cagkansayin

(This article was co-produced with Hoya Capital Real Estate)

Introduction

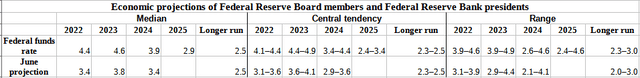

As I started writing this article, the FOMC increased the Federal Funds Rate by another 75bps, with expectations that another 125bps are coming before 2023.

Federal Reserve Board – Monetary Policy

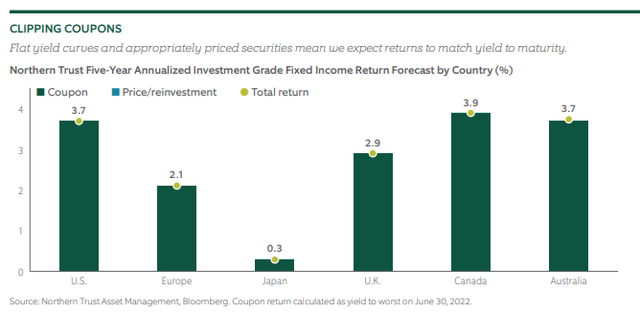

Most, if not all, data is moving in the wrong direction for bond investors, and this tendency is spreading around the world. Northern Trust projects US bonds will be some of the better ones to own over the next five years, but even those would generate a sub-4% return.

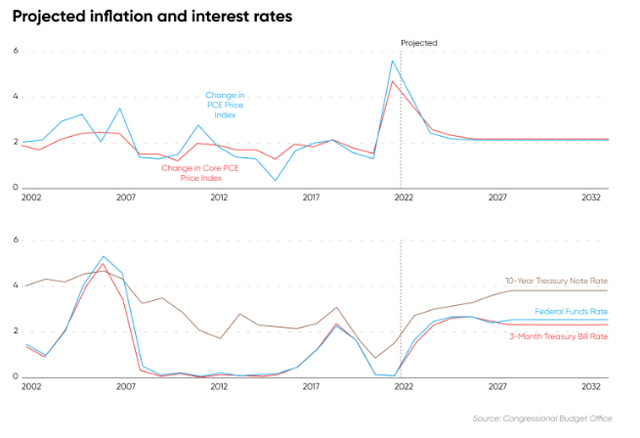

The Congressional Budget Office is making the current forecasts for both inflation and interest rates.

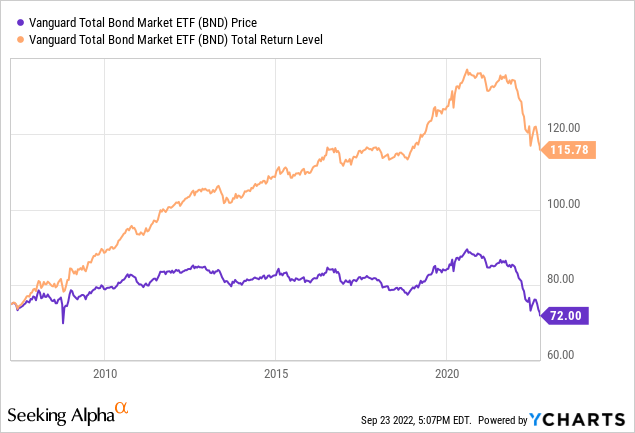

What might worry bond investors is their projection for the 10-Yr TSY rate to keep climbing to 4% before leveling off. As investors know, bond prices move inversely to rates and that has hurt bond funds, including those covered by this article.

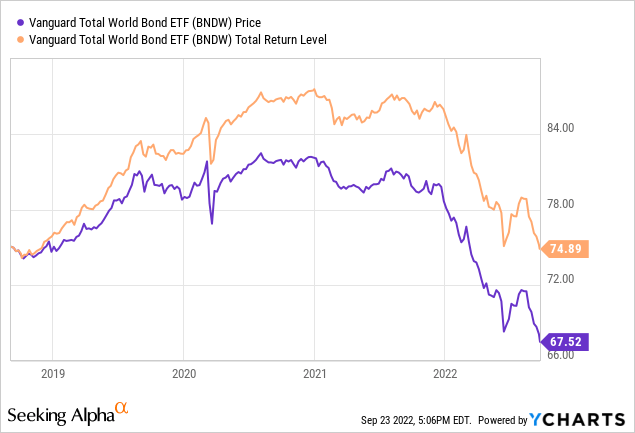

While some investors avoid bond funds even when they look favorable, others want some allocation for various reasons, like income or the fact they don’t correlate to stocks at 100%. The Vanguard Total World Bond ETF (NASDAQ:BNDW) was designed to give investors the ability to own one ETF that covers the world for investment-grade bonds. For those investors, even with rates rising, I would give BNDW a Buy rating.

