to grow its reach. This past year, the company’s total operating expenses increased 99%, up to $2.8 billion. As a result, DraftKings generated an EBITDA loss of $1.4 billion, notably higher than the $729 million EBITDA loss in 2020. Moving backwards – although many say this might be necessary for the longevity of DraftKings’ business – is never optimal from a shareholder’s standpoint.

In its most recent earnings announcement, management indicated that it expects a net loss between $825 million and $925 million in 2022, a range higher than what Wall Street analysts were initially forecasting. According to Seeking Alpha data, analysts aren’t modeling a full-year of profitability for DraftKings until 2027, meaning investors will have to wait the until the latter half of the decade for the company to realize a positive bottom-line.

There are no promises that DraftKings will eventually turn a profit, either – the online gambling market is becoming extremely crowded, and there are still regulative question marks in a number of states. As a long-term investor, I’m totally fine having to wait several years for a company to become profitable. That said, it’s important that a company show material progress. I don’t think DraftKings has been able to do that in recent quarters.

DraftKings is still expensive

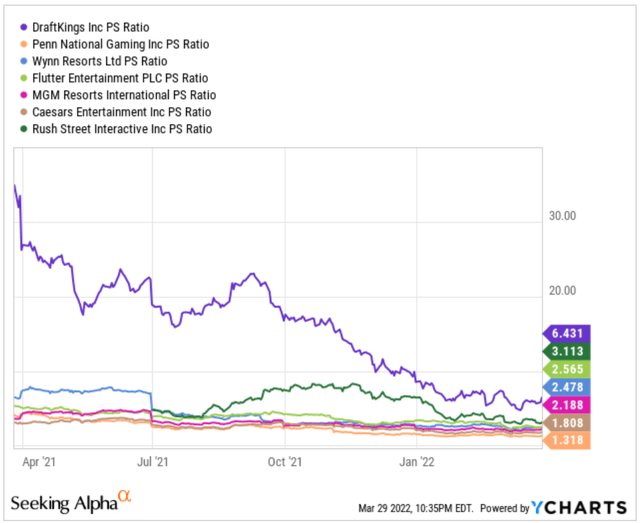

In March 2021, DraftKings was trading around 30 times sales. Today, the company bears a price-to-sales multiple of 6.4x, nearly five times less than a year ago. This has led many to believe the stock is undervalued, and thus, offers investors an advantageous opportunity to acquire the online gambling company at a bargain price.

But not so fast. DraftKings’ valuation has normalized, but the stock is still expensive compared to competitors. DraftKings’ 6.4x price-to-sales multiple is patently higher than close industry peers like Penn National Gaming (NASDAQ:PENN), Flutter Entertainment (OTCPK:PDYPY), and MGM Resorts International (NYSE:MGM), which carry multiples of 1.3x, 2.6x, and 2.1x, respectively.

It’s a fallacy to suppose that DraftKings shares are now cheap. Yes, the company’s stock is more reasonably priced than before, but it’s still expensive relative to industry peers. Investors should wait until DraftKings’ price-to-sales multiple approaches the 2x-3x range before considering a stake in the online gambling company.

Stay on the sidelines for now

DraftKings’ unpromising path to profitability and relatively high valuation creates an unfavorable risk-to-reward ratio for investors. In today’s market, many people see stock prices falling drastically and automatically assume that they are inexpensive. The truth is that many tech stocks soared to unjustifiable highs in recent years, and now the market is doing its part in correcting their once-outrageous valuations.

Unless you have an extremely high risk tolerance, I would avoid DraftKings at all costs. Wait until the company is able to prove that its business model is sustainable and presents a clear path to profitability. I advise investors to stay clear of DraftKings for now – there are more favorable investment opportunities at our disposal today.

Be the first to comment