Funtap

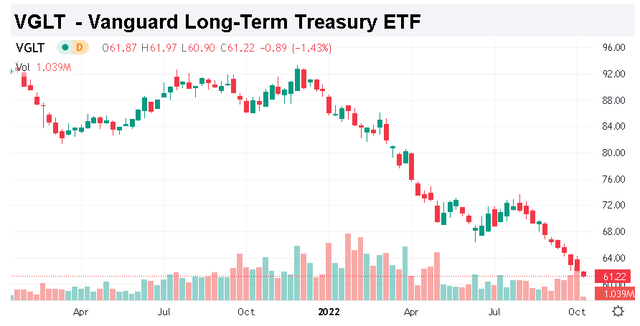

The Vanguard Long-Term Treasury ETF (NASDAQ:VGLT) tracks the performance of long-dated U.S. treasury bonds. For anyone associating bonds with low-risk and a conservative investing strategy has likely been in for quite a surprise this year amid historic volatility while VGLT is down by more than 30%. The move reflects the impact of stubbornly high inflation and surging interest rates. It’s a very difficult market environment although we see room to take the other side of the trade ahead of a potential rally.

The way we see it playing out is that bonds may soon find a bottom either with confirmation inflation has peaked or in a scenario where economic conditions deteriorate much further. Either way, the setup would open the door for the Fed to pull back from its aggressively hawkish policy stance. We like the VGLT ETF that currently offers a yield approaching 3% through a monthly dividend adding to its attraction on a relative value basis.

What is the VGLT ETF?

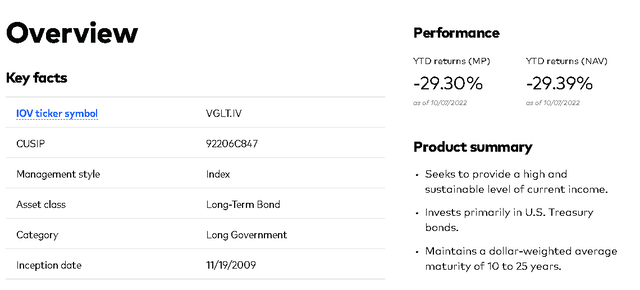

VGLT offers exposure to the long end of the yield curve, technically tracking the “Bloomberg U.S. Long Treasury Index” through a sampling method attempting to approximate the full Index in terms of characteristics and performance. With a portfolio of government issuances, the credit rating of the underlying bonds is AAA and recognized as risk-free assuming they are held to maturity. That being said, while you won’t need to worry about the possibility of a default, the interest rate risk is the more significant concern.

source: Vanguard

Since bonds are priced based on the net present value of all their future coupon payments and final repayment, the time component is particularly important. Simply put, the long timeframe means that long-dated bonds are highly sensitive to changes in interest rates which affect the discounting of every cash flow. This concept is known as duration sometimes measured in the years which is a key risk measure for bonds.

VGLT’s portfolio consists of bonds with a Dollar weighted average maturity between 10 and 25 years resulting in an average effective maturity of 23.4 years and an average duration of 16.8 years. The interpretation of this figure is that with a 1% drop (or climb) in interest rates, VGLT would be expected to appreciate or (depreciate) by approximately 16.8%.

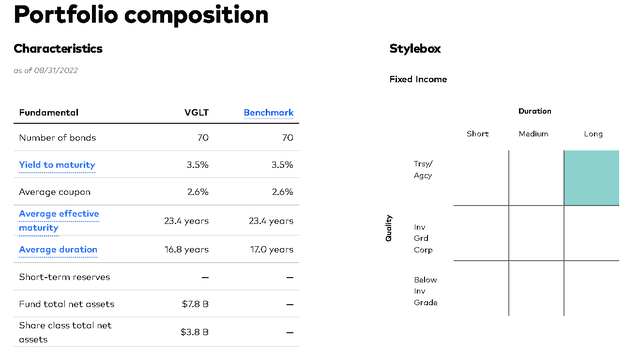

This compares to the Vanguard Total Bond Market ETF (BND), recognized as a broad market bond fund diversified across the maturity curve with an average duration of 6.8 years. There is also the Vanguard Short-Term Bond Fund ETF (BSV) with an average duration of 2.7 years as a lower-risk alternative. By this measure, VGLT is an aggressive or very high-duration bond fund but also an important component of fixed income.

source: Vanguard

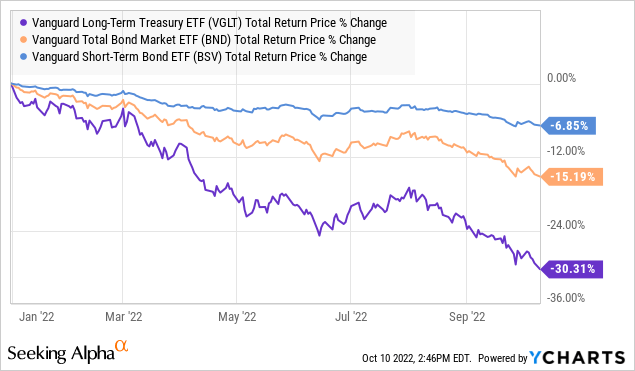

Why Did VGLT Crash?

