Editor’s note: Seeking Alpha is proud to welcome Bersit Research as a new contributor. It’s easy to become a Seeking Alpha contributor and earn money for your best investment ideas. Active contributors also get free access to SA Premium. Click here to find out more »

filmfoto

Veolia Environnement S.A. (OTCPK:VEOEY) recently confirmed some of the expected synergies from its transaction with Suez, and signed an agreement with a large financial group. Guidance for 2022 was also beneficial, and management already noted significant improvements – mainly in Eastern Europe. In my base case scenario, which includes conservative free cash flow generation for seven years and perhaps some additional M&A transactions, I obtained a fair valuation of $34 per share. I also observed major risks coming from climate change and new regulatory frameworks. However, I don’t believe that the downside risk is quite worrying, and I assign a buy rating for Veolia.

Company Background

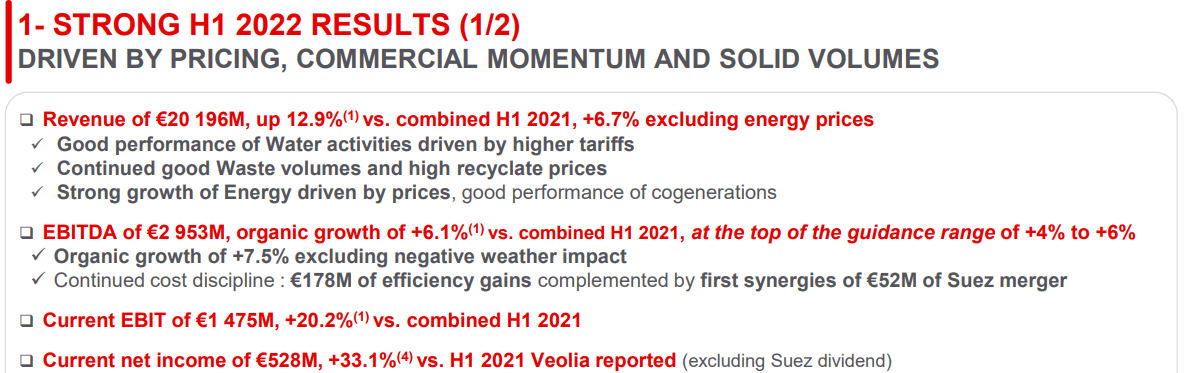

Veolia Group is an international player deploying game-changing solutions for water, waste, and energy management. After carefully reading the most recent H1 2022 presentation, I decided to conduct some research about the company’s financial figures. There are a few good reasons to do so.

Source: H1 2022 Presentation

First, Veolia is benefiting from high energy prices and good performance of energy cogeneration. High recyclate prices are also helping in this regard. If we include the fact that the first synergies from the merger with Suez (OTCPK:SZSAY) are showing up, Veolia gets even more interesting:

Veolia expects the integration of the Suez activities to generate synergies of €500m over the next four years.

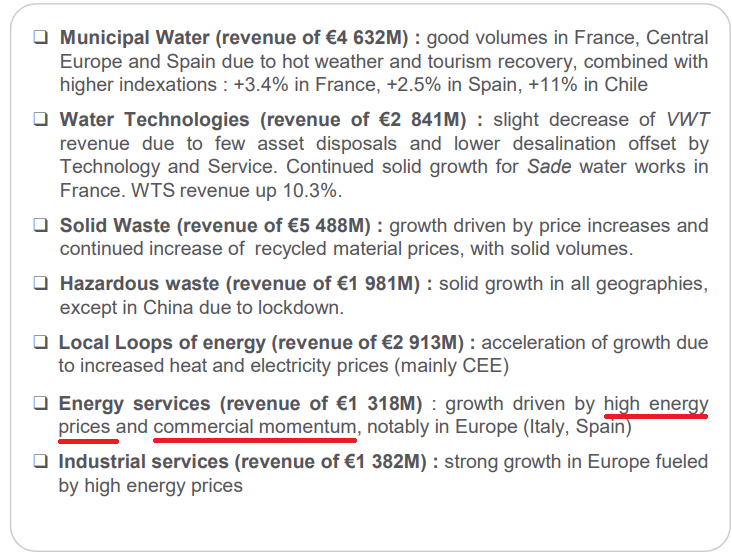

It is also worth noting that Veolia’s water business model is present in many jurisdictions, including France, Spain, many parts of Europe, and Chile. The business model is well-diversified, so revenue growth volatility, in my view, might not be that significant. If one region does not perform, Veolia could perform in other countries.

