Jamakosy/iStock via Getty Images

Co-produced with “Hidden Opportunities”

Preferred stocks are a class of financial security that pays a set schedule of dividends. They combine aspects of both common stock and bonds in one security, including regular income and ownership in the company. These securities are structured to provide stable and consistent income payments like bonds while providing equity ownership advantages of common stock, including the potential for the stock to appreciate in value when bought at discounted prices. Preferreds are a must-have if you want to get more consistent dividends with higher protection for the payments.

Why do companies issue preferred shares?

Companies requiring capital sometimes choose not to use the bond market since overuse can impact their credit rating and increase borrowing costs. Secondary offerings are dilutive to shareholders and are frowned upon by value investors. By issuing preferred stock, the company can raise capital while lowering its debt-to-capital ratio and supporting (or even improving) the strength of its overall balance sheet.

Let’s talk about interest rate risk

Investors are shying away from fixed-rate preferreds because of the sentiment that CDs are paying high yields with no risk for the capital. I expect interesting discussions in the comments section for saying this, but don’t fall for these temporary high yields. The Fed is fighting above-average inflation and will bring down the rates once they get inflation down. We expect the U.S. economy to see significantly lower rates again in a couple of years, and your money market income will dry out.

if we over tighten, and we don’t want to, we want to get this exactly right, but if we over tighten, then we have the ability with our tools, which are powerful, to, as we showed at the beginning of the pandemic episode, we can support economic activity strongly if that happens, if that’s necessary – Jerome Powell

Long-term income investors should add quality preferred securities to their portfolio, especially when they are trading at attractive discounts. We have two picks with up to 8.5% yields to get you started with fixed-income investing.

Pick #1: GMRE-A, Yield 7.5%

Global Medical REIT, 7.50% Series A Cumulative Redeemable Perpetual Preferred Stock (GMRE.PA)