Vanguard Total World Bond ETF review

Seeking Alpha describes this ETF as:

The investment seeks to track the performance of the Bloomberg Global Aggregate Float Adjusted Composite Index that measures the investment return of investment-grade U.S. bonds and investment-grade non-U.S. dollar-denominated bonds. The fund is a fund of funds and employs an indexing investment approach designed to track the performance of the index, which is a custom, USD-hedged index designed to track the market capitalized weights of the global investment-grade bond market. Seeks to track the performance of the Bloomberg Global Aggregate Float Adjusted Composite Index. BNDW started in 2018.

Source: Seeking Alpha

BNDW has $570m in assets and provides a current yield just over 3%. Vanguard charges 6bps in fees.

Index review

Bloomberg provides this description of the benchmark used by BNDW:

The Bloomberg Barclays Global Aggregate Float-Adjusted and Scaled Index is a customized version of the Global Aggregate Float-Adjusted Index. This multi-currency benchmark includes fixed-rate treasury, government-related, corporate and securitized bonds from developed and emerging market issuers with maturities of more than one year.

Source: assets.bwbx.io/documents

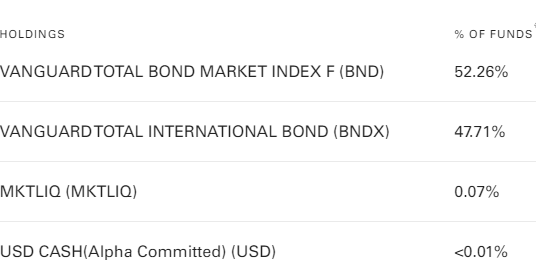

BNDW holdings review

BNDW mainly holds two other Vanguard bond ETFs:

BNDW (Vanguard Advisors)

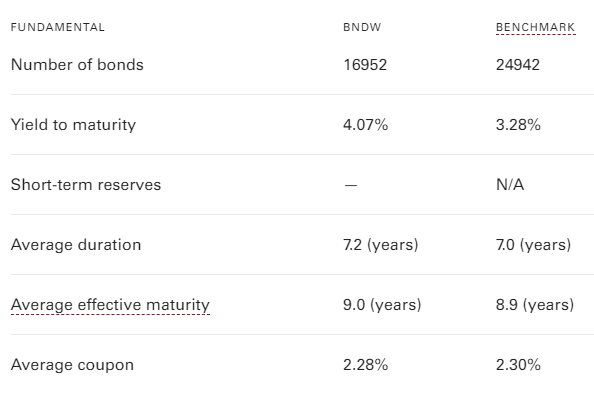

The allocation split between the two ETFs shows little movement over the past year. Vanguard provided a few statistics on the holdings for BNDW.

Vanguard Advisors BNDW (Vanguard Advisors)

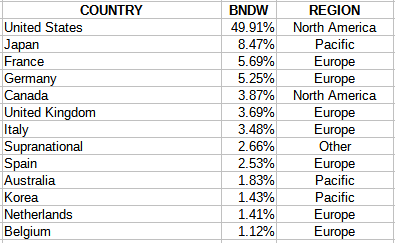

The above is a list of countries with a 1+% weight in BNDW.

BNDW (Vanguard Advisors)

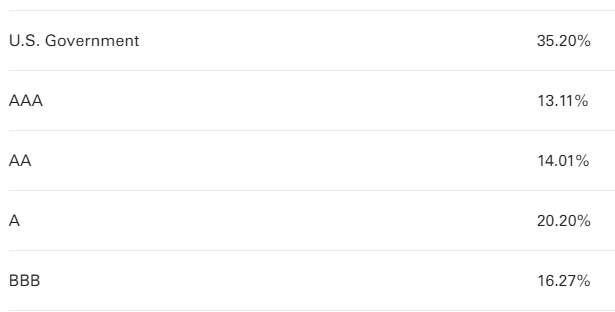

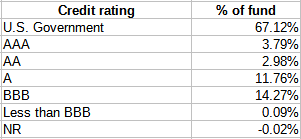

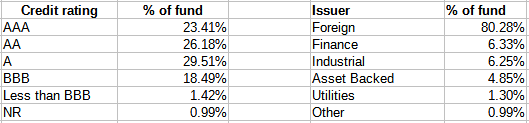

About 1.2% of the debt is below BBB or not rated.

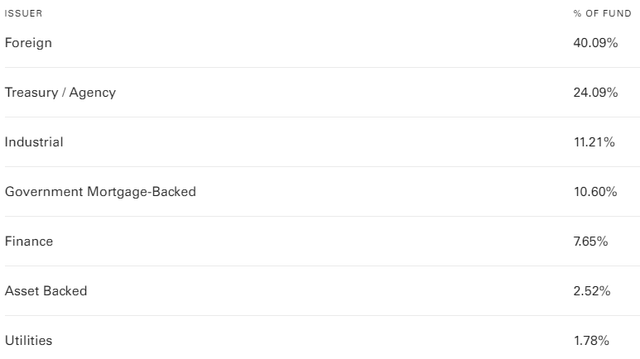

UST/Agency debt comprises 24% of the weight; with US Govt-backed mortgages almost an additional 11%. With only 13% rated “AAA”, little of the non-US Government (i.e., foreign) debt is in the top rating category. Since BNDW is the combination of two other ETFs, understanding them is a necessity.

