MF3d

In technology, occasional seismic shifts can change the landscape. We may be seeing one now, with artificial intelligence based tools. ChatGPT is the most recent example. It has been described as “scary good” and “stunning” to academics”. You can try it for yourself here.

This technology may replace various user scenarios that previously started with the Google search box. This presents a risk to Alphabet (NASDAQ:GOOG) (NASDAQ:GOOGL) that isn’t necessarily reflected in the current stock price today.

What Is ChatGPT?

ChatGPT is a chatbot powered by AI. But it’s more than the name suggests, and can do a broad range of tasks. It can write credible essays, it can provide insight into a broad range of topics, create travel itineraries and produce meal plans.

It has limitations that it is not trained on very recent data, has a bias towards English and isn’t necessarily logical in some of its responses. However it provides an 80% solution for a broad range of tasks. Furthermore, improvements in results over time are highly likely.

For example, I asked ChatGPT to describe why people use web-based search, this is the response it generated in a few seconds:

People use web-based search engines for a variety of reasons, but some of the most common reasons include looking for information on a specific topic, finding websites related to a particular subject, and searching for specific products or services online. Some people use search engines to find news, images, videos, or other types of content, while others use them to learn about a particular topic or to find answers to specific questions. Ultimately, the core scenarios for using a web-based search engine are to find information, discover new websites, and connect with others on the web.

ChatGPT poses a threat to usage of Google for certain scenarios such as learning about topics, getting questions answered and finding information. Of course, the ramifications of this technology go beyond Google, but Google is likely to be one of the more impacted companies.

Valuation

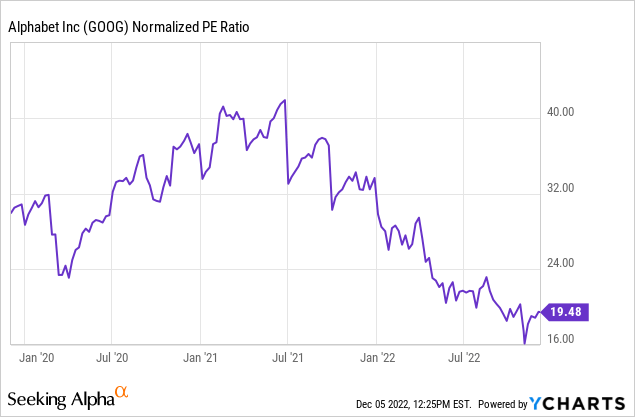

Google is not trading like a company that is about to be disrupted. It currently trades at 20x earnings, which although cheap compared to recent history is not cheap in absolute terms.

Google and AI

Of course, Google is heavily invested in AI, here’s what the CEO said about it on the most recent earnings call.

I think on the AI front, we are still in very early innings. We’ve been very good about, as our research teams are making progress, bringing it into Search so pretty much transformer-based models, including BERT and MUM are in Search now. So it’s driven a massive improvement in Search quality and helped us extend the lead in quality over other products.

We are definitely using it to make it multimodal. And I think going back to some of the earlier questions about making sure Search is visual, things like Google Lens bringing visual search into — being able to point your phone at things and ask questions, all that really helps set up Search well for the future of where computing is headed.

But AI not only affects search, it affects all our products. It makes YouTube better, ads better, and through Cloud, we are bringing it to other companies as well.

However, there may be a problem here related to the innovator’s dilemma. As is clear from the response above, Google are predictably using AI to improve search. However, there is a risk that AI replaces search for some scenarios. Are Google building a better buggy whip?

Potential Impact

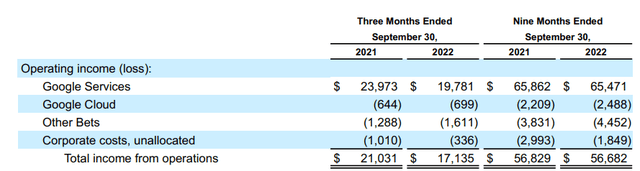

Then search-related businesses are very material for Google, representing more than 100% operating profit. Google Services includes “ads, Android, Chrome, hardware, Google Maps, Google Play, Search, and YouTube” per the 10-Q, so it’s not all search-related, but search remains the heart of Google despite some diversification. Also, Google Cloud is an area of heavy investment, so likely has greater profit potential than current numbers show, but still pales in comparison to search profitability.

Alphabet 10-Q (Alphabet)

Search Is Largely Informational

Then academic work suggests that search queries are about 80% informational, as opposed to transactional or navigational. This is a problem for Google as it is these informational searches where ChatGPT has the most value.

Illustrative Scenarios

Then it’s early days, but if informational searches do migrate to platforms other than Google. If we assume that profitability of Google Services is 70% related to search activity and 80% of those searches are informational, then the impact from Google if new AI-centric services take share is clearly stark given that search really is the core of Google’s profitability.

| Migration to non-Google AI services | Operating profit impact |

| 5% | -3% |

| 10% | -6% |

| 15% | -9% |

| 20% | -11% |

source: author’s analysis

Risks

- Google may capitalize on AI themselves to improve their products and services.

- It is not clear to what extent AI based tools will complement Google tools rather than replace them.

- Google is well positioned in many services and familiar to users, it may be hard for new tools to displace Google search even if their offerings are superior.

- The timing of this shift is hard to predict, adoption of AI tools may take some time.

- Shorting companies involves material investment risks.

Potential Drag For Google

Understanding of just how good and how useful AI-based tools are for computing tasks is growing. Early adopters are impressed. Google is investing in AI but has a lot to lose from this technology shift, should it occur.

Unlike most other tech giants, Google is not well diversified beyond a single business – search – for profitability. As AI-based tools evolve they may be a drag on earnings and sentiment over the medium-term for Google to the extent that previously search-based activities migrate, in part, to these emerging tools.

Be the first to comment