JHVEPhoto

I am buying Advanced Micro Devices, Inc. (NASDAQ:AMD) right now because I believe the market is wholly irrational about the value of AMD’s shares as well as the company’s growth prospects. The semiconductor company is seeing a slowdown in the Gaming business as consumers no longer buy graphics cards as quickly as they did a year ago, but AMD’s new Ryzen processors and Radeon GPUS may give revenues a bump in the fourth-quarter. The market is currently not in favor of AMD, which has led to a major repricing of the company’s shares. I believe the drop is a great opportunity to buy shares of AMD at a discounted price!

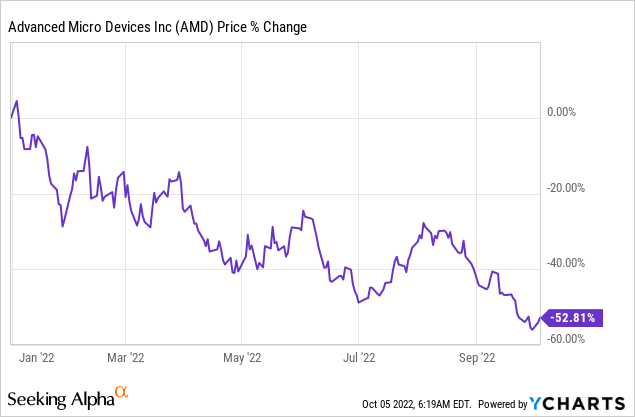

AMD’s repricing is exaggerated

Year to date, AMD’s shares have seen a 53% revaluation to the down-side due to a couple of factors that have created negative sentiment overhang for AMD. Among the factors that have hurt AMD are a light forecast for AMD’s third-quarter — which indicates a revenue deceleration — weaker gross margins, and slower growth in the Client and Gaming businesses.

In 2020 and 2021, GPU prices surged due to unprecedented demand from not only gamers that upgraded their equipment during the pandemic, but also from cryptocurrency miners. This demand pushed prices dramatically above the manufacturer’s suggested retail price for both AMD’s and Nvidia’s (NVDA) graphics cards and led to a shortage in GPUs that supported strong pricing. The market situation fundamentally changed in 2022, as demand for GPUs dropped rapidly and the price for AMD’s RX 6000 GPU, for example, fell below the manufacturer’s suggested retail price in July.

wccftech.com: AMD/Nvidia Graphics Card Prices

New product launches in Q4 ’22 could create catalyst for AMD’s two struggling businesses

