visualspace

A good Investor Day

Veeva Systems (NYSE:VEEV) held its Investor Day last Friday. The market reacted very well to the presentation and Q&A session, sending the stock up around 10%. Veeva is a long-term holding in my portfolio with a 4% allocation. Let’s take a look at what happened on the Investor Day.

Veeva stock price during investor day (Google)

Penetrating new sectors

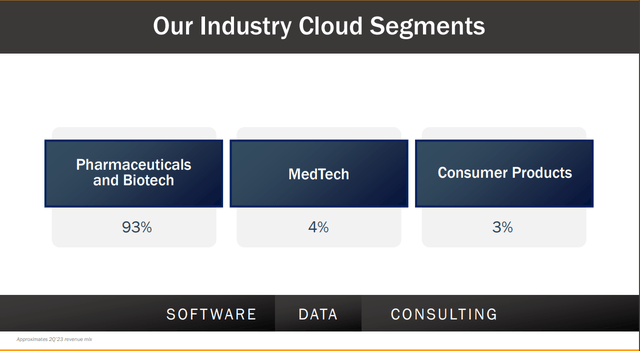

Veeva is the go-to ecosystem of enterprise solutions for the life sciences sector, where the company is being used by 19/20 of the biggest pharma companies in the world. The company is firmly entrenched in Pharma and Biotech companies, where Veeva is the go-to option for over 1000 customers. The software is highly specialized for the needs of the pharma and biotech industry. The MedTech segment was just a byproduct in the past, where MedTech companies used some of Veeva’s offerings and made them work for their niche. Recently Veeva announced a dedicated solution for the MedTech space, unifying the total MedTech product lifecycle. The MedTech industry is a $500 billion subcategory of the $2 trillion life sciences industry and a highly attractive market for Veeva to get into. Another category that has been briefly mentioned in prior earnings but hasn’t seen much focus is the Consumer Products segment. Customers here may have different needs, but some solutions Veeva offers can be utilized. Besides consumer packaged goods, specialty chemicals or cosmetics, the company recently started offering its services to food and beverage companies that use quality control solutions for their products.

Veeva revenue by segments (Veeva Investor Day)

Product excellence and portfolio strength

Veeva’s portfolio can be roughly divided into the development cloud (R&D and Quality control solutions), Commercial Cloud (S&M solutions) and Data Cloud (Data solutions). Commercial currently accounts for the majority of the business (56%), but R&D has been gaining share in the sales mix for years.

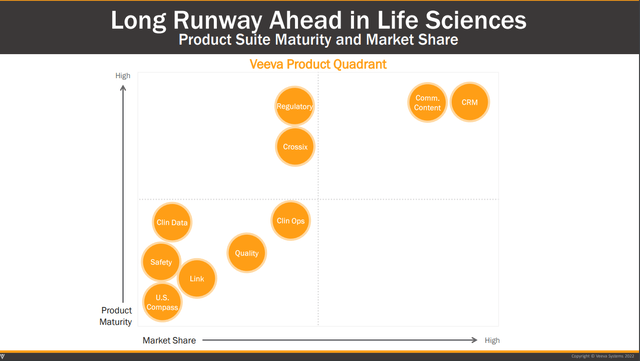

Veeva shared its Product Quadrant (see picture below), showing its different products’ maturity and market share. We can see that only two products (CRM and Commercial Content) are in the leader quadrant and both are in the Commercial Cloud segment. All other products have a low market share. Founder and CEO Peter Gassner said the following about how they think about market leadership:

we want product excellence, which means we don’t want too many products, and every product should be the leader, and we actually had a mathematical formula in the industry-specific. We said leadership means 40% or more market share.

Peter Gassner, Investor Day 2022

Veeva Product Quadrant (Veeva Investor Day)

Furthermore, Peter said the following about the enterprise software industry in the life sciences industry:

And I think I didn’t think we -when we started, I thought it’s most likely going to be more of a duopoly type of thing. It turns out there’s usually 1 lead dog. And that’s how it works. So I don’t think there’s any difference in any of those products.

Peter Gassner, Investor Day 2022

With its long-term relationships with most pharma companies and large data sets, the company is in the prime position to capitalize on this and increase its wallet share with customers over time. Many of these low-market share products need to be proven and once Veeva has a case study of integration with a customer, with the data to back up efficiency and cost savings, they can sell it to more and more of its customer base. I believe that this and future products that we don’t even know about yet, in combination with its largely underpenetrated markets, MedTech and Consumer Products, will provide Veeva with a long and sustained runway of growth.

