drserg

Setting The Landscape

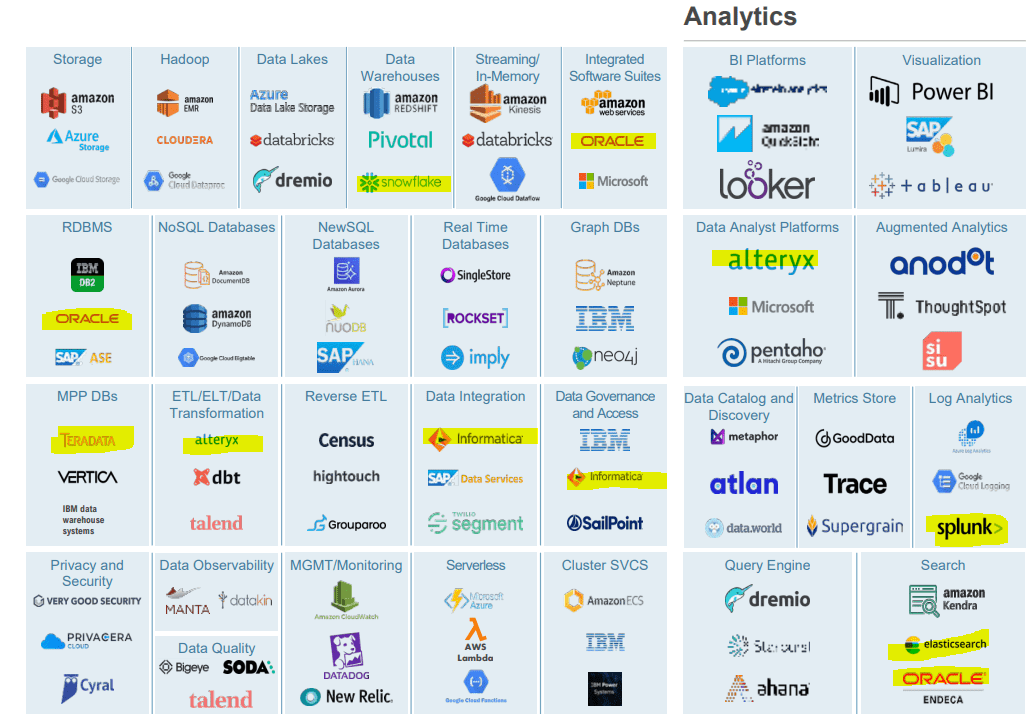

One of the most competitive, publicized, and future-facing in the market revolves around data, and what to do with it. One acronym that has been put out there is MAD, or Machine Learning, Artificial Intelligence, and Data Infrastructure. This industry revolves around storing, accessing, and analyzing the endless amount of data that is now being generated by nearly all entities around the world. Due to the sheer size and relatively young age of the industry, there are not many public companies that exist, but the ones that target this industry are fierce competitors.

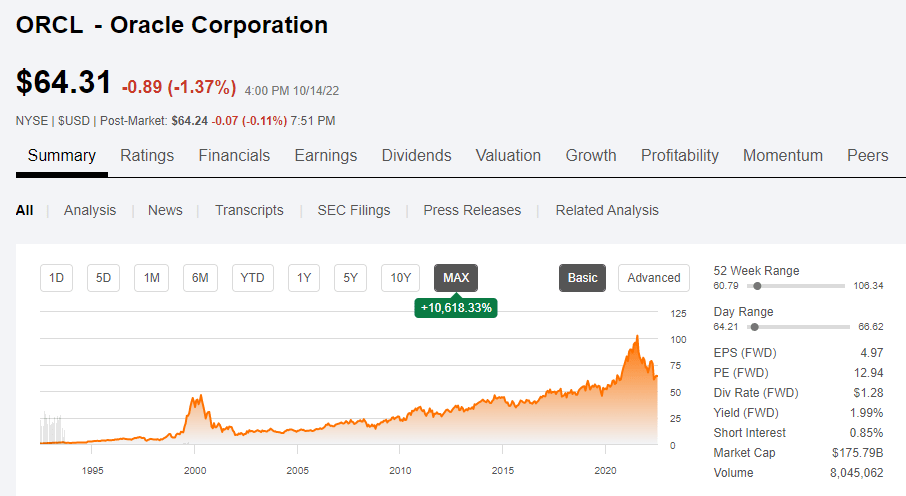

For this analysis, I will use the twelve companies outlined in a recently published Houlihan Lokey insight report on the industry. They cover just a tiny fraction of the entire market, but are keenly focused MAD. Remember, names like Amazon’s AWS (AMZN), Microsoft’s Azure (MSFT), and Google’s Cloud (GOOG) are all major entities in the field as well, but the investments are far broader in scope. However, Oracle (NYSE:ORCL) now fits the bill as the best investment for wide exposure to the industry.

