Portugal2004

Investment Thesis

It is always a challenge for an investor to find the right companies during times of economic uncertainty. Lots of investors tend to move their money toward dividend kings and champions, consumer staples, pharmaceuticals, and in this case, energy. Because of this, companies like Coca-Cola (KO), PepsiCo (PEP), and Procter & Gamble (PG) generally manage to hold on very well. Of course, the reason these companies are named as safe havens is not without any reason as is shown by the financial results of these companies so far this year. Coca-Cola is expected to deliver organic growth of 15-16% this year and PepsiCo expects 12% organic revenue growth for the full year. This is in sharp contrast with companies such as Nvidia (NVDA) or Meta (META), which are seeing a significant slowdown in their cyclical products.

The art of creating a resilient portfolio rest on choosing the companies with an incredible moat and a product that people will use, need, or consume every day, no matter the economic cycle. Something addictive is probably an extra bonus, although this does not sound like a good thing, for a company it is. This is the reason Altria (MO) is a dividend champion after all. This strong demand at all times is also the case for the products of Procter & Gamble, and the drinks and snacks of PepsiCo and Coca-Cola.

Another product that will be consumed no matter the time of the year, location, or the place in the economic cycle is alcohol, and in particular beer. There are multiple beer manufacturers to invest in, such as Anheuser-Busch InBev (BUD), Carlsberg (OTCPK:CABGY), or Heineken (OTCQX:HEINY). AB InBev is the biggest of the three and one that I am also planning on covering in the near term, but, in this article, I want to dive into the fundamentals of Heineken. I currently do not own shares in Heineken, but as explained above, I do think it might be a strong play with the current economic uncertainty. My position toward economy is also not getting rosier as I see more and more signals that we might be entering a severe recession in the near future and, therefore, I don’t think it is a bad thing to consider your portfolio diversification. My portfolio is defensive in nature, but I have no exposure to any beer brewer, while I do think it’s a business with great growth potential driven by GDP growth.

Let’s dive into Heineken.

Heineken N.V.

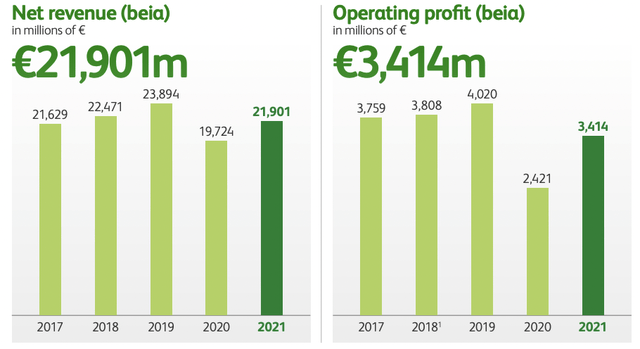

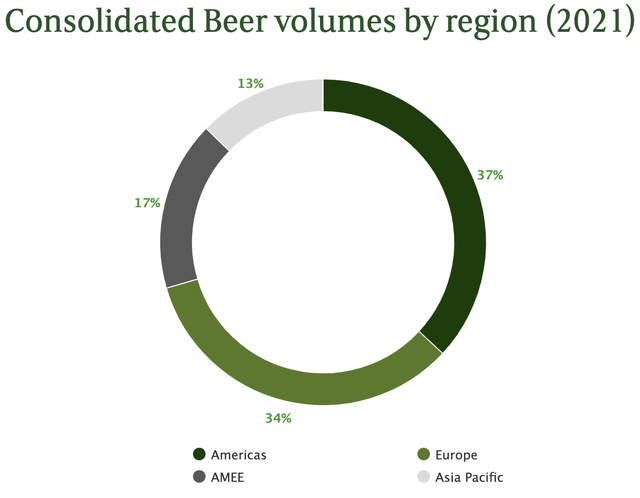

Heineken is a Dutch multinational brewing company, headquartered in Amsterdam. Heineken was founded in 1864 and nowadays serves 25 million bottles a day in over 192 countries, making it the second-largest brewing company. Heineken breweries are mostly located in the Netherlands. Heineken might just be one of the most familiar brands worldwide supported by its moat and a large amount of advertisement spending. Heineken is, for example, one of the main sponsors of Formula 1. The red star logo is a familiar sight worldwide. I am yet to find a place where I cannot get a Heineken beer. That Heineken is a huge company and is also confirmed in its 2021 financial results. Revenue for 2021 was €21.9 billion. Consolidated beer volume came in at 231.2mhl and the Heineken brand alone was good for 48.8mhl. Operating profit was €3.4 billion.

