miodrag ignjatovic/E+ via Getty Images Vericel

“Only buy something that you’d be perfectly happy to hold if the market shut down for 10 years.” – Warren Buffett

In biotech investing, you should not let a negative binary event – say, a complete response letter (i.e., CRL) from the FDA – scare you out of a highly promising growth stock. In light of such a negative event, you should analyze its impact on the investment fundamental. If the impacted asset contributes to less than 25% of the value/revenues of the stock, you shouldn’t worry about it. After all, that seems to be a “market overreaction”.

As you can see, Vericel Corporation (NASDAQ:VCEL) shares tumbled after the FDA issued a CRL for its burn franchise (NexoBrid) last year. Nevertheless, all other assets (i.e., the majority value) of the company are experiencing robust fundamental improvement. As such, you should consider averaging down on Vericel. In this research, I’ll feature a fundamental analysis of Vericel and provide my expectation on this growth equity.

Figure 1: Vericel chart

About The Company

As usual, I’ll deliver a brief overview of the company for new investors. If you are already familiar with the firm, I recommend that you skip to the next section. I noted in the prior research,

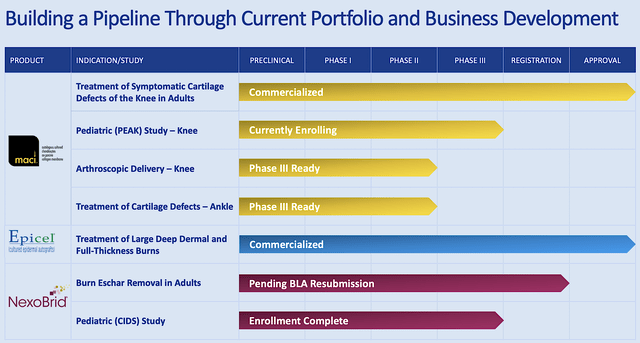

Headquartered in Cambridge, Massachusetts, Vericel is a leader in advanced cellular therapies for regenerative medicine and severe burns. As shown below, the company is brewing a pipeline of autologous cellular therapies – via either the infusion, injection, or transplantation – of the patient’s manufactured whole cells (for damaged tissues and organ regeneration).

Figure 2: Therapeutic pipeline

Leveraging The Strong Industry Tailwind

As you know, people are living longer nowadays. Consequently, there are more wear and tear on your joints, particularly on the ankles and knees. A company like Vericel that delivers innovative solutions for knees/ankle repair would enjoy the robust industry tailwind. To capture lucrative profits in this niche, Vericel is advancing stellar therapeutics for two specific business segments. They include the sports medicine and burn franchises. Notably, the crown jewel Maci is servicing the sports medicine division. As an autologous culture chondrocytes growing on a collagen membrane, Maci is utilized by surgeons to repair cartilage defects in adult’s knees.

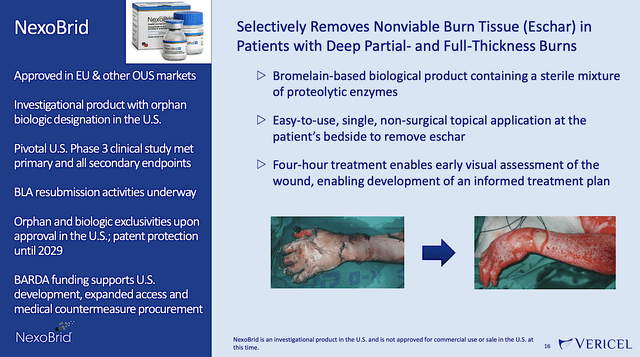

The severe burn care business is backed by two intriguing therapeutics: Epicel and NexoBrid. Accordingly, Epicel is a permanent skin replacement for full-thickness burns of at least 30% of total body surface area. As for NexoBrid, it is in-licensed from MediWound for North America rights. Vericel has luck with NexoBrid in Europe because it is already commercialized in the EU. Despite getting a no from the US FDA, the company is poised to resubmit their application to conquer the North America market.

