tomeng/iStock Unreleased via Getty Images

Honda (NYSE:HMC) isn’t the best or easiest company to invest in – I showed you as much in my previous article on the company published in January, which you can find here.

As it stands, it seems that I’m one of the few contributors actually following and maintaining a valuation model for this company. I wish I could say that the company deserves better treatment, but the fact is that the company’s performance hasn’t exactly been good on a 3-month basis.

Honda Article RoR (Seeking Alpha)

Let’s review and see where Honda stands for 2022 with some of these headwinds accounted for and included in the model.

Revisiting The Honda Motor Company

In my original article, I characterized the company as an appealing play on legacy automotive, as the world’s largest ICE manufacturer, and a massive and arguably even more important motorcycle/scooter segment. The company is, thus, a play on cars in key western markets, but different modes of transportation in other markets.

All of these modes of transportation, regardless of markets, are currently undergoing electrification, with most of the company’s lineup either electrified or hybrid-type products.

The main challenge faced by Honda in its legacy automotive market is sales pressure. The company suffers from a considerable lack of market share in European automotive, with almost less than 100k units sold in all of the continent – though it’s a market leader in Asia and around 8.5% of the US market.

The company doesn’t have cash problems, but it’s seen significant issues with its top-line growth and profitability for going 10 years now. Honda as an investment has been a terrible choice with an annual RoR of just north of 3.5% for the past 20 years.

Looking at Honda requires investors to re-think what they think they know about the company, and put very high importance on motorcycles due to massive share of profits from this segment. As I wrote in my previous article, it’s not that all of the sales revenue comes from motorcycles, but much of the profit comes from there because the car margins have declined to the south of 2%. Motorcycles are more than 5X this.

I also think it fair to say that the current operating environment does not favor automotive companies going through electrification of their lineup. Honda dropped due to Ukraine, though much of this was because other automotive did with peers like Ferrari (RACE) dropping over 8% when the war came. The situation is considerably worsening the already-precarious supply chain issues for the sector. Input costs and logistical issues are already high – this will push them higher, and the market is reacting to this. Also, the company’s legacy automotive products fade in their appeal when the gas/diesel price goes up.

Honda’s goal is rolling out new hybrid and EV solutions for both car and motorcycle products over the coming few years. However, because Honda doesn’t actually control its own input costs, the company is likely to see continued margin deterioration in its segments while they are trying to do this push. Even ICE motorcycles may see some drop in appeal as a result of these gas price increases.

These challenges and trends are already coming home to roost. Honda’s sales fell by more than 20% YoY in February due to massive supply issues, storm disrupts and other factors. Trucks especially saw sales declines of more than 25% YoY, and even EV’s dropped 18.9% in terms of sales. This is not a good environment for the company.

It seems obvious that standard handling of margin pressures and cost issues isn’t going to be enough for Honda to handle these issues. You’ll be glad to know that the company seems to have plans for this. With the cooperation of electronics firm Sony (SONY), these two companies seem to have plans to sell BEVs through a strategic alliance that’s set to begin this year. Honda’s role will be manufacturing the first model of the car, while Sony will handle the mobility platform.

The estimated market date for the first Sony/Honda car is 2025 – which puts it around 3 years in the future and, for now, is unlikely to help Honda in the short term.

In short, I believe that the already-negative trends I saw in January have considerably worsened for the remainder of 2022E. At the very least, raw material inflation and logistical pressures have grown worse and with political tensions higher, there will be further headwinds in geographies like Europe.

I now expect 2022E EPS to turn negative due to these negative supply chain/material costs trends, and I no longer expected a YoY double-digit EPS reversal in 2023. I don’t see Honda being able to push profitability in a world with rising inflation, costs, and increased tensions, which will effectively eliminate its plans for a quick turnaround in Cars, as well as some continued challenges in motorcycles. While I expect the Motorcycle segment to manage margins of over 10% and for it to remain strong, it seems doubtful to me that Motorcycles alone can manage some sort of turnaround in this environment.

Honda’s history is not in its favor either, as the company has a history of pushing sales even with poor margins to get market share – and this environment will be rife with competitors in the motorcycle/scooter segment as well. The headwinds in main markets like India and Indonesia will not become better with this development but worsen.

Overall, it’s fair to say that I don’t see a quick improvement for Honda. The recent events have only pushed the company’s operating weaknesses to the forefront. While the alliance with Sony might result in some eventual appeal, I believe there are currently significantly better-valued companies out there.