Vanguard Total Bond Market ETF review

Seeking Alpha describes this ETF as:

The investment seeks to track the performance of the Bloomberg U.S. Aggregate Float Adjusted Index. This index measures the performance of a wide spectrum of public, investment-grade, taxable, fixed income securities in the United States-including government, corporate, and international dollar-denominated bonds, as well as mortgage-backed and asset-backed securities-all with maturities of more than 1 year. BND started in 1986.

Source: Seeking Alpha

BND has $283b in AUM and shows a 2.6% yield. Vanguard charges just 3bps.

BND holdings review

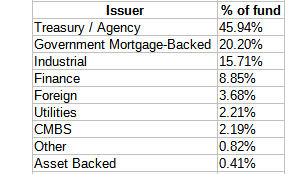

BND (Vanguard Advisors) BND (Vanguard Advisors)

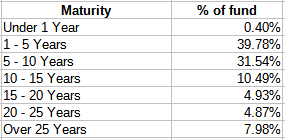

BND is heavily invested in US Government debt. The Corporate debt is almost all investment-grade, with about 40% of that in the BBB rating. The maturity schedule is such:

BND (Vanguard Advisors)

Assuming the 1-5 Years is evenly distributed, about 8% of the ETF will fall outside the Index and have to be replaced, hopefully by higher coupon bonds.

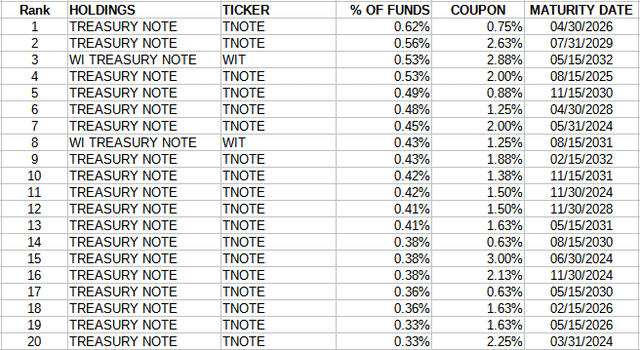

Top holdings

Vanguard Advisors; compiled by Author

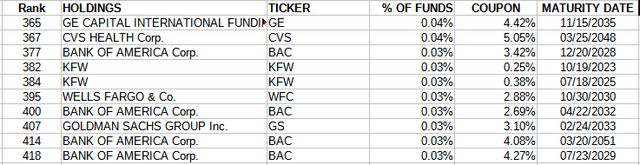

The Top 20 come to 8.7% of the portfolio. The next list shows the ten largest corporate bond holdings.

Vanguard Advisors; compiled by Author

Vanguard Total International Bond ETF review

Seeking Alpha describes this ETF as:

The investment seeks to track the performance of a benchmark index that measures the investment return of non-U.S. dollar-denominated investment-grade bonds. The fund employs an indexing investment approach designed to track the performance of the Bloomberg Global Aggregate ex-USD Float Adjusted RIC Capped Index (USD Hedged). This index provides a broad-based measure of the global, investment-grade, fixed-rate debt markets. BNDX started in 2013.

Source: Seeking Alpha

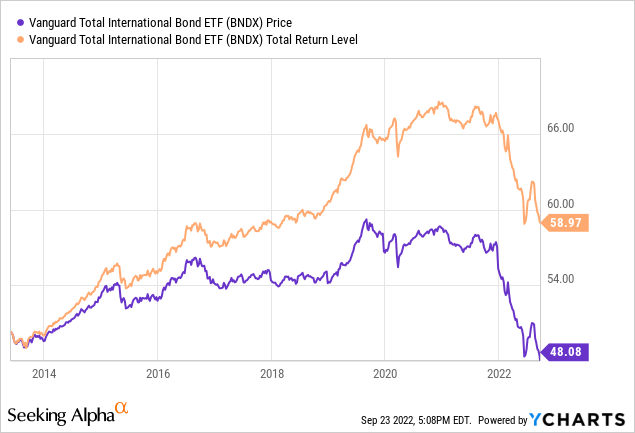

BNDX has $81.5b in AUM and shows a current yield of 4.26%. Vanguard charges 7bps in fees.