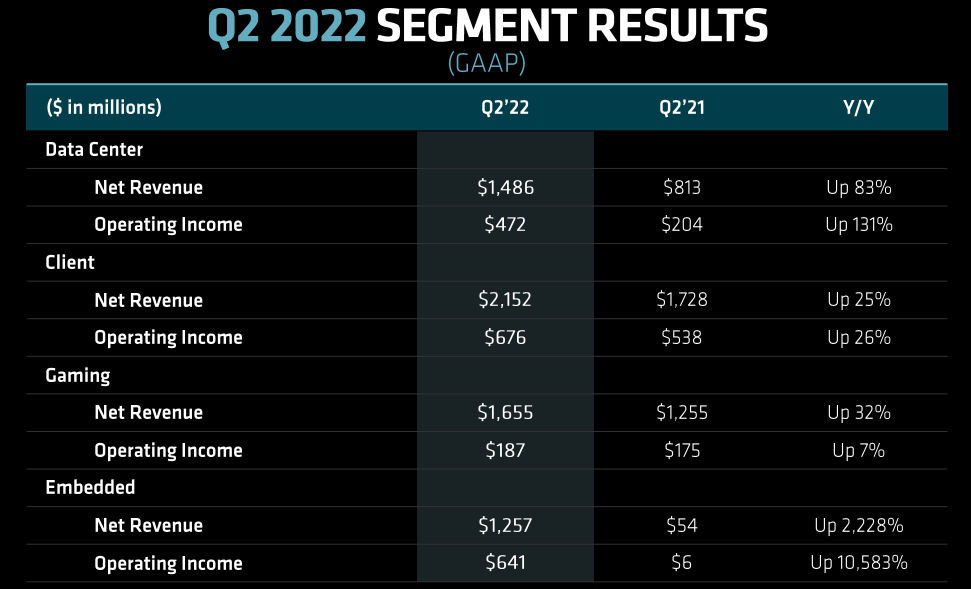

AMD’s two core business segments are Data Centers and Gaming. The chipmaker split up its reporting segments following the successful acquisition of Xilinx and now reports four segments: Data Center, Client, Gaming and Embedded. Data Center and Embedded are AMD’s two fastest growing businesses which continue to benefit from strong EPYC server processor sales as well as accelerating product adoption by enterprise customers. AMD’s new Client and Gaming segments effectively split up revenues generated from selling Ryzen processors (Client) and Radeon graphics cards (Gaming). Client and Gaming have seen the slowest top line growth rates of 25% and 32% in Q2’22 due to the broader slowdown in the PC market post-pandemic.

AMD: Q2’22 Revenue Breakdown

The Data Center business is likely going to continue to drive strong results for AMD due to strong product demand, growing enterprise adoption, and Intel’s (INTC) problems with its own data processor chips.

A key accelerant for AMD’s growth in the Data Center business is the delayed launch of Intel’s Sapphire Rapids server processors which are the chipmaker’s fourth-gen Xeon server processors. Intel has fought with delays for a while but it looks that the company’s server chips — which were originally meant to compete against AMD’s highly successful third-gen Zen 3 EPYC Milan processors — are set to launch only in the first quarter of 2023… with volume shipments kicking in even later. The delayed launch for the Sapphire Rapids will likely set up Intel for even stronger competition in the server market because AMD is set to launch the EPYC Genoa processor — which is build on the more powerful Zen 4 architecture — in FY 2023.

The slowdown in the Client And Gaming segments, however, is a concern for AMD, but the firm is launching new products that could lead to a re-invigoration of revenue growth in the fourth-quarter.

AMD just released a slew of new Ryzen processors and will release new Radeon GPUs in November that could make a strong impact on AMD’s revenue growth and lead to a new up-grade cycle for gamers. AMD just launched its new AMD Ryzen 7000 Series desktop processors which started to retail at about $300. A 3D V-Cache model is expected to come to market later this year. The new Ryzen 7000 Series processors, which promise significant performance enhancements over prior-gen models, have the potential to re-accelerate AMD’s revenue growth in the Client segment in the fourth quarter.

AMD’s new Ryzen 7000 Series desktop processors are powered by AMD’s new Zen 4 architecture, offering content creators stronger rendering performance and better energy consumption. AMD’s top-of-the-range processor, the 16-core AMD Ryzen 9 7950X processor offers 57% better content creation performance (speed) while delivering 47% better energy efficiency than prior-gen models.

AMD is also set to launch next-generation Radeon RX 7000 graphics cards in November which could result in accelerating segment revenue growth in the important fourth-quarter. I estimate that a successful roll-out of a new slate of CPU and GPU products could drive stronger revenue growth in the Client and Gaming segments, which have taken a backseat lately to AMD’s excellent performance in Data Centers.

Facing a long term growth catalyst: Metaverse

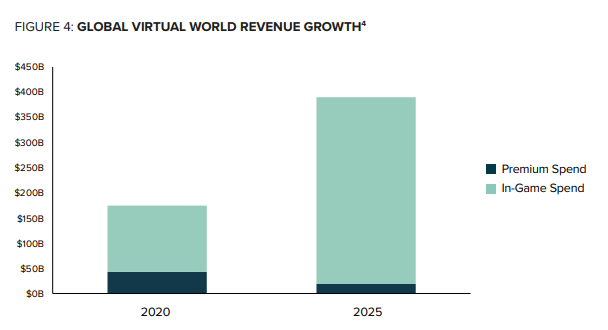

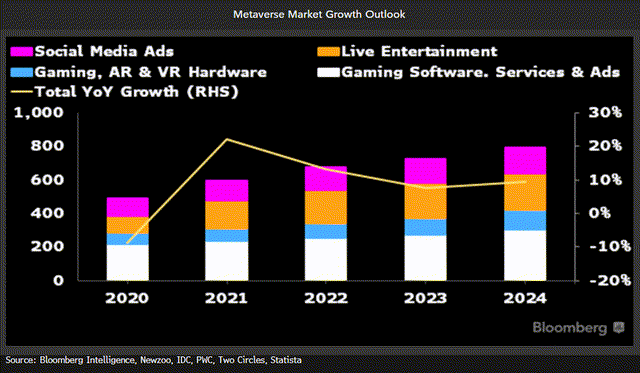

AMD could play a crucial role in helping Meta Platforms (META) to develop its next big business. Meta Platforms announced last year that it will invest heavily into the metaverse growth opportunity, which, according to Bloomberg Intelligence, could grow into an $800B market by 2024.

