Bill Oxford/E+ via Getty Images

Main Thesis & Background

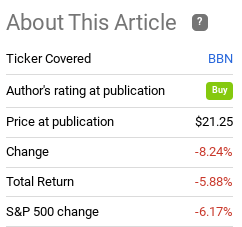

The purpose of this article is to evaluate the BlackRock Taxable Municipal Bond Trust (NYSE:BBN) as an investment option. This fund offers exposure in taxable municipal bonds, with an objective to “seek high current income, with a secondary objective of capital appreciation.” The taxable municipal bond sector is an area I review regularly, and BBN is one of the more popular ways to play this space. I often go back and forth with recommending it, driven primarily by the fund’s valuation. For 2022, I have mostly been bullish on this fund, including when I last wrote about it in March. In hindsight, I was too early with my “buy” call, as BBN has dropped a bit since publication, although most of the equity and fixed-income markets have seen similar weakness:

Fund Performance (Seeking Alpha)

Clearly, buying then would not have worked out very well. But this fund has come across my radar because it has been seeing some strong short-term momentum. While it is down 6% since March, it happens to be up quite strongly on a more shorter time period:

1-Month Performance (Seeking Alpha)

Given this strong, recent gain, I wanted to take another look at BBN to see if I should continue recommending it. After review, I do believe a buy case could be made. I actually see the gains as a reason to be more optimistic, not to sell and take profit, and I’ll explain why in detail below.

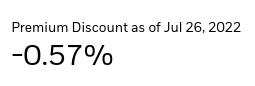

BBN Has Slight Valuation Advantage

To start, I will give a quick overview of the fund’s valuation. This is always critical when evaluating CEFs, since their premiums and discounts can swing wildly over time. Given the inherent nature of the product, the use of leverage, and investor’s willingness to use these as trading vehicles, timing is truly everything. In that respect, I tend to view BBN (and other funds like it) favorably when they sit at discounts. This, of course, assumes I am bullish on the broader municipal bond sector as a whole. At this point, I am.

At time of writing, BBN doesn’t offer an extreme bargain, but there is some relative value. For starters, the fund sits at a slight discount to NAV, which is generally a good time for accumulation, not selling:

Current Valuation – BBN (BlackRock)

On the surface, this suggests at least giving this fund a look. It isn’t at “cheap” levels, so I certainly wouldn’t advocate going all-in here or getting too aggressive. But for investors who have been on the sidelines waiting, this is a reasonable time to buy.

Importantly, while this discount is not too attractive, it does compare favorably with BBN’s closest competitors. The Nuveen Taxable Municipal Income Fund (NBB) and the Guggenheim Taxable Municipal Bond & Investment Grade Debt Trust (GBAB) both have reasonable valuations, but at levels that are slightly more expensive than BBN, as shown below, respectively:

Current Valuation – NBB (Nuveen)

Current Valuation – GBAB (Guggenheim)

The takeaway for me is that BBN offers a reasonable buy-in point here. Investors can get just below what the underlying holdings are worth, and its discount is also wider than its two closest competitors. That tells me it is at least worthy of consideration at the moment.

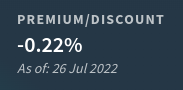

Why Taxable Munis?

As my followers know, I talk about the municipal bond sector a lot. I have favored tax-exempt munis for a long time, often times it is the bulk of my fixed-income holdings. For most of my investment career I have steered away from corporate bonds and treasuries, which has worked out in my favor. But I tend to hold on to tax-exempt munis for the long haul due to the tax savings. BBN, and the broader taxable muni sector does not have that distinct advantage. So, why consider this at all?

There are a few reasons at this juncture. For one, absolute yields are quite high. This means that, on a historical basis, there is value right now. This piques my interest regardless of any other considerations right off the bat:

Taxable Muni Yields (S&P Global)

BBN currently has a yield in excess of 7%, given its use of leverage. With yields in the 4.5 – 7% range within this sector, this could very well be advantageous to investors even without the accompanied tax savings one would get from tax-exempt munis. For those in lower income tax brackets, this is likely true.

