VLG/iStock via Getty Images

(This article was co-produced with Hoya Capital Real Estate.)

Back in August, I wrote an article entitled The World Of 4,818 Faces An Uncertain Future.

By “the world of 4,818,” I am referring to the confluence of circumstances that culminated with the S&P 500 reaching its all-time high of 4,818 during the trading session of January 4, 2022. Essentially, this referred to what some have described as a “Goldilocks” environment, fueled by a lengthy period of significant financial stimulus as well as a strong trend towards globalization.

The article then went on to explain why this has all changed and why, as I put it, “it will be difficult to quickly return to the world of 4,818.”

Since then, and in particular based on both the actions of the Fed and public comments of Fed Chairman Jerome Powell, I have continued to urge caution as we move into 2023.

As a result, I started to think about stock market sectors that may offer a measure of defensive protection during what I anticipate to be a challenging period. In November, I suggested that health care was one such sector and reviewed 2 top-notch ETFs for interested investors to consider.

In that November article, I mentioned that the Consumer Staples sector was another defensive sector worthy of consideration. In this article, I will do just that. First of all, we will review the characteristics that may make this sector particularly attractive at this time. Next, I will take a look at two ETFs that will serve you well if you like my big-picture analysis.

Consumer Staples – You Gotta Eat

Before I go any further, let’s address perhaps the biggest ‘elephant in the room.’ This sector may not be attractive to all investors. If you are a younger investor, with a long time frame and a willingness to accept the volatility that accompanies aggressive investment, this sector may not be for you.

Conversely, if capital preservation is a priority while at the same time allowing for a measure of risk and exposure to growth, this may be exactly the sector you are looking for.

Let’s spend just a few paragraphs discussing the high-level pluses and minuses of the sector, and how this may play out in 2023. First, the pluses.

Consumer Staples – Advantages

Solid performance during periods of recession – While they may vary on its scope or depth, virtually all serious forecasts I have reviewed in recent weeks suggest that we are in for some level of recession in 2023. One large predictor is the inversion of the yield curve, as recently featured in this note right here on Seeking Alpha.

During such times, consumer staples have value as a defensive sector. As I alluded to in the heading for this section, recession or not, “you gotta eat.” With that in mind, take a look at the sub sectors, or industries, into which this sector is commonly broken down:

- Beverages

- Food and staples retailing

- Food products

- Household products

- Personal products

- Tobacco

In short, this sector encompasses everything from the cereal you eat at breakfast to the toothpaste you use to brush your teeth at night, along with the beverages you drink during the day as well as the products you use to clean the floors of your home. It also encompasses the retail outlets at which you purchase such staples.

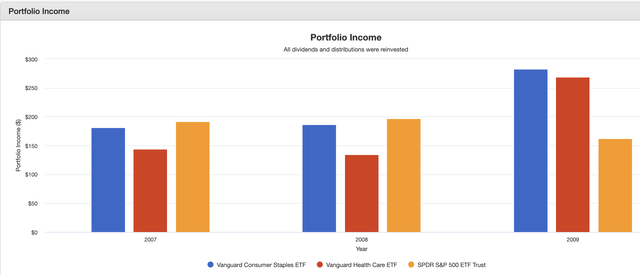

To get some idea of relative performance during the 2007-2009 recessionary period, take a look at the below backtest from Portfolio Visualizer.

VDC vs. VHT vs. SPY: 2007-2009 Recession (PortfolioVisualizer.com)

As can be seen, both the consumer staples sector as well as the health care sector did very well during this period, as compared against the overall S&P 500.

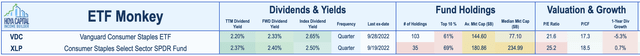

Strong and consistent dividend income – Consumer staples stocks tend to pay solid dividends, and be able to do so in both good times and bad.

Here, from the same backtest referenced above, is the level of dividend income provided during the 2007-2009 recession.

VDC vs. VHT vs. SPY: 2007-2009 Dividend Income (PortfolioVisualizer.com)

Stability and longevity – We’ll get into the specific companies comprising the Top 10 holdings of our 2 ETFs in the next section. When you see them, suffice it to say that you will recognize them as companies that have not only survived but prospered over decades, if not a century or more.

Consumer Staples – Drawbacks

In terms of minuses, here is the other side of the coin.

Lower Margins and Slower Growth – Given the fact that these products may be considered to be commodities and, in general, not subject to huge innovations and breakthroughs, profit margins tend to be less than in high-growth sectors. As a result, during periods of strong economic growth, they may underperform such dynamic and exciting sectors.

Potential Disruption – On the products side, you may have noticed that several large retailers now have ‘house brands’ to compete with products from established players, typically at lower prices. In turn, the retailers themselves are subject to online competition as the world continues to change.

Inflation – Ironically—and this is the drawback that could in my opinion prove most detrimental to my overall recommendation—consumer staples stocks can be negatively impacted during periods of high inflation. This is due to the fact that higher input and supply chain costs can eat into operating margins.

VDC vs. XLP – Digging Into Two Worthy Contenders

Let’s now take a quick look at two excellent ETFs with which to invest in the consumer staples sector. These are Vanguard Consumer Staples ETF (NYSEARCA:VDC) and The Consumer Staples Select Sector SPDR Fund (XLP)

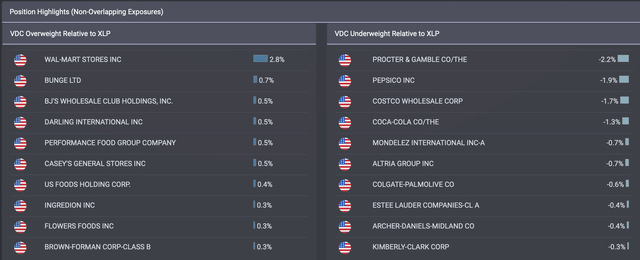

For a high-level overview of the 2 ETFs, have a look at this compact, yet comprehensive graphic, courtesy of Hoya Capital Income Builder.

