AndreyGorulko/iStock via Getty Images

Intro

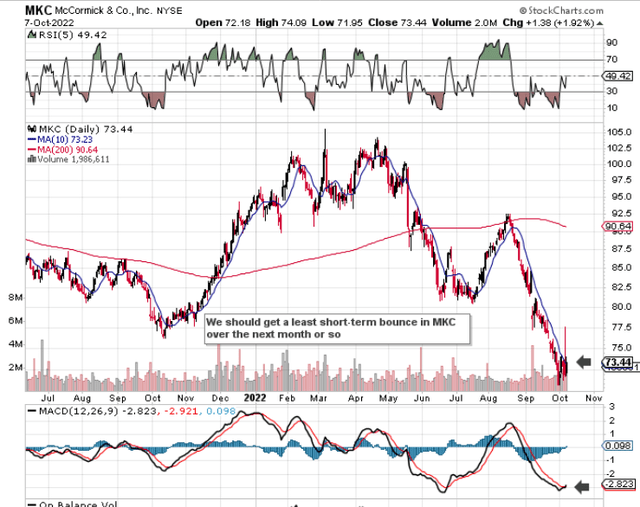

We are expecting a short-term bounce in McCormick & Company, Incorporated (NYSE:MKC) but the pending bounce may indeed be a bear market rally. As we can see from the technical chart below, McCormick’s daily MACD indicator has just crossed to the upside, meaning we should get some sort of bounce over the next couple of months. We state this because McCormick is a pretty reliable swing play candidate. As we can see below, both in June of this year as well as in October of last year when the MACD indicator gave short-term buy signals, we witnessed sustained rallies to the upside for at least 4 to 6 weeks in the aftermath. Suffice it to say, given how history repeats itself quite often in financial markets, we expect a similar result to play itself out this time round especially given how oversold McCormick’s MACD is in this present moment in time.

Short-Term Chart Of MKC (Stockcharts.com)

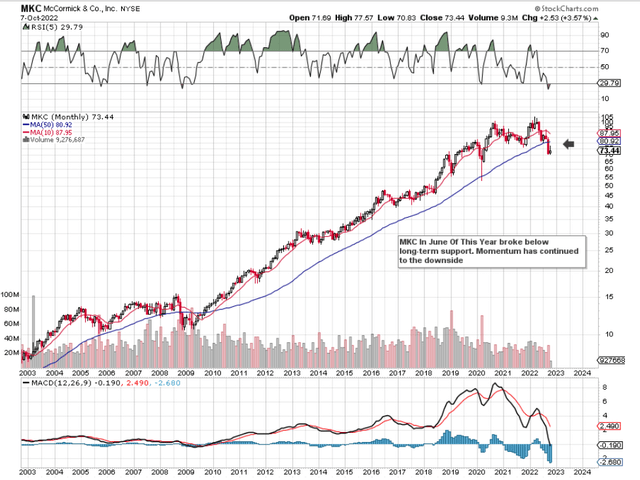

However, if you study the above chart more closely, the rally out of the July lows this year was stopped in its tracks pretty quickly by McCormick´s 200-day moving average. The reason for this is clear on the long-term chart. As we can see below, the 50-month moving average had acted as strong underside support basically since 2008. This support though ended in June of this year when the price breached the average. Furthermore, momentum to the downside in recent months has now turned down the slow-moving 50-month moving average which is ominous in itself.

MKC Losing Long-Term Support (Stockcharts.com)

Q3 Earnings

In saying the above, the company which is just off the back of its third-quarter earnings reported both sales ($1.6 billion) and earnings (EPS of $0.69) beats for Q3. Nevertheless, it is apparent that McCormick continues to struggle with supply chain headwinds where costs are mounting as a result. This trend is what has principally irked the market in that costs have been rising much faster than the company’s price increases on its products on the front end. McCormick’s plan is to leverage the CCI program whilst also removing inefficiencies which would bring down the cost load. This sounds all well and good in theory. The proof of the pudding will be, however, whether trading conditions can cooperate so these initiatives can indeed become a reality.

Strong Dividend Record

Long-term McCormick investors who have made a packet since the 2009 lows will most likely remain loyal to the company in this current down move. Not only have long-term investors made excellent capital gains over the past 13 years or so but the dividend also has been a mainstay with McCormick for quite some time now. Although the forward dividend yield of just over 2% may not turn many heads, McCormick has grown its dividend every year for the past 32 years and this does not look like changing anytime soon. Despite operating income being down over 12% year over year in McCormick, the trailing 12-month dividend growth rate still surpasses 9% which is impressive.

New long-term participants, however, will most likely stay out of McCormick until the relationship between its profitability and valuation changes for the better. Despite the fact that McCormick has always been a strong cash-flow generating company boasting high margins, it is where the company’s profitability is trending which is worrying the market at present. Sales will most likely continue higher predominantly driven by inflation but costs will continue to put pressure on margins for some time to come yet. This is due to sustained supply chain and operational leverage headwinds as well as a lower margin product mix overall.

Inflation

What is happening in McCormick really demonstrates the old adage of inflation where the company is actually selling more (Dollar-wise but not necessarily volume-wise) but making less money on the back end. McCormick’s net income margin over a trailing average still comes in at a very healthy 10.8% but this metric will continue to come under pressure if we continue to see compression with respect to the company’s gross margin metric. The other issue here for McCormick is that you can bet its customers will want the company to share the pain with respect to spreading the margin across the spectrum of both supplier and customer. This means repeated price hikes by McCormick may ultimately be met with resistance if indeed inflation continues at its present clip.

Conclusion

Therefore to sum up, although McCormick is due a short-term bounce here, the likelihood is that shares will turn over to the downside once more until we see improving forward-looking earnings projections. We look forward to continued coverage.

Be the first to comment