Source: H1 2022 Presentation

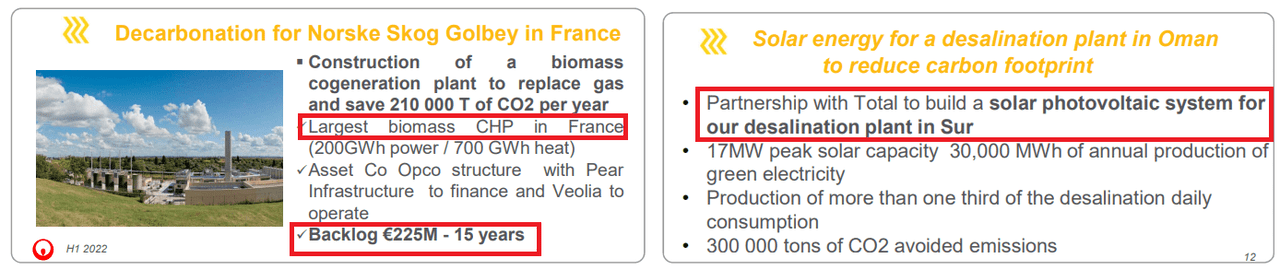

I believe that management is announcing new projects that might enhance revenue growth in the coming decade. Among several projects that have been announced, there is the construction of a biomass cogeneration plant for Norske Skog in France, which would represent a backlog of close to €15 million.

In addition, Veolia recently noted a partnership with Total (TTE) to build a solar photovoltaic system for a desalination plant in Oman. We would be talking about 300k tons of CO2 avoided emissions.

Source: H1 2022 Presentation

Finally, I believe that many market participants will likely appreciate the agreement signed with Macquarie (OTCPK:MCQEF) to sell Suez waste activities in the UK. The deal would represent close to €2.4 billion, which Veolia could use to finance other projects with larger expectations than that in the United Kingdom:

Veolia announces the execution of a unilateral put agreement whereby Macquarie Asset Management irrevocably undertakes to acquire 100% of the share capital of Suez Recycling and Recovery UK Group, regrouping Suez waste activities in the UK. The sale proceeds will amount to approximately €2.4 billion.