Revenue and profits took a hit during the covid-19 pandemic and lockdowns all over the world. People stopped going out of the house and no parties were allowed anymore. This was a hit for beer consumption and so for Heineken. The fact that most brands of Heineken are also drink-at-home brands, made sure that revenue stayed relatively resilient. Beer was still being consumed, just in lesser amounts, because people were not allowed to meet each other. Revenue and profit for 2021 already saw a strong recovery with lockdowns easing and people meeting each other again.

It is important to know that where Heineken might have started back in the days by brewing Heineken beer, it has acquired many brands over the years and the company now includes over 300 brands. Some of the largest brands include:

- Heineken

- Amstel

- Lagunitas

- Sol

- Birra Moretti

- Desperados

- Affligem

The company is home to 82,000 employees. In addition to its three main breweries in the Netherlands, the company has breweries in over 70 countries. So, the company brews beer all over the world and continues by selling these under different brand names worldwide.

One of the main challenges for any brewer is to stay on top of trends in order to not lose their customer base. This is also the reason Heineken acquired many brands over the years to diversify its portfolio. Heineken is well aware of the threats. Two of the trends Heineken is acting on today are the increasing popularity of craft beers such as Affligem, Brand IPA, and Birra Moretti. Another focus area is health-conscious beers. This is what Heineken says about this:

Many people are limiting alcohol consumption as they try to lead healthier lifestyles. We now offer more than 300 low- and no-alcohol products across 125 brands, from non-alcoholic beers and fruit shandies – or Radlers – to malt beers and malt-based energy drinks.

The 0.0 beer category has massive increasing popularity and for this reason, this is the main advertisement focus for Heineken.

Heineken Formula 1 advertisement (Heineken)

In February 2021, Heineken launched its EverGreen strategy, with the goal to future-proof the business and get back stronger out of the covid-19 pandemic. This is a multiyear strategy, which is supposed to increase growth and adapt to a fast-changing world. The company sees multiple opportunities to accomplish these goals.

- Portfolio growth: Heineken sees clear potential in certain parts of the portfolio. These are mainly expanding and growing their non-alcoholic beverages and flavored alcoholic beverages. Heineken sees 5.2x long-term growth potential for the non-alcoholic beverages segment and wants to expand its 0.0 portfolio and grow the penetration of its current brands. For the flavored alcoholic drinks, Heineken sees 5.5x long-term growth for this segment.

- Expand through acquisition: Heineken wants to strengthen its position in key profit pools and expand into more countries worldwide.

- Accelerate marketing & sales and Digital & technology

- Saving €2 billion for extra funding: The company wants to accomplish €2 billion in operational savings through an organizational redesign, efficiency, and commercial effectiveness.

Finally, the company wants to make sure that its use of capital is disciplined. Important long-term metrics to this are a debt/EBITDA ratio of below 2.5 and sustain a healthy dividend payout of between 30% and 40% of net profit. Sustainability is, of course, a part that cannot be left out in any public company nowadays, so this also goes for Heineken. The company wants to be net zero by 2030 and reduce water usage in water-stressed areas.

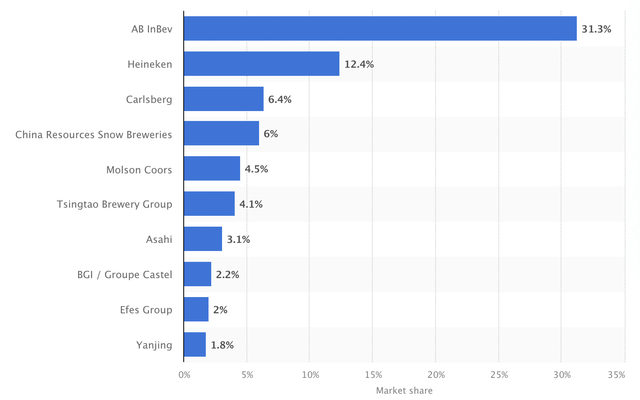

I appreciate Heineken management being clear about their goals and expectations for the future. I remain to see long-term growth in the beer industry, which is a tailwind to a major brewer such as Heineken. Revenue in the global beer industry is expected to come in at $560 billion in 2022. The market is expected to grow at a 10.34% CAGR until 2025, still supported by a recovery post covid. This is strong growth for the industry as well for Heineken. Based on volume sales, Heineken had a 12.4% market share in the total beer industry as of 2021.

Beer market sales share (Statista)

I believe industry growth will remain strong, driven by GDP growth and the general increase in the consumption of beer. Heineken can increase its market share in growth areas such as flavored beers and non-alcoholic beers. The non-alcoholic beer industry is expected to grow at a 7.8% CAGR until 2031 to reach a market size of $43.6 billion from $20.4 billion in 2022. Heineken is well positioned to benefit. Driven by its long-term goals and focus on growth sectors, I believe Heineken should be able to grow its top and bottom line by 3-7% until 2030. This is under the assumption that Heineken manages to keep its market share and possibly increase through acquisitions. How does this show in their latest financial results?