Figure 3: Business lines

Strong Market Performance

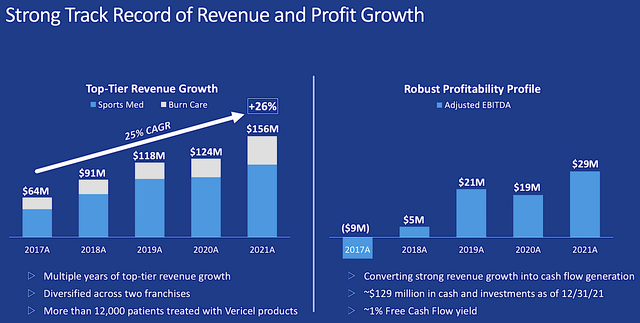

Shifting gears, you should analyze Vericel’s specific performance. Viewing the figure below, the revenues for both the Sports medicine and burn businesses have been increasing robustly since 2017. Jumped from $64M in 2017 to $156M in 2021, Vericel posted a 25% CAGR in revenue.

Catalyzing the aforesaid growth is Maci, which has been demonstrating substantial growth since launch. And, that’s due to its key advantages. For instance, Maci’s application entails a much simpler and less invasive procedure. Moreover, it has a good reimbursement profile. Furthermore, there is a broad label with strong clinical data.

Figure 4: Strong track records of sales growth

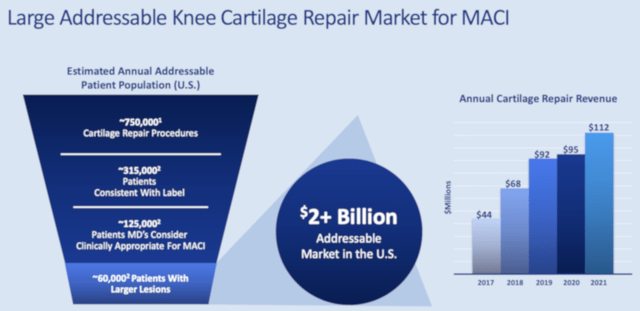

Aside from the aforesaid advantages, there is a large addressable market for Maci. You can see from the figure below that Maci can capture the +$2B market for knee cartilage repair. As you know, Maci is also being assessed in a Phase 3 study for ankle repair. If approved in the future (and I believe it will be approved), Maci can quickly capture more of that market and thereby leaps in sales.

Of note, research estimated there are 165K ankle resurfacing procedures. Of that figure, 66K would be considered by physicians as appropriate for Maci. Taken all together, you’re looking at another $700M added to Maci’s market for a total of $3B.

Figure 5: Total addressable market for Maci

Burn Franchise

As you can appreciate, Epicel is the only FDA-approved permanent skin replacement for adults and pediatric with full-thickness burns. Therefore, Epicel serves as an important treatment option for severe burn patients where little skin is available for autograft (i.e., graft using the patient’s own skin).

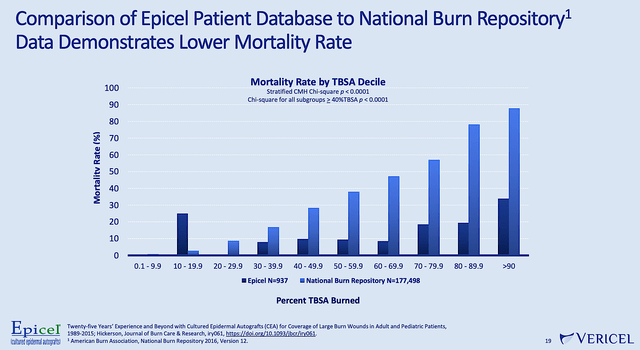

Sadly, there is a higher death rate in patients afflicted by large surface area burns due to an increased risk of infection. From the figure below, you can clearly see that Epicel treatment substantially reduced the risk of death for patients.

