Baloncici/iStock Editorial via Getty Images

Investment thesis

We expect Japan Tobacco (OTCPK:JAPAF) to exit the Russian market. This will have a materially negative impact on earnings, but we believe is priced into the shares. With a neutral outlook on earnings growth longer term, we believe a dividend yield of approximately 6% is sustainable, but we do not view this as being attractive enough given the negative secular trends for combustible tobacco and rate the shares as neutral.

Quick primer

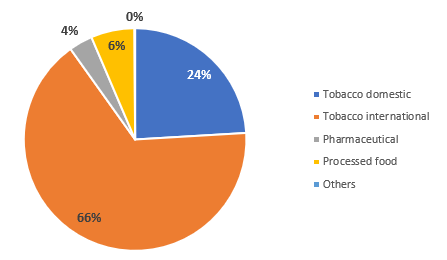

Japan Tobacco was founded in 1949 as a state-owned cigarette manufacturer, under the direction of GCHQ to conduct business in cigarettes, salt, and camphor. Listing in 1994, Japan’s Ministry of Finance remains the top shareholder with a 33.35% stake. Its largest earnings driver is overseas cigarette sales, with global brands such as Camel, Winston, Mevius, and Russia’s Liggett Ducat. It operates in over 70 markets, with the core strategy being to increase market share in the HTS (heated tobacco sticks) segment of the tobacco market with the ‘Ploom’ product which remains loss-making. The business also has small operations in pharmaceuticals and processed food.

During FY12/2021 the company conducted 340 investor relations meetings with institutional investors, down 10% YoY from 380 in FY12/2020.

In FY12/2020 Japan Tobacco sold its Tokyo head office building, generating a one-time operating income gain of JPY41 billion/USD0.3 billion.

Sales split by business (FY12/2021)

Sales split by business (FY12/2021) (Company)

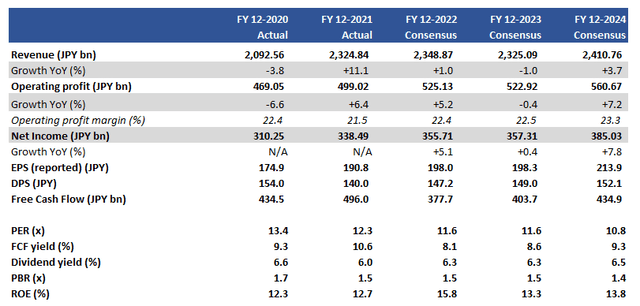

Key financials including consensus estimates

Key financials including consensus estimates (Company, Refinitiv)

Our objectives

The operating environment for Japan Tobacco remains highly challenging post-pandemic. The war in Ukraine had led to a suspension of new investments and marketing activities in Russia (including the planned release of Ploom X), relocating employees in Ukraine, and the key question as to whether the company should exit the Russian market where Japan Tobacco had 36.7% market share on FY12/2021. With this overhang on the shares, we want to assess whether the company has the ability to execute its strategy of generating sustainable long-term growth and delivering high shareholder returns.

Exit from Russia looks inevitable

Russia is a material market (page 4 in presentation) for Japan Tobacco, forecast to contribute 8% of total sales and 15% of adjusted operating profit for FY12/2022 company guidance. The official line is that the company remains committed to its 4,000 employees in Russia, but management has mentioned that it is investigating potential options from suspending operations to transferring ownership to a third party. Operationally on the ground, there are expectations of difficulties over raw material procurement, liquidity, and repatriation of funds. It appears to be only a matter of time until management formally announces an exit in some shape or form.

An exit from Russia would be negative for the business, but we believe this is priced in. As its peer group Philip Morris (PM), BAT (BTI), and Imperial Brands (OTCQX:IMBBF) have already announced their exit plans, it would be highly irregular if Japan Tobacco did not follow suit. As a Japanese company, there may be more leeway in how an exit (and potential return) is executed, but it is unlikely that the company can remain in the market.

It is hard to read whether consensus estimates have baked in an exit – the sell side in Japan tends to be reactive as opposed to proactively adjusting estimates. FY12/2022 consensus revenue appears more or less in line with company guidance, and operating profit is only 2% below. With the weakened JPY there is scope for upside as well as tobacco demand being currently firm in Western Europe and EMA (Eastern Europe, Middle East, Africa & Americas) clusters.

Our view is that Japan Tobacco’s formal exit from Russia will not be a negative surprise and will have a neutral impact on the share price. We now look at how the company will continue to generate free cash flow to fund attractive shareholder returns.

Usual playbook with a 75% payout ratio

Tobacco businesses face a constant headwind with decreasing volumes for their legacy combustibles products. Consequently, sales growth has been driven by a combination of price hikes, brand mix, and boosting exposure to RRP-related (reduced-risk products) goods. On top of this M&A has been at the forefront to gain economies of scale and enter new geographic markets.

Management’s core strategy to develop a sustainable business is to invest and boost its RRP products, with the combustibles business continuing on its terminal decline. The issue is that Japan Tobacco does not expect RRPs to break even until the end of FY12/2027. The balancing act is to generate sufficient returns to fund attractive shareholder returns whilst investing in the future of the business.

The company’s target is to increase returns to shareholders through mid- to long-term profit growth while maintaining a target payout ratio of about 75%. Whilst we do not see the payout ratio as being at risk, determining a straightforward growth outlook is more tricky for Japan Tobacco. At best we expect to see flat to falling earnings at the business for the next 2-3 years, given high pressure on consumer spending with the rise in the cost of living, although more stay-at-home consumption may result in stable tobacco sales. Overall, we are neutral on earnings prospects for the business, and we assess the outlook for dividend yields.

Valuations

Consensus forecasts estimate a dividend yield of 6.3% for FY12/2023. We believe this looks on the bullish side, considering that a Russia exit would reduce profits by around 10%. However, management may increase the payout ratio to compensate, as current company policy already formulates that the ratio could be boosted up to 80%.

The question is whether an approximate dividend yield of 6% is attractive enough to invest in the stock. Whilst it is not a low yield, we believe that it is not attractive enough given the earnings trajectory of what is inherently a business in terminal decline.

Risks

Upside risk comes from a relatively neutral outlook for the business where nothing materially goes right or wrong! A stable earnings stream will be able to generate a steady stream of dividends.

Legalizing the recreational use of marijuana is said to have a positive impact on combustible tobacco sales. There will also be an uptick in demand once Chinese tourism returns to Japan driving travel retail.

Downside risk comes from the more regulatory pressures on the tobacco business, stemming from increasing the legal age of sale, marketing restrictions, higher health insurance premiums for smokers deterring behavior, and rising excise taxes.

Conclusion

We expect Japan Tobacco’s exit from the Russian market to be a neutral event. The longer-term earnings outlook for the business remains relatively unconvincing, and the prospective dividend yield of around 6% is not high enough to warrant investing in the shares. Given the negative secular trends of combustible tobacco, we rate the shares as neutral.

Be the first to comment