While there are certainly merits to diversification of your investments, this article will instead focus directly on the industry. Feel free to discuss your other favorite public, or still private, companies in the comments. I, for one, am waiting for the MariaDB IPO (POND). Anyway, the companies are as follows, in ascending EV/2022E Sales multiple:

-

Teradata (TDC)

-

Sumo Logic (SUMO)

-

Couchbase (BASE)

-

Informatica (INFA)

-

Splunk (SPLK)

-

Oracle (ORCL)

-

Alteryx (AYX)

-

Elastic (ESTC)

-

Palantir (PLTR)

-

MongoDB (MDB)

-

MicroStrategy (MSTR)

-

Snowflake (SNOW)

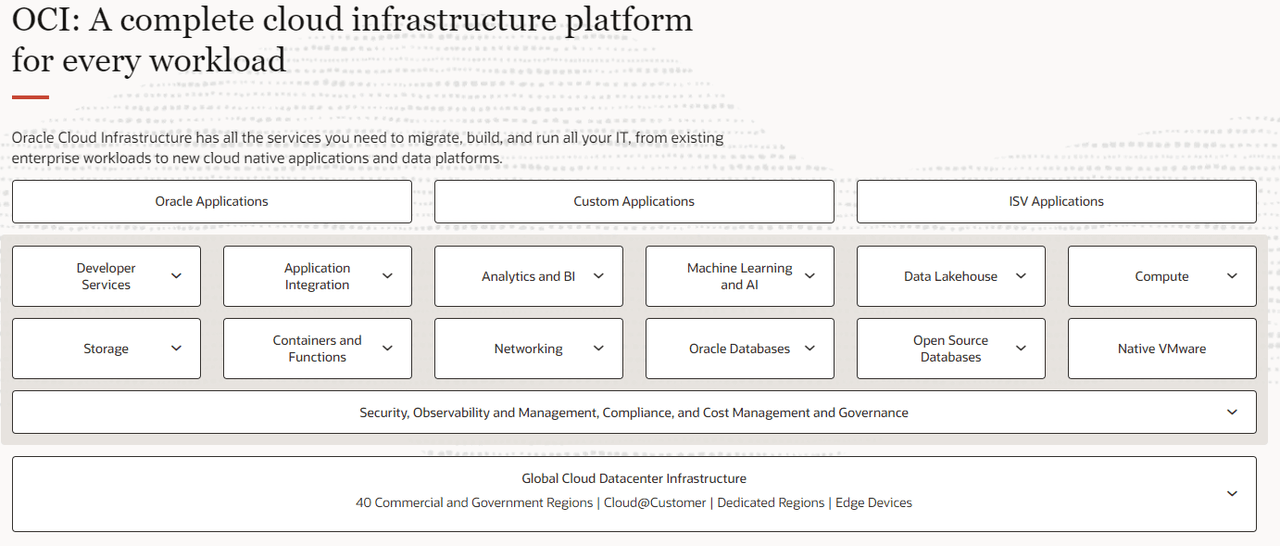

As you can see, the list of companies are all quite different in terms of size, valuation, growth, and capabilities. Some are focused on the data side of the equation, while others focus on the analytics and visualization. However, Oracle is one of the most diversified entities across the sector with capabilities in providing data management services, integrated software suites (so users can access the many other companies in the industry), search analytics, and nearly every area. The image below highlights just simple coverage of the complex industry, and I highlighted the companies this research will address.