Meta Platforms has even changed its reporting structure to include a segment called “Reality Labs” in its disclosures which consolidates its activities in the metaverse. The metaverse is a connection of virtual worlds where consumers can engage online in virtual reality social spaces, and Meta Platforms needs high-performance chips to support the development and use of virtual reality apps. A large part of Meta Platforms’ top-line growth going forward is likely to come from its Horizon World’s VR platform through which the company plans to take a 50% cut from virtual asset sales. Until FY 2025, it is expected that virtual world spending will double to $400B, with the majority coming from in-game purchases.

Grayscale Research

With user growth slowing at Meta Platforms’ social media platform Facebook, it needs a partner that can help develop a foundation for the next growth frontier, the metaverse… and AMD could play a critical role in doing this. Specifically, AMD’s acquisition of Xilinx has created an opportunity for AMD to support the creation of a metaverse-ready infrastructure that will set the foundation for Meta Platforms’ growth going forward. AMD’s RF chip Xilinx Zynq UltraScale+ RF SoC, for example, has been selected as a key chip for Meta’s Evenstar program, which is meant to accelerate the adoption of open radio access networks/RANs. RANs are critical to expanding 4G/5G global mobile network infrastructure, and AMD’s expanded product portfolio, through the acquisition of Xilinx, could be critical in powering not only Meta Platforms’ growth, but its own as well.

Earnings risk and relative valuation

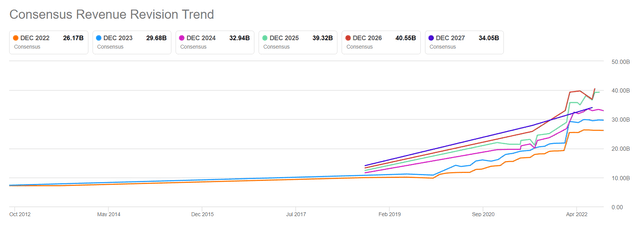

Due to AMD’s 53% decline in the price of its shares this year, AMD has a much better risk profile than at the beginning of the year, despite slowing revenue growth. AMD’s revenue estimates have fallen lately, in part because of a lighter revenue outlook for AMD’s third-quarter. In the last 90 days, there were 24 downward revisions and 8 upward revisions for AMD’s forward annual revenue estimates. The trend clearly indicates that the market expects slowing overall top line growth.

Seeking Alpha: Revenue Estimates

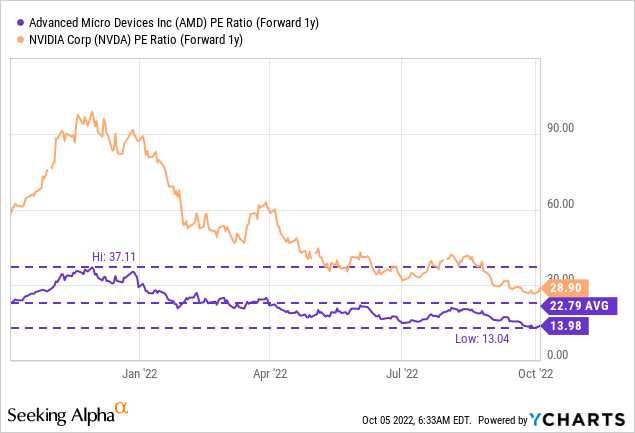

AMD is expected to generated $4.35 in EPS this year and $4.88 next year, which implies a current P/E ratio of 14 X… which is very close to AMD’s 1-year low. Relative to Nvidia, I believe AMD is the much better investment in the chip industry… not only because of the lower valuation based off of earnings, but also because Nvidia has more exposure to the decelerating GPU market than AMD. AMD trades — despite lowered EPS estimates — well below its 1-year average P/E ratio of 23 X.

