Brandon Bell/Getty Images News

Arcos Dorados Holdings Inc. (NYSE:ARCO) is the world’s largest McDonald’s franchisee. This is determined by counting the number of restaurants and the total system-wide sales. The company owns and operates McDonald’s franchise restaurants in 20 countries in Latin America and the Caribbean. This accounts for 6.7% of McDonalds franchises globally. In addition to being a large, recognizable chain, the company also employs over 94,000 people, serving as one of the leading employers for young and first-time job holders within the region. The company was founded in 2007 after the company’s regional managers reached an agreement to acquire the McDonald’s Corporation’s Latin-America-based business operations.

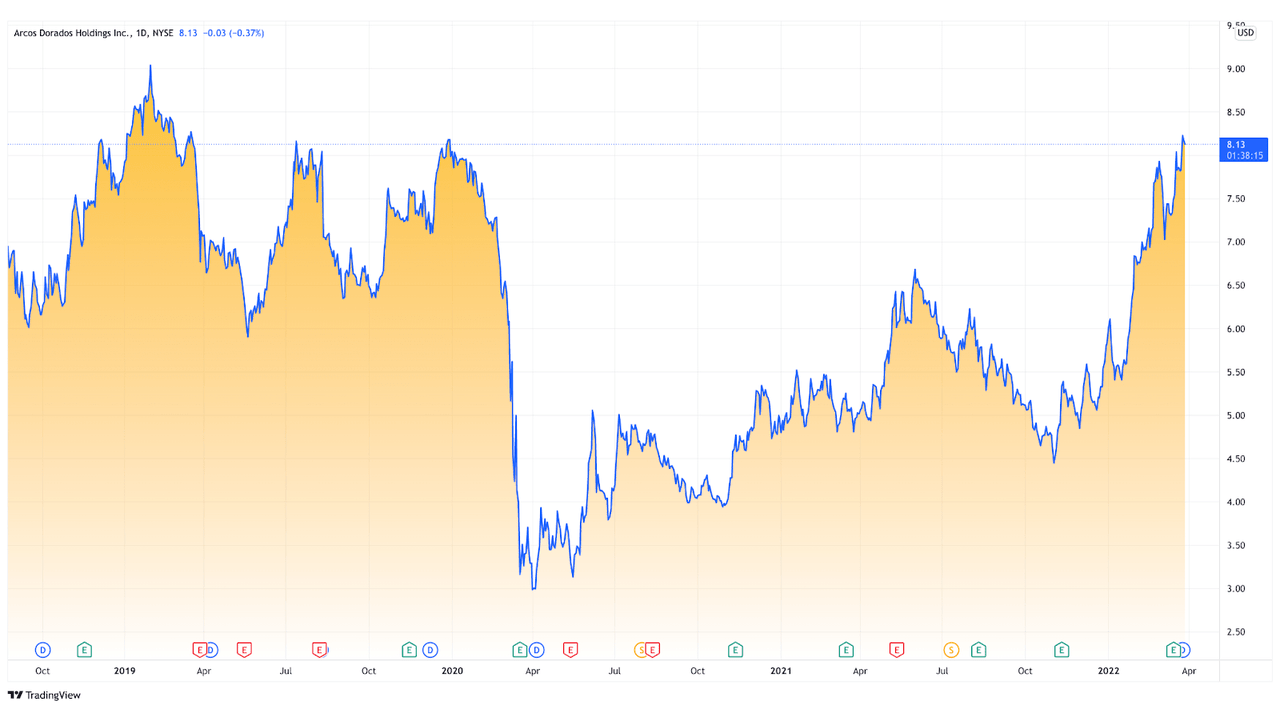

tradingview.com

In this article, I will show that despite a poor fiscal year in 2020, Arcos Dorados has a largely stable enterprise, a stable customer base, a recognizable brand, and a very bright future. The Covid-19 pandemic took a heavy toll on many industries, but the restaurant industry was one of the most affected. I believe that it is clear that this was the primary cause of the 2020 numbers reflecting a marked decline.

It is a safe bet that as the world begins to return to normal, the trends of historically stable restaurant chains linked to McDonald’s worldwide will begin to climb back to and even exceed revenues and profits from the pre-pandemic 2018-2019 years. For those reasons, I have Arcos Dorados as a solid buy, and I believe investors should pursue this stock with a bullish investment strategy.

Effects of Covid-19 on the Restaurant Industry

When the Covid-19 pandemic hit in early 2020, it drastically changed the world in a number of ways. Businesses closed down, streets remained empty, and people were largely confined to their homes in an effort to combat the spread of the deadly virus. The global health crisis impacted almost every single market in every industry. While many were forced to navigate the changing health protocols in a safe or effective manner, that was the only logistical issue they had to face.

The restaurant industry, however, faced a two-fold issue: health and safety, and supply chain disruption. These issues have had effects that have lasted far beyond just 2020 and are likely to continue to impact restaurants across the globe into 2022.