Houlihan Lokey Oracle Website

Growth Vs. Value

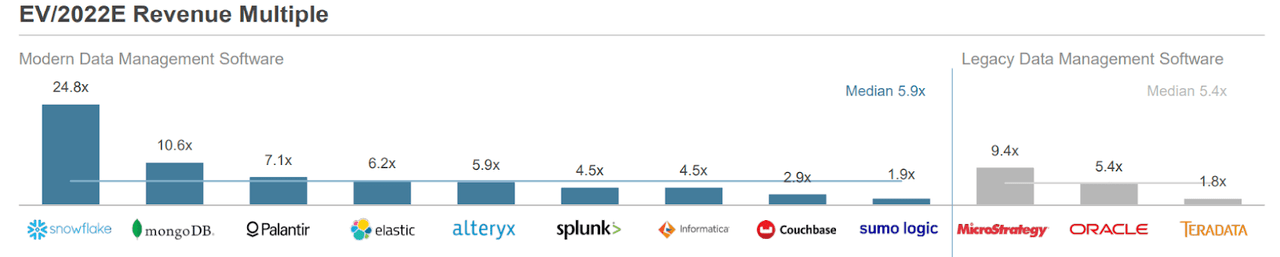

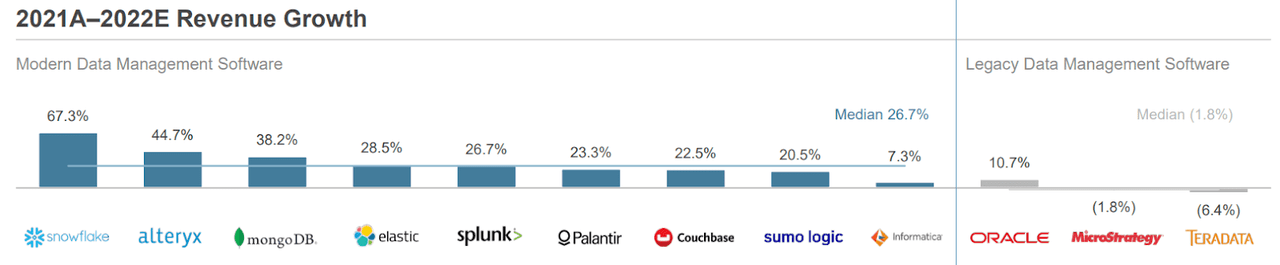

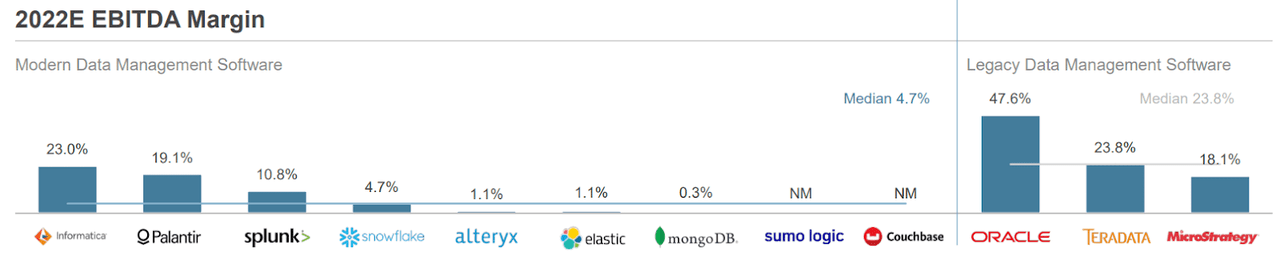

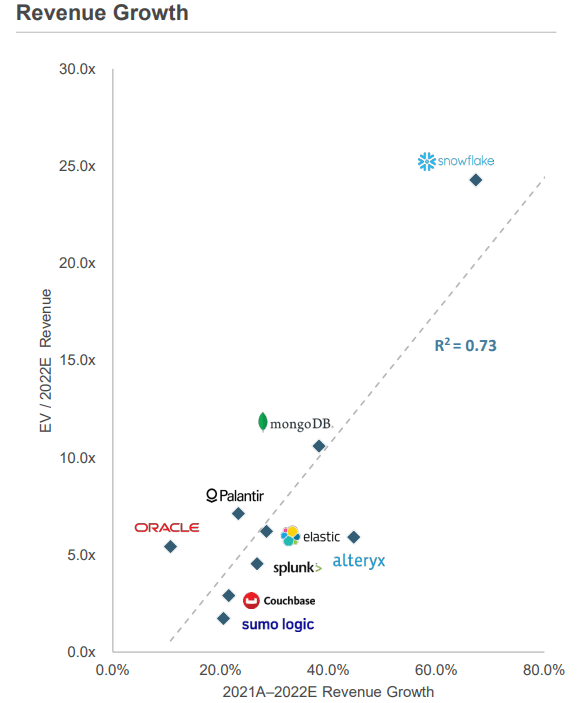

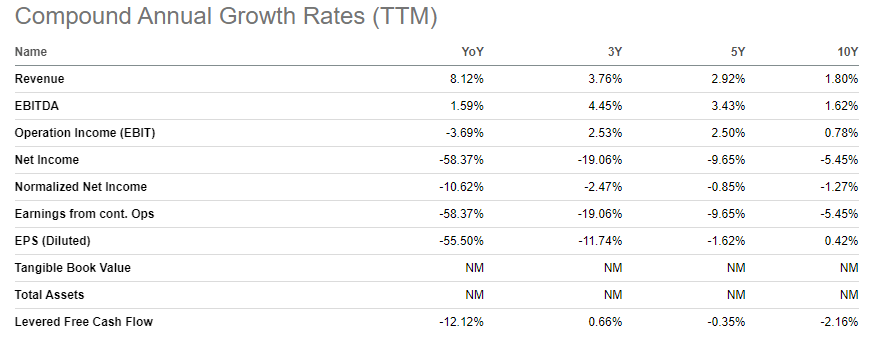

While we could spend weeks discussing the qualitative intricacies of every company and how they have the potential for further value, we can see there are some patterns that are noticeable from financial statements. Recently, valuations in the industry were primarily determined by revenue growth and outlook, although the effect is lessening in 2022. As in the two charts below, we can see that ultra-growth peer Snowflake continues to hold on to the highest EV/Sales multiple, but 40% revenue growth rate Alteryx is closing in on the same valuation as Oracle who is expected to have 10% growth in 2022.

The data is clear, investors are now applying increased valuation to companies with high profitability as economic uncertainty weighs on the outlook of unprofitable companies. This change in valuation leadership, led by Oracle, is one of the key factors that allow Oracle to remain the best choice moving into far weaker economic conditions over the coming quarters or years. However, it is important to note that other fairly profitable firms such as Teradata, Palantir, Splunk, or Informatica, may seem to offer a better growth to value proposition, but I will highlight how that may be a mistake to rely on.