Honda’s valuation

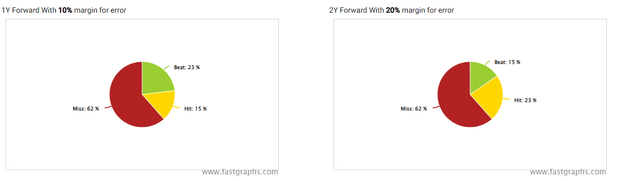

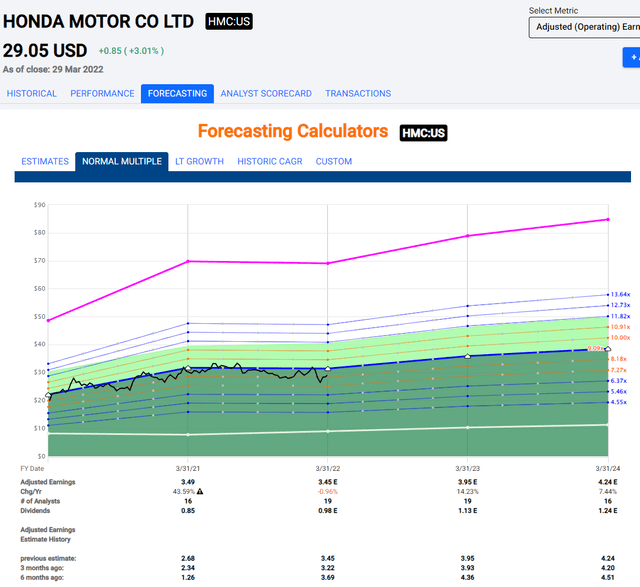

A quick look at the updated valuation thesis. The issue with Honda is its comparative volatility to many other automotive companies out there. The company is expected to start improving earnings in 2023-2024, around 7% on average per year, but this improvement forecast comes at such abysmal analyst accuracy numbers that it might as well be ignored.

Honda Analyst Accuracy, Factset (F.A.S.T graphs)

With analysts unable to properly or accurately guide the trajectory, the baseline bullish thesis even if this EPS growth materializes is a 15-16% annualized RoR upside, most of that on the back of the expected 2023 14% EPS improvement. Following the current crisis, I don’t see this happening. Analysts have already downgraded their estimates compared to 6 months ago as well.

Honda Forward Estimates (F.A.S.T graphs)

The company’s targets to collaborate with Sony are, as of yet, too unclear as to how these would impact revenues, market share, or earnings. I can say that I would personally be very interested in seeing what Sony and Honda can come up with together, but with a 2025E market date for their first product, we’re far off here.

There is at the very least a theoretical upside to Honda. However, given what I see as the realistic potential for further deterioration in margin as well as overall sales, likely to trickle down to EPS, I don’t see that theoretical upside, adjusted for this, as high enough to even consider investing in Honda here.

S&P Global still sticks to its target of around $36/share for the company, but this is only from 3 analysts, and these analysts have had a history of a 15-20% premium for the company that rarely has been realized. At 2.8% yield, it’s not a massive yielder either and there are automotive that yield better and have decent upsides to boot.

Though at this time I would be careful investing in any automotive company unless it was significantly undervalued. I don’t view Honda as significantly undervalued just yet. Once the company deteriorates to the lower end of $20/share, we can start talking about a reversion potential for the company.

For now, though, I’m including and discounting for these increased headwinds by increasing my overall discount to the company. I had a $22-$25/share PT range in my original article on Honda motor. I’m lowering this to $22-$23, making the company significantly overvalued to an investable target price.

Thesis

My thesis for Honda remains a troubled one. I don’t view the company as able to offset some of the margin deterioration/cost increases/issues that are coming, because the company’s lack of vertical integration here means it’s (like most automotive) subject to broader market conditions.

This makes the company a poor investment at this time – and one I would avoid even at the current price of below $30/share.

If you’re interested in Honda, I would point to my price target of $22-$23/share at most, which would give you over 3% yield and a good reversion upside, even in the likely case of further EPS pressure.

Remember, I’m all about :

1. Buying undervalued – even if that undervaluation is slight, and not mind-numbingly massive – companies at a discount, allowing them to normalize over time and harvesting capital gains and dividends in the meantime.

2. If the company goes well beyond normalization and goes into overvaluation, I harvest gains and rotate my position into other undervalued stocks, repeating #1.

3. If the company doesn’t go into overvaluation, but hovers within a fair value, or goes back down to undervaluation, I buy more as time allows.

4. I reinvest proceeds from dividends, savings from work, or other cash inflows as specified in #1.

If you’re interested in significantly higher returns, then I’m probably not for you. If you’re interested in 10% yields, I’m not for you either.

If you however want to grow your money conservatively, safely, and harvest well-covered dividends while doing so, and your timeframe is 5-30 years, then I might be for you.

Thank you for reading.

Be the first to comment