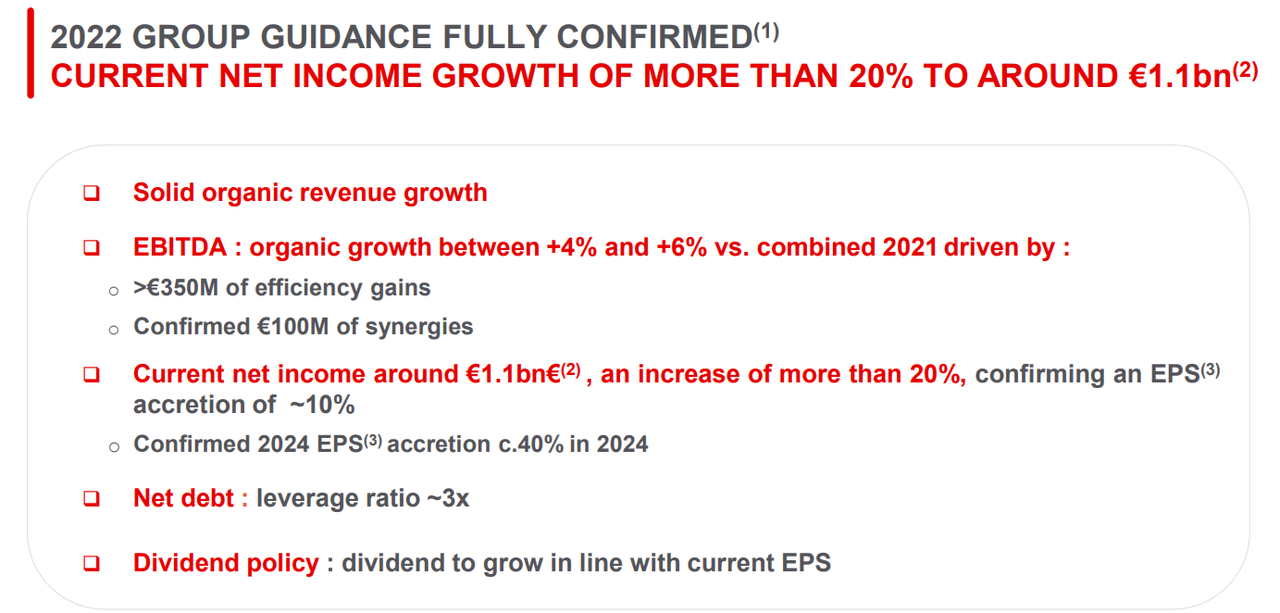

Veolia’s Guidance

Veolia’s guidance is quite positive. The company expects 2020 net income growth around 20%, close to a net income of €1.1 billion. Management also pointed out EBITDA margin efficiencies of more than €350 million and significant organic growth close to 4%-6%. In my view, if dividends continue to grow as promised, and net debt continues at close to 3x, I would say that there would exist demand for the stock.

Source: H1 2022 Presentation

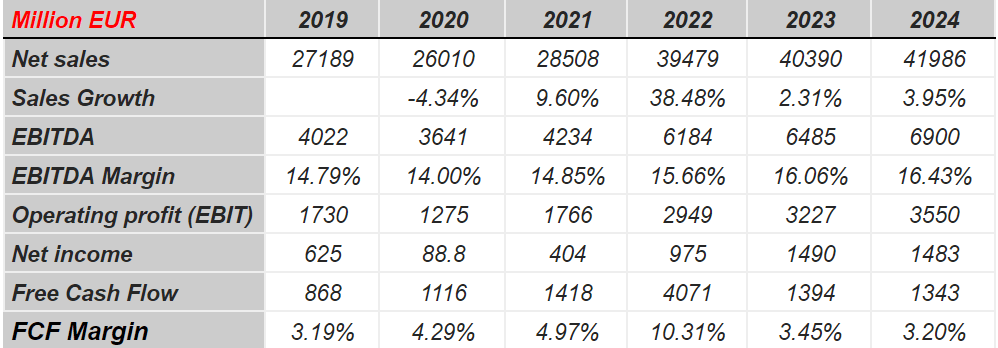

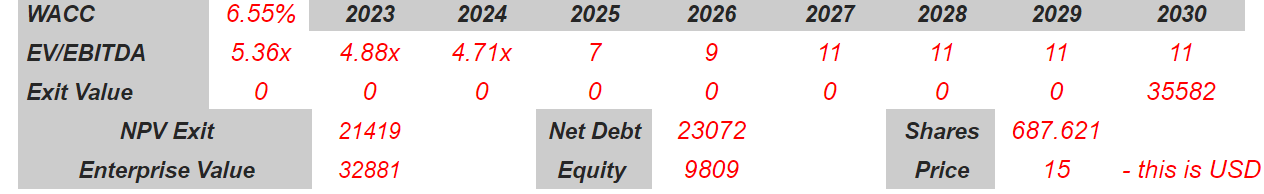

Financial analysts reported beneficial estimates for the years 2023 and 2024. For 2024, they expect a net sales of €41 billion and sales growth of 3.95% with an EBITDA margin of 16.43%. 2024 net income would be close to €1.4 billion, and free cash flow would reach €1.3 billion with a free cash flow margin of 3.20%.