Some of the health and safety protocols mandated were common sense, such as wearing masks and gloves while handling food and keeping customers isolated by six feet. Many restaurants were forced to close their in-restaurant dining options and offer only takeout instead. In America alone, 110,000 establishments closed permanently, unable to reopen.

Fast food franchises had near immunity to this, thanks to the stability of operating a global enterprise, which allowed them to adapt quickly without drastically altering their procedures. Other health and safety protocols required more drastic changes. For example, the handling of physical menus became taboo, with many restaurants opting for online or digital menus. The McDonalds franchises, in particular, radically shifted to a self-order kiosk system that eliminated the need to have any person-to-person contact when placing an order. While this is bad in terms of the employment rate, it will likely increase the overall bottom line of the company moving forward.

Supply-chain disruption was another major issue that dragged down restaurants during the pandemic and is still causing issues to this day. Now, again, fast-food franchises were able to weather the storm a touch better than other restaurants because of company-owned centralized distribution hubs afforded to franchisees. However, certain products have been challenging to get with price fluctuations (even more so now due to the Russian invasion of Ukraine) which has led to inconsistency in inventory. This has caused some customer dissatisfaction and has likely been a contributing factor in the industry’s slow recovery.

Global Restaurant Market Overview

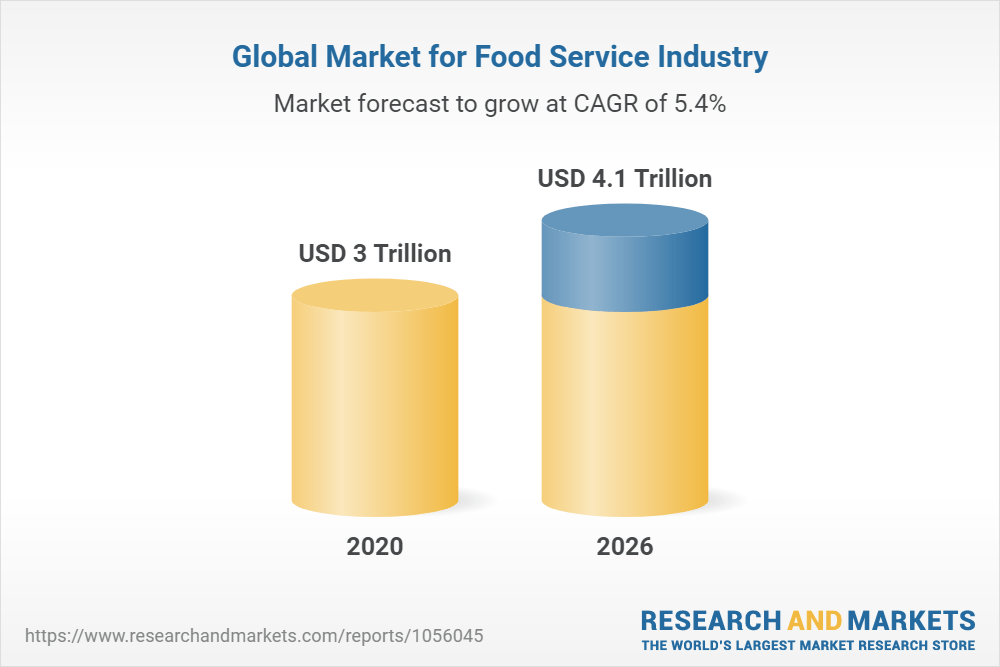

researchandmarkets.com

Following the pandemic, the global food market is expected to experience a strong rebound in 2026. In 2020 the market cap was estimated at $3 trillion. By 2026 that number is expected to rise to $4.1 trillion at a CAGR of 5.4%. The global fast-food segment of this market is expected to enjoy the greatest amount of growth. The segment currently accounts for over 28% of the global restaurant industry and is projected to grow at a robust 6.5% CAGR over the next seven years. This makes fast-food chains the most lucrative investment option in terms of future projected earning potential.

The pandemic is slowly fading out around the world, which drives the growth of this market. With infection rates dropping, many of the looming restrictions that have clamped down on restaurant earning potential have been lifted. Travel bans have been relaxed, and the world is beginning to return to a state of normalcy. Restaurants were quite popular pre-pandemic and will likely regain that popularity in the post-pandemic world. As travel and tourism recover, restaurants that survived the pandemic will see their margins steadily improve. This bodes well for the future of the market.

