Ignatiev/iStock via Getty Images

Investment Thesis

Verizon Communications Inc (NYSE:VZ) is likely to trade in a sideways range if we are lucky, given the company’s reduced FY2022 guidance. Realistically, we will likely witness a moderate stock price decline moving forward, given the bearish market sentiments, the Fed’s hike in interest rates against VZ’s elevated debts/ aggressive capital expenditure for 5G expansions, and the potential recession reducing consumers’ discretionary spending through FY2023.

Therefore, we are of the opinion that the headwinds are not ending soon for the stock market in general, thus advising investors to be more prudent in their investments moving forward. While VZ has been a relatively decent dividend stock thus far, its current and projected underperformance could be a bane to its stock price in the short term. Therefore, given the current high volatility environment, we expect to see the patient investors rewarded with more attractive entry points for long-term investing.

Verizon Has Performed Relatively Well Despite The Multiple Headwinds

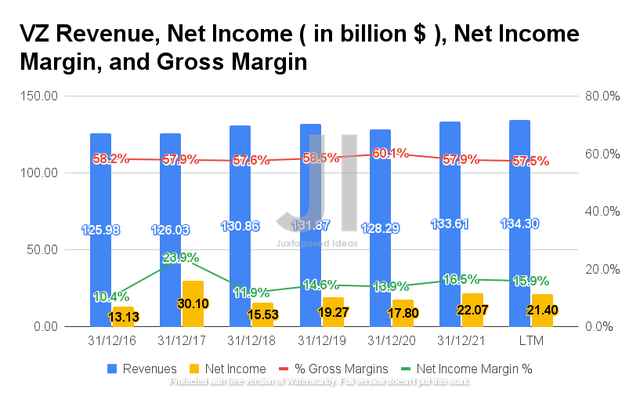

It is evident that VZ has been performing decently in the past year, despite the brief dip in sales and margins in FY2020. By the last twelve months (LTM), the company reported revenues of $134.30B and gross margins of 57.5%, representing an increase of 1.8% though a decline of 1 percentage point from FY2019 levels, respectively. In addition, VZ reported improving net income profitability over the years, with a net income of $21.4B and a net income margin of 15.9% in the LTM, representing an increase of 11% and 1.3 percentage points from FY2019 levels.

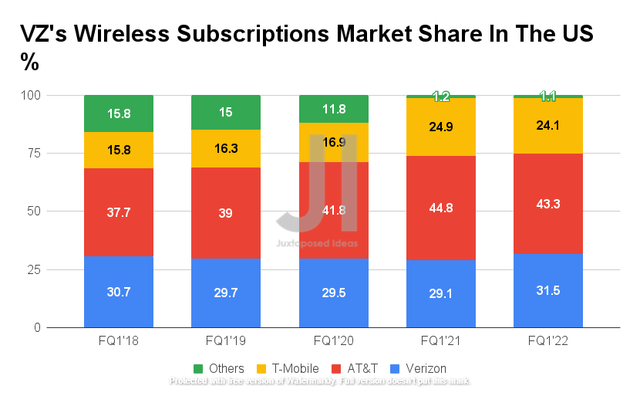

For its latest quarter, VZ also reported a favorable increase in market share for wireless subscriptions in the US, from 29.1% in FQ1’21 to 31.5% in FQ1’22. This is mainly attributed to the total net addition of 229K subscribers, comprised of 194K fixed wireless and 35K wireline broadband net additions. Nonetheless, these gains were discounted by the fact that the VZ lost a net of 36K postpaid subscribers at the same time to its peer, AT&T (T).

AT&T had extensively beaten consensus estimates with the impressive net add of 965K postpaid subscribers and 691K postpaid phone net in FQ1’22. In addition, the company also grew its wireline fiber subscribers by a net of 289K. In retrospect, VZ still has some catching up to do against the market leader, given the highly competitive market. Consequently, VZ may report slower growth or even a decline in critical market share for its upcoming FQ2’22 earnings call, if AT&T continues to outperform.

