BitsAndSplits/iStock via Getty Images

Main Thesis & Background

The purpose of this article is to evaluate the iShares Core High Dividend ETF (NYSEARCA:HDV) as an investment option at its current market price. The fund is managed by BlackRock, and its stated objective is “to track the investment results of an index composed of relatively high dividend-paying U.S. equities”.

It has been almost exactly a year since I covered HDV. At that last time I had placed a “neutral” rating on the fund, anticipating modest gains. In hindsight, the fund has seen its share of ups and downs and the return has essentially been flat. While this doesn’t sound too appealing, we should keep in mind how the broader market has dropped over the same time period:

Fund Performance (Seeking Alpha)

Given the length of time that has passed combined with HDV’s out-performance over the time, I thought I would give the fund another look. After review, I definitely see merit to owning this ETF going forward, and will explain why in detail below.

Income Play Is Justifiable Story

The first attribute to look at for HDV in my opinion is the dividend. As a “high” dividend ETF it lives up to its name. Yes, “high” is a bit subjective in this environment with inflation where it is. But HDV’s yield has pushed higher than the 3.5% mark and that compares pretty favorably to the broader market.

Expanding on that, I am encouraged by the year-over-year dividend growth. While not overwhelming, it is reasonable, and when I couple it with the already high yield, I am pretty satisfied:

| Q1 – Q3 Distributions 2021 | Q1 – Q3 Distributions 2022 | YOY Growth |

| $2.45/share | $2.57/share | 4.9% |

Source: iShares

This is a fairly straightforward point so there is not a lot to add. I view HDV’s income stream positively and I use this as a valid supporting factor for the buy rating I am giving it now.

Energy Bulls Could Look To This Option

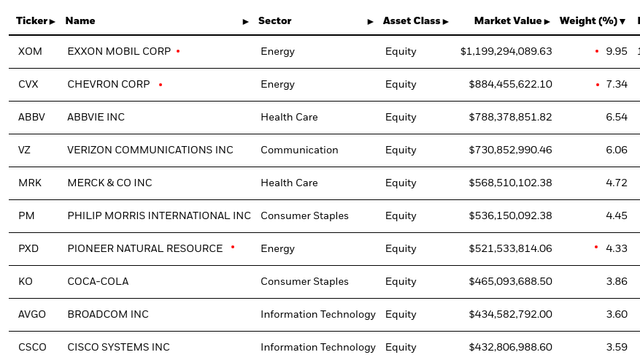

I will now shift to the underlying holdings of HDV because this is a critical reason why I think the fund has merit here. In particular, this is a bull play on the Energy sector because the ETF is heavily slanted in that positioning. Over 27% of total fund assets are held by companies in that sector, which includes three positions in the top ten holdings:

As my followers are aware, Energy has been a play I have emphasized throughout 2022. I reiterated this stance for Q4, and have so far been definitively impressed. I don’t see much to change this outlook in the short-term, so I like HDV’s heavy inclusion of stocks in this area. Of course, investors could just choose an Energy ETF to play it, but I like that HDV is a diversified way to get this exposure, along with the other highest yielding stocks in the S&P 500.

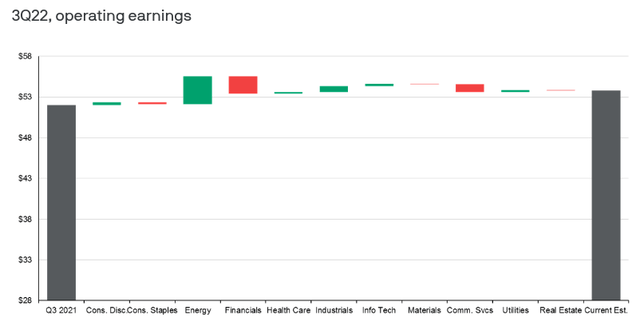

Saying that Energy has done well this year is stating the obvious. So it may seem like “late to the game” to be buying in. While I would not surmise, we will see similar returns in next year that we have this year, I still think higher share prices are on the way in Q4. A key reason why is that earnings season (Q3 results) is kicking off and Energy is once again expected to be a leader. While multiple sectors are expected to see YOY growth (profits and earnings), many are not. Among those that are, Energy is again a clear leader (expected):

