David Ramos

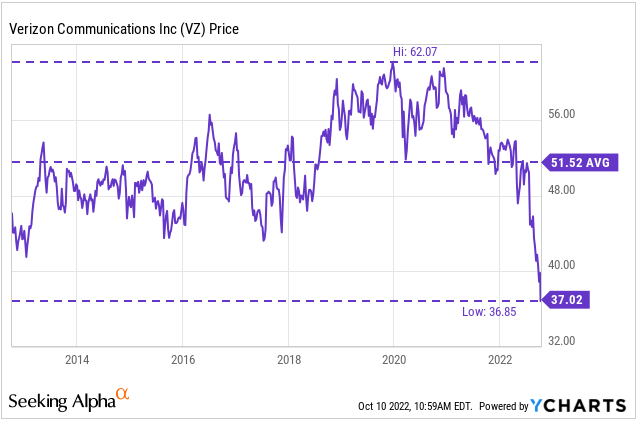

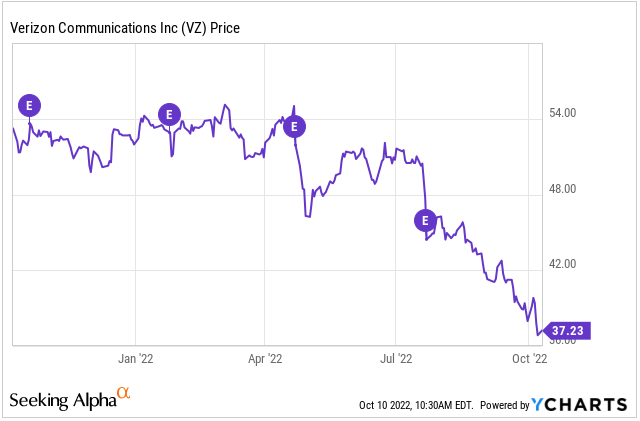

Verizon Communications Inc. (NYSE:VZ) has been one of the worst performing components of the DJIA over the past year, down over 30% versus an index decline of 15% over the same period.

Presently, shares are trading at multi-year lows. Their dividend payout, as a result, is now yielding over 7%.

YCharts – 10-YR Price History Of VZ

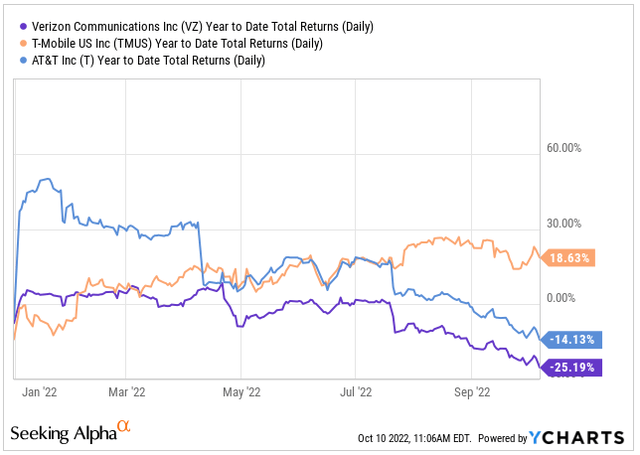

The YTD decline in VZ has been so extensive that earlier this year, T-Mobile (TMUS) surpassed the company in market value, a feat that has never before been achieved on a closing basis. In addition to greatly lagging behind TMUS, VZ is also significantly trailing AT&T (T) on a YTD basis.

YCharts – YTD Total Returns Of VZ Compared To Competitors

Dismal comparative net postpaid additions and disappointing forward guidance are two factors that have weighed on the stock in recent periods. The company, however, is still a market leader that operates a business that generates predictable cash flows. This has provided stability through challenging operating conditions.