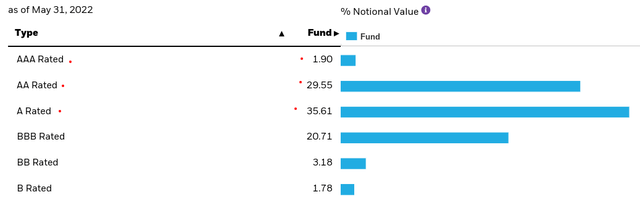

Two, credit quality is very strong, especially when set against comparable IG corporate bonds. For example, BBN is made up of IG debt, but the point of emphasis is that over two-thirds of the fund is in the upper-tier of the credit ladder spectrum:

BBN Credit Quality Breakdown (BlackRock)

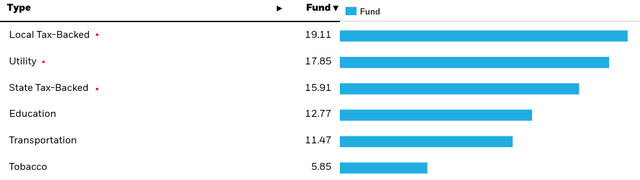

By contrast, the IG corporate bond market is dominated by credit quality in the lowest tranche, BBB-rated debt. This is confirmed in a recent report by Fitch Ratings, which shows roughly 60% of newly issued IG corporate bonds fall into that rating category:

IG Corporate Credit Quality (Fitch Ratings)

What I am getting at here is that when it comes to credit quality taxable munis actually hold an edge over comparable debt from the corporate bond realm. This suggests investors who are interested in fixed-income more broadly want to give this idea some serious consideration, before putting cash into a sector with comparable yields but lower credit quality. BBN is a perfect way to capitalize on that mismatch.

State and Local Debt As An Inflation Hedge

Moving into the municipal bond sector more broadly, I want to reaffirm my stance that I think there is inherent value in it in the second half of the year. Clearly, inflation is on the minds of all investors, so fixed-income positions are a tricky proposition. But personally, I see the worst of the pain as over. Can bond prices move lower as interest rates keep rising? Of course, and if inflation does not end up peaking at these levels more downside definitely exists. This is a key element to weigh before making the plunge into this sector. But the reality is that inflation and rising interest rates have been hammering away at investor sentiment all year long. To the point where a lot of pain is already baked in, making levels here much more attractive in my view.

Another key point is that muni bonds can actually offer as a partial inflation hedge, in certain sectors. While not a perfect hedge by any means, they can provide a relative cushion against inflation, when compared to other fixed income investments (i.e. corporate bonds or treasuries). This is because many tax receipts supporting municipal credits also increase as asset prices rise. While the tax rate could be constant, with inflation going up on goods and services, that means sales tax receipts will increase, assuming the same amount of goods and services are purchased. Similarly, for state and local debt general obligation debt backed by property taxes, rising home values will bring in more tax collections – even if property tax rates stay constant. Another area is utility-backed bonds, which often have covenants allowing them to increase their rates, and therefore revenues received, when their costs of servicing go up.

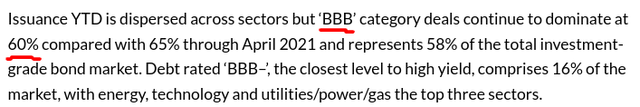

So, why is this relevant? Well, for one, because all of the above examples I just highlighted are actually happening now. Two, because BBN’s top sectors are indeed areas that are poised to benefit from rising prices, including General obligation bonds (both state and local backed) and utility-backed bonds, as shown below:

BBN’s Sector Weightings (BlackRock)

My takeaway is that with just over half of its underlying holdings in sectors that should see credit improvement in an inflationary environment, that supports a more positive view on BBN as a whole. With investors looking for ways to beat inflation, or at least manage the risk, fixed-income does not often come to mind. But with this backdrop and the broader year-to-date sell-off in muni bonds, I think the risk-reward picture is interesting here.

States Are In A Better Position Than Year’s Past

Another reason why I like munis more broadly – taxable and tax-exempt – is that state and local governments are in reasonable shape fiscally. There have been some headlines recently about budgetary restraints and fears of a recession impacting revenues and debt obligations. And investors should take this seriously. If we have a meaningful or prolonged pullback in economic growth, state and local budgets will be impacted. And the market drop in 2022 has also impacted state coffers, as their investments are worth less along with everyone else’s.

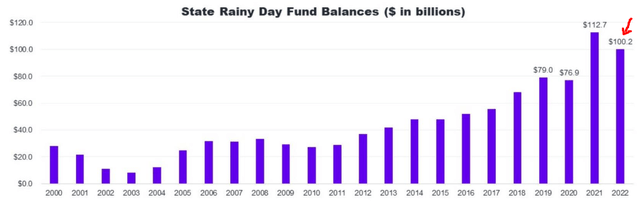

However, we have to put this in perspective. Since the recovery from the 2008-09 recession over a decade ago, states have on average been adding to their “rainy day” funds. These are savings and investments to prepare for economic downtimes. While the declines in the stock market have sent these rainy-day funds into decline in 2022, they are still at an elevated level when we look at balances over the past decade:

State Balances (On Average) (Raymond James)

My point here is that while these average balances are down from 2021, they are still very strong on a historical perspective. These bodes well for overall muni quality, even though the balances have declined in the short-term. The longer-term trend shows this is a very healthy level and should keep credit quality for muni bonds strong.