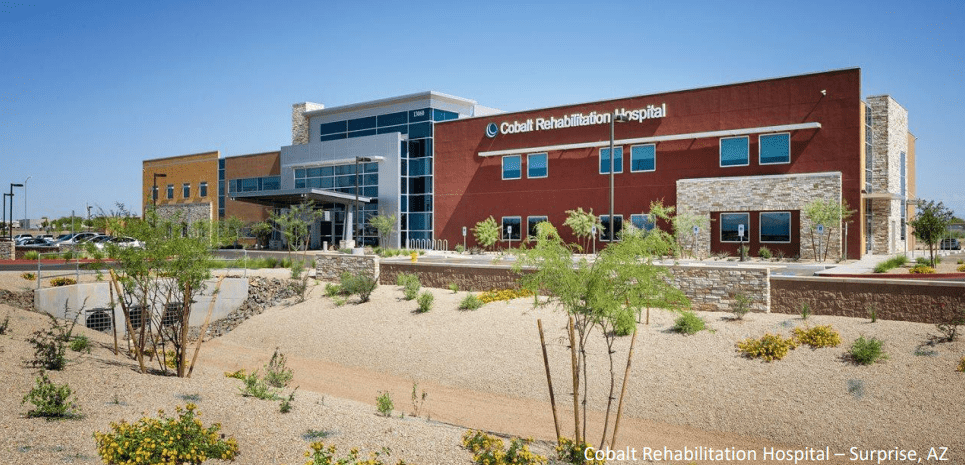

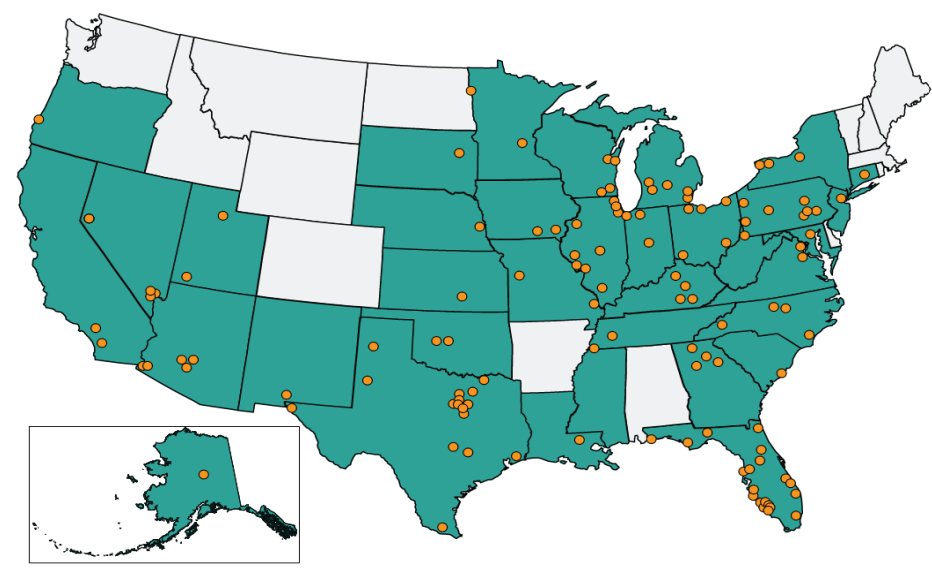

Global Medical REIT (GMRE) is a net-lease medical office real estate investment trust (‘REIT’) that acquires healthcare facilities and leases those facilities to leading healthcare systems and physician groups. The company owns 189 buildings in 35 states rented out to 269 tenants. No tenant accounts for more than 10% of the company’s revenues. (Source: GMRE Sept 2022 Investor Presentation)

GMRE Investor Presentation

Despite their name, their properties are all located in the U.S.

GMRE Investor Presentation

The REIT’s leases carry a 2.1% average rent escalation, providing a cushion under long-term inflation pressures. At the end of September 2022, the company reported a 96.8% portfolio occupancy and a healthy rent coverage ratio of 4.7x.

Being a landlord of clinics and hospitals, GMRE’s business is well-protected from recession pressures since medical ailments don’t differentiate between good and bad economies. During this bear market, many companies are laying off staff and rethinking their growth ventures; GMRE is opportunistically growing. The REIT completed five acquisitions, encompassing an aggregate 247,346 leasable sq ft, for an aggregate purchase price of $50.8 million at a weighted average cap rate of 7.1%. Notably, the company has completed 14 acquisitions YTD at a weighted average cap rate of 7.2%.

From a debt perspective, GMRE maintains a healthy balance sheet, with its debt carrying a weighted average interest rate of 3.9% and a weighted average remaining term of 4.2 years. Approximately 80% of the debt is fixed-rate ($558.4 million), with a weighted average interest rate of 3.75%. The company has employed several forward swap structures that bring the weighted average interest rate on fixed debt to decrease to approximately 3.67% in 2023, 3.50% in 2024, and 3.43% in 2025. (Source: GMRE website)

GMRE Website

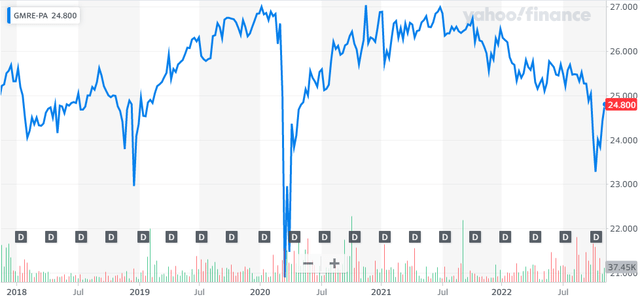

GMRE is executing well and growing its portfolio. But we see a tremendous fixed-income opportunity in its attractively priced preferred – GMRE-A. In the five years of the security’s existence, there are rare moments where it traded below the $25 par value.

Yahoo Finance

Today, GMRE-A trades at a slight discount to par value and carries an attractive 7.5% yield. Notably, GMRE-A is trading post its call date. Given the current interest rate environment, we do not expect GMRE to redeem the preferred. As a result, we can build positions slowly and hold for a long time, collecting dividends.

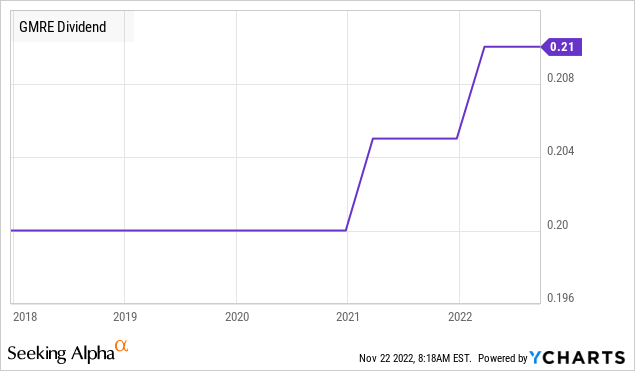

GMRE-A is a cumulative preferred, meaning that the preferred dividends must be paid in full before common shareholders can receive any dividends. This is particularly good in the case of GMRE-A since the common share dividends have been showing a growth trajectory in the past five years. This provides a nice “cushion” for the preferred shares in a black swan event. Not that the cushion is likely to be needed, GMRE didn’t even reduce the common dividend during COVID.

