chaiyapruek2520 Vanda

Does the company have a short-range or long-range outlook in regard to profits? – Phillip Fisher

Author’s Note: This is an abbreviated version of an article originally published in advance inside Integrated BioSci Investing for our members.

In biotech investing, it’s crucial that you follow any intellectual property (i.e., IP) infringement and thereby adjust your position accordingly. Let’s say a company loses its patent infringement for the lead franchise, the stock can shed most of its value. That being said, Vanda Pharmaceuticals (NASDAQ:VNDA) shares tumbled over 32% in one single trading session after the company was defeated in its IP case against Teva Pharmaceuticals (TEVA) and Apotex. In this research, I’ll feature a fundamental analysis of Vanda while focusing on the prevailing concerns.

Figure 1: Vanda chart (Source: StockCharts)

About The Company

As usual, I’ll provide a brief corporate overview for new investors. If you are familiar with the firm, I recommend that you skip to the next section. Operating out of Washington, DC, Vanda Pharmaceuticals is focused on the innovation and commercialization of novel medicines to fill the unmet needs in psychiatry. I noted in the prior research,

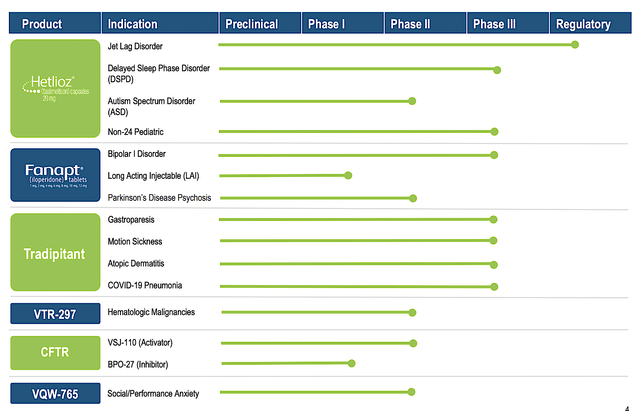

You can see that Vanda is brewing a deep pipeline of highly promising drugs. Interestingly, the two therapeutics (Hetlioz and Fanapt) are already approved and [generating significant] sales. And yet, Vanda is aggressively expanding their label which is indicative of a prudent growth strategy. In other words, growing by label expansion is a risk-deleveraged approach. Based on the vast number of label expansions, there is a good chance that at least one would become an investment bonanza.

Figure 2: Therapeutics pipeline (Source: Vanda)

Latest Operating Results

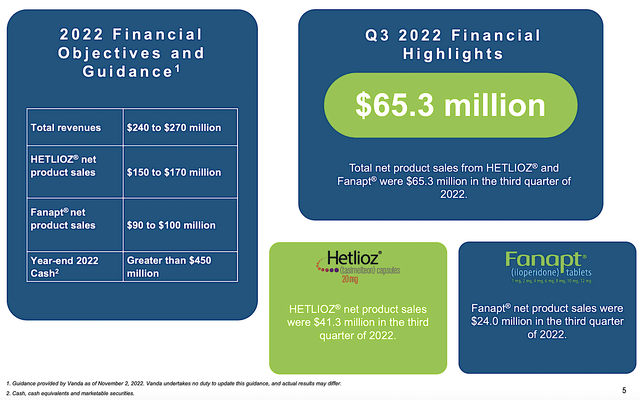

In the latest quarterly earnings presentation, Vanda continues to post a declining revenue trend. Precisely speaking, the company generated $65.3M in total sales which is 7% lower than $70.1M for the same period last year. Of that figure, Hetlioz contributed to the bulk of sales (i.e., $41.3M) with Fanapt accounting for the rest (i.e., $24.0M). On that trajectory, Hetlioz sales depreciated the most (i.e., at 9%) while Fanapt posted a 2% decline.

Figure 3: Latest operating results

In terms of absolute figures, the company is expected to deliver over $450M in sales for Fiscal 2022. As you can see, that figure is more than the $402M market capitalization. On absolute numbers alone, you can appreciate that Vanda is undervalued. Now, today’s sales are as important as where they will be in the future. On that note, you have to dig deeper to see if Vanda can reverse its recent top and bottom-line depreciation.

IP Infringement of Hetlioz

As I strongly believe it’s the ultimate determinant of Vanda’s sales growth, let us dissect the IP debacle. On December 13, Vanda announced that the company has brought several lawsuits in the District Courts of Delaware against Teva Pharmaceuticals and Apotex. The suit entails patent infringement against Hetlioz 20mg capsules.