Source: MarketScreener.com

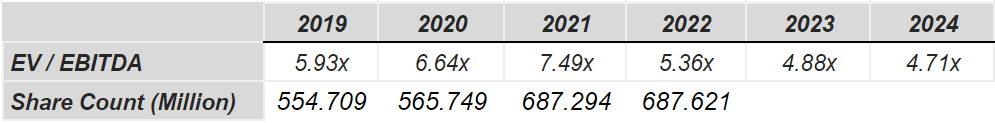

Finally, 2024 EV/EBITDA is expected to remain at 4.71x, compared to 4.88x in 2024, and the share count would stay at close to 687 million in 2022. I used some of these figures in my financial models, so I invite readers to have a look at them.

Source: MarketScreener.com

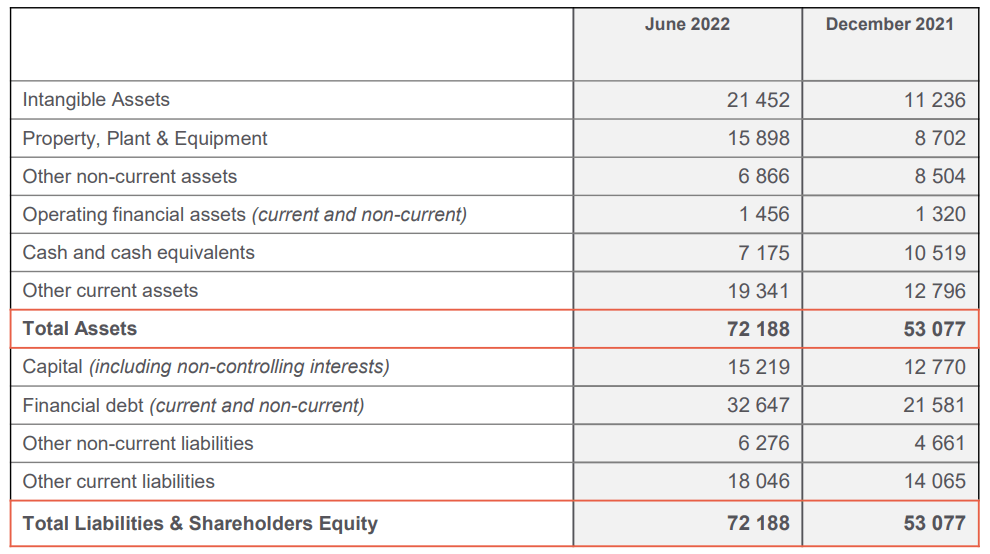

Balance Sheet: Debt Doesn’t Seem Significant

As of June 2022, Veolia reported intangible assets of €21 billion, property, plant, and equipment of €15 billion, and cash and cash equivalents of €7 billion. Current assets are worth €19 billion, and total assets are worth €72 billion. I believe that Veolia has both cash in hand and significant property and equipment to help finance future projects of M&A transactions.

Financial debt was equal to close to €33 billion with other current liabilities for €18 billion. In my view, the future stream of free cash flow and the stability of the company’s EBITDA margin appear sufficient to justify the total amount of debt. I wouldn’t expect shareholders to be afraid of the total amount of debt.

Source: H1 2022 Presentation

Beneficial Outcomes Could Lead to Valuation of $34 Per Share

In my base case scenario, I would expect more benefits from the company’s tariff indexation mechanisms in the majority of contracts, which enables it to offset cost inflation.

I believe in the strategic program Impact 2023, and also assume that the merger with Suez will be successful. I believe that Veolia will receive synergies from the transaction. In this regard, I should point out the expectations of management, which includes an EPS increase of close to 40% in 2024. From the 2021 annual report, we can observe the following:

This growth, in addition to the expected synergies, will enable our current net income to grow by more than 20% in 2022 and will enhance our earning per share by around 40% in 2024. The creation of the undisputed world champion of ecological transformation is underway and on track.