Figure 6: Epicel efficacy

Now, the hanging albatross is NexoBrid. Back in June last year, Vericel disclosed that the company and its partner (MediWound) received a CRL of NexoBrid from the FDA. That was the event that caused Vericel shares to drop precipitously. A sharp downtrend occurred in the ensuing months. According to Vericel,

The FDA communicated to MediWound that it had completed its review of the BLA, as amended, and has determined that it cannot approve the BLA in its present form. The FDA identified issues related to the Chemistry, Manufacturing and Controls (i.e., CMC) section of the BLA and requested that MediWound provide additional CMC information. The FDA stated that it has not reviewed several amendments submitted by MediWound in response to the CMC information requests for this action. The FDA also stated that inspections of manufacturing facilities in Israel and Taiwan are required before the BLA can be approved, but that it was unable to conduct the required inspections during the current review cycle due to COVID-related travel restrictions. In addition, the CRL referenced observations that were made during good clinical practice inspections related to the DETECT study and requested that MediWound address questions regarding the impact of the observations on the study’s efficacy findings. The FDA also requested that MediWound provide a safety update as part of its BLA resubmission.

Figure 7: NexoBrid overview

With NexoBrid approved in Europe, there is a high likelihood that this CRL would be alleviated. In other words, resubmission would yield a positive outcome. Notably, the CRL relates to CMC which can be fixed without having to run a new trial. Now, Vericel stated in the Fiscal 2021 report that the resubmission is underway. Leveraging my Integrated system of forecasting, I ascribed a 65% (i.e., more than favorable) chance of approval. I based my rationale on my forecasting experience over the year, Europe approval, and available data.

From figure 4, you can see that the burn franchise comprises of roughly 25% of Vericel’s total business operations. Hence, you can bet that NexoBrid alone is much less than 25%. In case of non-approval after resubmission, NexoBrid should be a non-significant contributor to Vericel’s fundamentals.

Competitor Landscape

Regarding competition, Vericel goes toes-to-toes with other cellular therapy innovators that are catering to the regenerative medicine market. In recent years, mesenchymal stem cells have been found to deliver robust results for burns. And, those stem cells treatments work synergistically with hyperbaric (oxygen) therapy.

Asides from the novel cellular therapies, Vericel’s therapeutics (Maci, Epicel, and NexoBrid) compete with established procedures/conventional treatments. Due to the novelty and superior efficacy of Epicel, it will trump the competition. Maci is also increasingly widely accepted by the market to give it a brand moat. In other words, its strong brand gives Maci an edge over competitors.

Financial Assessment

Just as you would get an annual physical for your well-being, it’s important to check the financial health of your stock. For instance, your health is affected by “blood flow” as your stock’s viability is dependent on the “cash flow.” With that in mind, I’ll analyze the 4Q2021 earnings report for the period that concluded on December 31.

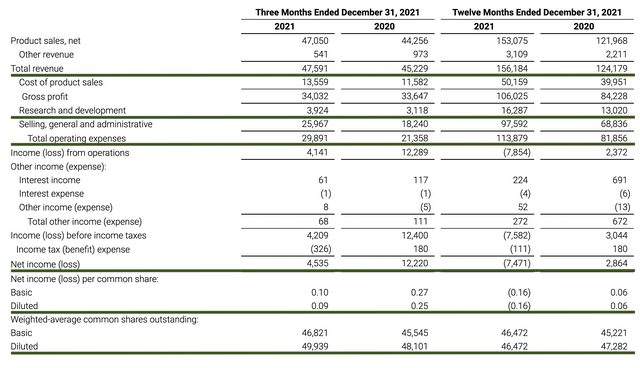

As follows, Vericel procured $47.5M for the quarter compared to $45.2M for the same period a year prior. On an annual basis, the revenues registered at $156.1M versus $124.9M for the respective Fiscal 2021 and Fiscal 2020. Therefore, the annual product sales increased at the 24.9% year-over-year (YOY) clip.