Q3 Earnings By Sector (Expected) (FactSet)

The way I see it, Energy’s momentum is set to continue. While the demand side of the equation has been called in to question given looming global recession risks, OPEC+ has already counter-balanced that by announcing production cuts going forward. This will limit any further downside to the price of crude in my view. Ultimately, this should keep in-tact the multi-year strength of this sector, making me bullish on HDV as a result.

Balance Sheets Within Energy Sector Look Healthy

While Energy is not the only sector in HDV, I am going to add one more justification for why I like the sector. Again, there is plenty more to HDV and I will examine that as well – but I want to emphasize that investors in this fund need to be bullish on Energy as a whole. It would make little sense to buy a dividend ETF so heavily exposed to the Energy sector if one is not bullish on the prospects.

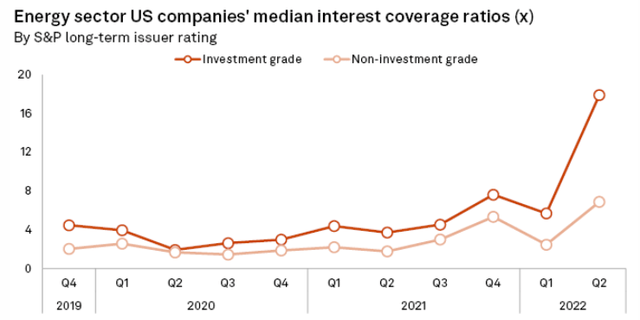

Fortunately, I am – and for valid reasons. Beyond expected earnings which I touched on in the previous paragraph, readers should note that the health of corporate balance sheets have improved on average. With rising interest rates set to continue in 2023, companies with debt-laden balance sheets are at risk. The logic being that as loans and bonds mature and needs to be replaced, companies heavily reliant on debt are going to be paying a much steeper price for it. Typically, the Energy sector is one that is indeed more saddled with debt. But as profits improved, many companies in this sector planned ahead for raising interest rates by paying down debt. The combination of rising profits and debt payments have sent coverage ratios up markedly across the board:

Coverage Ratios (Energy Sector) (S&P Global)

In particular, companies rated investment grade have seen sharper improvement. This is relevant for HDV in particular because the fund holds large-cap, quality companies that have been screened for financial health. So while non-investment grade Energy companies have seen improvement, that is not really relevant for HDV because the fund doesn’t hold those types of companies generally. The stronger metric for investment grade companies is the focus, and this makes me confident in my decision to amplify my Energy exposure going into the final stages of the year.

Dividend Payers Provide Stability During Times Of Turmoil

Moving to a more macro-discussion, I want to amplify that I absolutely favor dividend paying stocks and funds right now. This includes HDV, but also any number of dividend ETFs out on the market at the moment. This year has been a difficult one, and dividend paying stocks and ETFs are still mostly in the red. But the point to remember is they are down less and that helps to justify why we want to hold them in the first place. The income and relative stability come in handy when the market is under pressure.

Think about this logically for minute. When a firm is obligated (through dividend announcements) to send a portion of its earnings back to the stockholders, this imposes discipline. It is a restraint on over-spending or reckless spending. No, it is not foolproof, as management can still be reckless and/or cut or suspend dividends. But that is not a common occurrence and generally the dividend itself helps to provide needed income and is partially responsible for the superior returns over time.

I think this is important in this climate because in a low interest rate world, investors have gotten used to “growth” stocks being the alpha generators. The past decade has rewarded risk and less so the more conservative dividend play. But 2022 turned the table on its head. Dividends suddenly became very much in fashion, and have beaten Tech/Growth/High Risk equity plays by a wide margin. I see this as a return to a more normalized equity environment.