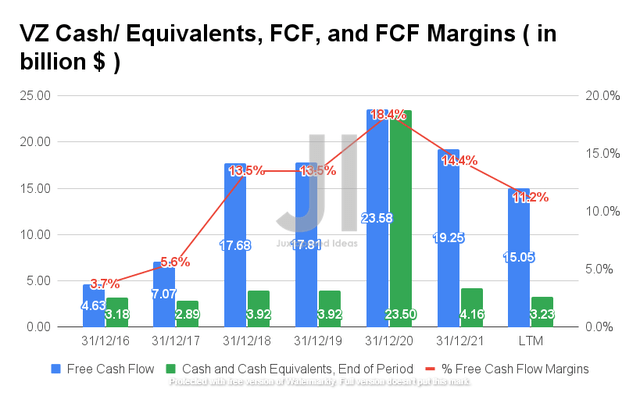

On the other hand, VZ has been generating robust Free Cash Flow (FCF), given its improving net income margin. By the LTM, the company reported an FCF of $15.05B and an FCF margin of 11.2%, with decent cash and equivalents of $3.23B on its balance sheet. Nonetheless, we are also observing a notable fall in its FCF margins by FQ4’21 at 5.7% and FQ1’22 at 3% compared to the pre-pandemic average of 13.5%, thereby potentially affecting its stock performance moving forward, given its lowered guidance for FY2022.

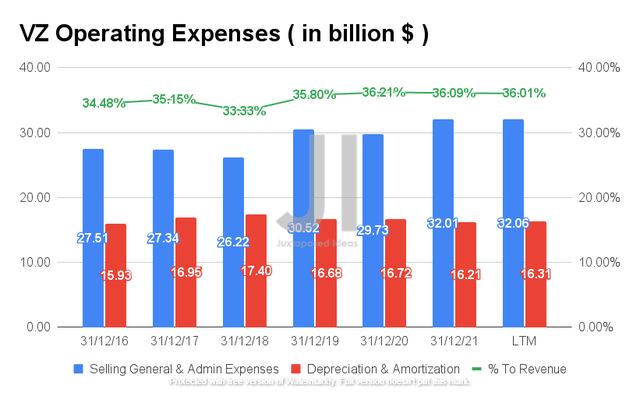

Nonetheless, we must also applaud VZ for being prudent in its operating expenses since FY2019, representing a minimal increase of 2.4% by the LTM. In addition, the ratio to its growing revenue has also remained relatively stable at 36.01% in the LTM.

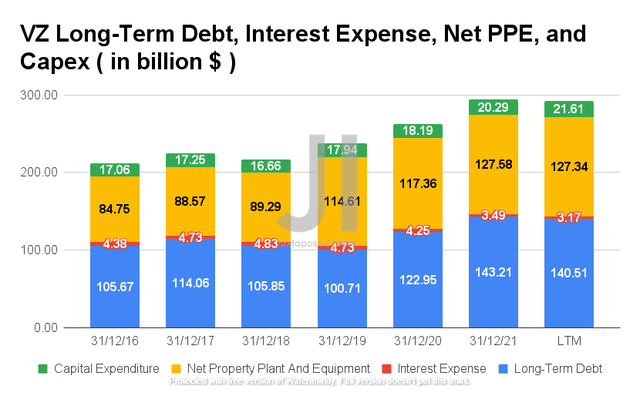

In the meantime, VZ had also taken more liabilities during the COVID-19 pandemic, with a total of $140.51B of long-term debts and $3.17B of interest expenses by the LTM. It represented a massive increase of 39.5% from FY2019’s level of debt. The company also increased its net PPE assets to $127.34B with notable growth in capital expenditure by the LTM, representing an increase of 11.1% and 20.4% from FY2019 levels. Given the management’s guidance of up to $23.5B in Capex for FY2022, we may expect to see VZ’s FCF generation suffer in the short term, on top of a $13.4B in debt maturity by 2022.

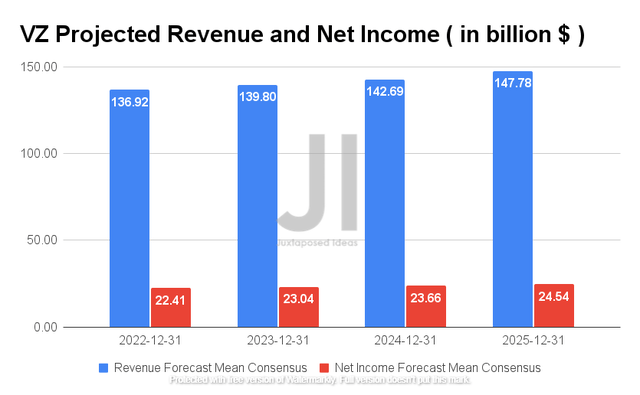

Over the next four years, VZ is expected to report revenue and net income growth at a CAGR of 2.55% and 2.7%, respectively. For FY2022, consensus estimates that the company will report revenues of $136.92B and net income of $22.41B, in line with FY2021 levels, based on the management’s lowered FY2022 guidance for its revenue and EPS growth in April 2022. As a result, it was no wonder that the VZ stock had plunged by 15.9% post FQ1’22 earnings call, from $55.01 on 21 April to $46.23 on 2 May 2022.

