jetcityimage

Thesis

Verizon Communications Inc.’s (NYSE:VZ) Q3 card stunned its investors, as the market sent it tumbling toward lower lows after a tepid earnings release. However, investors who carefully observed VZ’s price action would have gleaned that the market had already de-rated VZ from its August recovery.

Hence, we believe the market had already anticipated a relatively weak earnings release, as it reported unexpected churn on consumer metrics. In our previous article (Hold rating), we also apprised investors not to get too excited yet, as we think its valuation was still not attractive.

Therefore, we welcome the recent battering, as it has improved VZ’s valuations tremendously. VZ was still overvalued in August (Vs. 10Y relative valuation metrics). With a looming recession that could impact its results moving ahead, the de-risking is justified.

We gleaned that the bottoming process in VZ is still underway. However, we are satisfied that investors should be able to partake in a mean-reversion opportunity from the current levels. Coupled with an attractive dividend yield nearing 7.3%, it should offer investors some respite as the buyers attempt to stanch further downside.

As such, we revise our rating on VZ from Hold to Buy, with a medium-term price target (PT) of $44, implying a potential upside of 22%.

VZ Was Too Expensive

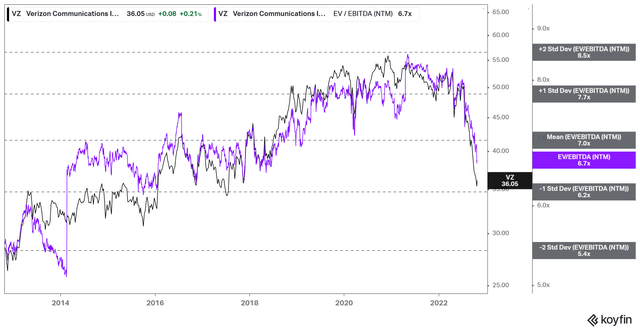

VZ NTM EBITDA multiples valuation trend (koyfin)

As seen above, the market pummeled VZ’s overvaluation over the last six months, sending its NTM EBITDA multiples back under its 10Y mean. Therefore, we assess that the battering is justified, as VZ was too expensive as we head into a recession.

Furthermore, management highlighted elevated churn from its pricing actions to address the competitive headwinds from AT&T (T) and T-Mobile (TMUS). Even though management accentuated that it expects to see better progress moving forward, it’s hard to convince the market given its previous overvaluation.

As a result, its NTM EBITDA multiple of 6.7x is now below its peers’ median multiple of 7.6x. Also, VZ’s NTM P/E of 7.1x is more in line with its industry forward P/E of 6.4x. Hence, we deduce that the current entry levels are more palatable from a valuation perspective.

But Don’t Expect A Quick Turnaround

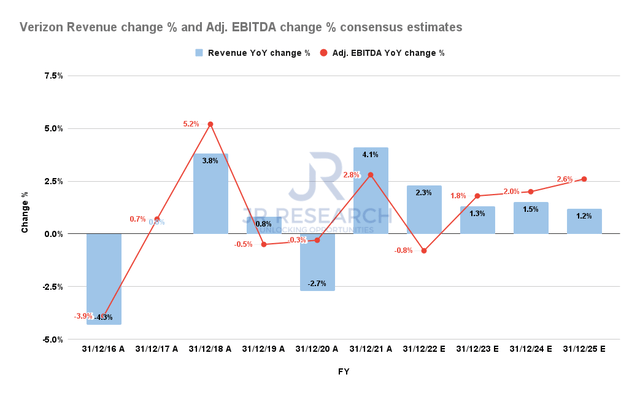

Verizon Revenue and Adjusted EBITDA change % consensus estimates (S&P Cap IQ)

The company also highlighted that it continues to drive cost savings in its OpEx base to improve its profitability even as topline growth slows. However, the improvement is not expected to lift Verizon’s profitability growth markedly, suggesting it could continue to trade at a low valuation.

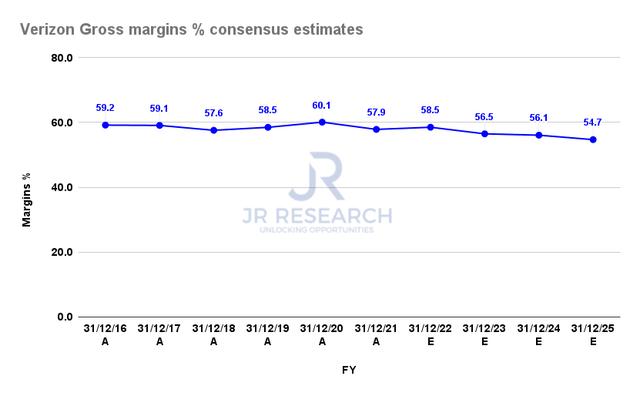

Verizon Gross margins % consensus estimates (S&P Cap IQ)

Also, investors are urged to continue monitoring the company’s gross margins. The competitive challenges could erode its pricing leadership further, with its gross margins expected to drop from 58.5% in FY22 to 54.7% by FY25. Therefore, it could also impact the company’s ability to drive further operating leverage if churn metrics do not improve markedly.

Is VZ Stock A Buy, Sell, Or Hold?

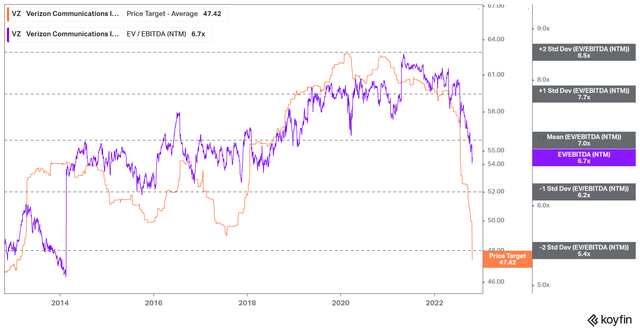

VZ average price targets (koyfin)

VZ’s analysts were overly-optimistic over the past year, as they kept their price targets (PTs) at levels that were not sustainable, given VZ’s overvaluation.

Hence, the battering in VZ forced the analysts to go into panic mode over the past few months, cutting their PTs in VZ significantly.

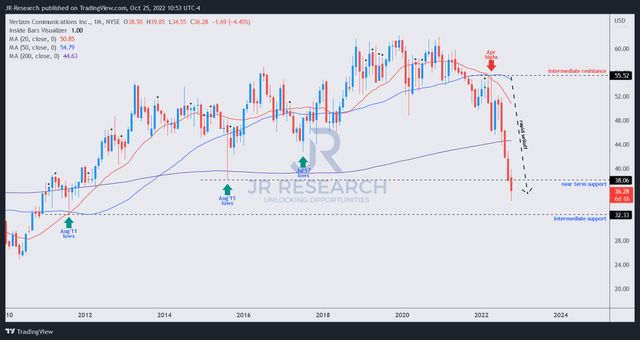

VZ price chart (weekly) (TradingView)

The pummeling from its April highs continued in earnest, with the selling pressure taking out lows last seen in November 2011.

The extent and speed of the selloff likely created a panic situation, as investors bailed rapidly to protect their hard-earned gains.

But, we like the de-rating, as it has proffered patient investors a much better entry zone with VZ’s valuations much improved.

We parse that a consolidation process could form at the current levels, helping to deny further selling downside.

Hence, we revise our rating on VZ from Hold to Buy with a medium-term PT of $44.

Be the first to comment