GMRE spends very little on preferred dividends. During the nine months of 2022, GMRE reported approximately $75 million in Adjusted EBITDAre, which provides comfortable coverage to the $15 million in interest expenses and $4.5 million towards preferred dividends. The company’s 3.8x coverage of interest and preferred dividend payments is very favorable for preferred investors. This means the company is in little danger of defaulting on its commitments to preferred shares and debt holders, with a sizable cushion.

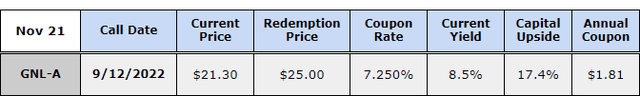

Pick #2: GNL-A, Yield 8.5%

Global Net Lease, 7.25%% Series A Cumulative Redeemable Preferred Stock (GNL.PA)

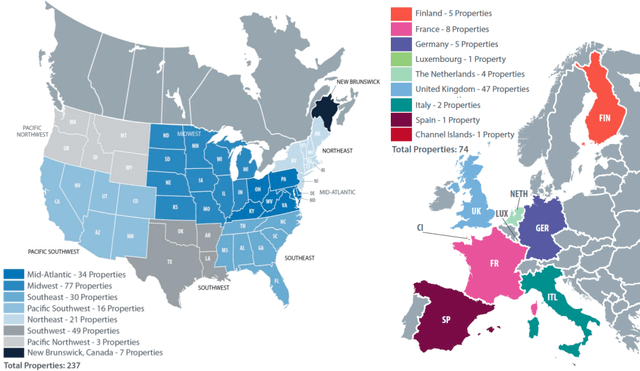

Global Net Lease (GNL) is a Real Estate Investment Trust (‘REIT’) that operates a portfolio of 237 properties in the U.S. and Canada, complemented by a 74-property Europe portfolio. The REIT operates a globally diversified portfolio of industrial and office properties leased to high-credit quality tenants under long-term, triple-net leases. At the end of Q3 2022, GNL’s tenant base was adequately diversified across 141 tenants in 51 industries. (Source)

November 2022 GNL Investor Presentation

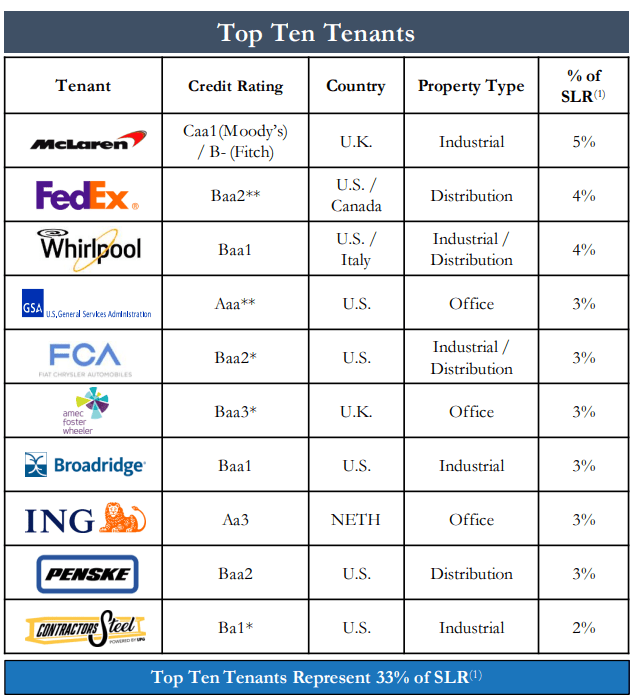

GNL maintains a high-quality net lease portfolio. 33% of GNL’s Straight-Line Rent (‘SLR’) comes from well-known tenants with varying property types that have little impact on their physical operations due to digital transformation.

