Justin Sullivan

What Happened?

Verizon Communications Inc.’s (NYSE:VZ) stock nosedived 10% after reporting an earnings miss.

VZ Long-term Chart

Then it fell another 10% following the severely hawkish speech given by Chair Powel at Jackson Hole, yet just bounced off 10-year historic long-term support.

Current Chart

The reason for the pullback was that the company lowered guidance slightly for the remainder of 2022, missed on eps, and lost business to AT&T (T). This caused the stock to drop nearly 10% in short order.

Verizon shares have now fallen to their lowest level since 2012 amid a rough reaction to a quarterly report where the company narrowly missed profit expectations and cut back its guidance after a big miss in wireless subscription growth.

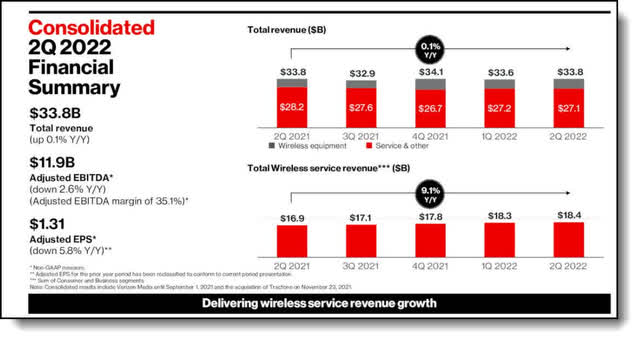

Consolidated Second Quarter Results

Revenues overall were flat at $33.8B, in line with expectations. And wireless service revenues rose 9.1% to $18.4B. But the company added just 12,000 net new postpaid phone customers when analysts had forecast adds of more than 167,000. The slowdown resulted in some heavy guidance cuts that sent investors into selling mode. Verizon (said it now expects to earn between $5.10 and $5.25 a share, down from a previous forecast of $5.40 to $5.55 a share.

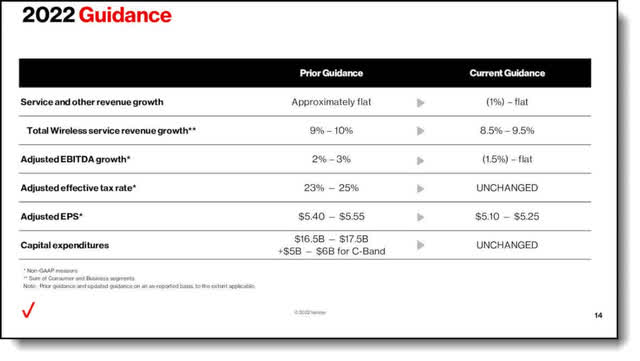

2022 Guidance Cuts

Verizon’s management also reduced the company’s 2022 expectations for wireless service revenue growth to between 8.5% and 9.5%, down from a previous forecast for 9% to 10%. Verizon also said it expects service and other revenue for 2022 to be flat or decline up to 1% from a year ago, suggesting slim prospects for growth this year. The company had previously guided to EBITDA growth of 2% to 3%, but now expects that to be flat, at best, or decline as much as 1.5% from a year ago. Chief Financial Officer Matt Ellis stated:

“Although recent performance did not meet our expectations, we remain confident in our long-term strategy. We believe that our assets position us well to generate long-term shareholder value.

Our second quarter was not a good barometer for where Verizon has been or where it’s going. While we are not satisfied with our performance, we know what the issues are. And we are already executing to reaccelerate in the second half of the year. As I said in our first quarter earnings call and reiterated since, we are seeing weaker consumer wireless volumes.

The inflationary environment is clearly impacting consumer behavior. And we also saw intensified competition for consumer attention. The result was a significant impact on our gross adds. Based on our performance this quarter and [Indiscernible] of the landscape, we are updating our financial guidance by lowering our expectation for service and other revenue, adjusted EBITDA and adjusted earnings per share. Matt will provide more detail in a few minutes.

As you know, we have already responded. Last week, we launched our Welcome Unlimited plan for consumer wireless that will meet the needs of budget-conscious consumers without providing device subsidies. In addition to these new plans, we took pricing actions in both of our business units to mitigate inflationary pressures.”

Since then, the stock has actually sold off another 10%. The hawkish Powell speech and several downgrades have absolutely pummeled the stock. Nevertheless, I see this as an excellent opportunity to lock in the substantial dividend yield of 6.2% at present. I have come to see this as a contrarian indicator from my past experience. I’m a big believer in Sir John Templeton’s strategy of “invest at the point of maximum pessimism.” Let me explain.

Invest At The Point Of Maximum Pessimism

One of my favorite quotes from investing icon Sir John Templeton is the following:

“Invest at the point of maximum pessimism.”