Analysts will also be closely watching its FQ2’22 performance, with consensus revenue estimates of $33.82B and EPS of $1.34, representing YoY growth of 0.15% and a decline of -2.55%, respectively. Assuming continued underperformance, we may expect the stock to continue its downwards decline moving forward, despite the company having mostly outperformed consensus estimates for the past nine consecutive quarters. We shall see on 22 July 2022.

So, Is VZ Stock A Buy, Sell, or Hold?

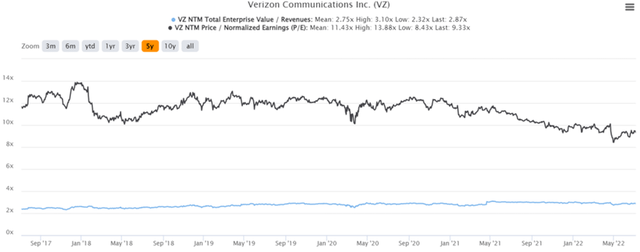

VZ 5Y EV/Revenue and P/E Valuations

VZ is currently trading at an EV/NTM Revenue of 2.87x and NTM P/E of 9.33x, lower than its 5Y mean of 2.75x and 11.43x, respectively. The stock is also trading at $50.50, down 11.1% from its 52-week high of $56.85 though at a premium of 10.8% from its 52-week low of $45.55.

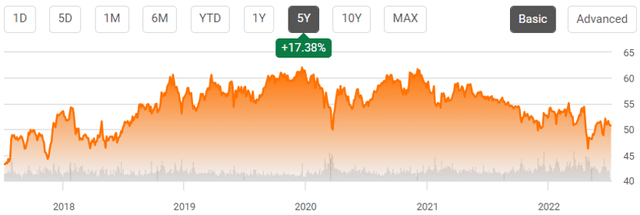

VZ 5Y Stock Price

Assuming that VZ continues to lose the prepaid market share to its peers, we may, unfortunately, expect a further stock price decline moving forward, continuing the downward trend since December 2020. Even consensus estimates have cut their price targets pre-FQ2’22 earnings call to $56.55 with only an 11.52% upside. As a result, given the potential stock underperformance, we do not advise anyone to add now.

VZ 10Y Share Price and Dividend Yield

Nonetheless, it is also essential to note that the VZ stock has had a broad uptrend behavior in the past ten years, with a relatively stable dividend yield at the same time. Long-term VZ investors would have seen a 10Y Price Total Return of 78.8% and a 5Y Price Total Return of 45.8%, given their steady dividend payouts and satisfactory dividend yields of 5.05% thus far. Therefore, VZ has indeed performed relatively well as a dividend stock.

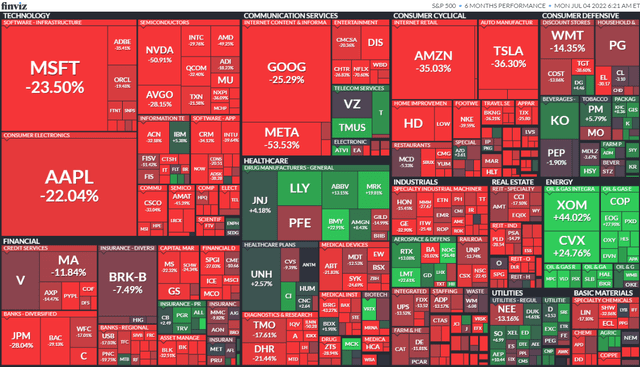

S&P 500 Index 6M Performance

However, with the potential recession and overly bearish market conditions, there are indeed many reasons for caution moving forward, on top of VZ’s reduced FY2022 guidance. Even the S&P 500 Index had fallen by 21.8% in H1’22, the worst it had fallen in the past fifty years due to the rising inflation. As a result, we encourage investors to wait for a deeper retracement before adding to their portfolio, given the potential volatility moving forward. In contrast, existing VZ investors should simply sit back and enjoy the dividends.

Therefore, we rate VZ stock as a Hold for now.

Be the first to comment