VDC vs. XLP – Key Data Points (Hoya Capital Income Builder)

Before we get into any differences, let’s talk about the things the two ETFs share in common. First of all, they both have an excellent long-term track record, with VDC having an inception date of 1/26/2004 and XLP going back even further, at 12/16/1998. Secondly, they both sport huge AUM; with VDC at $6.856 billion and XLP at $17.382 billion. Finally, they both carry the same expense ratio of .10%. In each of the 3 metrics, these are amazing numbers for a sector fund.

Similar to my recent comparative article on 2 health care ETFs, the main difference is in the scope of the field from which VDC and XLP draw their constituents. In the case of VDC, the index tracked is the MSCI US Investable Market Consumer Staples 25/50 Index. This index is comprised of stocks of large, mid-size, and small U.S. companies within the health care sector.

In the case of XLP, as with all Select Sector indexes from SSGA (State Street Global Advisors), the starting point is the S&P 500 index. As a result, whereas XLP includes only large-cap stocks, VDC takes a broader approach, also including mid- and small-cap stocks.

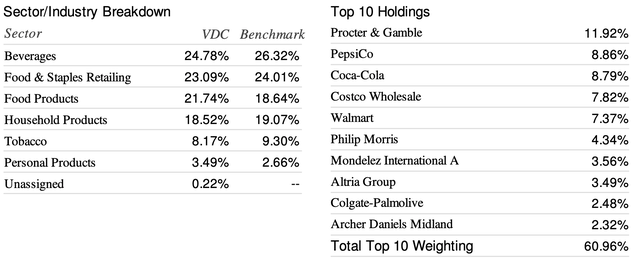

Let’s see how all of this plays out in two compact graphics. As I dug into the two ETFs, I noticed a couple of interesting details. I started by checking the fund overlap on etfrc.com.

VDC vs. XLP: Holdings Overlap (etfrc.com)

The right side of the screen was completely intuitive. Since there are far more holdings in VDC, most of the Top 10 holdings are slightly diluted as compared to XLP. In contrast, on the left side you see a list of smaller companies that VDC includes that likely are not even included in XLP.

But wait a minute. What’s Walmart Stores (WMT) doing over there on the left side? In this case, VDC holds even more WMT than does XLP. I tried to see if I could come up with an explanation as to why this is the case, but came up empty.

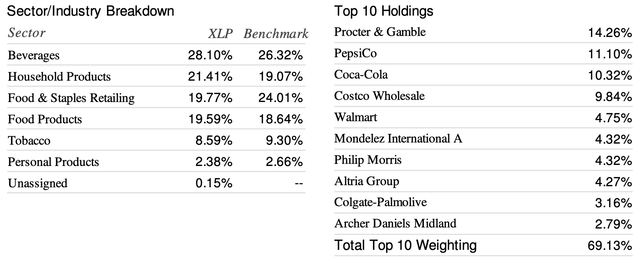

What effect does this have on the overall characteristics of the 2 ETFS? I had to do a little digging to come up with a concise way to display what I found. Happily, the reports from FactSet, available on my Fidelity account, offered a nice option.

First, for VDC.

VDC – Portfolio Characteristics (FactSet)

And next, for XLP.

XLP – Portfolio Characteristics (FactSet)

Unsurprisingly, one of the minor differences is that the Food & Staples Retailing sub sector is more heavily weighted in VDC by a little over 3%. In contrast, Beverages and Household Products are less heavily weighted in VDC by roughly that same 3%.

Performance – And Picking A Winner

So what does this all mean?

To me, the most meaningful conclusion is that either of these ETFs are worthy of serious consideration for inclusion in your portfolio. As we face the uncertain future described in my previous article, the Consumer Staples sector should hold up well in relative terms, as outlined in this article.

But which ETF should you choose? VDC, or XLP?

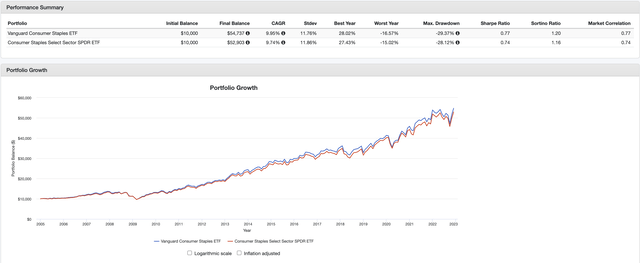

To help you make a decision, take a look at the results of a backtest I ran, courtesy of Portfolio Visualizer. It’s a simple comparison of the two ETFs, covering the period starting in January, 2005 through the present.

VDC vs. XLP: 2005-2022 Backtest (Portfoliovisualizer.com))

Over this period of time, I would have to say that VDC appears to be the winner. Its slightly more inclusive stock selection filter, which includes exposure to mid- and small-cap stocks, has returned slightly better overall results with roughly the same volatility.

Moving into 2023, I believe there is a good chance that VDC will continue to outperform. If you go all the way back to the graphic from Hoya Capital Income Builder that I featured early in the article, you will notice that both VDC’s P/E and P/CF ratios are a little lower than XLP. On the flip side, XLP is offering a marginally higher dividend payout.

In summary, then, either ETF is a solid candidate for taking a defensive posture as we look to a likely recession in 2023. Of the two, I give a slight edge to VDC.

Be the first to comment