Financial Overview

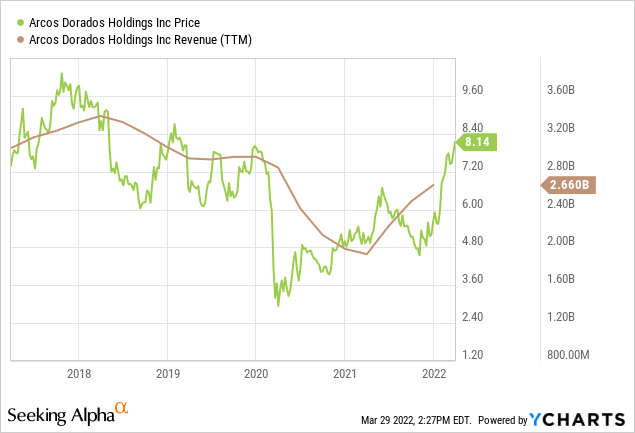

ycharts.com

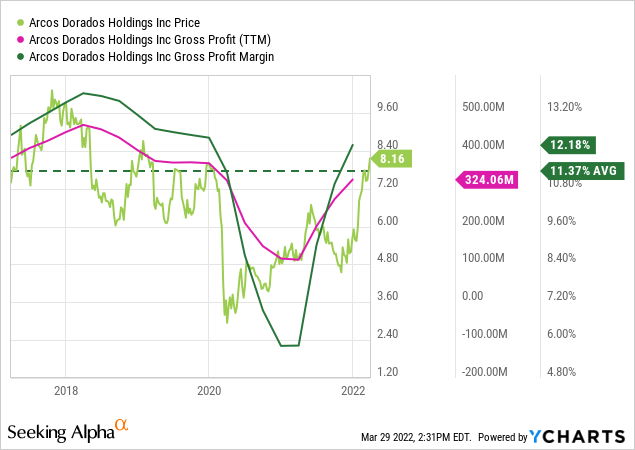

In 2021, Arcos Dorados reported revenue of nearly $2.7 billion, a significant recovery from pandemic lows. From 2017 through 2019, company revenues had stayed mostly stable, with the numbers tailing off a bit towards the end of 2019. 2020, for pandemic-related reasons, was a terrible year, and that reflects on the income statement. In 2017 the company raked in $3.3 billion in revenues. In 2018 that number decreased slightly to just under $3.1 billion. 2019 saw another slight decline to $2.95 billion, while 2020 came in with a lowly $1.98 billion in revenues. Gross profit margin also returned to around 12%, surpassing the average over the last three years. In 2021, gross profit had climbed all the way back to $324 million, about the same levels seen in the first quarter of 2020. The company posted gross profits of $1.2 billion in 2017, $1.17 billion in 2018, $1 billion in 2019, and just $639 million in 2020.

ycharts.com

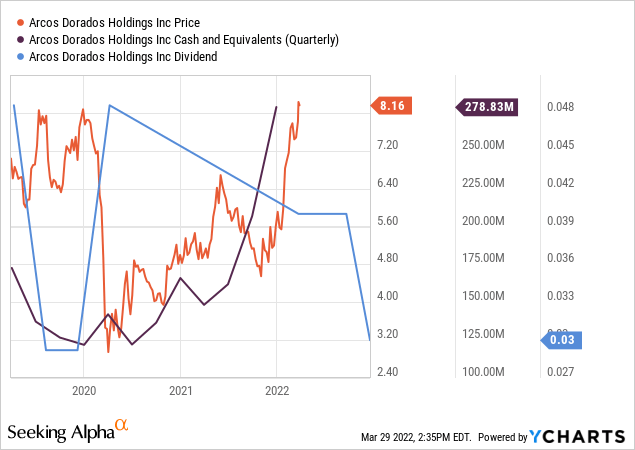

To maintain stability, the company has taken a hit in terms of cash in hand; however, recent headwinds have enabled cash and equivalents to skyrocket to nearly $280 million in 2021. In 2017 the company possessed $308 million in cash. In 2018 that number decreased to $197 million. In 2019 the number dropped again to $121 million. In 2020 however, despite the terrible revenues, the company was able to add to its cash flow totals closing the year with $167 million. While some of those cash expenditures could be chalked up to franchise expansion, it is a little unsettling to see cash reserves decline at the same time the company’s long-term debt has increased. In 2017, the company had $637 million in long-term debts. By the end of 2020, that number had ballooned to nearly $788 million.

ycharts.com

The company has done well in terms of reducing its liabilities. In 2017, the company incurred $178 million in liabilities. In 2018 that number decreased to $69 million. By 2019 that number had risen slightly to $75.5 million, but in 2020 that number plummeted to just $28.9 million.

This shows that the company is working hard to continually increase their profits margins. Given the fact that despite its debts and lack of cash flow, the company continues to generate a healthy profit, it is a safe assumption that the debt issues will be settled in due time. The fact that the Board of Directors authorized dividends to be paid to shareholders in 2022 is proof positive of a resurgence, as seen by past dividends.

Conclusion

Arcos Dorados Holdings Inc. has produced a mixed bag of financial results. However, the bottom line has remained strong and consistent over a number of years. The debt is a little concerning, but given that yearly profits generally exceed debt levels by at least a 4:1 ratio, I would say it’s a low level of concern.

The restaurant market as a whole is expected to see a substantial comeback over the next seven years, and that bodes well for the company’s future. Additionally, the fast-food segment is expected to see the highest growth rate, which is also favorable to the company. When you factor that in with a return to tourism, stable profit margins, and a dependable, recognizable brand, it points to a company that is absolutely worth investment. For those reasons, I believe investors should pursue this stick with a bullish investment strategy.

Be the first to comment