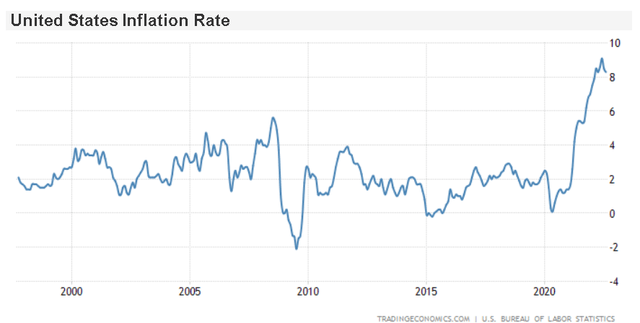

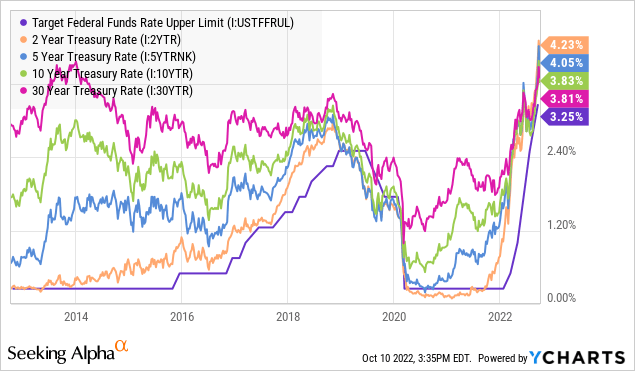

Over the past year, the 10-year U.S. Treasury Yield climbed from 1.6% to a current level of 3.8%. Over this same period, VGLT has declined by -30.3% compared to a -15% loss in BND and a -7% drop in BSV. Again, the dynamic here goes both ways meaning VGLT would be expected to outperform on the upside in a scenario where bond yields drop going forward as part of its allure.

The challenge right now is that interest rates are climbing based on several factors. The first point is that with the persistently high inflation rate currently above 8% from the August CPI has been a problem. In turn, the Fed has moved to hike the Fed Funds Rate in an attempt to reduce the money supply and limit credit demand as part of the strategy to slow pricing pressures.

source: tradingeconomics

The result is a sharp move higher in market rates across the yield curve reflecting both longer-term expectations for monetary policy and inflationary trends. The uncertainty here comes down to how inflationary trends will evolve going forward as dictating the Fed’s next steps.

Naturally, the most bullish scenario for VGLT and bonds, in general, would be a sharp reversal with yields dropping. At the same time, investors could also realize a positive return on bonds simply through a return of interest rate stability where yields simply stay relatively flat from the current level.

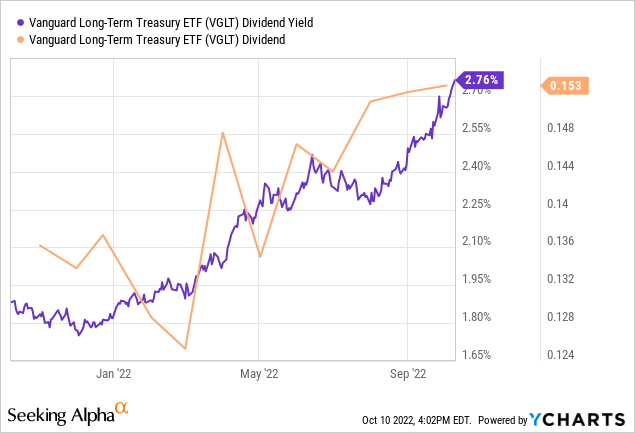

We mentioned the fund’s monthly dividend distribution schedule. The yield on the fund is listed at 2.8%. That being said, the understanding is that as the portfolio continuously gets rebalanced, new bonds added to holdings offer a higher yield to maturity based on the more current market rates. In this regard, investors can expect a climbing payout going forward to converge with current rates.

VGLT Price Forecast

VGLT and long bonds have been nothing short of a disaster all year. The fund is down nearly eleven weeks in a row which, in our view, has become an increasingly crowded short bonds trade building on the mantra of higher rates for longer and out-of-control inflation.

Seeking Alpha

This week, the bond bulls will have a chance to fight back with the release of the September CPI report on Thursday, October 13th. Following up on the August data that came in hotter than expected, the call we’re making is to look for a surprise to the downside on the headline inflation print that would provide some relief to the bond selloff.

This case would be driven by the impact of lower energy prices compared to the peak in Q2 trickling down to other categories like transportation and other types of services. Reports are that everything from used car prices, to housing, and even airline tickets have pulled back which would be a favorable development if confirmed with this upcoming report.

The reason we believe this would be bullish for bond bulls is that it offers some evidence that the Fed’s strategy is working, and allow the group to pare back their urgency for more and more aggressive rate hikes into 2023. A surprise lower in the inflation data over the next few months, while economic conditions remain resilient, could be considered the goldilocks scenario for the broader market benefiting bonds and risk assets.

On the other hand, we also see room for bonds to rally under a more concerning “doom and gloom” environment. If there is a chance economic conditions collapse going forward, accompanied by a surge in the unemployment rate and lower consumer spending, deflation could become a reality. In this case, bonds would rally as interest rates drop while benefiting from a flight to safety trade.

Final Thoughts

VGLT with an expense ratio of just 0.04% is a high-quality fund in an important market segment. While the performance has been poor this year, our take is that it’s a good time to add exposure ahead of a potential rebound. Beaten-down bonds have value at the current level with several dynamics that can kickstart a rally going forward.

Between the extremes of the bullish scenarios we mentioned, there is also a middle ground with an outlook that interest rates simply stabilize at the current level. Here VGLT would realize its value through the steady monthly income.

Finally, we can bring up what would be a bearish scenario for bonds as the main risk to consider. The possibility that inflation continues to surprise the upside while economic growth sputters would be a worst-case scenario. A stagflation type of environment would drive bond yields even higher and open the door for more downside in the bond prices and the VGLT ETF.

Be the first to comment