David Ramos

Investment thesis

While Nokia (NYSE:NOK) stock may face some further downward pressures in the next few months as the markets adjust to the reality of the brutal energy crisis that Europe is going through, the selloff may not necessarily be justified by current, or future results, or in regards to its company-specific fundamentals. A global economic downturn, with Europe probably taking the brunt of it, does not necessarily mean that Nokia’s revenues or profits will be impacted. There is no reason to expect telecommunications investment to slow down in Europe, North America, or anywhere else in the World, in response to the hard times ahead. Nokia continues to rack up contracts, which suggests a decent future ahead, while its current financial results are solid. A further decline in its stock price should be considered a potential opportunity to invest.

The latest financial results are encouraging

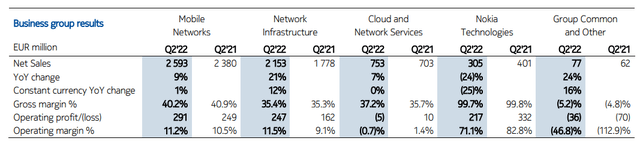

For the latest quarter, Nokia’s revenues increased by 11% compared with the same quarter from last year, to 5.9 billion euros. Its operating profits increased by 17% for the same period, to 564 million euros. This is a profit margin of about 10%, which is not so bad within the current global business environment.

Of those total sales, 2.6 billion euros or almost half came from Nokia’s mobile network equipment contracts, which is the driving force behind the company’s future prospects, together with its related network infrastructure business which provided 2.2 billion euros of the total revenues. As I shall point out, the fallout from a global recession should not hinder this business segment. Furthermore, the overall global geopolitical trends of technological fragmentation have the potential to more or less offer Nokia a duopoly situation in certain markets around the world.

Other financial trends of note include Nokia’s debt trend. So far this year, its long-term debt declined by just over 100 million euros, to 4.4 billion. Its dividend payments are less than 1%, and there seems to be no obvious threat of it being lost or reduced, especially since it is not by any means a very generous one.

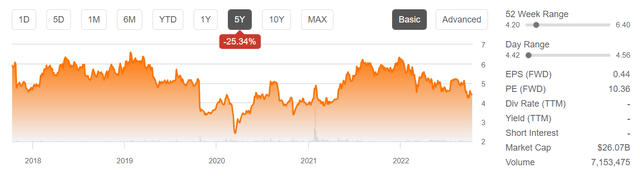

As we can see, Nokia’s stock has not gone place in the past years, which is, in my view, a reflection of the company’s long path of re-orientation after the phone business faltered and was eventually divested. With a forward P/E ratio of just over 10, even a moderate upshift in growth would make this company and its stock a potential star performer, within the context of an increasingly bleak global economic environment. Some growth may become a very valuable company asset, when potentially compared to an overall business climate where most companies may be forced to cut business volumes, at least in the short to medium term.

Nokia performs well against its two main global 5G infrastructure competitors. Geopolitics may end up playing a positive role going forward

Looking at a recent report in regards to a major 5G contract that Nokia earned in Norway, beating out its two main competitors, Huawei and Ericsson (ERIC), it seems that Nokia is faring well, where it is standing toe to toe in what we can assume was a fair, competitive awarding of a contract. In certain parts of the world, the competition between Nokia and Huawei is less than fair, with politics and geopolitics increasingly taking precedence over business considerations. It seems however that in a market like Scandinavia for instance, where Nokia and Ericsson are presumably competing on an even playing field, Nokia seems to be edging out its main competitor, meaning that it has the potential to gain more market share.

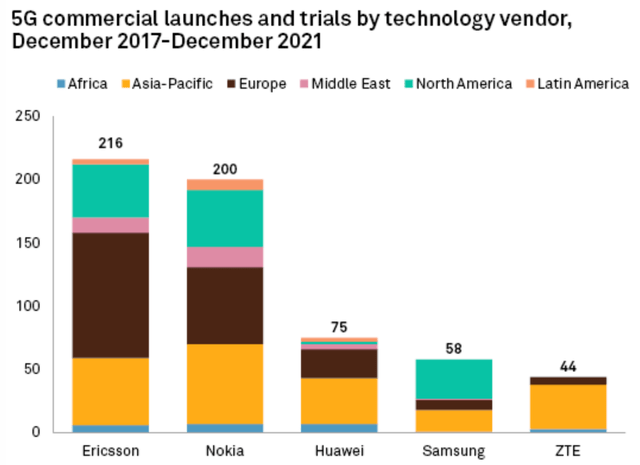

Nokia currently has over 200 5G infrastructure contracts worldwide, up from 50 contracts in 2019. It may not be a very accurate account of business volumes due to project size, but in terms of the number of projects deployed and geographical reach, Nokia and Ericsson seem to be beating Huawei.

It should be noted that given the more extensive launch of 5G in China, Huawei continues to lead in terms of actual sales volume. The fact that its European rivals are raking up more contracts that are geographically more widespread, can be considered to be a sign that in the long run, they may end up doing more business around the world than Huawei.

The fact that American policy towards China’s domestic tech industry is now to contain it, putting pressure on a number of countries around the world to avoid making deals with Chinese tech solutions providers, such as Huawei, is causing a technological split of the world. This policy may certainly lead to Nokia eventually finding itself locked out of certain markets, but it seems that overall, the market for its equipment is more geographically diverse than that of Huawei thanks to those geopolitical pressures.

Global & European economic slowdown should not greatly affect Nokia’s business. Its stock getting caught up in general selling should be viewed as an investment opportunity

Nokia stock is down over 30% YTD as I write this, in large part due to the bleak outlook for Europe’s and the World’s economy, thus for European stocks. It should be noted however that in this particular case, it would be useful to discriminate between companies that stand to lose production capacities, such as petrochemical producer BASF (OTCQX:BASFY), which I covered recently, highlighting its broad exposure to the risks associated with high energy prices and potential outright shortages going forward.

Nokia’s stock is almost as battered as BASF’s this year, with the latter being down 40% YTD, despite the fact that the former has very little direct exposure to the energy crisis issue. Consumer demand should not be affected either, given that such investments are not highly cyclical. If anything, state actors may look to stimulate such infrastructure projects through various modes of support during tough economic times, such as what we seem to be heading towards currently. Additionally, Nokia may also be one of the rare companies out there, where there may be more upside to the growing economic rift between the US and China than the potential downside.

I am not certain how much longer we can expect Nokia to be caught up in the general widespread indiscriminate selling trend. At some point, the fact that certain companies are less affected by the otherwise bleak global economic outlook, or not affected at all will become evident and certain investments will start to outperform and even break with the overall downward trend. The case of Nokia can potentially demonstrate that even within the European context, where things are looking bleaker than anywhere, there are likely to be companies that can thrive and do well. For this reason, I decided to add to my already existing stock position in Nokia.

Be the first to comment