Successful M&A will also provide significant confidence for doing further transactions in the future. With the money to be received from Macquarie, I would expect further transactions to enhance revenue generation.

With regard to the organic growth, I believe that the company’s business model will continue to benefit in Eastern Europe. Favorable weather impact, increased tariffs, and integration of new assets in different regions will likely bring revenue growth and perhaps a larger EBITDA margin in the coming years. Let’s note some of the annual results obtained in the past in Central and Eastern Europe (see above link):

This progression is mostly attributable to Central and Eastern Europe (including Germany), with a revenue of €6 260M, up +19.6%, mainly coming from the Energy business, up +37%, due to the combination of a favorable weather effect, higher heat and electricity prices, and the integration of new assets in Prague and Budapest. Water revenue was up by +3% including volumes +0,3% and more sustained tariff increases. Germany grew by +9.1% thanks to volume recovery in C&I Waste, higher energy and recyclate prices, a favorable weather impact and increased tariffs. Northern Europe revenue was €3 276M, a growth of +7.6% vs. 2020 and of +2% vs. 2019.

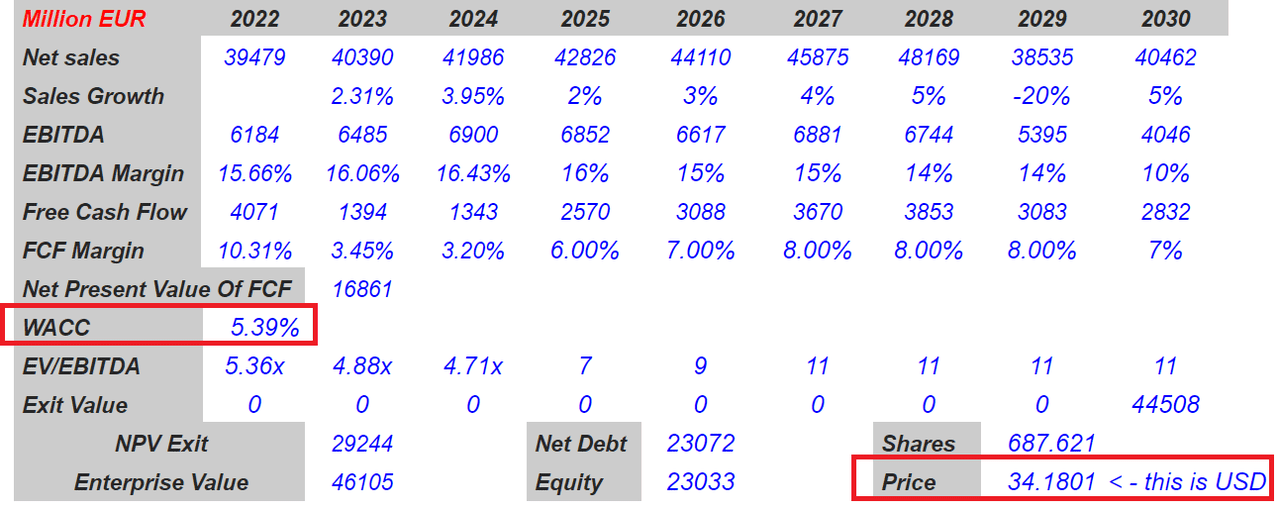

For 2030, I estimated a net sales of €40 billion, sales growth of 5%, EBITDA of €4 billion, and an EBITDA margin of 10%. Considering a WACC of 5.39%, in addition to a free cash flow of €2.832 billion, with the FCF margin of 7%, I obtained a net present value of FCF of €16 billion. If we also use an optimistic EV/EBITDA of 11x, the exit value would be €44 billion, and the NPV would remain at €29 billion. Finally, with a share count of 687 million, I obtained a fair price of $34 per share.