In the press release, Vanda mentioned that a trial was held back in March this year. And yet, the Court recently ruled in favor of Teva and Apotex. As a ramification, the Court determined that Teva/Apotex did not infringe U.S. Patent No. RE46,604. Adding further injury to the insult, the Court claimed that Vanda’s U.S. Patent Nos. RE46,604; 9,730,910; 10,149,829; and 10,376,487 are invalid.

As you can see, Hetlioz is one of Vanda’s two lead franchises. As a matter of fact, Hetlioz contributed to most of the revenue for Vanda. As you know, Vanda projected that Hetlioz’s upper estimate for Fiscal 2022 is $170M; whereas, its other lead drug (Fanapt) could only contribute to $100M in sales. By losing such broad patent coverage for Hetlioz in the most lucrative market (i.e., USA), you can imagine that Vanda’s sales would trend down significantly in the next few years.

Stay of Market Entry

Interestingly, Vanda intends to take the fight to the Federal Court by filing with the U.S. Court of Appeals. In the efforts to halt Teva/Apotex from launching their biosimilar, Vanda also requests “a stay of market entry” while the appeal is pending. As you can see, that is a prudent course of action for Vanda. Preventing competitors from entering the market as long as possible would help the company to retain its leading market shares. At the very least, it would buy more time for Vanda’s management to figure out its plans.

European Market Not Affected

As the patent infringement deals with the US market, Hetlioz’s European market remains intact. While this is a positive development, you can imagine that the US market is what mattered most. After all, drugs are priced much higher in the USA than anywhere else in the world. It’ll be extremely difficult to stave off revenue decline when you lost the battle to generic competitors in the golden market.

Similarity To Amarin’s Debacle

As you can see, a similar situation occurred with another pharmaceutical company, i.e., Amarin Corporation (AMRN). Due to the loss of IP protection against biosimilars from a Federal ruling, Amarin’s crown jewel drug (Vascepa) sales started to experience a sharp downward trend. Similar to Vanda, Amarin lost its protection in the US market alone. Nevertheless, the effect has been devasting on its overall drug sales. Consequently, the share price depreciated substantially in the ensuing quarters.

Figure 4: Amarin’s revenue trend

Notably, Vanda is different from Amarin because the company still has other molecules like Fanapt and tradipitant, plus the earlier stage molecules to boost further growth. That is to say, if the lead drug fails, Vanda would still have secondary therapeutics to deliver long-term growth.

Other Legal Battles

Aside from the aforementioned legal issues, Vanda filed a lawsuit against the FDA back on September 13. In response, the FDA agreed to publish a notice in the Federal Register on October 11. That is to say, the Agency gives an opportunity for a hearing on Vanda’s sNDA for Hetlioz’s use in Jet Lag Disorder.

Beyond that, Vanda has also been busy with another lawsuit against the Center of Medicare & Medicaid Services (i.e., CMS) relating to product rebates. The company believes that CMS rules are “unlawful and contrary to the intent of Congress when it passed the Affordable Care Act.”

Though litigation is a corporate tool, you can argue that Vanda would be better off focusing on the advancement of other fruitful molecules. You can see that Hetlioz IP protection is not robust. Else, it would have held up on the lower courts. Moreover, you can say that souring the relationship with the FDA would deter future approval. On the flip side, you can also reason that by pushing it back on the FDA and CMS, Vanda can get better future treatment. I’m not saying that the FDA/CMS are bullies. However, when you deal with bullies, you have to bring the fight to them.

Robust Phase 2 Data for VQW765

Contrary to the seeming negativity, Vanda recently posted strong data for a Phase 2 study of VQW-765 – a potential treatment of acute performance anxiety (in social situations like public speaking). As a novel small molecule alpha 7 nicotinic acetylcholine receptor (α7-nAChR) partial agonist, VQW765 was assessed in 230 volunteers having performance anxiety. Compared to patients on the placebo (i.e., the control arm), patients who took VQW765 experienced a much lower stress level and less nervousness.

Of note, 20% of the US population suffer from performance anxiety like public speaking, test-taking, etc. As such, positive data for VQW765 can position the drug to capture a huge market. As this is only a Phase 2 study and there are potential study biases, it’s early to make definitive claims. Be that as it may, I believe that more developments like this one would substantially deliver future growth for Vanda.