Houlihan Lokey Houlihan Lokey Houlihan Lokey

The Rule of 40 Effect

The tradeoff between growth and profitability is a difficult area to tread, and management in the past have had to choose either one or the other. Then, starting the mid-part of the 2010s, investors began using a new metric to value companies: the Rule of 40. I am sure my readers are familiar with this modern metric, but I will provide a summary by the consultants Bain:

The Rule of 40—the principle that a software company’s combined growth rate and profit margin should exceed 40%—has gained momentum as a high-level gauge of performance for software businesses in recent years, especially in the realms of venture capital and growth equity. Increasingly, software industry executives are embracing the Rule of 40 as an important metric to help measure the trade-offs of balancing growth and profitability.

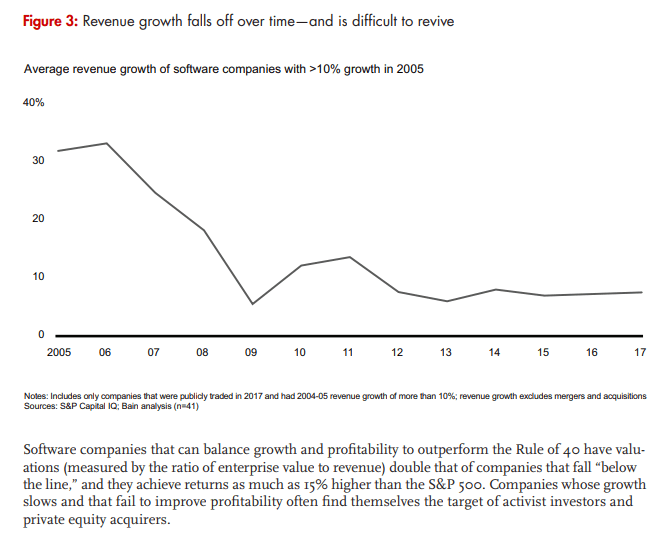

Management at software firms are now able to prove to investors that there is some value in low profitability, as long as growth is elevated enough. Although, growth rates can change in a flash and lead to sharp declines in valuation. At the same time, slow growers like Oracle can also meet the rule but offer far less volatility.

