OpenRangeStock/iStock via Getty Images

Investment Thesis

Verano Holdings Corp. (OTCQX:VRNOF) is a vertically integrated cannabis producer in the U.S. VRNOF is a top-5 cannabis retailer by revenue and has been profitable since going public, with one of the highest gross margins in the sector at 54%.

On top of having a good strategy in Mergers and Acquisitions (M&A), VRNOF is capable of self-funding capex with its estimated $40m a year of Free Cash Flow (FCF). VRNOF is experiencing explosive growth with 223% year-over-year revenue growth driven by acquisitions and mergers and, to a lesser extent, organic growth. The company should benefit if federal legalization occurs and as additional states legalize recreational cannabis.

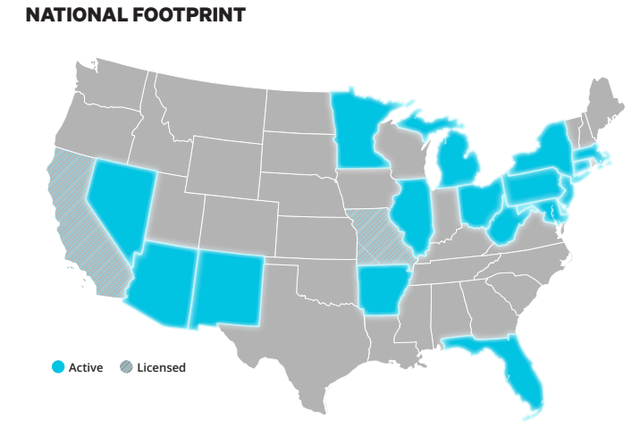

The existing operations of VRNOF include 18 licenses, with 16 in active use across 15 production facilities and 115 retail locations. Even with lockdowns ending, store traffic increased 12%, with same-store growth of 4.5% year over year. Solid organic growth.

73% of VRNOF’s revenue comes from its own stores and only 27% from wholesale.

|

Verano Holdings |

E2022 |

E2023 |

E2024 |

|

Price-to-Earnings |

7.6 |

6.6 |

5.3 |

|

Price-to-Sales |

2.4 |

1.8 |

1.6 |

|

EV/EBITDA |

6.5 |

4.8 |

4.3 |

Operational Expansion

|

State |

Status |

Dispensaries |

Cultivation (thousands of square feet (SQFT) |

|

Illinois |

Legal |

10 |

192 |

|

Florida |

Medical |

46 |

220 |

|

Arizona |

Legal |

6 |

62 |

|

New Jersey |

Medical (Transitioning to recreational) |

3 |

120 |

|

Pennsylvania |

Medical |

13 |

62 |

|

Ohio |

Medical |

5 |

22 |

|

Nevada |

Legal |

5 |

52 |

|

Maryland |

Medical |

4 |

38 |

|

New York |

Medical (Transitioning to recreational) |

4 |

64 |

|

Connecticut |

Legal |

2 |

217 |

|

Minnesota |

Medical |

8 |

87 |

|

Massachusetts |

Legal |

2 |

26 |

|

Michigan |

Legal |

1 |

None |

|

New Mexico |

Medical (transitioning to recreational) |

4 |

19 |

|

Arkansas |

Medical |

1 |

0 |

|

West Virginia |

Medical |

1 (6 planned) |

40 |

|

Other Business |

|||

|

California |

Legal |

Majority share in pesticide remediation operation |

|

|

Missouri |

Medical |

Unused license for a dispensary |

|

Expansion for VRNOF mostly includes strategic M&A, with 14 acquisitions since it went public in February 2021. This expanded access to a Florida vertical license, entrance into Connecticut, New York, Minnesota, New Mexico, Pennsylvania, Arizona, and Ohio.

Of the 60 dispensaries opened in 2021, 29 were organically added, and 31 were added through M&A. This brings the total addressable market in their retail footprint to over 150 million Americans if you include both recreational and medicinal. In addition, the total cultivation space is over 1 million sqft.

Changing Regulatory Landscape

To opportunistically prepare for recreational legalization in Pennsylvania and Florida, VRNOF has expanded cultivation capacity preemptively: thus, leveraging its already existing medical cannabis operations in those two states

This follows a similar expansion strategy in states like NJ, NY, CT, and NM before legalizing adult recreational use.

Cannabis remains federally illegal and is a Schedule I controlled substance. There is currently a wide push by congressional Democrats to extend traditional banking and credit to cannabis companies that have historically been shut out, as cannabis is still a criminal activity on the Federal statutes. Over time, we expect the Biden administration to legalize cannabis at the federal level or move it from a Schedule I to a Schedule III controlled substance. If either of these were to occur, it would reduce the tax and regulatory burden and greatly increase revenue – causing customer growth to explode. Recently the IRS and Treasury Department have begun to change their stance on cannabis companies, releasing several reports and guidance measures for those operating within the industry. However, the IRS has not extended the various tax benefits other businesses enjoy to cannabis companies.

Even without federal decriminalization, Florida will likely see recreational cannabis on the ballot in 2022, with Pennsylvania positioned to soon join the Northeast in recreational legalization. Connecticut and New Jersey were the most recent NE states opening in early 2022. In addition, there is significant momentum in the legalization of cannabis for both medical and recreational uses across the United States, with Arizona and New York both recreationally legalizing early in 2021. There remains some uncertainty over the 5-year investment horizon, but there is plenty of room for the cannabis industry to grow throughout the United States. Across both legal and illegal cannabis markets, there is an estimated $100 billion in addressable market. We are hopeful that most of the illegal market will change to legal over the next 5-7 years.

Risk

Cannabis is still federally illegal and a Schedule I drug. The cannabis industry is cash-heavy and currently does not have the same level of access to banking and credit that a traditional retail firm might. As previously mentioned, there is a renewed push to expand that access even if federal decriminalization may be out of reach. While we expect cannabis legalization to continue, a near-term risk to the stock is that federal legalization does not make any progress this year, even with the Democrats in charge of both houses and the presidency.

Conclusion

VRNOF is a good regulatory arbitrage opportunity with a low price point. It has proven that even with aggressive M&A a high level of FCF and margin is possible — coming with this is the opportunity to be a first-mover in many fledgling markets should recreational legalization come to fruition.

Be the first to comment