That aside, the research and development (R&D) for the corresponding quarters tallied at $3.9M and $3.1M. I view the 25.8% R&D increase positively because the capital invested today can turn into blockbuster profits tomorrow. After all, you have to plant a tree to enjoy its fruits.

Additionally, there were $4.5M ($0.09 per share) net loss versus $12.2M ($0.25 per share) net decline for the same comparison. On a per-share basis, the bottom line appreciated by 177.7%. It’s a great sign for a revenue-generating company like Vericel to improve its bottom line. Typically, that means the management is conservative in its spending.

Figure 8: Key financial metrics

About the balance sheet, there were $129M in cash and investment. Against the $29.8M quarterly OpEx, there should be adequate capital to fund operations into 4Q2022. Simply put, the cash position is adequate compared to the burn rate.

While on the balance sheet, you should check to see if Vericel is a “serial diluter.” After all, a company that is serially diluted will render your investment essentially worthless. Given that the shares outstanding increased from 48.1M to 49.9M, my math reveals an 3.7% annual dilution. At this rate, Vericel easily cleared my 30% cut-off for a profitable investment.

Valuation Analysis

It’s important that you appraise Vericel to determine how much your shares are truly worth. Before running our figure, I liked to share with you the following:

Wall Street analysts typically employ a valuation method coined Discount Cash Flows (i.e., DCF). This valuation model follows a simple plug-and-chug approach. That aside, there are other valuation techniques such as price/sales and price/earnings. Now, there is no such thing as a right or wrong approach. The most important thing is to make sure you use the right technique for the appropriate type of stocks.

Given that developmental-stage biotech has yet to generate any revenues, I steer away from using DCF because it is most applicable for blue-chip equities. For developmental biotech, I leverage the combinations of both qualitative and quantitative variables. That is to say, I take into account the quality of the drug, comparative market analysis, chances of clinical trial success, and potential market penetration. For a medical diagnostic device, I focus on market penetration and sales. Qualitatively, I rely heavily on my intuition and forecasting experience over the decades.

|

Molecules and franchises |

Market potential and penetration |

Net earnings based on a 25% margin |

PT based on 49.9M shares outstanding and 10 P/E |

“PT of the part” after appropriate discount |

|

Sports Medicine business with Maci |

$2B (estimated on the $3B addressable market with the 25% GAGR) | $500M | $100.20 | $90.18 (10% discount because Maci is already approved and generating increasing sales) |

| Burn franchise with Epicel and NexoBrid | $100M (estimated from the $400M composite addressable market) | $25M | $5.01 | $4.50 (10% discount because both are already in commercialization) |

|

The Sum of The Parts |

$94.68 |

Figure 9: Valuation analysis (Source: Dr. Tran BioSci)

Potential Risks

Since investment research is an imperfect science, there are always risks associated with your stock regardless of its fundamental strength. At this point in its growth cycle, the main risk (from a market sentiment viewpoint) for Vericel is whether the company/Mediwound can gain approval for NexoBrid at resubmission.

The other more pertinent fundamental risk is if the company can continue to ramp up sales of Maci and Epicel. Though sales are gaining traction, it’s still difficult for a small grower to fully unlock the value of their medicine. As a young growth company, Vericel might grow too aggressively and thereby run into the potential cash flow constraint.

Conclusion

All in all, I maintain my strong buy recommendation on Vericel with a 4.8 out of 5 stars rating. Despite the minor setback with NexoBrid, the market viewed the CRL as Mount Everest. As such, I believe the massive sell-off was indeed a market overreaction. The current biotech bear market also added further fuel to the fire. Contrary to the negative market sentiment, Vericel fundamentals are stronger than ever. Specifically, the Sports Medicine franchise (i.e., Maci) is enjoying the robust industry tailwind that manifested as substantial revenue improvement. Riding the potential approval for ankle repair in the near future, you can expect that Maci’s sales will post a leaping growth. As for the burn segment, Epicel continues to increase sales traction while Vericel is positioning NexoBrid for approval. Looking ahead, you can expect that the share price will rally to match the stock’s intrinsic value.

Be the first to comment