Financial Assessment

Just as you would get an annual physical for your well-being, it’s important to check the financial health of your stock. For instance, your health is affected by “blood flow” as your stock’s viability is dependent on the “cash flow.” With that in mind, I’ll dig deeper into the 3Q2022 earnings report for the period that concluded on September 30.

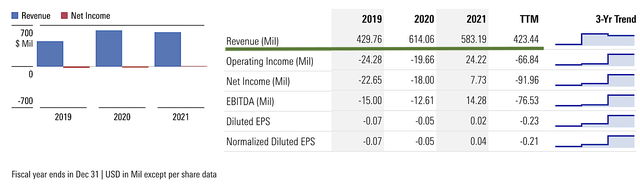

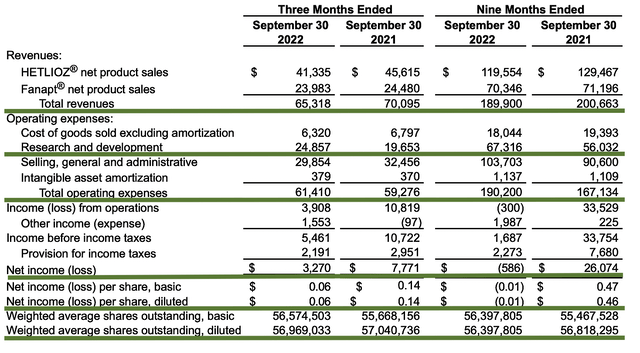

As you know, Vanda generated $65M in revenue compared to $70.0M for the same period a year prior. That aside, research and development (i.e., R&D) registered at $24.8M compared to $19.6M for the same period of comparison. I viewed the 26.5% R&D increase positively because the money invested today can turn into blockbuster profits tomorrow. After all, you have to plant a tree to enjoy its fruits.

Additionally, there were $3.2M ($0.06 per share) versus $7.7M ($0.14 per share) net incomes for the same comparison. As such, the bottom line depreciated by 57.1%. As you can see, the higher operational expenses for legal battles against Medicare, FDA, and other pharmaceutical companies cut into the bottom line. Notwithstanding, the company is still operating at a net profit.

Figure 5: Key financial metrics

About the balance sheet, there were $454.8M in cash, equivalents, and investments. Against the $61.4M quarterly OpEx and on top of the $65.3M quarterly revenue, there should not be any concerns about cash flow. Simply put, Vanda has an extremely robust cash position relative to its earnings and cash burn.

While on the balance sheet, you should check to see if Vanda is a “serial diluter.” After all, a company that is serially diluted will render your investment essentially worthless. Given that the shares outstanding decreased from 57.0M to 56.9M, you can see that Vanda increase the value of your shares by not diluting.

Potential Risks

Since investment research is an imperfect science, there are always risks associated with your stock regardless of its fundamental strengths. More importantly, the risks are “growth-cycle dependent.” At this point in its life cycle, the most important risk for Vanda is whether the company can regain IP protection for its lead drug, Hetlioz. That aside, there is the concern that Vanda would burn excessive cash in its legal battles against much larger pharmaceuticals that would constrain its bottom-line earnings.

Conclusion

In all, I reduced my recommendation on Vanda Pharmaceuticals from a buy to hold with a lower (i.e., 4.5/5 stars rating). Previously a long-term investment (and a highly promising stock), Vanda recently posted a declining sales trend for its leading drugs (Hetlioz and Fanapt). As it turned out, the situation got worse with Vanda losing the court battles/protection for its flagship medicine, Hetlioz. Without the IP protection of Hetlioz in the US market, you can imagine that Vanda will likely suffer similar fates as Amarin. You can see that it’ll be tough to reverse the court decision. That aside, Vanda’s relationship with the FDA is now sour from the lawsuit. As such, FDA hurdles for the company can be much higher.

Despite what I believe to be the next three toughest years for Vanda, the company can still make a comeback without Hetlioz. The first reason is that there is ample cash to launch various turnaround initiatives. Unlike Amarin which has only one drug (Vascepa), Vanda still has its commercialized drug (Fanapt) with its ongoing label expansion. There are also other promising developing molecules to drive sales growth in the long term. The recent OliPass partnership is another growth catalyst. Tradipitant might surprise investors. Then, you also have strong data from VQW-765 to support a turnaround. However, it’ll take years for Vanda to make a comeback.

Be the first to comment