While their overall performance has provided fodder to “dead money” narratives, much has already been priced into the stock. In fact, overly so. Positive trends in premium plan penetration, continuing momentum in fixed wireless access (“FWA”) additions, and expected synergies resulting from their recent acquisition of TracFone are all competitive strengths that warrant a reset to VZ’s current pricing multiple. For long-term investors, the rock bottom pricing provides a highly attractive entry point into a long-time DJIA component with a time-tested business.

Increased Penetration In Higher Priced Unlimited Plans

VZ continues to post weak net postpaid phone additions in relation to their competitors, but the results still hold up firmly against their historical averages. In Q1FY22, for example, they reported postpaid phone net losses of 36K, which was an 80% improvement from Q1FY21 and their best first quarter performance since 2018. Granted, the losses are still unacceptable, given the gains reported by both their rivals. But the results still represent an improvement, nonetheless.

And in the most recent quarter ended June 30, the company reported continued strength in their Business Group, with 227K postpaid phone net additions, their third consecutive quarter with over 200K wireless phone net additions. These gains, however, were offset by softness on the consumer side, which experienced net losses of 215K, resulting from increased churn and an 11% decline in gross additions from the prior year due to competitive pressures.

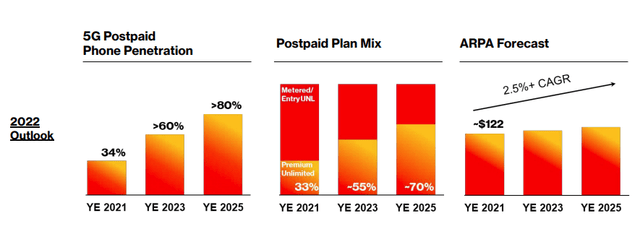

A more positive trend is reflected in the figures surrounding customer upgrades to higher priced unlimited plans. During Q1, 64% of new postpaid phone accounts chose premium unlimited plans, producing a penetration level of 36% of its postpaid phone customer base. While the number of new accounts opting for premium unlimited plans in Q2 were lower, at 57%, penetration reached 39% at quarter end, which in-turn drove average retail postpaid service revenue per account (“ARPA”) higher by 2.4% compared to last year.

Further penetration in subsequent periods will likely be a key driver of earnings strength and continued growth in ARPA. Reaching a penetration level of around 60% by the end of 2023 with over 60% of their base using 5G-enabled phones would be a significant milestone. These gains would also be one of the primary paths in their deleveraging efforts.

2022 Investor Day – Expected Penetration Levels Through 2025

Steadily Increasing Fixed Wireless Net additions

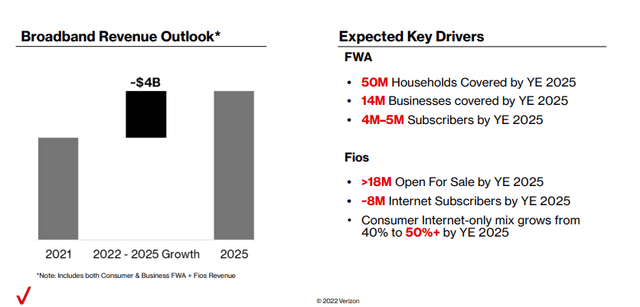

Another promising trend is the company’s continued momentum in fixed wireless. In Q1, VZ reported 194K net additions, which was up significantly from the 78K reported in Q4 of 2021. In Q2, VZ built on these gains by adding another 256K subscribers. Net additions in this category have now increased every month throughout 2022.

As U.S. household coverage for this service reaches 50M, VZ expects to drive their customer base to 4-5M by the end of 2025. Given current positioning in the market, this is entirely possible and would represent a key source of future revenue growth.

2022 Investor Day – Broadband Revenue Outlook

TracFone Positions VZ As A Leader In The Value Segment

VZ recently completed its acquisition of TracFone, a business that serves over 21M subscribers through a network of over 90K retail locations. While the company already had an existing wholesale agreement with TracFone, with over 13M of their subscribers already on VZ’s wireless network, there is still a large quantity of customers to be migrated over to the network, a process that is expected to be completed over the next two years.