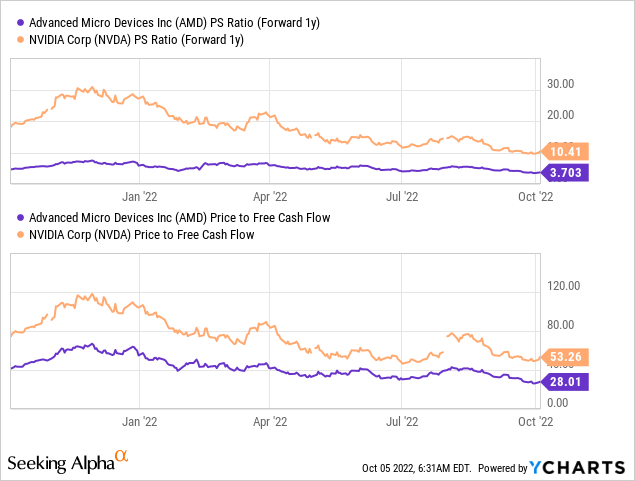

Based off of sales and free cash flow, AMD is also a much better deal than Nvidia: AMD has a P/S ratio of just 3.7 X, while Nvidia’s P/S ratio is almost three times higher. AMD may also grow much faster in the future than Nvidia due to the recently completed acquisitions of Pensando and Xilinx, which greatly strengthen AMD’s Data Center capabilities. Last but not least: Nvidia issued a very weak forecast for FQ3’23 due to its heavy reliance on graphics cards.

Risks with AMD

AMD projected $6.7B in revenues +/- $200M for the third-quarter, implying 55% year over year growth which is still impressive. Considering that AMD grew 70% in the second-quarter, AMD’s growth is slowing, however, which could pressure the firm’s valuation factor going forward. Intel and Nvidia effectively warned of weaker growth due to the decline in PC shipments and GPU sales in 2022, which may result in lower gross margins in the chip industry as a whole. Weaker gross margins may further pressure AMD’s valuation factor and lead to lower earnings estimates as a result.

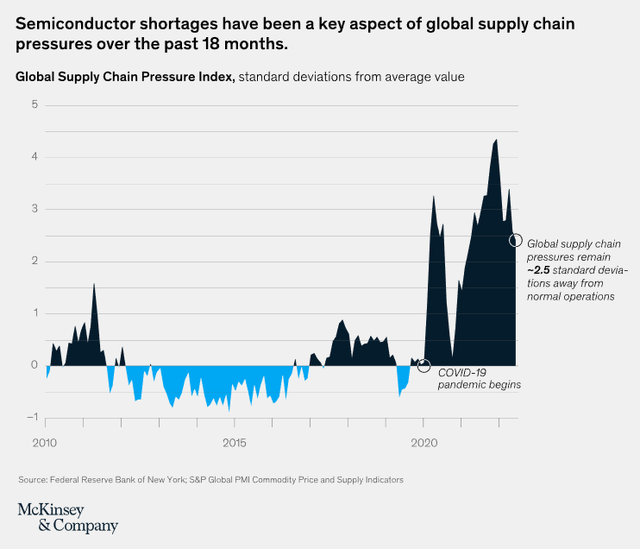

A global economic recession and inflation obviously represent significant risks for AMD and other chip manufacturers if weakening product demand translates to weaker pricing of PC and laptop components. The U.S. is already “unofficially” in a recession, and pricing strength in the GPU market already has eroded compared to last year. I also see continual risks with the supply chain, which, according to McKinsey, is still disrupted due to the global COVID-19 pandemic. While AMD faces a set of risks, I believe the low valuation strongly suggests upside potential.

Final thoughts

Pricing AMD’s growth at a 13 X P/E ratio is irrational, and I have acquired shares of AMD quite aggressively in the last few days. AMD has launched new Ryzen processors which could be a strong catalyst for AMD’s fourth-quarter revenues. The new generation of 5nm gaming processors promises significant performance improvements over prior-gen processors, and AMD may kick off a new upgrade cycle with its newest Ryzen 7000 Series as well as new Radeon graphics cards. AMD also continues to benefit from Intel’s problems with its own server processors. Because shares of AMD are cheap — given the firm’s long-term potential and connection to the metaverse opportunity — I believe investors may want to be greedy as long as the market appears to be fearful!

Be the first to comment