Templeton is known as a contrarian investor. He referred to his investment philosophy as “bargain hunting.” Templeton’s guiding principle was:

“Search for companies that offered low prices and an excellent long-term outlook.”

In 1999, Money Magazine called Templeton “arguably the greatest global stock picker of the century.” Templeton attributed much of his success to his ability to maintain an elevated mood, avoid anxiety, and stay disciplined. This is the point I was trying to drive home in my last video update.

Templeton focused on buying stocks he calculated were substantially undervalued, holding them until selling when their price rose to fair market value. His average holding period was about four years. However, Templeton did not buy stocks merely because they were undervalued; he also took care investing in companies he determined were profitable, well-managed and with good long-term potential. I believe this to be the case with Verizon.

By emphasizing overlooked or unpopular stocks, Templeton was in many ways a contrarian and became known for his “avoiding the herd” and “buy when there’s blood in the streets” philosophy to take advantage of market turmoil.

I feel this statement perfectly illustrates where the current market environment and where Verizon’s stock lies right now. The reward far outweighs the risk at this time, with the stock down on factors that are bound to improve. The stock is under-owned and oversold presently.

My definition of Contrarian Investing

A contrarian is one who attempts to profit by going against the crowd. A contrarian believes that certain crowd behavior can lead to exploitable opportunities. Pervasive cynicism about a stock can drive the price so low that it exaggerates the investment’s perils and belittles its future prospects. Identifying and seizing on these opportunities is a well-known investing tactic utilized by legendary investor Warren Buffett: “Be greedy when others are fearful.”

Even so, this only works if you have courage in your convictions and plan on holding for the long run. It’s time in the market, not timing the market, my friends. Moreover, the current bear market won’t last forever. Can anyone guess how many times the market has bounced back after a steep selloff such as the one happening now? The answer is every time. Right now, bearish sentiment is at record highs. This is exactly the time to strike.

Classic Case Of First Level Thinking

I see those who sold out of Verizon at the lows as a classic case of first-level thinking. A first-level thinker sells stocks as they fall and buys stocks when things are going well. The fact of the matter is, in order to be truly successful, you have to do the exact opposite. Think of first-level thinking as checkers, and second-level thinking as chess. Warren Buffett’s quote mentioned above, “be fearful when others are greedy and greedy when others are fearful,” is a classic example of second-level thinking. Times of market turmoil often present the best buying opportunities for savvy investors. Contrarians find their best investment opportunities during times of market duress while others are panic selling. Nonetheless, the underlying stock needs to have a solid growth story and strong fundamentals, Verizon does. Let’s dive in.

My “Three Pillars” Of Successful Dividend Investing

The three primary factors I take into consideration when determining whether or not a security meets my requirements to enter my SWAN dividend and income retirement portfolio are:

- Growth story must be robust, intact, and long term.

- Dividend must be paid out from growing organic revenue streams.

- Payout ratio must be reasonably adequate and paid out from growing solid free cash flow.

I refer to these as the three pillars of conservative dividend and income investing. There are always additional factors to consider, these are the three primary ones. Now let’s review each for Verizon.

Growth Story Is Intact

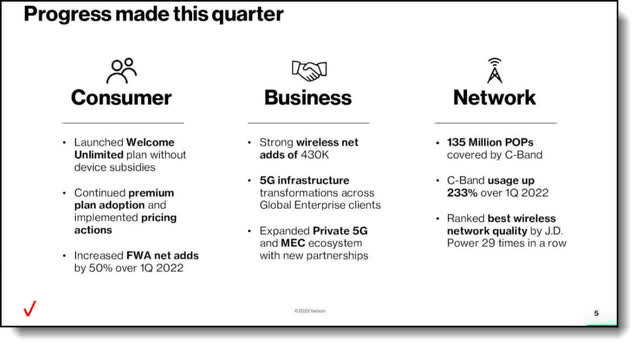

Verizon has big growth plans going forward, including the expansion of its 5G Ultra Wideband network to nearly 113 million people around the country. What’s more, the company has elevated demands for its 5G mobility and nationwide broadband services. The company’s performance produced its best broadband result in over a decade. Verizon Chairman and CEO Hans Vestberg stated:

“Our operational performance further positions Verizon for long-term growth and increases our competitive standing in mobility, nationwide broadband, the value market, and above the network business solutions and applications. The January launch of C-Band and expansion of our 5G Ultra Wideband network helped to amplify our fixed wireless momentum in both Consumer and Business, with quarterly additions 2.5 times that of our fourth-quarter performance, and drove momentum in wireless upgrades. We continue to accelerate our C-Band network build with our goal of reaching at least 175 million people by the end of the year and, with the recent early clearing spectrum announcement, we now have the ability to deploy more of this spectrum a full year sooner.”

