Khanchit Khirisutchalual

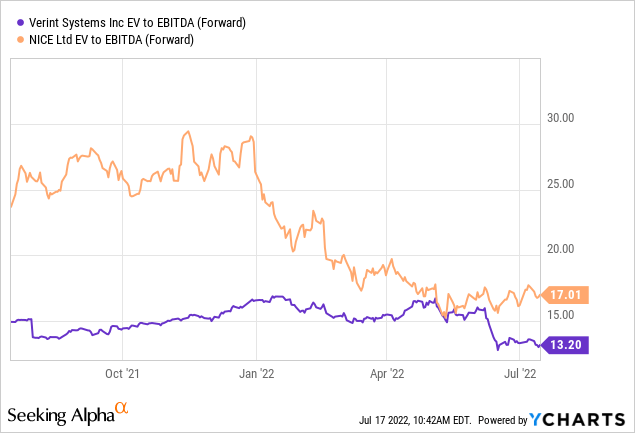

Verint Systems (NASDAQ:VRNT) hit all the right notes at this year’s investor update (webcast replay here), emphasizing the strong competitive position across the key customer engagement market, as well as its growing cloud and analytics capabilities – increasingly crucial competencies given today’s backdrop. With the disconnect between VRNT’s fundamentals and valuation growing wider in recent months, I see limited downside risk to the stock even with more interest rate hikes on the horizon. For a company delivering >30% cloud growth, the ~13x EBITDA multiple does not fairly assign VRNT enough credit for its accretive cloud transition, in my view. As the cloud contribution continues to ramp up, total revenue growth and margins should inflect higher, catalyzing a re-rating toward its closest peer NICE Ltd. (NICE).

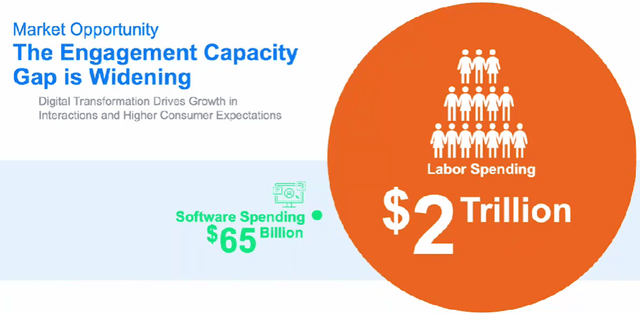

Tackling Massive Addressable Market Opportunities

Using new software/AI technologies to reduce labor spending and unlock significant ROI gains for customers is VRNT’s key long-term focus – management pegs ~$65 bn of spending on engagement software vs. ~$2tn on labor. With attrition and remote work increasing labor costs, this gap should narrow and VRNT’s AI and automation tools should allow it to capitalize. The key here is improving labor utilization so that clients can accomplish more per unit of labor cost, resulting in every dollar spent on technology yielding 30x investments in labor. Thus, the addressable market opportunity is large (and expanding), particularly across verticals such as insurance and banking, as well as healthcare.

In line with this outlook, VRNT has underwritten significant cloud infrastructure investments in recent years, starting with core platforms like Da Vinci and Engagement Data Hub, both of which add value for customers by helping them tackle the engagement capacity gap. Having built up a one-stop solution suite, VRNT is well-positioned to reap the benefits both ways – through the conversion of the maintenance base and by onboarding new customers. The latter has been boosted by some impressive wins, with the likes of Chipotle (CMG), Costco (COST), and FedEx (FDX), onboarded in recent years. While competitive concerns from Contact Center as a Service (CCaaS) resellers such as Five9 (FIVN) and 8×8 (EGHT) are valid, these vendors lack the full breadth of the VRNT platform, which extends well beyond the contact center. Given the significant R&D costs and time needed to catch up (if done organically), VRNT is the clear front runner, in my view.

Promising Cloud Growth Signals Long-Term Outperformance

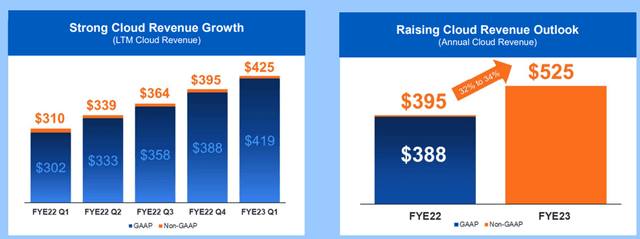

Having last issued its three-year cloud growth guidance for a 30% CAGR at the 2021 investor day (post Cognyte spin), VRNT is tracking well ahead of this outlook at +38% growth in its most recent quarter to ~$112m. Most of this came from organic cloud revenue at ~$109m (+34% YoY), with the remaining ~$3m from Conversocial. Split differently, cloud growth was driven by unbundled SaaS (+87%), which continues to benefit from VRNT’s CCaaS partnerships. With bundled SaaS also performing strongly at +25%, the full-year cloud revenue growth guidance (including managed services) was raised once again to +33% YoY (up from 31% YoY previously). This number does not yet account for Five9’s recently announced ~$40m deal, though, so expect more revisions to the cloud guidance in the next quarter or so.