November 2022 Investor Presentation

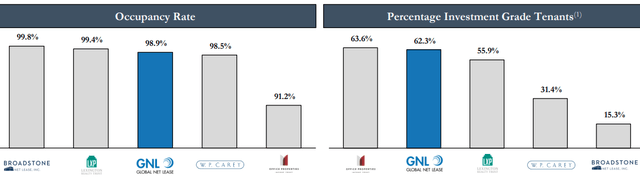

GNL maintained high rent collections through the pandemic (they reported collections at or above 97% for each quarter in 2020) and currently has a high occupancy rate of 98.9%. 62.4% of their REIT’s tenants have investment-grade ratings, and these factors put GNL at the top of its peer group of REITs.

GNL Investor Presentation

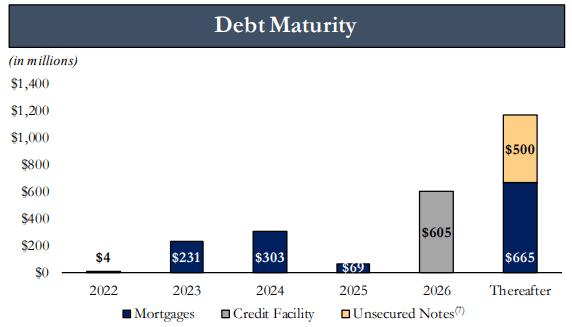

As of Q3 2022, nearly 94% of GNL’s leases featured annual rental increases, with 64% SLR-based fixed-rate, and 26% based on the Consumer Price Index (‘CPI’), respectively, making GNL’s business resilient to inflationary pressures. GNL also maintains an attractive debt schedule with staggered maturities and ~12% of its debt due in the next 14 months. Fitch Ratings has rated GNL’s senior unsecured notes BB+ with a stable outlook and projects the company’s leverage ratio to improve in coming quarters, driven by strong business execution.

November 2022 Investor Presentation

We like many things about GNL, namely its portfolio quality, diversification, and business fundamentals. While we are risk averse to its total leverage and financial engineering elements, we see significant safety with healthy upside potential and high yields through the GNL-A preferred shares, which ranks above common equity on the capital ladder as the preferred security. Moreover, this security is cumulative, meaning missed payments will automatically pause GNL common dividends until the preferred holders are compensated for all missed distributions.

GNL-A trades at a ~15% discount to par and carries an attractive 8.5% yield. Note that GNL-A is trading post-call date, meaning the REIT can redeem the securities anytime (with 30-60 days’ notice) and investors would immediately realize the capital upside. However, we don’t anticipate this redemption in the near term as the preferreds don’t cost the REIT much annually and they have better use for capital at this time.

GNL reported $128 million in cash on its balance sheet at the end of Q3. The REIT spends ~18 million annually on preferred dividends and $23.5 million on interest expenses. With FY 2021 AFFO of $173 million and YTD AFFO of $130 million, it is safe to say that the debt interest and preferred dividends are adequately covered by GNL’s cash position and the operating income.

Notably, the Q3 AFFO covered the REIT’s $41 million common dividend. This common dividend coverage is a bonus for the preferred shareholders, and the more consistent this coverage remains in subsequent quarters, the closer to the $25 par value GNL-A will move towards.

Conclusion

The market cap for preferred securities is much smaller than that of common stocks; therefore, this market is not as liquid. The size of the preferred stock market is around $270 billion, according to the S&P Dow Jones Indices, in contrast with the $46.5 trillion U.S. equities market.

At HDO, we maintain an extensive portfolio of ~50 preferred securities with a ~9% average yield. Some of these picks are fixed-rate, while others are rate-reset type and floating-rate preferred. Together, the objective is to ensure sustainable income during good and bad times and help retirees beat the long-term effects of inflation on their quality of life. Due to their low volume and small market caps, we only discuss a few of our picks in public articles.

Mr. Market is looking away from fixed-income securities due to a perception that there are risk-free alternatives. Make no mistake, the risk in those “risk-free” securities is their prices also fall. A Treasury Bond is only risk-free if you intend on holding it to maturity. Selling before maturity could result in a lower return or even a loss. Preferred equities can provide dramatically higher income in exchange for taking on a modest amount of risk.

It is critical to diversify your income stream to ensure reliability during good and bad economies. Two preferred stocks with up to 8.5% yield to help you protect your income stream from economic fluctuations.

Be the first to comment