Second Quarter growth progress

2022 second half growth strategy

The company is taking a slight hit to net adds due to AT&T’s aggressive promotions at present and inflationary pressures causing customers to cut back on expenses. Nevertheless, I see these as temporary issues. What’s more, the company is doing just fine when it comes to liquidity and cash flow.

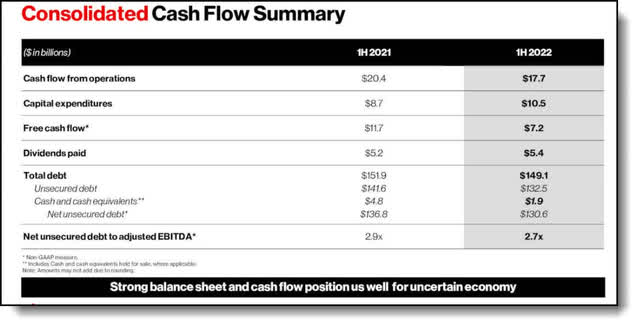

Consolidated Cash Flow Summary

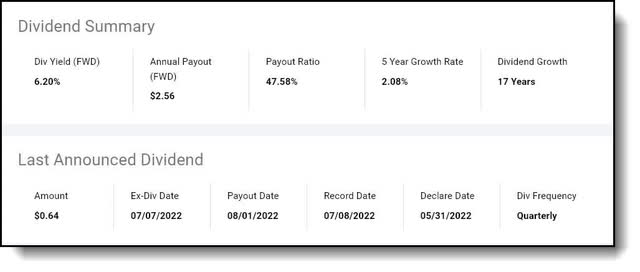

Now let’s take a look at the dividend detailed and payout ratio

Coverage Is Adequate, Payout Is Safe

The current annual payout of $2.56 has a payout ratio of 47.58%.

This level of coverage helps me to sleep very well at night. Furthermore, I expect it to increase as the company gains momentum. So, as you can see, Verizon satisfies all three pillars. On top of this, the stock is undervalued at present.

Stock undervalued historically and relatively

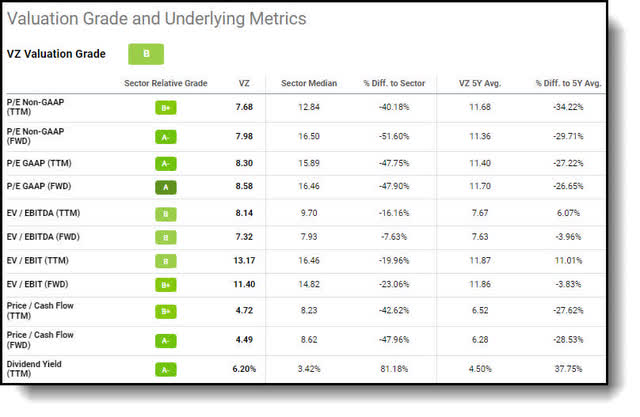

Seeking Alpha Valuation Metrics (Seeking Alpha)

With a forward P/E ratio of 7.98, the stock is trading for less than half the market’s current forward P/E of 18. Furthermore, the stock is trading for slightly more than 1 times sales, 2 times book value, and 4.49 times cash flow. This means not a whole lot of people have faith that the company will come through, creating an above-average buying opportunity for long-term dividend and income investors.

Now, let’s bottom-line the thesis.

The Bottom Line

Verizon’s stock has been beaten down due to the guidance being lowered and several recent downgrades. Furthermore, the macro market outlook has been extremely unfavorable with the Fed on the warpath and geopolitical risk at all-time highs. Nonetheless, if you have a contrarian spirit like me, this may be just the time to start or add to a position. At least, that’s what the all-time greats such as Rothchild, Buffett, and Templeton say.

Verizon meets my three pillars’ requirement, and, having courage in my convictions, I have decided to start a position in the stock for the portfolio. The 6% yield seems to act as a backstop as well. Many dividend and income investors seem to jump in and buy up shares whenever it gets to this level. My 12 month price target is $50, which implies 20% upside. Combine that with the 6% yield and you have a 26% total return on your hands!

Final Note

Nevertheless, if I was a prospective buyer, I would definitely layer into any new position over time to reduce risk. There’s a fine art to investing during highly volatile markets such as these. It entails layering into new positions over time to reduce risk. As a Veteran Winter Warrior of the US Army’s 10th Mountain Division, the attributes of patience and perseverance were instilled in me, hence the investing motto of my marketplace service The Winter Warrior Investor, “Patience Equals Profits.” Here’s a picture of me during winter warfare training in Ft. Drum, New York, circa 1988.

Those are my thoughts on the matter! I look forward to reading yours! Do you believe now is the time to buy Verizon? Are we at the point of maximum pessimism? Why or why not?

Be the first to comment