BNDX holdings review

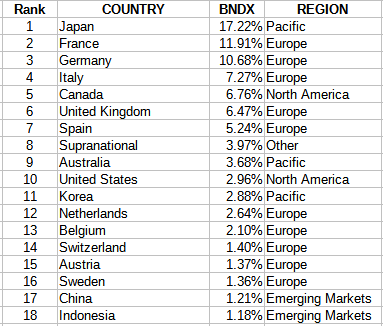

The next list shows every country with a 1+% weighting, and these account for 90% of the portfolio. Total country count is 49.

Vanguard Advisors; compiled by Author

Europe is the largest regional exposure (54%), followed by the Pacific (25%). Vanguard lumps all Emerging Market debt as a separate region (6%).

Vanguard Advisors; compiled by Author

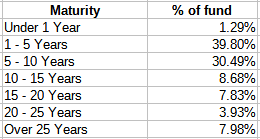

Under Issuer, Foreign would mostly be government debt. Being that most foreign debt is not rated AAA, the weighted credit rating here is lower than what BND owns. The maturity schedules are very close between BND and BNDX.

Vanguard Advisors; compiled by Author

Top holdings

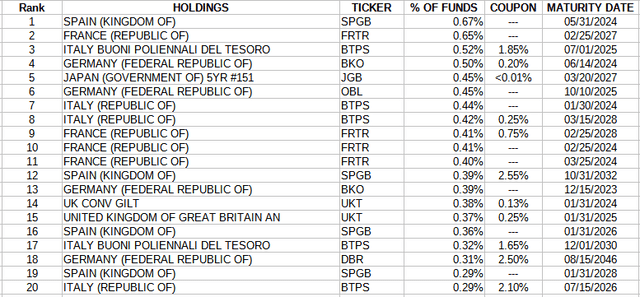

Vanguard Advisors; compiled by Author

I think I found the first corporate bond at #727 on the list (C @.03%). This ETF hedges to reduce currency risk.

BNDW distribution review

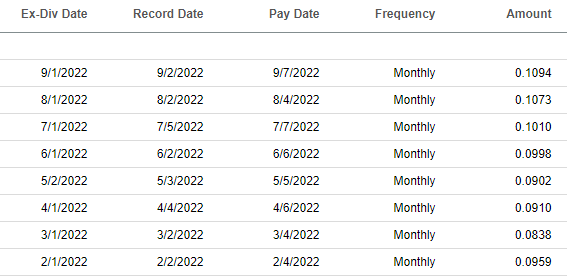

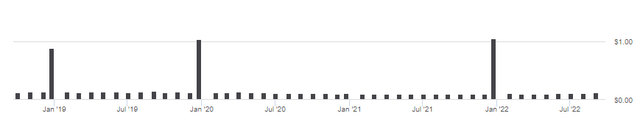

The large year-end payouts make the monthly values indistinguishable, but they vary between $.09 and $.13. So far in 2022, these are the payments.

BNDW DVDs (Seeking Alpha)

Performance data

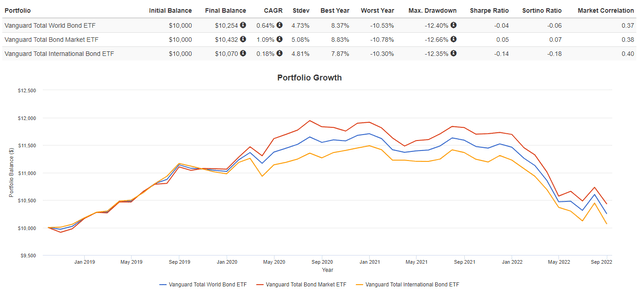

Since the underlying ETFs have more history (2013), I ran numbers using today’s allocation: that “backtest” results in a CAGR of only 1.9%. While adding BNDX with BND provides a lower return, the combination does give BNDW a lower StdDev value.

Portfolio strategy

My concept of a “core holding” is a fund that provides universal coverage of an asset class, like the Vanguard Total World Stock ETF (VT) does for equities. Such “core” funds don’t have to represent one’s total exposure to that asset class, but a base to build off of and to adjust one’s allocation from. Vanguard alone offers 20 bond ETFs (17 US/3 INTL) that will allow users to move up/down the credit ratings scale or to adjust the overall duration or Issuer mix of their bond holdings.

With rates scheduled to climb as the FOMC adds possibly 125bps more to the FFR, stashing funds in a 6-month CD might make sense and then re-evaluate buying BNDW when it matures. Fidelity shows those CDs yielding near 4%.

To save the fees BNDW adds to what BND/BNDX charge, doing your allocation between those two ETFs is another simple and more flexible strategy to be considered. Others recently covered in detail both of these ETFs:

Final thought

After the recent FOMC action, Mott Capital Management posted The Federal Reserve Delivers A Massive Shock To The Stock Market. While it didn’t deal with how bonds will react, it reminds investors that higher rates aren’t a friend of the stock market either.

Be the first to comment