aerogondo/iStock via Getty Images

The SPAC space is littered with struggling stocks, especially in the urban air mobility space. The big rally in recently public Vertical Aerospace (NYSE:EVTL) is noteworthy considering competitors remain down in the dumps. My investment thesis is Bearish on this rally in the stock considering the aircraft certification process is still years away.

Flying Stock Price

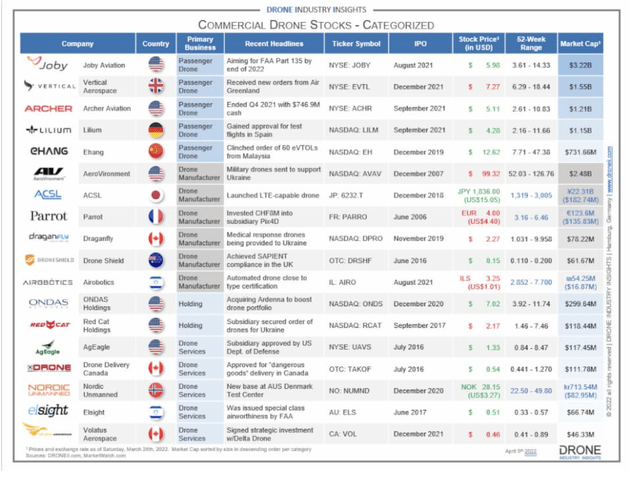

Vertical is a leader in the electric aviation space looking to pioneer the flying taxi concept with the manufacture of an eVTOL (electric vertical take-off and landing) aircraft with certification expected in 2024. The company competes with the likes of recently public Joby Aviation (JOBY), Archer Aviation (ACHR) and Lilium (LILM), amongst others, in the advanced aerial mobility space or the general commercial drone sector.

Vertical doesn’t have the same interest in operating a ride-share platform unlike most competitors. The company is much more focused on partnering with commercial operators to build out the flying taxis business whether with American Airlines (AAL) in the U.S. or Virgin Atlantic in the U.K. along with the likes of Rolls-Royce (OTCPK:RYCEY) and Microsoft (MSFT) for parts and digital software.

Despite the space being crowded in the public markets now, Vertical is the only stock reaching above the SPAC price of $10. In fact, Archer and Lilium trade below $4 while Vertical soared over 50% at one point on April 12 to nearly reach $12. The stock traded over 18 million shares for a stock struggling to previously grab 50K shares in daily trading.

FinViz

Of course, all of the stock valuations aren’t equal with SPAC deals done at different valuations. Vertical was the last of the group to complete a deal suggesting maybe the valuation was more reasonable.

Vertical closed the deal in mid-December at a listed valuation of only $2 billion. The company raised only $300 million to fund operations through the certification process in 2024 and the initial production of the VX4 aircraft with material production not occurring until 2025 and into 2026.

The stock currently has a $1.7 billion market cap with the dip back into the $8s, following the irrational rally yesterday. In comparison, Joby Aviation has a $3.2 billion valuation due to the involvement of LinkedIn Reid Hoffman and Zynga co-founder Mark Pincus via the Reinvent Technology Partners SPAC.

Big Order Book

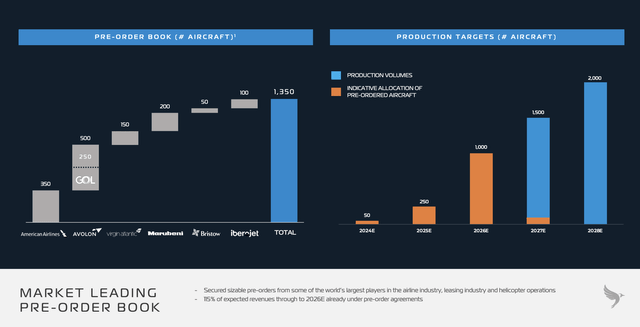

The odd part of the rally is that Vertical announced the placement of 500 pre-order aircraft by Avolon, the world’s second-largest aircraft lessor, about two weeks ago. As with the other eVTOL manufacturers, a lot of the major airlines have already placed orders worth billions for aircraft.

The other stocks didn’t rally and definitely didn’t hold any rallies on prior conditional order announcements. The potential airline customers are heavily in debt after the covid crisis and an investor should be critical of whether these pending orders will actually turn into purchases as opposed to just stated levels of interest.

At the time of the SPAC deal, Vertical promoted strong revenue levels with 2026 revenue surging to $3.6 billion and doubling again to an amazing $7.3 billion in 2028. Back in 2021, the company already had the pre-order book to meet the 2026 revenue targets which are mostly constrained by production volumes of ~1,000 aircraft that year. Vertical won’t burn off the pre-order book now at 1,350 aircraft with a book value of $5.4 billion until sometime in 2027 when production reaches 1,500 aircraft annually.

Vertical Analyst Day Presentation

The company has ~$300 million in cash and proposes not needing the same amount of cash as other eVTOL manufacturers to reach certification and production due to not focusing on building out commercial operations. Investors will definitely want to watch the quarterly spending in comparison to the sector on the path to aircraft certification.

The big stock catalyst is likely the FAA certification planned for in 2024. The stock will struggle during the 2+ year period where certification remains a headwind and future production ramps are a big hurdle to reach profitable revenues. Any company following electric vehicle manufacturers such as Nikola (NKLA) or Rivian Automotive (RIVN) will see how investors following hype didn’t make prudent investments. Vertical could probably reward investors picking up stock the next time a dip occurs.

Takeaway

The key investor takeaway is that Vertical soared to irrational levels in comparison to other competitors and near-term revenue opportunities. The company has an enormous opportunity in the manufacture of eVTOLs, but the stock faces a couple of major hurdles in the next couple of years where the stock will likely offer better investing opportunities.

Investors are encouraged to buy the eVTOL stocks on weakness over the next couple of years.

Be the first to comment