Financial results

On October 26th, Heineken reported their third-quarter earnings. Revenue increased by 27.5% during the quarter to come in at $9.4 billion. This means that for the first 9 months of the year Heineken’s revenue totals $25.8 billion, growing 33.4%. These top-line results are driven by the post-covid recovery. This was mainly visible in the Asia-pacific region. Net revenue for the quarter increased 19.8% YoY and organic growth for beer volume was 8.9%. Following these results, Heineken confirmed its FY22 guidance.

The results do show a slowdown in growth compared to 1H22, but this is because of a harder comparison since the covid recovery started in the second half of last year. Still, growth remained strong.

If we look at the beer volume per region we can see that growth in the Asia-Pacific region recovered strongly following the easing lockdowns. Volume growth for the region came in at 89.6% for the quarter. Other regions were not as strong and saw just low single-digit growth. I am a bit worried about near-term growth for Heineken as the recovery is coming to an end and current growth is mainly driven by Asia. Without this tailwind, volume growth would come in at low single digits. Volume growth seems to show slow growth in the near term and might even be a worry if we would enter a recession. Net revenues for the regions gave more of a positive look as revenue for most regions saw double-digit growth, with Europe staying behind at just 8.7% net revenue growth.

Comparing this quarter to 3Q19 might paint us a clearer picture since this was the last covid-free year. Beer volume increased slightly from 64.2mhl in 2019 to 66.8mhl in 2022. This shows us Heineken did recover from the covid-19 impact.

The third quarter for Heineken is called a trading update, meaning it does not provide us with all the numbers. It will be more interesting to see the financial results at the end of the year. We can conclude that Heineken has recovered most of the business, with Asia still lacking in most areas because of the continuation of lockdowns in China. I expect growth in volume to come from Asia for the largest part and this will also be the driver for revenue growth over the next few quarters.

Valuation and balance sheet

Heineken has a total cash position of $2.89 billion and total debt of $16.58 billion. I always prefer a company with a positive net cash position, and this is definitely not the case for Heineken. As Heineken is not a company with a lot of need for Capex spending and since it does have strong cash flows, I find it less of a problem, but it is definitely not a plus. The cash position does allow it to make acquisitions if needed.

Heineken also pays a 1.24% forward dividend yield. Not a very high yield and I would like to see Heineken increase this. The company has a payout ratio of 27%, allowing it to grow the dividend over the next couple of years. Heineken gets a D and D+ from Seeking Alpha Quant, respectively.

Dividend growth has not been a strength for Heineken as the company has only grown its dividend by a 3.18% CAGR over the last 10 years. The 5-year CAGR has been even more disappointing at just 0.69%. The company was forced to cut its dividend as a result of the covid-19 pandemic and the dividend has still not returned to its 2019 levels. I would not buy Heineken for its dividend as the yield, growth, and history are not convincing to me.

As for the valuation, Heineken receives a C- from Seeking Alpha Quant. The company is valued at a forward P/E of 17.03 and 9.45% undervalued compared to the sector average. Compared to its main competitor Anheuser-Busch InBev, Heineken is pretty much valued at the same P/E, as BUD is valued at a 17.76 forward P/E. At current prices, I do not find Heineken very cheap compared to its growth outlook. I would rather look for Heineken at a P/E of under 15 because this would provide you with a margin of safety, which I am missing at current prices.

Risks

For Heineken, I am less afraid of the economic downturn as discussed in the thesis of this article. A recession will not be supporting growth for Heineken, but the business is generally more resilient. People will keep drinking beer, no matter their situation. People will be more careful spending their money and therefore I do expect growth to slow down more than expected. Inflation has so far not been a huge problem for Heineken, and I think the company has enough pricing power to offset eventual increases in energy prices for their breweries or other inflationary problems.

More of a threat to Heineken is reputational damage as the brands rely a lot on their reputation.

Conclusion

Heineken is a strong company with a lot of history. The company has a huge moat and many impressive brands. I expect Heineken to remain resilient in an economic downturn and grow over the next decade supported by general growth in beer consumption. Yet, despite all this, growth is expected to be growing at a low single-digit CAGR and I am not convinced by their balance sheet. The dividend yield is not very high, and growth is very low. After the recent dividend cut, the dividend payout is still below 2019 levels.

Considering all of the above and by looking at the valuation, I rate Heineken a Hold.

I do think Heineken could be an interesting long-term investment, but not at current prices. If the price would drop further as a result of economic turmoil, an investment opportunity could become more interesting and would offer more of a margin of safety. I recommend waiting for now and keeping an eye on the stock price and fundamentals.

Be the first to comment