The growing cloud share of the VRNT business at ~58% of perpetual license equivalent (PLE) bookings from SaaS (~65% guided for the full year) bodes well for the margin profile. For the upcoming year, VRNT already sees as much as two-thirds of new PLE bookings coming from the cloud and the remainder from maintenance conversions (another ~$50m to convert in 2023 from a ~$250m maintenance base). Additional pricing levers include VRNT’s push to towards a consumption-based pricing model, which could yield long-term upside to revenue per user (ARPU), particularly as companies expand the use case to connect engagement data across the organization. Given the early promise (VRNT signed ~26 cloud orders with >$1m contract value and >100 new cloud logos), the company has a clear path to exceeding its 30% CAGR target through 2024, with the resulting operating leverage benefits likely to accelerate margin expansion in the coming years.

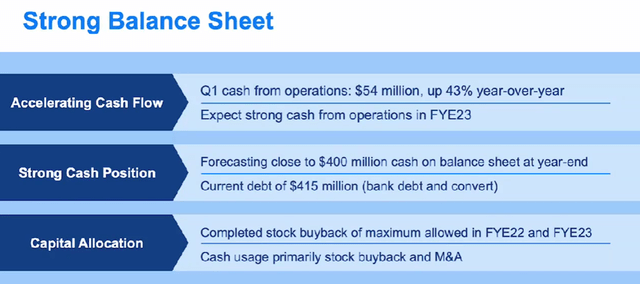

Cash Flow Ramping Up Amid Long-Term Cloud Transition

Over the near-term, the shift toward a SaaS pricing model (vs on-premise) has resulted in a temporarily negative mix impact on the overall cash flow profile. That said, as the cloud transition matures, cash flow is improving and as a result, cash flow from operations should outpace revenue growth over the coming years. Management has signaled as much, with operating cash flow guidance holding firm at ~$215m in 2023, driving a ~$400m year-end net cash target. In turn, this implies ample room for capital deployment optionality via share buybacks or tuck-in acquisitions – a potential source of incremental earnings upside down the line. While further M&A could accelerate R&D efforts and enhance the pipeline, buybacks will likely be prioritized at this point, given management commentary citing no urgent need for acquisitions.

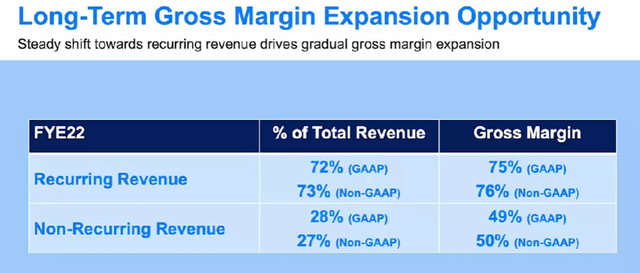

In addition to VRNT’s revenue growth ambitions, the updated gross margin guidance is also a key positive. In particular, the overall mix shift toward a recurring revenue base (already >70% of total), which holds gross margins of >75% (vs the non-recurring revenue base which has gross margins of ~50%), presents massive upside to the long-term earnings growth trajectory. Coupled with improving scale and efficiencies, increased recurring revenue contribution of >90% should naturally lift gross margins to the mid-70 % over time. Plus, as the operating leverage benefits kick in and flow through the model, expect a massive uplift in incremental cash flow as well.

Clear Path to Unlocking Long-Term Earnings Power

With various growth initiatives in the pipeline and the cloud strategy showing signs of accelerating revenue growth, VRNT looks set to unlock more earnings power in the coming years. Given the expanding recurring revenue base also carries higher gross margins than perpetual (>70% vs ~50%), the higher cloud-focused recurring mix should drive an improved gross margin profile and stronger cash flow. Plus, there remains ample room for even more profitability gains as management leverages operating efficiency levers following the Cognyte spin-off and deploys its strong cash balance into share buybacks and tuck-in acquisitions. Net, VRNT stock looks compelling at a relatively discounted ~13x EV/EBITDA and a growing high-single-digits % FCF yield.

Be the first to comment