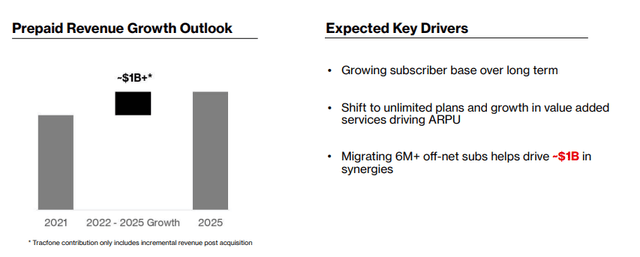

2022 Investor Day – Prepaid Revenue Growth Outlook

As this migration continues, VZ should realize significant network and cash flow synergies, while solidifying their position in the value segment of the market, a strength that would be a timely complement to their core operations, particularly due to the expected increases in churn rates as a result of recent price hikes. This will provide existing customers an alternative to terminating their relationship with VZ altogether.

Much Already Priced-In Going Into Earnings

VZ’s next earnings release is due out in the premarket hours on Friday, October 21. Though the company has beat on revenue and earnings projections in the past, postpaid additions and forward guidance has proved disappointing, particularly in the past two quarters, resulting in amplified selling pressure immediately following the past two releases.

YCharts – Recent VZ Share Price Performance Following Release Of Earnings

In Q2, for example, VZ reported a gain of just 12K postpaid phone connections. AT&T, on the other hand, reported a net gain of 813K equivalent connections over the same time span. To compensate for this weakness, management raised the monthly cost of some plans and added additional economic adjustment charges. While those changes could yield about +$1.0B in additional revenue, it could also produce higher churn rates.

In addition, VZ projected lower wireless-service revenue growth of 8.5% to 9.5% in 2022, which would be down from their earlier forecast of 9-10% growth. Furthermore, adjusted earnings are also expected to be flat to negative as opposed to growing. This contrasts with the raised guidance provided by T.

Consistent with prior quarters, these figures will be closely scrutinized on their upcoming earnings release. Deleveraging prospects in the face of rapidly rising interest rates and deterioration in their core business are also likely to figure into the post-release performance.

Given the significant pullback in the shares since their last release, however, it’s entirely feasible that much of the downside risk is already baked into the share price.

A Durable Business With Material Upside Potential

Verizon is a time-tested component of the DJIA that generates predictable cash flows through its highly profitable wireless business. And despite falling behind in performance in recent periods, the company still retains scale advantages through its sizeable base of assets, in addition to its improved spectrum position through recent investments. A strong commitment in maintaining or increasing capital intensity to defend its market position provides further confidence that the company will remain well positioned against disruptive market threats.

The sizeable capital budget, however, has resulted in elevated leverage levels. But a sizeable cash balance of nearly +$2.0B and over +$10.0B of unused capacity on their revolving credit facilities provides ample liquidity to readily address their incoming maturities. While interest expense will track higher in subsequent periods, EBITDA coverage continues to remain adequate, with levels in excess of 4.0x, which is in-line with historical averages.

VZ’s dividend policy does limit their financial flexibility, but there are no indications at present of any impending changes to the current payout, which is at a level that is highly desirable to income-focused investors. At a 7% yield, the payout is significantly higher than the average yield offered by the broader market average, which is less than 2%. It is also higher than the yield one can obtain from holding risk-free Treasury’s or through holdings in high-yield savings accounts.

With a long track record of continuous growth, income investors should expect further increases in the periods ahead. In addition, the share price itself presents material upside potential. Presently, VZ stock is trading at just 7.0x forward earnings, which is a steep discount from their five-year average of 11.0x.

While some would argue VZ is dead money, further penetration into premium unlimited plans and the deployment of 5G technologies provide two opportunities for future earnings growth. This could result in a multiple expansion back to levels in-line with their historical averages. Even at a 9.0x multiple, shares would have implied upside of nearly 30%. Including dividends, this has the possibility to produce long-run market-beating returns.

Be the first to comment