Author’s Work

Worst Case Scenario Would Imply Valuation of $15 Per Share

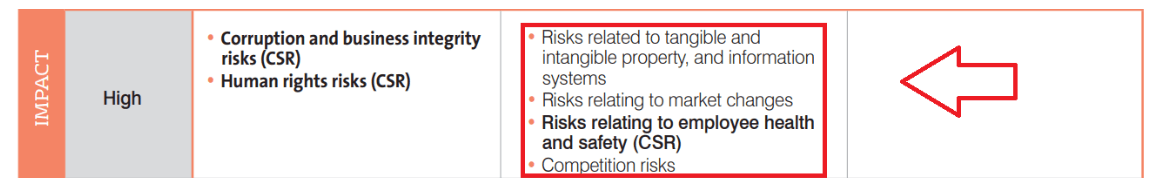

Regarding potential risks that could drive the company’s revenue growth down, there are risks related to impairment of intangible assets. Besides, market changes or new regulatory frameworks could also play a role, decreasing the company’s margins and driving revenue growth down. These risks were highlighted by management as high.

Source: H1 2022 Presentation

Under this scenario, I also assumed that political risks associated with the war in Ukraine, economic recessions, and climate change might also cause some harm to the company’s revenue growth.

Source: H1 2022 Presentation

Finally, I believe that deterioration in exchange rates could also be detrimental for shareholders. Veolia does a lot of business in Europe. If the EUR/USD change does not perform, investors in the U.S. could lose some money. Note that, in the last annual report (linked above), the company reported some small loses in this regard:

Exchange rates variations were almost neutral on revenue, at -€4M.

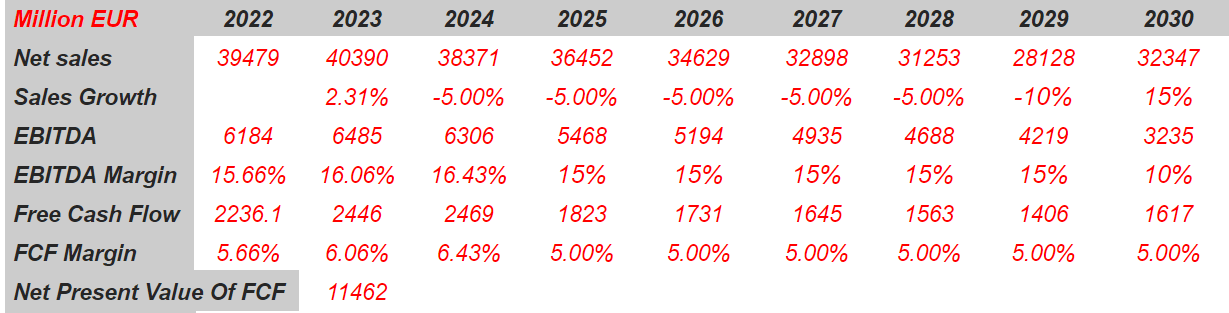

In this case scenario, in 2030 I foresee net sales of €32 billion, with sales growth of 15%, EBITDA of €3.2 billion, and an EBITDA margin of 10%. I also estimated a FCF of €1.6 billion and FCF margin of 5%. The net present value of FCF would be close to €11 billion with a discount of WACC of 6.55%.

I also obtained an exit value of €35 billion, with NPV of exit of €21.5 billion, an enterprise value of €32 billion, and equity close to €10 billion. Finally, the implied price would be close to $15 per share.

Author’s Work Author’s Work

Conclusion

Veolia recently signed many transactions that will likely bring synergies or cash for the sale of divisions. The transaction with Suez is a clear example, but the deal with Macquarie could also enhance the company’s balance sheet. In addition, the guidance given by Veolia for 2022 and the expectations of market analysts are also quite positive. In my base case scenario that includes reasonable free cash flow generation and improvement in Eastern Europe, the fair price turned out to be close to $34 per share. Yes, there are risks from impairment of intangible assets and climate change. However, I believe that the current market price does not represent the true picture for Veolia.

Be the first to comment