jetcityimage/iStock Editorial via Getty Images

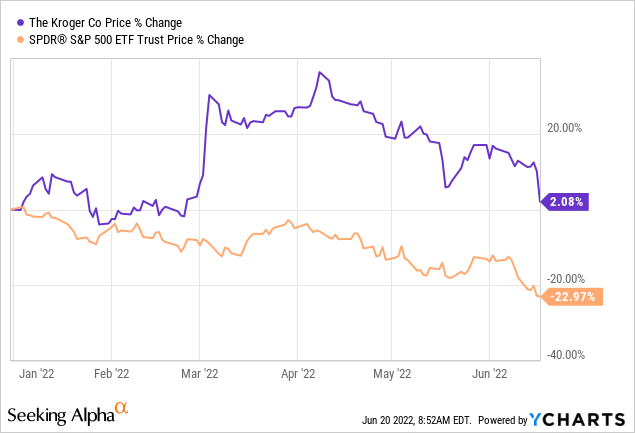

Kroger’s (NYSE:KR) share price has increased by 2% year-to-date, which might appear little, but it substantially outperformed the broader market, which has declined by more than 20% in the same time period.

In Kroger’s first quarter earnings presentation, there were several promising remarks that indicated that the firm is not likely to be significantly impacted by the current macroeconomic headwinds.

In this article, we will highlight some of the key points from the latest earnings release and discuss why the current price level could be an attractive entry point.

First quarter financials

Kroger’s sales in the first quarter have reached as much as $44.6 billion, representing a 3.8% growth compared to the year-ago quarter, excluding fuels. At the same time, the firm’s adjusted FIFO operating profit increased to $1,601 million from $1,375 million. Although the firm’s gross margin has contracted by 26 basis points to 21.6%, its operating margin has reached 3.4%, compared to the 2.0% from the year-ago quarter.

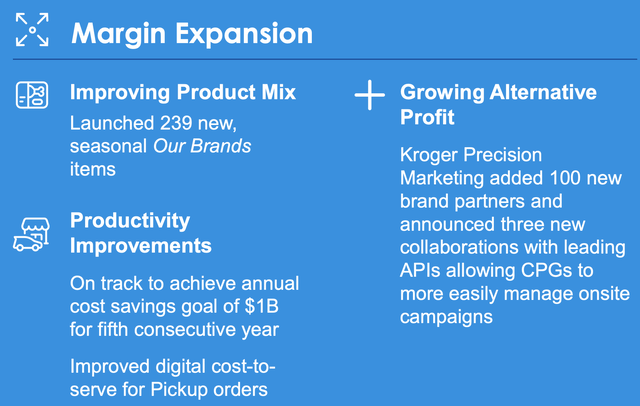

The main driver of margin expansion was the improving product mix, the productivity improvements and the growing alternative profits.

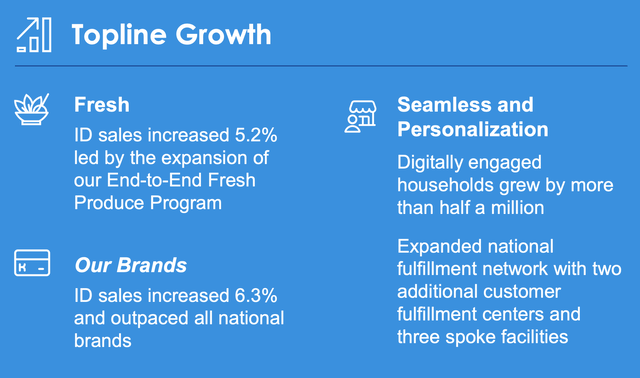

The two primary segments of growth were “Fresh” and “Our Brands”. The identical sales growth in fresh has reached 5.3%, fueled by certification of 355 new stores for the accelerated end-to-end fresh produce initiative. Also, important to point out is that Kroger has recorded its two highest single-day floral sales, further strengthening Kroger’s position as the largest floral retailer in the U.S.