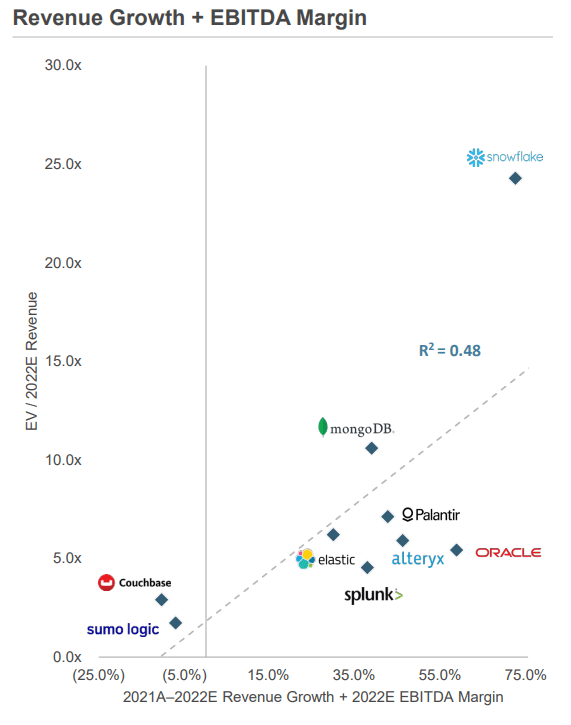

The two charts below highlight the power of the Rule of 40 when measured for our select group of companies. When valuing the group from only a revenue growth to value standpoint, Oracle looks extremely weak, but when looking from the Rule of 40, Oracle is the clear winner. Perhaps a bargain for the price. The only other companies meeting the Rule of 40 are Snowflake, Alteryx, and Palantir, so we will now narrow our focus moving forward.

Houlihan Lokey Houlihan Lokey

The above charts are quite interesting because they allow investors to easily assess relative valuations. In the case of Snowflake, they may beat the Rule of 40, but fail to provide a reason to support a 4- to 5-fold increase in valuation compared to the other peers who meet the Rule of 40. This is important because apart from business growth, valuation will play an important role in the future returns. As Snowflake is not yet profitable, any slowdown in growth will cause them to no longer pass the rule, and this is quite possible as shown in data provided by Bain.

As stated, it is hard for a company to revive growth to high levels, and it is unknown whether Snowflake can increase profitability in-turn. Therefore, I believe that while Snowflake does dominate the industry, offers a compelling package and opportunity, and is growing at a supremely fast rate, the current valuation leaves little room for weak economic conditions.

Bain

For Oracle, the Rule of 40 has provided significant returns for investors even as growth is nearly flat over the past decade. Slow and steady wins the race, and Oracle is slightly less expensive right now than their historical average valuation. As such, the opportunity is clear, despite continued worries about growth or competition. For others such as Alteryx and Palantir, the story is a bit less clear as AYX faces volatile growth and Palantir faces intense scrutiny by the market. However, both of their opportunities may be greater than Snow due to the current valuations.

Seeking Alpha Seeking Alpha

Conclusion

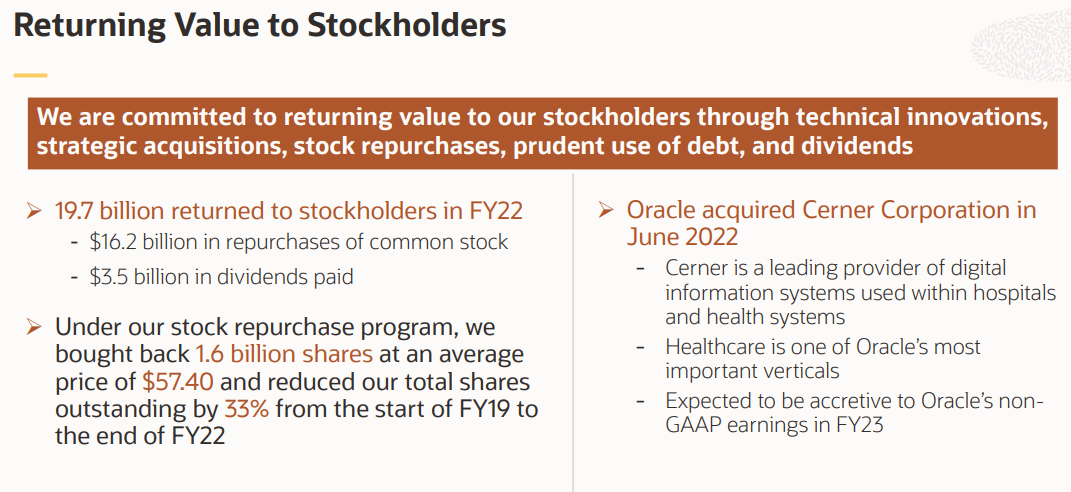

To conclude, I will highlight the primary reason why Oracle may continue their dominance moving forward: profitability is the key to mature growth. There are multiple issues that excess profitability can solve, including R&D spending, bolt-on acquisitions, and investing in shareholder returns. Some recent examples include the development of MySQL to out-compete Amazon Redshift/Aurora and Snowflake, while at the same time being integrated into AWS. Also, there was the acquisition of Cerner to expand further into healthcare data services.