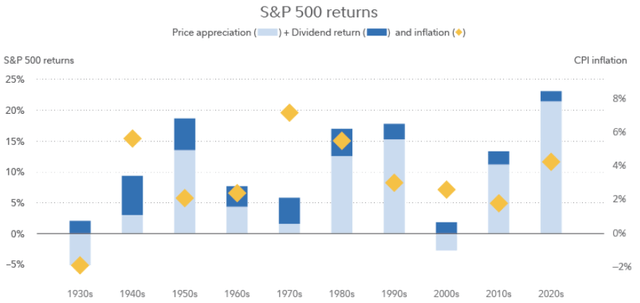

What I mean is – prior to the past decade dividends used to make up a larger share of total return. The boon decade of 2010 – 2020 changed that, but if we look back at history, we see that dividends have often accounted for a sizable portion of total return:

S&P 500 Returns (Fidelity Investments)

The message here is that over time dividends often play an important role in total return. While the past few years that story has been suspect, if we look back further in history, we see it rings true. Given that I predict further turmoil in equity markets in Q4 and Q1 2023, I am looking to dividends for some safety. HDV fits this bill nicely, and can complement other dividend strategies (such as growers, aristocrats, foreign payers, etc.) very nicely.

Overall Composition Provides Diversification

My final topic reverts back to HDV’s portfolio. I already discussed how I favor the overweight Energy exposure. But investors in HDV need to like the fund for more than just that – otherwise they would just buy an Energy ETF! In this vein, I see the heavy allocations to both Health Care and Consumer Staples positively. Combined, these sectors make up roughly 32% of the fund:

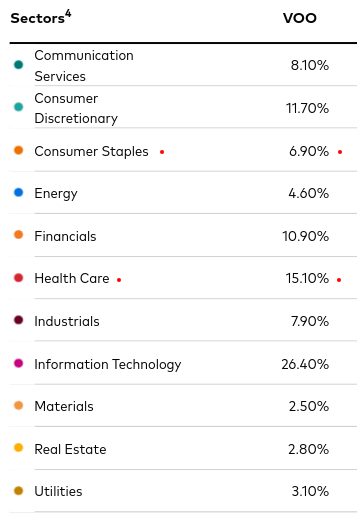

HDV Sector Breakdown (iShares)

I like this for two reasons. One, both of these sectors are more defensive. Demand for health-related services and necessities often do not fluctuate with the economy the way other cyclical areas do. So this is preferable exposure to me when the macro-environment has challenges (as it does now).

The second reason is this diversifies a portfolio a bit that may be heavily reliant on the S&P 500. This speaks to me since the S&P 500 is definitely the hallmark of my holdings overall. So I need to use ETFs, CEFs, and some individual holdings to diversify this a bit. HDV does this, as illustrated when we compare it to the sector weightings of the S&P 500, as measured by reviewing the Vanguard S&P 500 ETF (VOO):

S&P 500 Sector Breakdown (Vanguard)

For me this is supportive of HDV because I generally favor diversification. But this is subjective. Having more Health Care or Staples exposure at the expense of Tech/Growth plays is not “good” or “bad”. This depends on perspective. If a reader is looking to capitalize on a forthcoming rebound in the economy, a change in sentiment to risk-on, or feels the Tech-heavy NASDAQ’s drop over 30% is a value opportunity – then HDV is not the right move. But I don’t share those sentiments at present, so I view HDV’s defensive positioning positively.

Bottom-line

In the past year, HDV has lost about 1%. Not too great. But if we consider the S&P 500 is down by about 20%, all of a sudden, this ETF appears to be a big winner in this environment. My opinion is that the market will remain under pressure in the short-term, meaning that HDV’s out-performance could very well continue. The consumer retail environment is being beaten down by inflation, oil is probably going to resume an upward trajectory on OPEC+ production cuts, and higher interest rates are poised to keep pressuring the Tech (and other growth) sectors. For me, I see these as signals to be bullish on HDV, and I suggest readers give the fund some consideration at this time.

Be the first to comment