The identical sales in the Our Brands segment have increased by 6.3%, fueled by the introduction of 239 new, seasonal items.

Further, the firm has also placed a significant emphasis on accelerating its digital growth, by opening two new delivery facilities and expanding its delivery network through the opening of three new spoke facilities.

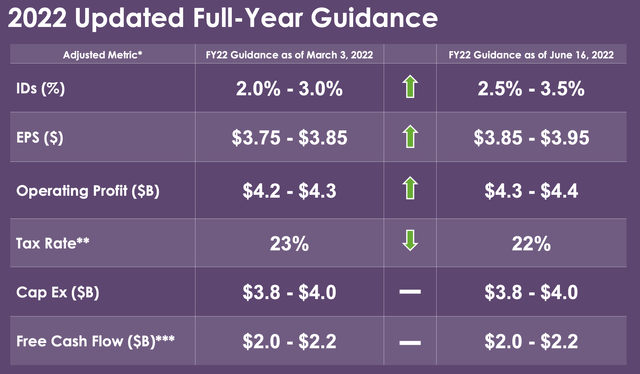

It’s important to point out that Kroger has even increased its outlook for the rest of 2022, both in terms of identical sales growth and earnings per share.

2022 Full-year guidance (Kroger)

In our opinion, Kroger’s strong first quarter financial results are proof of a well-working business model. Despite the current macroeconomic circumstances, the firm has not only achieved sales growth but also managed to expand its margins.

Dividends

Kroger has a strong track record of returning value to its shareholders in the form of dividend payments. To be precise, the firm has been paying dividends to its shareholders for 16 consecutive years, while also increasing the payments in each year.

The current quarterly dividend is $0.21 per share, resulting in a ~1.8% annual dividend yield.

Kroger’s dividend also appears to be safe and sustainable as the Dividend Payout Ratio (‘TTM’) (‘GAAP’) is about 29%, which is about in line with the firm’s 5-year historic average, while it is substantially below the consumer staples sector median of ~50%.

For these reasons, we believe that Kroger’s stock could be an attractive investment for investors looking for dividends and dividend growth.

Share buybacks

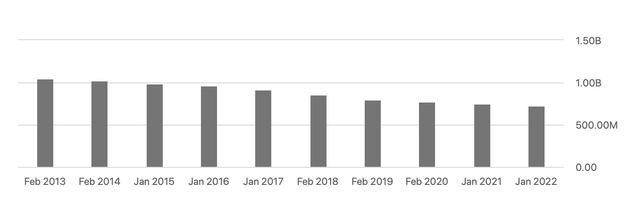

Other than dividends and capital gains, share buyback programs have also generated value for the investors over the last decade.

Shares outstanding (Seekingalpha.com)

The firm has managed to reduce its number of shares outstanding by as much as 30%.

Valuation

From a valuation point of view, based on a set of traditional price multiples, we also believe that at the current price levels Kroger’s stock could be an attractive option.

The stock is trading at a P/E multiple of 11.9x, more than 30% below the consumer staples sector median, and about in line with its own 5-year historic average. Both in terms of EV/EBITDA and P/CF, similar trends can be observed. Further, both the firm and analysts are forecasting earnings to grow throughout 2022-2024.

Due to these reasons, we believe that this discount compared to the sector median could be an attractive entry point.

Consumer confidence

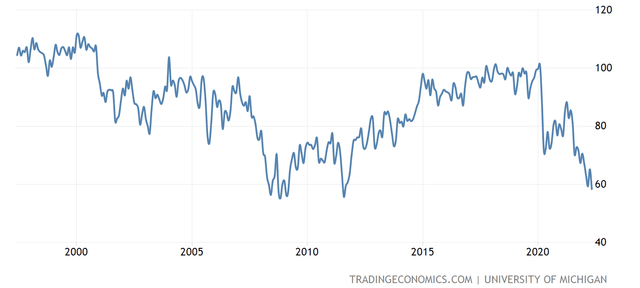

Steadily declining consumer confidence is likely to lead to a change in the spending behavior of the customers.