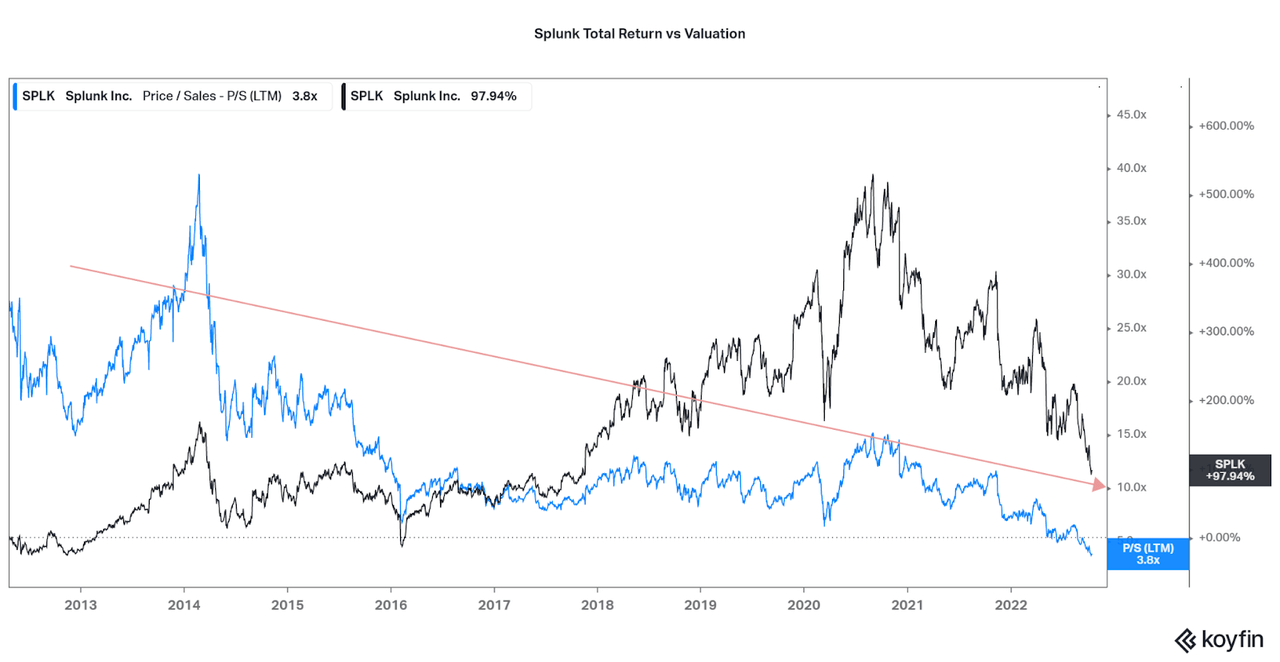

After that there is still plenty of money being put into dividends and share buybacks, one of the reasons for the strong price performance over the past decade, regardless of revenue growth. Will Snowflake be able to survive the same weakness? Just look at the price chart of Splunk to see what high revenue growth (30%+ per year CAGR), but perpetually falling valuation can result for shareholders.

Oracle August 2022 Presentation Koyfin

As the market continues to expect pain moving forward, I believe that extremely profitable Oracle will be able to survive. More speculative and overvalued names such as Snowflake may have inertia, but will face severe drops in valuation if growth slows down slightly. As such, I suppose investors will fare better accumulating Oracle over time, and if the weight in your portfolio gets high enough, use your profits to take a gamble on a speculative name, but when the opportunity looks far more favorable than right now.

Depending on how things turn out over the next few months, perhaps speculative names are beat up enough to find some value, but keeping money in a more safe option like Oracle until then may be best. I hope this article highlights the opportunity, but the decisions remain with you.

Thanks for reading. Feel free to share your insights below.

Be the first to comment