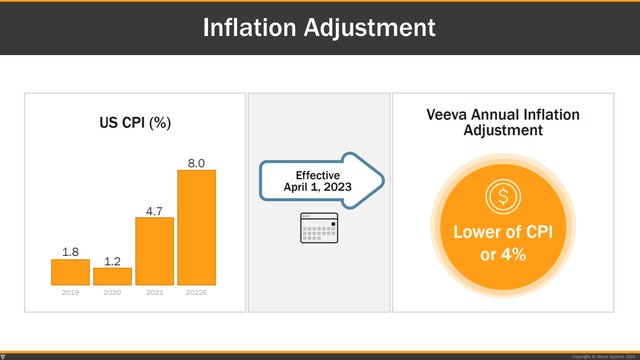

Inflation-adjusted contracts

The company announced its first-ever price increases for its offerings. In the past, Veeva never raised prices on renewals. This now changes with an annual inflation adjustment or the CPI number or 4%, whichever is lower. This will help offset rising costs while being fair with its customers and keeping good relationships intact.

Inflation Adjustments (Veeva Investor Day)

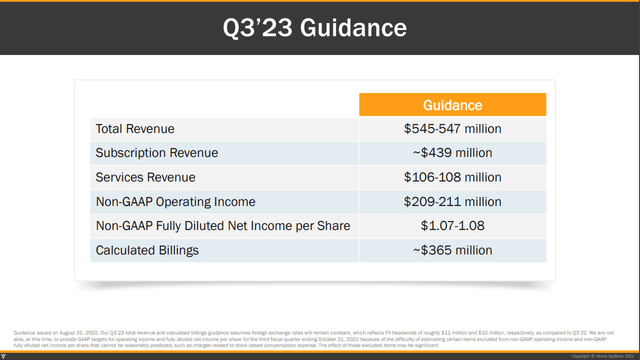

Confirming guidance

Veeva confirmed that it will “report results at or above our previous guidance.” The company also commented on its medium-term goal of $3 billion in revenues and 35% non-GAAP operating margin by Calendar year 2025. Veeva is still tracking ahead by about one year and will announce a new Target for 2030 after reaching the current target.

Q3 23 Guidance (Veeva Investor Day)

M&A discipline

A question that has been on my mind for a while has also been addressed: What’s the plan with the large cash balance? Veeva currently has $2.92 billion in cash and short-term investments on the balance sheet versus a mere $63 million in debt, representing a Net debt/EBITDA ratio of negative 5.5x!

The company said that it is happy to have such a significant cash position on the balance sheet in these uncertain times and that they do not want to rush anything. So far, they have had a 100% success rate in M&A and want to keep it that way:

And so you just – the timing has to be right, the puzzle pieces have to fit together, and you have to have the discipline to say no. So we look at we’ll look at 50 things and say no 39 to 49 of them.

Brent Bowman, Veeva Investor Day 2022

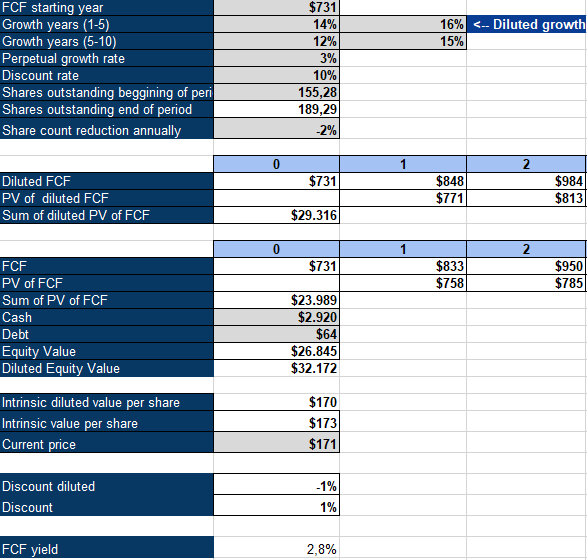

I am a buyer

To value Veeva, I use an inverse DCF model with a 10% discount rate/required rate of return, a 3% perpetual growth rate and I assume a 2% annual dilution, in line with the last five years. The current price implies a 15-16% growth rate for the business, which I believe can be sustained and exceeded for the next decade given the enormous opportunity in its low market share products and track record of product excellence. The added annual price increases will also help growth. I own shares of Veeva and added to my position last week after the investor day at $165.

Veeva Inverse DCF (Authors Model)

Be the first to comment