Supply Is Down YOY

The next topic touches on supply, specific to the taxable sector. As I mentioned, BBN is a rather unique muni fund in that it focuses solely on taxable munis, which is a much smaller overall market. While its share of the broader muni market has grown post-2017 tax reform, it is still the minority.

The good news for BBN investors is that supply has been relatively tight in 2022. This has helped shore up bond values, all other things being equal. While rising inflation and interest has pressured the value of the underlying bonds, the limited supply has helped stymie the drop somewhat. To understand why, consider that on a year-over-year basis, taxable muni supply was down roundly in the second quarter:

Taxable Muni Supply (Nuveen)

Ultimately, this helps support prices and likely means that investor demand will be more than enough in this space to absorb incoming supply. Simply, I see this as a catalyst for owning this sector, since relative scarcity is present.

A Word Or Two On Risk

To wrap up this review I want to emphasize this is not a sure thing. I have placed many buy ratings on funds throughout 2022 and some have worked out, others have not. There is a lot of uncertainty in the market today, and the general sentiment has been negative for most of the year. This makes short-term gains difficult and reminds investors that they need to stay focused on the longer term. BBN is not immune to general sell-offs or investment headwinds, so please keep this in mind.

Specifically, BBN has had a poor 2022 for a couple of reasons. While fixed-income has come under pressure more broadly, leveraged CEFs in particular have been hit very hard. The reason is two-fold. One, leverage works both ways, including on the downside. The added exposure to a sector/theme/idea means that when that play turns out of favor, the pain is amplified. BBN has a substantial amount of leverage, just over 33%. So that partially explains the poor YTD performance, and this is something that has not gone away.

A second reason is that short-term interest rates have been rising faster than long-term interest rates. The yield curve has even inverted a few times this year. (That means short-term yields are higher than long-term yields). This impacts leveraged CEFs again because the fund borrows at short-term rates. The idea is that fund managers can reinvest that borrowed cash and higher yielding, longer-dated securities. When short-term rates are rising faster, borrowing costs are rising and the yield pick-up in longer-dated securities is not as lucrative as it used to be. This pressures fund earnings and income. The leverage can still be advantageous, but the benefit has been minimized to a degree. This is another important headwind that has not gone away and will continue to pressure leveraged CEFs of all stripes in the second half of 2022.

Bottom-line

This market continues to present challenges: ongoing geo-political risks in Europe and Asia, hawkish central banks, and increased volatility. While we have come off the lows from the last month or two, investors should continue to remain well balanced in their portfolio. Stocks are starting to come back, but muni bonds can continue to serve as a hedge.

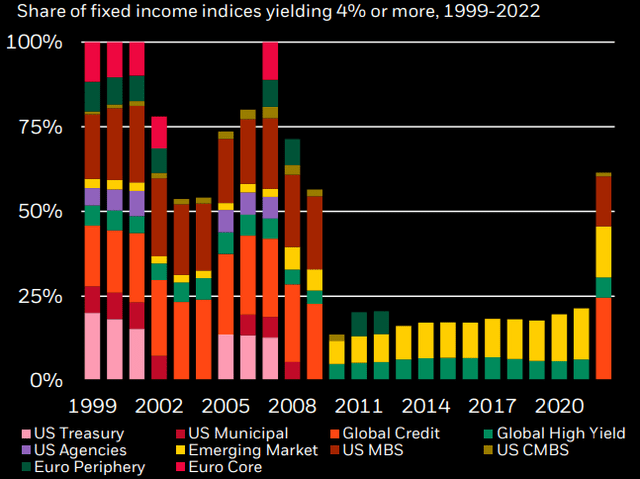

In fact, fixed-income more broadly is an area I was fading late last year and into 2022. I just didn’t see the value. Income streams were too low and duration risk was too high. As the sell-off in the sector got underway, I began to see value again, albeit before the pain was over. Fortunately, bonds have found some support and began trending upwards again. And the good news is that value may still be present now, even after the recent gains. Yields are up across the fixed-income realm, offering investors higher income streams than they have gotten in the past, by quite a wide margin too:

Breakdown of Yields By Sector (BlackRock)

Personally, I think BBN and taxable munis are a smart move here, but as the above graphic shows, there are more opportunities for yield across the globe than there has been in a long time. At the very least, it suggests there is merit to giving this arena some consideration when at most times over the past year that argument was more difficult to make. Because of all these factors, I think maintaining a “buy” rating on BBN is appropriate, and I would encourage readers to give this idea some thought at this time.

Be the first to comment