U.S. consumer confidence (Tradingeconomics.com)

However, this change is likely to negatively impact durable goods and discretionary items, primarily. We believe that Kroger as a food retailer in the consumer staples sector is not likely to be substantially hurt by the low consumer confidence. Further, Kroger is also a key player with strong brand recognition in the food retail industry as it is at first or second place in terms of market share in most of its markets.

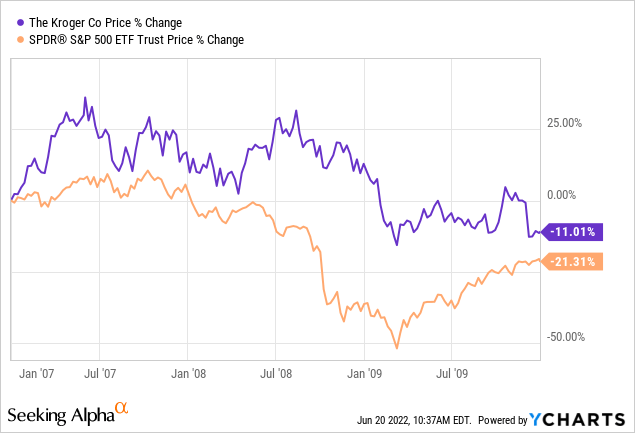

As a comparison, the following chart compares the returns of KR and SPY between 2007-2010, when the consumer confidence was relatively low in the U.S.

Although the firm’s stock lost about 11% of its value in this 3-year time frame, it outperformed the broader market by about 10%. We believe that Kroger’s stock is likely to be a safe haven also in the current volatile market environment.

ESG considerations

More and more investors are starting to pay closer attention to corporate governance, and ESG thematic investing has been gaining momentum.

Kroger has started an initiative to focus on reducing hunger and reducing waste, called Zero Hunger | Zero Waste. As a part of this initiative, the firm has given as much as $210 million in aid to help end hunger, while it has also directed 546 million meals.

They have also managed to divert as much as 79% of waste from landfills.

Be aware of potential risks

Before concluding our writing, we would like to point out one of the most crucial factors that has significantly impacted many retailers, the gasoline price.

Elevated gasoline prices

In this first quarter of 2022, due to the geopolitical tension in the Eastern European region, gas, oil, and therefore, energy prices and freight costs have skyrocketed. This has put a significant downward pressure on the margins of many firms, including some larger retailers like Target (TGT) and Walmart (WMT).

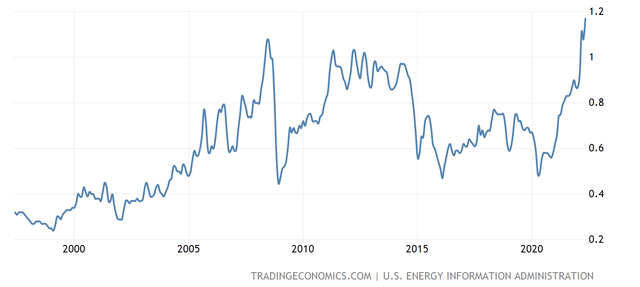

Gasoline price (USD/L) (Tradingeconomics.com)

Although Kroger’s operating margin has even expanded in the same period, we have to be aware of potential implications of elevated gasoline prices in the near term. There has been both positive and negative news concerning the energy security of Europe in the last months, therefore the uncertainty about supply, and therefore prices, in the near term remains high.

Key takeaways

Kroger has presented strong first quarter results, with mid-single-digit growth in sales and an expansion of the operating margin.

Despite the declining consumer confidence, Kroger’s business and financial performance are not likely to be hurt, as it is one of the market leaders in the food retail industry, not significantly influenced by cyclical trends.

Kroger appears to be trading at a significant discount compared to the sector median of the consumer staples sector, while it pays a safe and sustainable dividend and has a strong track record of buying back shares.

We believe Kroger is an attractive option at the current price level.

Be the first to comment